As per Intent Market Research, the Atmospheric Water Generator Market was valued at USD 2.5 billion in 2024-e and will surpass USD 4.5 billion by 2030; growing at a CAGR of 10.3% during 2025 - 2030.

The atmospheric water generator (AWG) market is experiencing significant growth, driven by increasing concerns about water scarcity and the demand for sustainable water solutions. AWG technology enables the extraction of potable water from ambient air, making it a crucial innovation in areas with limited access to clean water. The global emphasis on environmental sustainability and the need for decentralized water systems are further propelling the adoption of AWG systems across residential, commercial, and industrial sectors.

The integration of advanced technologies such as IoT and AI to enhance operational efficiency and optimize water generation processes has significantly contributed to the market's expansion. Additionally, growing government initiatives to address water shortages and promote the adoption of eco-friendly solutions are expected to further boost the AWG market in the coming years.

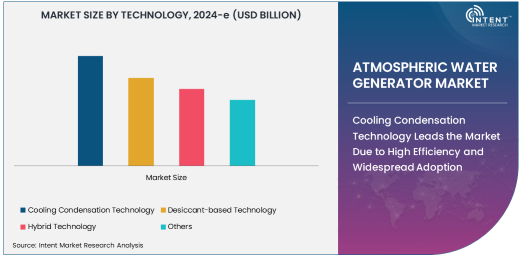

Cooling Condensation Technology Leads the Market Due to High Efficiency and Widespread Adoption

The cooling condensation technology segment dominates the atmospheric water generator market, owing to its high efficiency in extracting water from air in various climatic conditions. This technology relies on cooling ambient air to its dew point, enabling water vapor to condense and be collected as potable water. Its effectiveness in regions with moderate to high humidity levels has made it a preferred choice for residential and commercial applications.

Furthermore, cooling condensation technology is cost-effective and widely available, making it accessible for a broad range of end-users. Continuous advancements in this technology, such as the incorporation of energy-efficient components, have enhanced its operational efficiency, driving its adoption across the globe. As the demand for reliable and sustainable water generation solutions grows, the cooling condensation technology segment is poised to maintain its leadership in the market.

Commercial Application Segment Emerges as the Fastest-Growing Due to Rising Demand in Urban Areas

The commercial application segment is witnessing rapid growth in the atmospheric water generator market, attributed to the increasing need for sustainable water solutions in urban areas. Businesses, including hotels, offices, and educational institutions, are adopting AWG systems to ensure a consistent supply of clean water and reduce dependence on traditional water sources. The rise in water scarcity in metropolitan regions has further accelerated the adoption of AWG systems in the commercial sector.

Moreover, government policies promoting water conservation and sustainable practices are encouraging commercial entities to invest in AWG technology. With the growing emphasis on corporate social responsibility and sustainability, the commercial segment is expected to continue its upward trajectory, contributing significantly to the market’s expansion.

Capacity Segment: 100–500 Liters/Day Systems Dominate the Market Due to Versatility

The 100–500 liters/day capacity segment dominates the AWG market, primarily due to its versatility and suitability for a wide range of applications. These systems are ideal for small to medium-sized establishments, including residential complexes, small offices, and educational institutions. Their ability to generate an adequate water supply while being energy-efficient makes them a popular choice among end-users.

Additionally, the relatively compact design of these systems allows for easy installation and integration into existing water infrastructure. As the demand for scalable and efficient water generation solutions continues to grow, the 100–500 liters/day capacity segment is expected to remain a key contributor to the market's overall revenue.

Industrial Application Drives Growth in the End-User Segment Due to High Demand for Water Solutions

The industrial sector is a major end-user of atmospheric water generators, driven by the need for large-scale water generation solutions in manufacturing, construction, and other heavy industries. Industries require significant quantities of water for operational processes, and AWG systems provide a sustainable and cost-effective alternative to traditional water sources. The ability to generate clean water on-site reduces dependency on municipal supplies, ensuring uninterrupted operations.

Moreover, the adoption of AWG systems in industries is supported by stringent regulations on water usage and sustainability. Companies are increasingly incorporating AWG technology to meet their water requirements while aligning with environmental conservation goals. This trend is expected to drive significant growth in the industrial end-user segment.

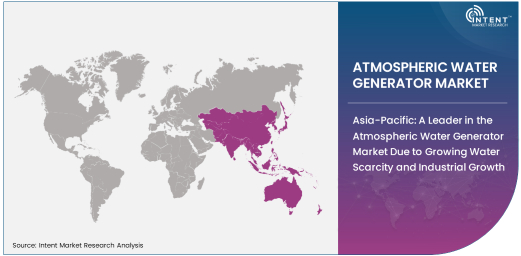

Asia-Pacific: A Leader in the Atmospheric Water Generator Market Due to Growing Water Scarcity and Industrial Growth

Asia-Pacific leads the atmospheric water generator market, fueled by increasing water scarcity and rapid industrialization in the region. Countries such as India and China are witnessing a growing demand for sustainable water solutions due to rising population and urbanization. Additionally, government initiatives promoting the adoption of AWG systems to address water shortages have further propelled the market in this region.

The region's industrial expansion and the increasing adoption of AWG technology in commercial and residential applications contribute significantly to its market dominance. With continuous investments in research and development and the introduction of cost-effective AWG solutions, Asia-Pacific is expected to retain its leadership position in the market.

Leading Companies and Competitive Landscape

The atmospheric water generator market is characterized by intense competition, with key players focusing on innovation and strategic partnerships to enhance their market presence. Leading companies in the market include Watergen, Dew Point Manufacturing, EcoloBlue, Atmospheric Water Solutions (AWS), and Drinkable Air. These companies are investing in research and development to improve the efficiency and sustainability of their AWG systems.

Watergen has established itself as a market leader with its advanced AWG technology and focus on social impact, providing water solutions to underserved communities. EcoloBlue and AWS are notable for their diverse product portfolios catering to residential, commercial, and industrial applications. The competitive landscape is marked by continuous innovation, with companies prioritizing energy efficiency, scalability, and affordability to gain a competitive edge.

Recent Developments:

- In December 2024, Watergen announced the launch of a compact AWG designed for residential use, capable of producing 50 liters/day.

- In November 2024, GENAQ Technologies partnered with a military organization to develop high-capacity AWG systems for remote deployment.

- In October 2024, EcoloBlue, Inc. expanded its product portfolio with a solar-powered AWG system aimed at off-grid consumers.

- In September 2024, Dew Point Manufacturing introduced a hybrid AWG system combining cooling and desiccant-based technologies for enhanced efficiency.

- In August 2024, Ambient Water Corporation announced a new industrial AWG capable of generating over 5,000 liters/day for commercial clients.

List of Leading Companies:

- Watergen

- Akvo Atmospheric Water Systems

- Dew Point Manufacturing

- Drinkable Air Technologies

- EcoloBlue, Inc.

- Saisons Trade & Industry Private Limited

- GENAQ Technologies S.L.

- PlanetsWater

- Ambient Water Corporation

- Atlantis Solar

- Skywater

- Aqua Sciences

- Ray Agua

- Watair Inc.

- Konia Water Supplies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.5 billion |

|

Forecasted Value (2030) |

USD 4.5 billion |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Atmospheric Water Generator Market By Technology (Cooling Condensation Technology, Desiccant-based Technology, Hybrid Technology), By Application (Residential, Commercial, Industrial, Government and Defense), By Capacity (Below 100 Liters/Day, 100–500 Liters/Day, 500–1,000 Liters/Day, Above 1,000 Liters/Day) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Watergen, Akvo Atmospheric Water Systems, Dew Point Manufacturing, Drinkable Air Technologies, EcoloBlue, Inc., Saisons Trade & Industry Private Limited, GENAQ Technologies S.L., PlanetsWater, Ambient Water Corporation, Atlantis Solar, Skywater, Aqua Sciences, Ray Agua, Watair Inc., Konia Water Supplies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Atmospheric Water Generator Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Cooling Condensation Technology |

|

4.2. Desiccant-based Technology |

|

4.3. Hybrid Technology |

|

4.4. Others |

|

5. Atmospheric Water Generator Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Residential |

|

5.2. Commercial |

|

5.3. Industrial |

|

5.4. Government and Defense |

|

6. Atmospheric Water Generator Market, by Capacity (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Below 100 Liters/Day |

|

6.2. 100–500 Liters/Day |

|

6.3. 500–1,000 Liters/Day |

|

6.4. Above 1,000 Liters/Day |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Atmospheric Water Generator Market, by Technology |

|

7.2.7. North America Atmospheric Water Generator Market, by Application |

|

7.2.8. North America Atmospheric Water Generator Market, by Capacity |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Atmospheric Water Generator Market, by Technology |

|

7.2.9.1.2. US Atmospheric Water Generator Market, by Application |

|

7.2.9.1.3. US Atmospheric Water Generator Market, by Capacity |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Watergen |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Akvo Atmospheric Water Systems |

|

9.3. Dew Point Manufacturing |

|

9.4. Drinkable Air Technologies |

|

9.5. EcoloBlue, Inc. |

|

9.6. Saisons Trade & Industry Private Limited |

|

9.7. GENAQ Technologies S.L. |

|

9.8. PlanetsWater |

|

9.9. Ambient Water Corporation |

|

9.10. Atlantis Solar |

|

9.11. Skywater |

|

9.12. Aqua Sciences |

|

9.13. Ray Agua |

|

9.14. Watair Inc. |

|

9.15. Konia Water Supplies |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Atmospheric Water Generator Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Atmospheric Water Generator Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Atmospheric Water Generator Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA