As per Intent Market Research, the Onychomycosis Treatment Market was valued at USD 4.0 billion in 2024-e and will surpass USD 6.5 billion by 2030; growing at a CAGR of 8.5% during 2025 - 2030.

The onychomycosis treatment market has seen significant growth due to the rising prevalence of fungal nail infections, which affect a large percentage of the global population. Onychomycosis, commonly known as nail fungus, is a condition that results in discoloration, thickening, and deformation of the nails, often causing discomfort and potential complications if left untreated. The market for onychomycosis treatments has expanded as a result of increased awareness, better diagnostic capabilities, and advancements in treatment options. The market is primarily driven by the growing demand for effective treatments that address both the aesthetic concerns and medical complications associated with fungal infections.

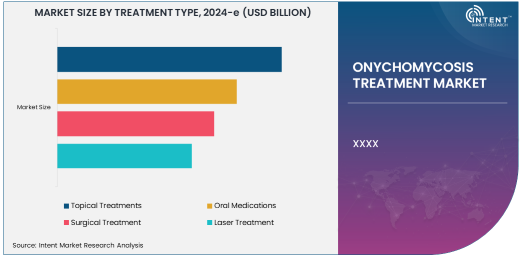

Among the various treatment options, topical treatments, oral medications, and advanced therapies such as laser treatments have emerged as the most commonly utilized solutions. The demand for these treatments is expected to increase as the understanding of onychomycosis expands and as healthcare providers gain more access to innovative treatment options. With a variety of therapies available, including traditional medications and cutting-edge technologies, patients now have more options to manage and cure onychomycosis, contributing to the growing market. As the market for onychomycosis treatments continues to expand, it presents a significant opportunity for pharmaceutical companies, healthcare providers, and treatment developers.

Topical Treatments Are Largest Due to Accessibility and Convenience

Topical treatments remain the largest treatment type in the onychomycosis market, owing to their accessibility, convenience, and non-invasive nature. Topical antifungal medications, such as nail lacquers and creams, are widely used by patients seeking treatment for fungal nail infections. These treatments are typically applied directly to the affected area, offering an easy and less expensive alternative to oral medications or surgical procedures. One of the key advantages of topical treatments is that they allow patients to manage their condition at home without the need for extensive medical intervention, making them particularly popular among those with mild to moderate infections.

The growth in the popularity of topical treatments can also be attributed to advancements in formulation technology, which have improved the efficacy and speed of treatment. Products that penetrate the nail effectively and target the fungus directly have become more accessible, contributing to higher patient satisfaction. As the market for onychomycosis continues to expand, the demand for topical treatments is expected to grow, driven by their simplicity, cost-effectiveness, and ease of use for patients seeking to manage nail fungus at home. Moreover, the increasing availability of over-the-counter topical treatments will further fuel the market growth in this segment.

Nail Fungus Is Largest Application Segment Due to High Prevalence

Nail fungus, or onychomycosis, is the largest application segment in the treatment market, largely due to its high prevalence among the global population. This fungal infection, which affects the nails of the hands and feet, is one of the most common dermatological conditions. It is estimated that a significant portion of the adult population experiences some form of nail fungal infection during their lifetime, particularly among older individuals and those with compromised immune systems. As a result, the demand for effective treatment options for nail fungus continues to rise, making it the leading application in the onychomycosis treatment market.

Several factors contribute to the high prevalence of nail fungus, including environmental conditions such as humidity and warmth, as well as underlying health conditions like diabetes, obesity, and poor circulation. The condition is often slow to progress and can be difficult to treat without consistent intervention, prompting patients to seek solutions that can effectively eliminate the infection. As a result, the nail fungus segment remains the dominant driver of market growth, with a growing number of treatment options aimed at alleviating the symptoms and curing the infection. This trend is expected to continue as more effective and accessible treatments are developed for patients suffering from nail fungal infections.

Dermatology Clinics Are Fastest Growing End-User Segment Due to Increased Specialist Consultation

Dermatology clinics represent the fastest growing end-user segment in the onychomycosis treatment market. As patients become more aware of the importance of proper treatment for nail fungus, there has been an increasing tendency to seek specialized care from dermatologists, particularly for more severe or persistent infections. Dermatologists are equipped with advanced diagnostic tools to accurately identify the condition and recommend appropriate treatment plans, which may include a combination of topical treatments, oral medications, or laser therapies. This has driven the growth of dermatology clinics as the preferred healthcare setting for treating onychomycosis.

The shift toward specialist consultation has been further influenced by the availability of innovative treatment options such as laser therapy, which requires professional administration. As the awareness of the effectiveness of laser treatments increases, more patients are turning to dermatology clinics for specialized care. The growing demand for expert care and advanced treatment technologies has made dermatology clinics the fastest growing end-user segment in the market. With an increasing number of patients seeking professional treatment to manage onychomycosis, dermatology clinics are poised to continue expanding in this space.

North America Is Largest Region Due to High Prevalence and Advanced Healthcare Infrastructure

North America is the largest region in the onychomycosis treatment market, driven by the high prevalence of fungal nail infections, a well-established healthcare infrastructure, and the availability of advanced treatment options. The United States, in particular, is home to a large population of individuals affected by onychomycosis, particularly among older adults, individuals with diabetes, and those with compromised immune systems. As a result, the demand for onychomycosis treatments, including both over-the-counter and prescription medications, has surged.

Additionally, North America benefits from a robust healthcare system that offers easy access to specialized dermatology services and advanced treatments such as laser therapies, which are gaining popularity for treating onychomycosis. The region’s strong pharmaceutical and biotechnology sectors also contribute to the availability of innovative treatments, which further drives the growth of the market. As healthcare providers continue to embrace new technologies and treatment modalities, North America is expected to maintain its position as the largest region in the onychomycosis treatment market.

Leading Companies and Competitive Landscape

The onychomycosis treatment market is highly competitive, with a range of key players offering various treatment options, including topical treatments, oral medications, and advanced therapies. Major players in the market include pharmaceutical companies such as Novartis, Pfizer, and Johnson & Johnson, which offer both over-the-counter and prescription treatments for nail fungus. These companies are leveraging their extensive research and development capabilities to introduce new and more effective therapies aimed at addressing the growing demand for onychomycosis treatments.

Additionally, companies specializing in dermatology and medical devices, such as Cutera and Noveon, are at the forefront of providing advanced laser treatments for fungal nail infections. As the market continues to grow, these companies are expanding their portfolios to include combination therapies, novel drug formulations, and cutting-edge technologies. The competitive landscape is also marked by increasing partnerships between pharmaceutical companies, dermatology clinics, and research institutions, driving innovation and enhancing treatment accessibility for patients. With the ongoing demand for effective, accessible, and safe treatments, competition is expected to intensify in the onychomycosis treatment market in the coming years.

Recent Developments:

- In December 2024, Johnson & Johnson launched a new antifungal cream for treating mild to moderate onychomycosis.

- In November 2024, Merck & Co. received FDA approval for a new oral antifungal medication for onychomycosis.

- In October 2024, Sanofi introduced an enhanced laser treatment for fungal nail infections, reducing treatment time.

- In September 2024, Bayer AG expanded its antifungal treatment line to include new topical nail products.

- In August 2024, Amgen Inc. announced the acquisition of a company specializing in innovative oral onychomycosis treatments.

List of Leading Companies:

- Johnson & Johnson

- Pfizer Inc.

- Novartis

- Merck & Co., Inc.

- Sanofi

- GlaxoSmithKline

- Bayer AG

- Eli Lilly and Company

- Abbott Laboratories

- Cipla Ltd.

- Taro Pharmaceutical Industries

- Amgen Inc.

- Valeant Pharmaceuticals International, Inc.

- Astellas Pharma Inc.

- Mylan N.V.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.0 billion |

|

Forecasted Value (2030) |

USD 6.5 billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Onychomycosis Treatment Market By Treatment Type (Topical Treatments, Oral Medications, Surgical Treatment, Laser Treatment), By Application (Nail Fungus, Skin Fungus, Prevention), By End-User (Dermatology Clinics, Hospitals, Home Care) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Johnson & Johnson, Pfizer Inc., Novartis, Merck & Co., Inc., Sanofi, GlaxoSmithKline, Bayer AG, Eli Lilly and Company, Abbott Laboratories, Cipla Ltd., Taro Pharmaceutical Industries, Amgen Inc., Valeant Pharmaceuticals International, Inc., Astellas Pharma Inc., Mylan N.V. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Onychomycosis Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Topical Treatments |

|

4.2. Oral Medications |

|

4.3. Surgical Treatment |

|

4.4. Laser Treatment |

|

5. Onychomycosis Treatment Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Nail Fungus |

|

5.2. Skin Fungus |

|

5.3. Prevention |

|

6. Onychomycosis Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Dermatology Clinics |

|

6.2. Hospitals |

|

6.3. Home Care |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Onychomycosis Treatment Market, by Treatment Type |

|

7.2.7. North America Onychomycosis Treatment Market, by Application |

|

7.2.8. North America Onychomycosis Treatment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Onychomycosis Treatment Market, by Treatment Type |

|

7.2.9.1.2. US Onychomycosis Treatment Market, by Application |

|

7.2.9.1.3. US Onychomycosis Treatment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Johnson & Johnson |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Pfizer Inc. |

|

9.3. Novartis |

|

9.4. Merck & Co., Inc. |

|

9.5. Sanofi |

|

9.6. GlaxoSmithKline |

|

9.7. Bayer AG |

|

9.8. Eli Lilly and Company |

|

9.9. Abbott Laboratories |

|

9.10. Cipla Ltd. |

|

9.11. Taro Pharmaceutical Industries |

|

9.12. Amgen Inc. |

|

9.13. Valeant Pharmaceuticals International, Inc. |

|

9.14. Astellas Pharma Inc. |

|

9.15. Mylan N.V. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Onychomycosis Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Onychomycosis Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Onychomycosis Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA