As per Intent Market Research, the Aspergillosis Treatment Market was valued at USD 3.0 Billion in 2024-e and will surpass USD 4.7 Billion by 2030; growing at a CAGR of 7.9% during 2025 - 2030.

The Aspergillosis Treatment Market is witnessing robust growth, driven by the rising incidence of fungal infections, particularly among immunocompromised patients. Aspergillosis, caused by the Aspergillus fungus, poses significant health risks ranging from allergic reactions to severe invasive infections. The market is shaped by advancements in antifungal therapies, diversified treatment options, and increased awareness about early diagnosis. As healthcare providers and pharmaceutical companies continue to innovate, the market is poised to cater to the growing demand for effective and targeted therapies.

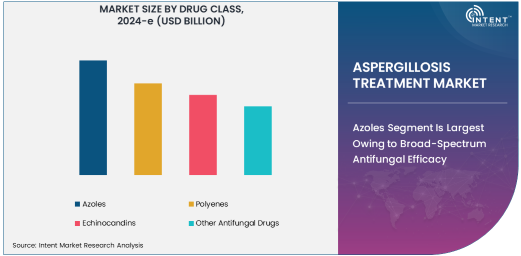

Azoles Segment Is Largest Owing to Broad-Spectrum Antifungal Efficacy

Azoles are the largest drug class in the aspergillosis treatment market due to their broad-spectrum antifungal activity and established efficacy. Azoles, including itraconazole, voriconazole, and posaconazole, are widely used as first-line therapies for both invasive and non-invasive forms of aspergillosis. Their ability to inhibit fungal growth by targeting ergosterol biosynthesis has made them a cornerstone in aspergillosis management.

The dominance of azoles is further supported by their effectiveness in treating a wide range of fungal infections, including chronic pulmonary aspergillosis and allergic bronchopulmonary aspergillosis. Continued innovations, such as extended-spectrum azoles and formulations with improved bioavailability, ensure their relevance in addressing the evolving needs of aspergillosis patients.

Intravenous Segment Is Fastest Growing Owing to Preference for Severe Infections

The intravenous (IV) route of administration is the fastest-growing segment in the aspergillosis treatment market, primarily due to its effectiveness in managing severe and invasive infections. IV antifungal therapies are essential for critically ill patients, particularly those in hospital settings, as they ensure rapid drug delivery and high systemic bioavailability.

This route is often preferred for patients unable to tolerate oral medications or those with life-threatening conditions such as invasive pulmonary aspergillosis. The growing prevalence of severe aspergillosis cases, coupled with advancements in IV formulations, is driving the rapid adoption of this treatment method.

Salvage Therapy Segment Is Largest Owing to Critical Role in Refractory Cases

Salvage therapy is the largest treatment type segment, addressing the unmet needs of patients who do not respond to primary therapies. Invasive aspergillosis, in particular, often necessitates alternative therapeutic strategies due to drug resistance or intolerance to initial treatments. Salvage therapy typically involves combination regimens of azoles, echinocandins, and polyenes to improve outcomes in refractory cases.

The importance of salvage therapy lies in its role in managing complex and persistent infections. With ongoing research and the development of novel antifungal agents, salvage therapy is becoming increasingly effective, ensuring its prominence in the aspergillosis treatment landscape.

Hospitals Segment Is Largest End-Use Industry Owing to High Patient Volume

Hospitals represent the largest end-use industry for aspergillosis treatment due to the high volume of patients requiring advanced care for fungal infections. Hospitals are equipped to handle severe cases, including those requiring intravenous administration and multidisciplinary management.

The dominance of hospitals in this market is further supported by their role in treating immunocompromised patients, such as organ transplant recipients and individuals undergoing chemotherapy, who are at a higher risk of aspergillosis. The availability of specialized care, advanced diagnostics, and access to a wide range of antifungal therapies make hospitals the primary hub for aspergillosis treatment.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure

North America is the largest region in the aspergillosis treatment market, driven by its advanced healthcare infrastructure, high awareness levels, and significant investments in research and development. The prevalence of conditions such as cancer, organ transplants, and chronic lung diseases, which increase susceptibility to aspergillosis, further propels the market in this region.

Additionally, the presence of leading pharmaceutical companies and their focus on developing novel antifungal therapies ensures the availability of cutting-edge treatment options. Government initiatives to enhance fungal infection diagnostics and treatment accessibility also contribute to North America's market dominance.

Competitive Landscape and Key Players

The Aspergillosis Treatment Market is highly competitive, with key players such as Pfizer Inc., Astellas Pharma Inc., Merck & Co., and Gilead Sciences leading the way. These companies focus on developing innovative antifungal drugs, such as extended-spectrum azoles and combination therapies, to address the complexities of aspergillosis management.

The competitive landscape is characterized by ongoing research into drug resistance mechanisms, clinical trials for next-generation antifungal agents, and strategic collaborations to expand market reach. As the need for effective aspergillosis treatments continues to grow, these companies remain at the forefront of driving advancements in the field.

Recent Developments:

- Pfizer Inc. launched a new clinical trial for azole antifungal combinations targeting invasive aspergillosis.

- Merck & Co., Inc. announced the approval of an expanded use for its echinocandin drug in chronic aspergillosis treatment.

- Astellas Pharma Inc. introduced an advanced antifungal formulation aimed at improving patient compliance.

- Gilead Sciences, Inc. received FDA approval for a new intravenous antifungal therapy targeting invasive aspergillosis.

- Basilea Pharmaceutica Ltd. partnered with a biotech firm to develop next-generation antifungal agents for multidrug-resistant strains.

List of Leading Companies:

- Pfizer Inc.

- Merck & Co., Inc.

- Astellas Pharma Inc.

- Novartis AG

- GlaxoSmithKline plc

- Basilea Pharmaceutica Ltd.

- Amgen Inc.

- Gilead Sciences, Inc.

- F. Hoffmann-La Roche Ltd.

- Mylan N.V.

- Cipla Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Eli Lilly and Company

- Abbott Laboratories

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 4.7 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Aspergillosis Treatment Market by Drug Class (Azoles, Polyenes, Echinocandins, Other Antifungal Drugs), by Route of Administration (Oral, Intravenous), by Treatment Type (Primary Therapy, Salvage Therapy), by End-Use Industry (Hospitals, Clinics, Specialty Treatment Centers); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., Merck & Co., Inc., Astellas Pharma Inc., Novartis AG, GlaxoSmithKline plc, Basilea Pharmaceutica Ltd., Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd., Mylan N.V., Cipla Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., Abbott Laboratories |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aspergillosis Treatment Market, by Drug Class (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Azoles |

|

4.2. Polyenes |

|

4.3. Echinocandins |

|

4.4. Other Antifungal Drugs |

|

5. Aspergillosis Treatment Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Oral |

|

5.2. Intravenous |

|

6. Aspergillosis Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Primary Therapy |

|

6.2. Salvage Therapy |

|

7. Aspergillosis Treatment Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Specialty Treatment Centers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Aspergillosis Treatment Market, by Drug Class |

|

8.2.7. North America Aspergillosis Treatment Market, by Route of Administration |

|

8.2.8. North America Aspergillosis Treatment Market, by Treatment Type |

|

8.2.9. North America Aspergillosis Treatment Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Aspergillosis Treatment Market, by Drug Class |

|

8.2.10.1.2. US Aspergillosis Treatment Market, by Route of Administration |

|

8.2.10.1.3. US Aspergillosis Treatment Market, by Treatment Type |

|

8.2.10.1.4. US Aspergillosis Treatment Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Pfizer Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Merck & Co., Inc. |

|

10.3. Astellas Pharma Inc. |

|

10.4. Novartis AG |

|

10.5. GlaxoSmithKline plc |

|

10.6. Basilea Pharmaceutica Ltd. |

|

10.7. Amgen Inc. |

|

10.8. Gilead Sciences, Inc. |

|

10.9. F. Hoffmann-La Roche Ltd. |

|

10.10. Mylan N.V. |

|

10.11. Cipla Inc. |

|

10.12. Teva Pharmaceutical Industries Ltd. |

|

10.13. Sanofi S.A. |

|

10.14. Eli Lilly and Company |

|

10.15. Abbott Laboratories |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aspergillosis Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aspergillosis Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aspergillosis Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA