As per Intent Market Research, the Asphalt Additives Market was valued at USD 2.9 Billion in 2024-e and will surpass USD 4.3 Billion by 2030; growing at a CAGR of 7.0% during 2025 - 2030.

The asphalt additives market is witnessing steady growth driven by the need for enhanced performance and durability in asphalt applications. Additives are used to modify the properties of asphalt, improving its resistance to environmental stress, enhancing its workability, and prolonging its lifespan. With growing infrastructure development, especially in road construction, and the increasing focus on sustainable and high-performance materials, the demand for asphalt additives continues to rise across residential, commercial, and industrial sectors.

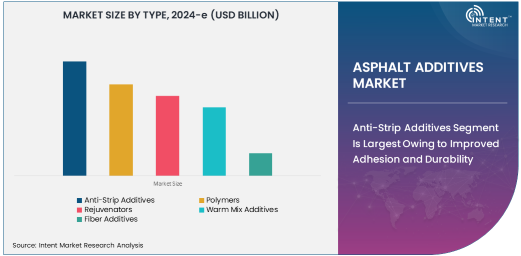

Anti-Strip Additives Segment Is Largest Owing to Improved Adhesion and Durability

The anti-strip additives segment is the largest in the asphalt additives market, primarily due to their ability to enhance the adhesion between asphalt binder and aggregates. These additives are widely used in road construction to improve the performance and durability of asphalt pavements, particularly in regions prone to extreme weather conditions.

Anti-strip additives help prevent stripping, which occurs when moisture weakens the bond between the asphalt and the aggregates, leading to surface deterioration. As the need for durable, long-lasting pavements continues to grow, the use of anti-strip additives remains essential, driving the segment’s dominance in the market.

Polymers Segment Is Fastest Growing Owing to Enhanced Performance and Sustainability

Polymers are the fastest-growing type of asphalt additives, driven by their ability to improve the flexibility, strength, and overall performance of asphalt. The incorporation of polymers, such as styrene-butadiene-styrene (SBS) and ethylene-vinyl acetate (EVA), enhances the asphalt’s resistance to cracking, rutting, and aging, making it ideal for high-traffic areas and harsh climates.

Polymers also offer sustainability benefits by improving the long-term performance of asphalt, reducing the need for frequent repairs and maintenance. The growing demand for high-performance, environmentally friendly materials in road construction is fueling the rapid adoption of polymer-modified asphalts.

Road Construction Segment Is Largest Application Owing to Infrastructure Expansion

The road construction segment is the largest application for asphalt additives, as these materials are crucial for producing durable and high-performance pavements. Asphalt additives are widely used to improve the characteristics of asphalt mixtures, making them more resistant to weathering, wear, and fatigue.

With the increasing investments in road infrastructure across emerging economies and developed countries, the demand for asphalt additives in road construction remains robust. The need for longer-lasting roads and sustainable infrastructure solutions continues to propel growth in this application.

Commercial Segment Is Largest End-Use Industry Owing to High Demand for Paving Solutions

The commercial sector is the largest end-use industry for asphalt additives, driven by the growing demand for paving solutions in urban areas, parking lots, and commercial facilities. Asphalt additives play a vital role in ensuring the durability and longevity of paved surfaces, which are subject to heavy foot and vehicle traffic.

The expansion of commercial infrastructure, such as shopping centers, office buildings, and recreational areas, continues to drive the demand for high-quality, long-lasting pavements. The commercial sector’s need for cost-effective, durable solutions further supports the growth of the asphalt additives market in this segment.

North America Is Largest Region Owing to Robust Infrastructure Development

North America is the largest region in the asphalt additives market, supported by ongoing investments in infrastructure and the high demand for durable road and commercial paving solutions. The region's well-developed transportation networks and urbanization efforts create a continuous demand for high-performance asphalt materials.

Additionally, North America’s focus on sustainable construction practices, including the use of environmentally friendly additives and polymers, contributes to the market's growth. The adoption of innovative asphalt solutions in road construction and the rising need for maintenance and repair of existing infrastructure are key drivers of the market in this region.

Competitive Landscape and Key Players

The asphalt additives market is competitive, with key players such as BASF SE, Dow Chemical Company, Chevron Phillips Chemical Company, Arkema Group, and Evonik Industries leading the industry. These companies focus on developing advanced additives, such as polymers, anti-stripping agents, and rejuvenators, to enhance the performance and sustainability of asphalt.

The competitive landscape is characterized by significant investments in R&D, product innovation, and strategic partnerships aimed at expanding market share. As the demand for durable and high-performance asphalt materials continues to rise, these key players are well-positioned to lead the market in the coming years.

Recent Developments:

- BASF SE launched a new warm mix additive aimed at reducing energy consumption in road paving.

- Dow Inc. expanded its operations to increase production of asphalt additives in Asia-Pacific.

- Sika AG introduced an innovative polymer-based additive to enhance the durability of asphalt pavements.

- ExxonMobil Corporation partnered with Colas Group to develop new anti-strip additives for better pavement adhesion.

- Huntsman Corporation unveiled a rejuvenator additive designed to extend the life of aging asphalt roads.

List of Leading Companies:

- BASF SE

- Dow Inc.

- Sika AG

- ExxonMobil Corporation

- TotalEnergies SE

- Huntsman Corporation

- Chevron Corporation

- AkzoNobel N.V.

- Colas Group

- Vulcan Materials Company

- Brenntag AG

- Lanxess AG

- Arkema S.A.

- W.R. Grace & Co.

- GAF Materials Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.9 Billion |

|

Forecasted Value (2030) |

USD 4.3 Billion |

|

CAGR (2025 – 2030) |

7.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Aspergillosis Treatment Market by Drug Class (Azoles, Polyenes, Echinocandins, Other Antifungal Drugs), by Route of Administration (Oral, Intravenous), by Treatment Type (Primary Therapy, Salvage Therapy), by End-Use Industry (Hospitals, Clinics, Specialty Treatment Centers); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, Dow Inc., Sika AG, ExxonMobil Corporation, TotalEnergies SE, Huntsman Corporation, AkzoNobel N.V., Colas Group, Vulcan Materials Company, Brenntag AG, Lanxess AG, Arkema S.A., GAF Materials Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Asphalt Additives Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Anti-Strip Additives |

|

4.2. Polymers |

|

4.3. Rejuvenators |

|

4.4. Warm Mix Additives |

|

4.5. Fiber Additives |

|

5. Asphalt Additives Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Road Construction |

|

5.2. Roofing |

|

5.3. Airport Runways |

|

5.4. Parking Lots |

|

6. Asphalt Additives Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial |

|

6.3. Industrial |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Asphalt Additives Market, by Type |

|

7.2.7. North America Asphalt Additives Market, by Application |

|

7.2.8. North America Asphalt Additives Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Asphalt Additives Market, by Type |

|

7.2.9.1.2. US Asphalt Additives Market, by Application |

|

7.2.9.1.3. US Asphalt Additives Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF SE |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Dow Inc. |

|

9.3. Sika AG |

|

9.4. ExxonMobil Corporation |

|

9.5. TotalEnergies SE |

|

9.6. Huntsman Corporation |

|

9.7. Chevron Corporation |

|

9.8. AkzoNobel N.V. |

|

9.9. Colas Group |

|

9.10. Vulcan Materials Company |

|

9.11. Brenntag AG |

|

9.12. Lanxess AG |

|

9.13. Arkema S.A. |

|

9.14. W.R. Grace & Co. |

|

9.15. GAF Materials Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Asphalt Additives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Asphalt Additives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Asphalt Additives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA