As per Intent Market Research, the Assisted Reproductive Technology Market was valued at USD 23.6 Billion in 2024-e and will surpass USD 41.8 Billion by 2030; growing at a CAGR of 10.0% during 2025 - 2030.

The assisted reproductive technology (ART) market has experienced significant growth in recent years, driven by advancements in reproductive science, increasing awareness about fertility treatments, and changing societal norms regarding family planning. ART encompasses various medical procedures and technologies aimed at helping individuals and couples with fertility issues achieve pregnancy. As more people seek effective solutions for infertility, the market is evolving with innovative treatments, increasing success rates, and expanding access to reproductive services. The ART market includes treatments for both male and female infertility, as well as options such as genetic screening and egg/sperm donation.

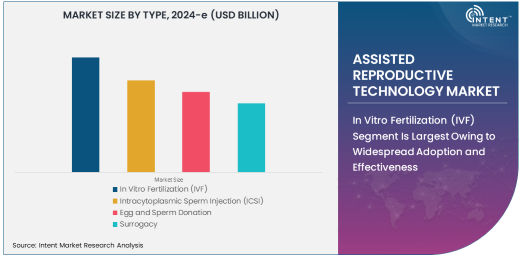

In Vitro Fertilization (IVF) Segment Is Largest Owing to Widespread Adoption and Effectiveness

The in vitro fertilization (IVF) segment is the largest in the assisted reproductive technology market, owing to its widespread adoption and high success rates. IVF involves the fertilization of an egg outside the body, followed by implantation of the embryo into the uterus, and is widely recognized as one of the most effective treatments for infertility. IVF is used by individuals and couples facing a variety of fertility issues, including low sperm count, blocked fallopian tubes, and unexplained infertility.

As IVF technology continues to advance, success rates have improved, making it the go-to option for many seeking assisted reproduction. Additionally, with rising infertility rates worldwide, IVF’s broad applicability and proven effectiveness make it the largest and most commonly used ART procedure.

Egg and Sperm Donation Segment Is Fastest Growing Owing to Increased Acceptance and Availability

Egg and sperm donation is the fastest-growing segment in the ART market, driven by the increasing acceptance of assisted reproduction methods and the growing availability of donor sperm and eggs. This option is particularly beneficial for individuals who cannot use their own gametes due to age, genetic conditions, or infertility.

The growth of egg and sperm donation is further supported by advances in genetic screening and donor selection, which ensure a higher likelihood of successful pregnancies. As societal acceptance of donor-assisted conception grows, this segment is expected to see continued expansion, particularly in regions with well-regulated donation programs.

Female Infertility Treatment Segment Is Largest Application Due to High Prevalence

The female infertility treatment segment is the largest application within the ART market, driven by the high prevalence of female infertility issues, including ovulation disorders, age-related infertility, and polycystic ovary syndrome (PCOS). Female infertility treatments often involve IVF, egg retrieval, and other ART procedures designed to overcome reproductive challenges.

As women delay childbearing until later in life, the demand for female infertility treatments continues to increase. The growing awareness of fertility preservation and treatment options is also contributing to the rising number of women seeking ART services. This trend is expected to drive the continued growth of the female infertility treatment segment in the ART market.

Healthcare Segment Is Largest End-Use Industry Owing to High Demand for Fertility Services

The healthcare sector is the largest end-use industry in the assisted reproductive technology market, as fertility clinics, hospitals, and specialized medical centers are the primary providers of ART services. Healthcare institutions are integral to the development and delivery of ART treatments, as they house the necessary medical expertise, technologies, and infrastructure to support fertility procedures.

The increasing demand for ART services, combined with advancements in fertility treatments and the growing focus on maternal health, ensures that the healthcare industry remains the dominant end-use segment. The adoption of ART in healthcare facilities continues to rise as fertility preservation becomes a priority for individuals and couples globally.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and Access to ART

North America leads the assisted reproductive technology market, primarily due to its well-established healthcare infrastructure, advanced medical technologies, and widespread access to fertility services. The United States, in particular, is a significant contributor to the region's dominance, with numerous fertility clinics offering a wide range of ART procedures.

Factors such as increasing infertility rates, higher acceptance of ART treatments, and supportive reimbursement policies contribute to North America's leadership in the market. The presence of key players in the region and the increasing availability of ART options continue to drive growth in this market segment.

Competitive Landscape and Key Players

The assisted reproductive technology market is highly competitive, with key players such as Ferring Pharmaceuticals, Merck Group, IVF Europe, Vitrolife, and Cook Medical leading the industry. These companies provide a range of ART solutions, from IVF and ICSI to egg and sperm donation services, catering to the growing demand for fertility treatments worldwide.

The competitive landscape is characterized by continuous innovation, strategic acquisitions, and partnerships aimed at expanding service offerings and geographic reach. As ART technologies evolve, leading players are investing in research and development to enhance treatment success rates and improve patient experiences, ensuring their position in this rapidly growing market.

Recent Developments:

- CooperSurgical, Inc. introduced new embryo freezing technologies aimed at improving the success rates of IVF.

- Thermo Fisher Scientific Inc. launched next-generation sequencing solutions to support genetic screening in assisted reproductive treatments.

- Merck Group expanded its assisted reproductive technology product portfolio with a new range of fertility drugs.

- Ferring Pharmaceuticals announced a partnership with Monash IVF Group to offer customized fertility treatments to global markets.

- CryoLife, Inc. received FDA approval for a new cryopreservation system to enhance oocyte and embryo freezing for IVF.

List of Leading Companies:

- CooperSurgical, Inc.

- Vitrolife AB

- Thermo Fisher Scientific Inc.

- Merck Group

- Cook Medical

- Ferring Pharmaceuticals

- Monash IVF Group

- Vitrolife

- Elekta AB

- Genea Limited

- Igenomix

- EmbryoScience

- The ART Lab

- CryoLife, Inc.

- IVF España

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 23.6 Billion |

|

Forecasted Value (2030) |

USD 41.8 Billion |

|

CAGR (2025 – 2030) |

10.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Assisted Reproductive Technology Market by Type (In Vitro Fertilization [IVF], Intracytoplasmic Sperm Injection [ICSI], Egg and Sperm Donation, Surrogacy), by End-Use Industry (Healthcare, Fertility Clinics, Research Institutions), by Application (Male Infertility Treatment, Female Infertility Treatment, Genetic Screening); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

CooperSurgical, Inc., Vitrolife AB, Thermo Fisher Scientific Inc., Merck Group, Cook Medical, Ferring Pharmaceuticals, Vitrolife, Elekta AB, Genea Limited, Igenomix, EmbryoScience, The ART Lab, IVF España |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Assisted Reproductive Technology Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. In Vitro Fertilization (IVF) |

|

4.2. Intracytoplasmic Sperm Injection (ICSI) |

|

4.3. Egg and Sperm Donation |

|

4.4. Surrogacy |

|

5. Assisted Reproductive Technology Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Healthcare |

|

5.2. Fertility Clinics |

|

5.3. Research Institutions |

|

6. Assisted Reproductive Technology Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Male Infertility Treatment |

|

6.2. Female Infertility Treatment |

|

6.3. Genetic Screening |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Assisted Reproductive Technology Market, by Type |

|

7.2.7. North America Assisted Reproductive Technology Market, by End-Use Industry |

|

7.2.8. North America Assisted Reproductive Technology Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Assisted Reproductive Technology Market, by Type |

|

7.2.9.1.2. US Assisted Reproductive Technology Market, by End-Use Industry |

|

7.2.9.1.3. US Assisted Reproductive Technology Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. CooperSurgical, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Vitrolife AB |

|

9.3. Thermo Fisher Scientific Inc. |

|

9.4. Merck Group |

|

9.5. Cook Medical |

|

9.6. Ferring Pharmaceuticals |

|

9.7. Monash IVF Group |

|

9.8. Vitrolife |

|

9.9. Elekta AB |

|

9.10. Genea Limited |

|

9.11. Igenomix |

|

9.12. EmbryoScience |

|

9.13. The ART Lab |

|

9.14. CryoLife, Inc. |

|

9.15. IVF España |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Assisted Reproductive Technology Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Assisted Reproductive Technology Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Assisted Reproductive Technology Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA