As per Intent Market Research, the Bionic Prosthetics Market was valued at USD 2.0 billion in 2023 and will surpass USD 4.5 billion by 2030; growing at a CAGR of 12.2% during 2024 - 2030.

The bionic prosthetics market is revolutionizing the field of medical devices by providing innovative solutions for individuals with limb loss or disability. These prosthetics integrate advanced technologies, such as myoelectric and neural-controlled systems, to offer enhanced functionality and a higher quality of life for users. By mimicking the natural movement of limbs, bionic prosthetics have become a vital tool in rehabilitation and the restoration of physical capabilities. As the global population ages and the incidence of limb loss due to trauma or disease rises, the demand for sophisticated prosthetic devices continues to grow.

The integration of cutting-edge technologies into bionic prosthetics is transforming how these devices are designed and used. Key trends include the development of prosthetics that are increasingly personalized, with materials and sensors tailored to the needs of individual users. Bionic prosthetics are not just about restoring mobility but also enhancing comfort, durability, and ease of use. With advancements in robotics and artificial intelligence, these prosthetics offer the potential to not only mimic the natural functions of the human body but also go beyond, enabling more intuitive control and interaction.

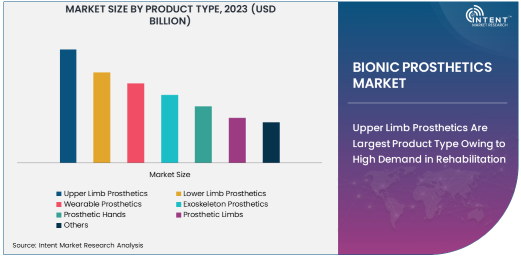

Upper Limb Prosthetics Are Largest Product Type Owing to High Demand in Rehabilitation

Upper limb prosthetics represent the largest product type within the bionic prosthetics market. This is primarily due to the significant demand for solutions that address the loss of hands, arms, and forearms, where function restoration is crucial for daily activities and personal independence. The loss of upper limbs significantly impacts a person's ability to perform tasks such as writing, eating, and driving, which drives the need for more functional, adaptable, and comfortable prosthetic devices.

Technological advancements in myoelectric and neural-controlled prosthetics have enhanced the capabilities of upper limb prosthetics, allowing users to regain fine motor control and perform intricate tasks. These prosthetics are becoming more versatile, with features such as adjustable grip strength, multi-joint movement, and improved sensory feedback, making them a preferred choice in the rehabilitation of upper limb amputees.

Myoelectric Prosthetics Are Fastest Growing Technology Due to Increased Functionality and Comfort

Myoelectric prosthetics are the fastest growing technology segment in the bionic prosthetics market, owing to their ability to provide a higher level of functionality compared to traditional prosthetic limbs. These prosthetics are controlled by electrical signals generated by the muscles remaining in the residual limb, allowing for more natural and intuitive movement. The ability to control the prosthetic hand or arm through muscle contractions significantly enhances the user experience, offering improved dexterity, strength, and control over everyday tasks.

Myoelectric prosthetics are gaining popularity due to their ease of use, reduced energy consumption, and the increasing availability of advanced materials that make these devices lighter, more durable, and more comfortable. As these prosthetics continue to evolve, they are expected to become even more sophisticated, with improved responsiveness and better integration with other technologies, such as artificial intelligence and sensors, driving continued growth in this segment.

Carbon Fiber Is Leading Material for Prosthetics Due to Strength and Lightweight Properties

Carbon fiber is the leading material used in the production of bionic prosthetics, largely due to its superior strength-to-weight ratio and durability. It is widely preferred for both upper and lower limb prosthetics, offering a lightweight yet strong alternative to traditional materials like aluminum or titanium. This makes carbon fiber particularly valuable for prosthetics that require both comfort and high performance, as it reduces the weight of the prosthetic limb while maintaining its structural integrity.

The material's resistance to wear and corrosion, coupled with its flexibility and ease of molding, makes it ideal for the dynamic movements required in prosthetics. The use of carbon fiber also enhances the overall aesthetic appeal of prosthetics, as it can be molded into sleek, ergonomic designs that improve both function and appearance, further contributing to its dominance in the market.

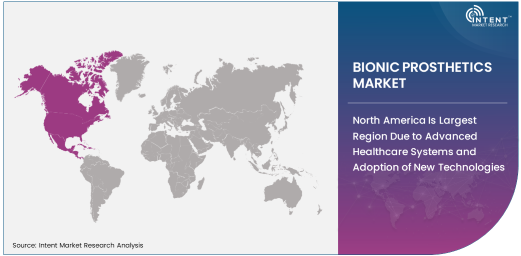

North America Is Largest Region Due to Advanced Healthcare Systems and Adoption of New Technologies

North America is the largest region in the bionic prosthetics market, driven by the advanced healthcare infrastructure and high adoption of cutting-edge medical technologies. The United States, in particular, has a well-established market for bionic prosthetics, with a large number of rehabilitation centers, medical institutions, and veterans' associations that provide prosthetic services. The region also benefits from substantial research and development activities, which accelerate innovation in prosthetic technologies.

The growing emphasis on improving the quality of life for individuals with disabilities, combined with increased government support for healthcare innovations, is fueling the expansion of the bionic prosthetics market in North America. The availability of advanced prosthetics, along with strong healthcare reimbursement policies, has contributed to the widespread use of bionic prosthetics in this region.

Competitive Landscape and Leading Companies

The bionic prosthetics market is highly competitive, with several key players leading the innovation and development of new products. Prominent companies include Ottobock, Össur, Touch Bionics, and the Institute of Bionics, which are all focused on enhancing the functionality, comfort, and affordability of their prosthetic offerings. These companies have made significant investments in research and development to create more sophisticated, personalized prosthetic solutions that offer better control, aesthetics, and integration with modern technologies.

As the market evolves, companies are increasingly collaborating with research institutions, technology firms, and rehabilitation centers to integrate advanced materials, such as carbon fiber, and next-generation technologies, such as artificial intelligence and robotics, into their products. This collaboration is expected to drive further innovations in the market, creating new opportunities for growth and competition among industry players.

Recent Developments:

- In December 2024, Össur launched a new generation of bionic prosthetic limbs with enhanced myoelectric control systems for more intuitive movement.

- In November 2024, Otto Bock Healthcare unveiled a prosthetic hand with integrated sensory feedback technology to improve dexterity for amputees.

- In October 2024, BionX Medical Technologies introduced a cutting-edge lower limb prosthesis designed with lightweight materials for better user comfort.

- In September 2024, Blatchford Group announced the launch of an advanced exoskeleton designed for rehabilitation and mobility assistance in patients with lower limb amputations.

- In August 2024, Hanger Inc. introduced a new line of customizable bionic prosthetic limbs for upper limb amputees, incorporating artificial intelligence to adapt to the user’s movements.

List of Leading Companies:

- Össur

- Otto Bock Healthcare GmbH

- Blatchford Group

- BionX Medical Technologies

- Touch Bionics

- Endolite

- RSLSteeper

- Hanger Inc.

- iLimb (by Touch Bionics)

- Kinova Robotics

- Biodesigns (Ortho Europe)

- Freedom Innovations

- Mobius Bionics

- Rewalk Robotics

- Proteor

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.0 billion |

|

Forecasted Value (2030) |

USD 4.5 billion |

|

CAGR (2024 – 2030) |

12.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Bionic Prosthetics Market By Product Type (Upper Limb Prosthetics, Lower Limb Prosthetics, Wearable Prosthetics, Exoskeleton Prosthetics, Prosthetic Hands, Prosthetic Limbs), By Technology (Myoelectric Prosthetics, Neural-Controlled Prosthetics, Targeted Muscle Reinnervation, Bionic Prosthetics with Sensors), By Material (Carbon Fiber, Titanium, Aluminum, Silicon) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Össur, Otto Bock Healthcare GmbH, Blatchford Group, BionX Medical Technologies, Touch Bionics, Endolite, RSLSteeper, Hanger Inc., iLimb (by Touch Bionics), Kinova Robotics, Biodesigns (Ortho Europe), Freedom Innovations, Mobius Bionics, Rewalk Robotics, Proteor |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Bionic Prosthetics Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Upper Limb Prosthetics |

|

4.2. Lower Limb Prosthetics |

|

4.3. Wearable Prosthetics |

|

4.4. Exoskeleton Prosthetics |

|

4.5. Prosthetic Hands |

|

4.6. Prosthetic Limbs |

|

4.7. Others |

|

5. Bionic Prosthetics Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Myoelectric Prosthetics |

|

5.2. Neural-Controlled Prosthetics |

|

5.3. Targeted Muscle Reinnervation |

|

5.4. Bionic Prosthetics with Sensors |

|

5.5. Others |

|

6. Bionic Prosthetics Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Carbon Fiber |

|

6.2. Titanium |

|

6.3. Aluminum |

|

6.4. Silicon |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Bionic Prosthetics Market, by Product Type |

|

7.2.7. North America Bionic Prosthetics Market, by Technology |

|

7.2.8. North America Bionic Prosthetics Market, by Material |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Bionic Prosthetics Market, by Product Type |

|

7.2.9.1.2. US Bionic Prosthetics Market, by Technology |

|

7.2.9.1.3. US Bionic Prosthetics Market, by Material |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Össur |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Otto Bock Healthcare GmbH |

|

9.3. Blatchford Group |

|

9.4. BionX Medical Technologies |

|

9.5. Touch Bionics |

|

9.6. Endolite |

|

9.7. RSLSteeper |

|

9.8. Hanger Inc. |

|

9.9. iLimb (by Touch Bionics) |

|

9.10. Kinova Robotics |

|

9.11. Biodesigns (Ortho Europe) |

|

9.12. Freedom Innovations |

|

9.13. Mobius Bionics |

|

9.14. Rewalk Robotics |

|

9.15. Proteor |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Bionic Prosthetics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Bionic Prosthetics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Bionic Prosthetics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA