As per Intent Market Research, the Artificial Photosynthesis Market was valued at USD 0.4 Billion in 2024-e and will surpass USD 2.0 Billion by 2030; growing at a CAGR of 32.9% during 2025 - 2030.

The artificial photosynthesis market is poised for growth as it represents a revolutionary approach to addressing global energy challenges, environmental sustainability, and food security. Artificial photosynthesis systems aim to mimic natural photosynthesis to convert sunlight, carbon dioxide, and water into valuable products, including oxygen, hydrogen, and organic compounds. This technology has the potential to address the growing demand for clean energy, reduce carbon emissions, and contribute to sustainable agricultural practices. As innovation and research continue to progress, artificial photosynthesis is emerging as a viable alternative to traditional methods of energy generation, chemical production, and environmental remediation. The market is being driven by a combination of technological advancements, government policies supporting clean energy, and increasing awareness of the need for sustainable practices.

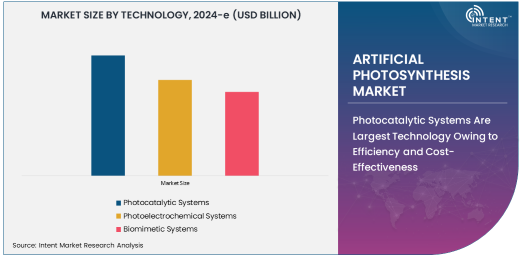

Photocatalytic Systems Are Largest Technology Owing to Efficiency and Cost-Effectiveness

Photocatalytic systems are the largest technology segment in the artificial photosynthesis market, primarily because of their efficiency and cost-effectiveness in converting solar energy into chemical energy. Photocatalytic systems utilize semiconductors to drive chemical reactions upon exposure to sunlight, making them a promising solution for hydrogen production, carbon dioxide reduction, and other chemical processes. These systems are relatively easier to develop and scale compared to other technologies, such as photoelectrochemical and biomimetic systems.

The continued advancement of photocatalytic materials, particularly photocatalysts that can efficiently absorb sunlight and facilitate chemical reactions, is further accelerating the growth of this segment. Furthermore, photocatalytic systems can be utilized in diverse applications such as energy production, water splitting for hydrogen generation, and carbon dioxide capture, which makes them highly attractive for industries looking to transition to sustainable practices. As a result, photocatalytic systems hold the largest share of the artificial photosynthesis market.

Renewable Energy Is Fastest Growing End-Use Industry Owing to the Need for Clean Energy

The renewable energy sector is the fastest-growing end-use industry in the artificial photosynthesis market, driven by the increasing global demand for clean, renewable energy sources. Artificial photosynthesis technologies, particularly those focused on hydrogen production and energy storage, are seen as key solutions for transitioning from fossil fuels to renewable energy sources. These technologies are able to harness solar energy, which is abundant and sustainable, and convert it into usable forms of energy, such as hydrogen, which can be stored and used in fuel cells or other energy systems.

The renewable energy market's rapid expansion is further fueled by global initiatives to reduce greenhouse gas emissions and combat climate change. Governments around the world are providing incentives and funding for clean energy research and development, including artificial photosynthesis technologies. As a result, the renewable energy industry is becoming the fastest-growing end-use segment, with artificial photosynthesis playing a critical role in the future of sustainable energy production.

Photocatalysts Are Largest Component in Artificial Photosynthesis Owing to Their Central Role in Solar Energy Conversion

Photocatalysts are the largest component in the artificial photosynthesis market, as they are central to the process of converting solar energy into chemical energy. These materials absorb sunlight and facilitate chemical reactions, such as water splitting or carbon dioxide reduction, by generating reactive species that drive these processes. The efficiency of photocatalysts directly influences the overall performance of artificial photosynthesis systems, making them a critical component in the development of scalable and efficient technologies.

The development of advanced photocatalysts with higher light absorption capacity, stability, and reactivity is a major area of research. New materials, such as semiconductor-based photocatalysts and metal-organic frameworks, are being explored to improve the efficiency and cost-effectiveness of artificial photosynthesis systems. The continual improvements in photocatalyst design and functionality are expected to drive further adoption and growth in the market.

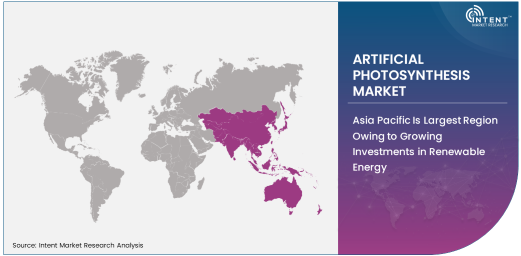

Asia Pacific Is Largest Region Owing to Growing Investments in Renewable Energy

Asia Pacific is the largest region in the artificial photosynthesis market, driven by the region's growing investments in renewable energy, environmental sustainability, and cutting-edge research. Countries like China, Japan, and India are at the forefront of renewable energy development and are increasingly investing in emerging technologies such as artificial photosynthesis. The region's large-scale production of solar energy, combined with government incentives for sustainable practices, is accelerating the adoption of artificial photosynthesis systems for energy production and environmental applications.

China, in particular, has made significant strides in research and development in renewable energy technologies, and it is leading the world in solar energy production. As a result, the Asia Pacific region is expected to maintain its dominant position in the artificial photosynthesis market. The region's favorable policy environment, growing demand for clean energy, and investments in environmental sustainability are likely to continue driving the market's growth in the coming years.

Competitive Landscape and Key Players

The artificial photosynthesis market is characterized by intense competition, with key players focusing on advancing technology, developing new materials, and scaling up production capabilities. Notable companies in the market include First Solar, Inc., Siemens AG, and Panasonic Corporation, which are involved in the development of solar energy solutions and artificial photosynthesis technologies. Additionally, research institutions and startups are making significant contributions to the development of photocatalysts, photoelectrochemical systems, and other advanced materials.

Collaboration between companies, research institutions, and government agencies is common in the industry to accelerate innovation and commercialization. Key players are focusing on partnerships, funding opportunities, and joint ventures to expand their product offerings and gain a competitive edge. As the market for artificial photosynthesis grows, companies are likely to focus on improving efficiency, reducing costs, and addressing the scalability challenges of these technologies to meet the increasing global demand for clean energy solutions.

Recent Developments:

- Sun Catalytix received a funding boost to accelerate its artificial photosynthesis technology, aimed at increasing solar fuel production efficiency.

- Carbon Clean Solutions launched a new artificial photosynthesis-based carbon capture system for industrial applications to reduce CO2 emissions.

- Haldor Topsoe announced a collaboration with Fraunhofer UMSICHT to develop photoelectrochemical systems for large-scale solar hydrogen production.

- BASF SE revealed its plans to enhance photocatalytic technologies for renewable energy production, supporting carbon-neutral goals.

- First Solar, Inc. introduced an innovative solar cell design aimed at improving the energy efficiency of artificial photosynthesis systems for hydrogen production.

List of Leading Companies:

- Sun Catalytix

- Carbon Clean Solutions

- First Solar, Inc.

- Haldor Topsoe

- Sharp Corporation

- Solvay S.A.

- PhotoSolar Inc.

- NREL (National Renewable Energy Laboratory)

- Fraunhofer UMSICHT

- BASF SE

- Lavoisier Inc.

- Asahi Kasei Corporation

- IHI Corporation

- Australian National University (ANU)

- SunPower Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.4 Billion |

|

Forecasted Value (2030) |

USD 2.0 Billion |

|

CAGR (2025 – 2030) |

32.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Artificial Photosynthesis Market by Technology (Photocatalytic Systems, Photoelectrochemical Systems, Biomimetic Systems), by End-Use Industry (Renewable Energy, Agriculture, Environmental Sustainability, Chemical Manufacturing), by Component (Photocatalysts, Electrodes, Solar Cells, Reactor Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sun Catalytix, Carbon Clean Solutions, First Solar, Inc., Haldor Topsoe, Sharp Corporation, Solvay S.A., NREL (National Renewable Energy Laboratory), Fraunhofer UMSICHT, BASF SE, Lavoisier Inc., Asahi Kasei Corporation, IHI Corporation, SunPower Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Artificial Photosynthesis Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Photocatalytic Systems |

|

4.2. Photoelectrochemical Systems |

|

4.3. Biomimetic Systems |

|

5. Artificial Photosynthesis Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Renewable Energy |

|

5.2. Agriculture |

|

5.3. Environmental Sustainability |

|

5.4. Chemical Manufacturing |

|

6. Artificial Photosynthesis Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Photocatalysts |

|

6.2. Electrodes |

|

6.3. Solar Cells |

|

6.4. Reactor Systems |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Artificial Photosynthesis Market, by Technology |

|

7.2.7. North America Artificial Photosynthesis Market, by End-Use Industry |

|

7.2.8. North America Artificial Photosynthesis Market, by Component |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Artificial Photosynthesis Market, by Technology |

|

7.2.9.1.2. US Artificial Photosynthesis Market, by End-Use Industry |

|

7.2.9.1.3. US Artificial Photosynthesis Market, by Component |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Sun Catalytix |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Carbon Clean Solutions |

|

9.3. First Solar, Inc. |

|

9.4. Haldor Topsoe |

|

9.5. Sharp Corporation |

|

9.6. Solvay S.A. |

|

9.7. PhotoSolar Inc. |

|

9.8. NREL (National Renewable Energy Laboratory) |

|

9.9. Fraunhofer UMSICHT |

|

9.10. BASF SE |

|

9.11. Lavoisier Inc. |

|

9.12. Asahi Kasei Corporation |

|

9.13. IHI Corporation |

|

9.14. Australian National University (ANU) |

|

9.15. SunPower Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Artificial Photosynthesis Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Artificial Photosynthesis Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Artificial Photosynthesis Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA