As per Intent Market Research, the Augmented and Virtual Reality in Healthcare Market was valued at USD 2.0 billion in 2024-e and will surpass USD 5.1 billion by 2030; growing at a CAGR of 16.4% during 2025 - 2030.

The augmented reality (AR) and virtual reality (VR) market in healthcare is experiencing rapid growth, driven by the increasing need for innovative solutions to improve patient care, enhance medical training, and support various therapeutic applications. AR and VR technologies have proven to be transformative, offering immersive experiences that enable healthcare professionals to better visualize complex medical data, improve precision in surgeries, and enhance patient treatment outcomes. The use of AR and VR in healthcare extends across a variety of applications, including surgical planning, rehabilitation, pain management, and mental health treatment, providing healthcare providers with advanced tools to offer superior care.

These technologies are also revolutionizing medical education and training, allowing students and professionals to simulate complex procedures, practice surgeries, and gain hands-on experience in a controlled, risk-free environment. The increasing adoption of AR and VR in healthcare is further supported by growing investments in digital healthcare solutions and the rising demand for personalized treatment plans. With advancements in technology and the ongoing digital transformation in the healthcare sector, the AR and VR healthcare market is expected to continue its upward trajectory, offering significant opportunities for growth across diverse healthcare sectors.

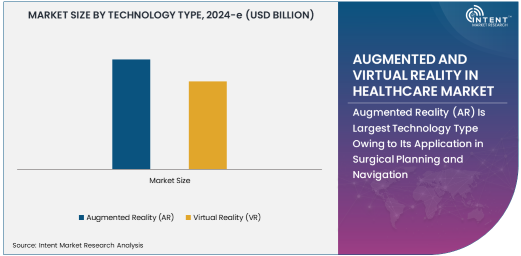

Augmented Reality (AR) Is Largest Technology Type Owing to Its Application in Surgical Planning and Navigation

Augmented reality (AR) holds the largest share in the AR and VR healthcare market, owing to its growing application in surgical planning and navigation. AR technology overlays digital information onto the real world, allowing surgeons to visualize critical anatomical structures during surgery, improving precision and reducing the risk of errors. By integrating patient-specific data with real-time images, AR enhances the ability to plan and execute complex procedures, making surgeries more effective and safer. This technology allows for a more interactive and intuitive approach, offering real-time guidance during operations and aiding in pre-surgical planning.

AR is also gaining traction in medical education and training, as it enables healthcare professionals to simulate surgeries and procedures in a virtual environment before performing them on real patients. The integration of AR in healthcare has shown promising results in reducing patient recovery times and improving overall surgical outcomes. As more hospitals and clinics adopt AR solutions to improve clinical practice, the technology is expected to continue to dominate the healthcare AR and VR market, making it a crucial tool in modern medical procedures.

Virtual Reality (VR) Is Fastest Growing Technology Type Owing to Its Advancements in Pain Management and Rehabilitation

Virtual reality (VR) is the fastest-growing technology type in the AR and VR healthcare market, driven by its application in pain management and rehabilitation. VR creates immersive, interactive environments that engage patients in therapeutic exercises, offering an alternative to traditional methods of pain management. By immersing patients in calming virtual environments or guiding them through relaxation exercises, VR has proven effective in reducing chronic pain and anxiety, especially for individuals undergoing surgery, chemotherapy, or other medical treatments. The immersive nature of VR allows for greater distraction and emotional engagement, helping patients manage their symptoms more effectively.

In rehabilitation, VR is being used to help patients recover from injuries or surgeries by providing virtual exercises and activities that improve motor skills and coordination. The use of VR in physical therapy has gained momentum, as it offers personalized rehabilitation programs that adapt to the patient's progress, making therapy more engaging and effective. As VR technology continues to evolve, it is expected to play an increasingly important role in patient care and recovery, particularly in pain management and rehabilitation, making it the fastest-growing segment in the market.

Medical Training and Education Is Largest Application Owing to the Need for Advanced Learning Tools

Medical training and education is the largest application segment in the AR and VR healthcare market, driven by the increasing demand for advanced learning tools in the medical field. Both AR and VR are revolutionizing medical education by providing students and healthcare professionals with realistic, immersive simulations of medical procedures, surgeries, and patient care scenarios. These technologies offer hands-on experience in a controlled environment, where learners can practice their skills without the risks associated with real-life procedures. Virtual simulations help in mastering complex skills, understanding human anatomy, and experiencing rare medical conditions that may not be available in traditional clinical settings.

The use of AR and VR in medical training also enhances the ability to understand intricate details of surgical procedures and visualize critical anatomical structures in 3D. These technologies provide a safe and effective means of training new medical personnel, improving the overall quality of healthcare education. As the demand for skilled healthcare professionals grows, the role of AR and VR in medical training and education is expected to continue expanding, solidifying its position as the largest application in the healthcare market.

Pain Management Is Fastest Growing Application Owing to the Increasing Use of Non-invasive Treatment Methods

Pain management is the fastest-growing application segment in the AR and VR healthcare market, driven by the rising preference for non-invasive treatment options and the increasing recognition of the effectiveness of VR in managing pain. Virtual reality has demonstrated significant potential in reducing pain perception by providing patients with immersive, interactive environments that distract them from their discomfort. For patients undergoing painful procedures or experiencing chronic pain, VR therapy offers a non-invasive, drug-free alternative that can complement traditional pain management techniques.

Research has shown that VR-based pain management can effectively reduce pain in patients undergoing surgery, burn treatment, or chemotherapy. By using virtual environments to engage patients in relaxation exercises or therapeutic scenarios, VR can help alleviate the psychological and emotional aspects of pain. The growing adoption of VR in pain management, coupled with its ability to reduce reliance on pharmaceuticals, is expected to drive further growth in this application, making it the fastest-growing segment in the AR and VR healthcare market.

Hospitals and Clinics Are Largest End-User Owing to the Integration of AR and VR in Patient Care

Hospitals and clinics are the largest end-user segment in the AR and VR healthcare market, driven by the increasing integration of AR and VR technologies in patient care. These healthcare institutions are adopting AR and VR solutions to enhance surgical precision, improve patient monitoring, and provide better rehabilitation and pain management services. AR and VR technologies are being used to guide medical professionals during procedures, allowing for more accurate and efficient treatment plans. Moreover, the integration of VR in rehabilitation centers within hospitals helps in improving patient recovery rates and promoting active engagement in therapeutic exercises.

The rising adoption of AR and VR in hospitals and clinics is also supporting medical training and education by offering real-time simulations and interactive learning experiences for healthcare professionals. As these institutions seek to improve patient outcomes, reduce healthcare costs, and enhance the overall experience for patients and staff, the use of AR and VR technologies is expected to continue growing. This demand for cutting-edge technologies in hospitals and clinics positions them as the largest end-user segment in the market.

Research Institutes Are Fastest Growing End-User Owing to Advancements in Medical Research

Research institutes are the fastest-growing end-user segment in the AR and VR healthcare market, driven by their role in advancing medical research and developing new treatments. These institutions leverage AR and VR technologies to conduct in-depth studies on human anatomy, simulate drug effects, and explore innovative therapies for various diseases and conditions. The ability to visualize complex biological processes in 3D and create virtual models of organs and tissues has opened new doors for research, allowing scientists and medical researchers to explore previously uncharted areas of healthcare.

Furthermore, AR and VR are being used to test the efficacy of new medical devices and treatments in a controlled, simulated environment before they are introduced to the market. The use of these technologies in research is enabling faster, more accurate data collection and analysis, contributing to the acceleration of medical discoveries. As the demand for innovative healthcare solutions continues to rise, research institutes are expected to be a key driver of growth in the AR and VR healthcare market.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and Technology Adoption

North America is the largest region in the AR and VR healthcare market, driven by the region’s advanced healthcare infrastructure and the rapid adoption of cutting-edge technologies in medical practice. The United States, in particular, has seen significant investments in digital health technologies, including AR and VR, as healthcare providers, hospitals, and research institutes adopt these technologies to enhance patient care, improve medical training, and drive innovation in therapeutic practices. North America’s well-established healthcare systems, coupled with its emphasis on adopting innovative solutions, make it the dominant region in the global AR and VR healthcare market.

The region’s healthcare market benefits from strong collaborations between technology companies and healthcare providers, fostering the integration of AR and VR in clinical and educational settings. Additionally, the presence of leading AR and VR technology developers in North America has further accelerated market growth. As the demand for more personalized, efficient, and cost-effective healthcare continues to grow, North America is expected to maintain its leadership in the AR and VR healthcare market.

Leading Companies and Competitive Landscape

The AR and VR healthcare market is highly competitive, with key players focused on developing innovative technologies to support various healthcare applications. Leading companies in this market include Microsoft Corporation, Google Inc., HTC Corporation, Osso VR, and MindMaze. These companies offer a range of AR and VR solutions designed for medical training, surgical planning, rehabilitation, and mental health treatment. They are investing heavily in research and development to advance the capabilities of AR and VR technologies and improve patient outcomes.

The competitive landscape is characterized by collaborations between technology providers, healthcare institutions, and academic research centers, enabling the development of tailored solutions that address the specific needs of healthcare providers. Furthermore, the increasing demand for non-invasive treatment methods, such as VR for pain management and rehabilitation, is creating new opportunities for companies in this space. As the market continues to expand, the focus will be on delivering more immersive, user-friendly, and cost-effective solutions that meet the evolving demands of the healthcare sector.

Virtual Reality (VR)

Recent Developments:

- In December 2024, Microsoft Corporation launched a new mixed-reality platform designed specifically for healthcare providers to enhance surgical planning and training.

- In November 2024, Oculus VR (Facebook Technologies, LLC) introduced a new VR headset tailored for medical education and surgical simulation with improved ergonomics and realism.

- In October 2024, Siemens Healthineers unveiled a next-generation AR tool for operating rooms, providing surgeons with real-time data overlays during procedures.

- In September 2024, Medtronic plc launched a VR-based surgical training module to provide medical professionals with hands-on experience in complex procedures.

- In August 2024, Brainlab AG partnered with a leading hospital network to integrate AR in neurosurgery, improving navigation and precision during brain surgeries.XXXX

List of Leading Companies:

- Microsoft Corporation

- Google LLC

- Oculus VR (Facebook Technologies, LLC)

- Philips Healthcare

- Siemens Healthineers

- GE Healthcare

- Medtronic plc

- Osso VR

- Surgical Theater

- Brainlab AG

- Vuzix Corporation

- Magic Leap, Inc.

- Varjo Technologies

- MindMaze

- Touch Surgery

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.0 billion |

|

Forecasted Value (2030) |

USD 5.1 billion |

|

CAGR (2025 – 2030) |

16.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Augmented and Virtual Reality in Healthcare Market By Technology Type (Augmented Reality (AR), Virtual Reality (VR)), By Application (Medical Training and Education, Surgical Planning and Navigation, Pain Management, Rehabilitation, Mental Health Treatment, Patient Care and Monitoring), By End-User (Hospitals and Clinics, Research Institutes, Medical Device Companies, Medical Training Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Microsoft Corporation, Google LLC, Oculus VR (Facebook Technologies, LLC), Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic plc, Osso VR, Surgical Theater, Brainlab AG, Vuzix Corporation, Magic Leap, Inc., Varjo Technologies, MindMaze, Touch Surgery |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Augmented and Virtual Reality in Healthcare Market, by Technology Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Augmented Reality (AR) |

|

4.1.1. Mobile-based AR |

|

4.1.2. Head-mounted AR |

|

4.2. Virtual Reality (VR) |

|

4.2.1. Head-mounted VR |

|

4.2.2. Mobile-based VR |

|

5. Augmented and Virtual Reality in Healthcare Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Medical Training and Education |

|

5.2. Surgical Planning and Navigation |

|

5.3. Pain Management |

|

5.4. Rehabilitation |

|

5.5. Mental Health Treatment |

|

5.6. Patient Care and Monitoring |

|

6. Augmented and Virtual Reality in Healthcare Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Research Institutes |

|

6.3. Medical Device Companies |

|

6.4. Medical Training Centers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Augmented and Virtual Reality in Healthcare Market, by Technology Type |

|

7.2.7. North America Augmented and Virtual Reality in Healthcare Market, by Application |

|

7.2.8. North America Augmented and Virtual Reality in Healthcare Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Augmented and Virtual Reality in Healthcare Market, by Technology Type |

|

7.2.9.1.2. US Augmented and Virtual Reality in Healthcare Market, by Application |

|

7.2.9.1.3. US Augmented and Virtual Reality in Healthcare Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Microsoft Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Google LLC |

|

9.3. Oculus VR (Facebook Technologies, LLC) |

|

9.4. Philips Healthcare |

|

9.5. Siemens Healthineers |

|

9.6. GE Healthcare |

|

9.7. Medtronic plc |

|

9.8. Osso VR |

|

9.9. Surgical Theater |

|

9.10. Brainlab AG |

|

9.11. Vuzix Corporation |

|

9.12. Magic Leap, Inc. |

|

9.13. Varjo Technologies |

|

9.14. MindMaze |

|

9.15. Touch Surgery |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Augmented and Virtual Reality in Healthcare Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Augmented and Virtual Reality in Healthcare Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Augmented and Virtual Reality in Healthcare Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA