As per Intent Market Research, the Artificial Intelligence Robots Market was valued at USD 4.4 billion in 2024-e and will surpass USD 24.9 billion by 2030; growing at a CAGR of 28.0% during 2025-2030.

The artificial intelligence (AI) robots market is experiencing rapid growth, driven by advancements in AI algorithms, robotics technology, and increasing demand for automation across industries. These robots integrate cognitive computing and machine learning to perform complex tasks, improve efficiency, and enhance decision-making. Applications range from industrial automation to healthcare, security, and logistics, making AI robots indispensable in today’s technologically driven landscape.

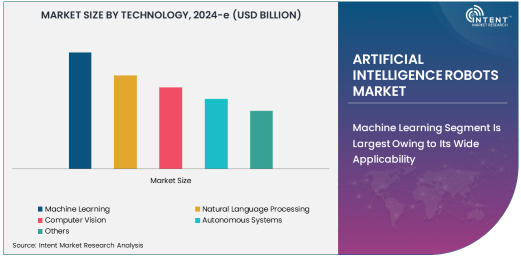

Machine Learning Segment Is Largest Owing to Its Wide Applicability

Machine learning dominates the technology segment due to its extensive applications in training robots to perform tasks autonomously. By analyzing vast datasets, machine learning allows robots to adapt, predict, and make decisions, enhancing their capabilities across industries.

Industries such as manufacturing and logistics rely heavily on machine learning for process optimization and predictive maintenance. The ability to continuously learn and improve through iterative processes makes machine learning the cornerstone technology in the AI robots market, driving its widespread adoption.

Security & Surveillance Segment Is Fastest Growing Due to Rising Demand for Safety Solutions

The security and surveillance segment is experiencing the fastest growth as organizations and governments increasingly adopt AI robots for safety and monitoring purposes. These robots leverage AI-powered vision systems to detect threats, monitor activities, and provide real-time analytics.

Growing concerns over public safety, coupled with the need for efficient and cost-effective surveillance solutions, have fueled demand in this segment. Additionally, advancements in facial recognition and pattern detection technologies further bolster the capabilities of AI robots in this domain.

Cloud-Based Deployment Is Fastest Growing Due to Scalability and Accessibility

Cloud-based deployment is gaining momentum as the fastest-growing segment in the deployment type category. Cloud solutions provide flexibility, scalability, and cost efficiency, enabling businesses to integrate AI robots without substantial upfront investments in infrastructure.

The seamless connectivity offered by cloud-based systems also facilitates real-time data sharing and decision-making, which is essential for applications like autonomous navigation and remote monitoring. This scalability makes cloud deployment particularly appealing to industries with dynamic operational requirements.

Healthcare Segment Is Largest Owing to Advanced Robotic Assistance

The healthcare industry is the largest end-user of AI robots, leveraging their capabilities in diagnostics, surgeries, and patient care. AI robots assist in minimally invasive procedures, enhance precision, and reduce recovery times for patients.

Robotic assistance in healthcare has seen rapid advancements, with AI enabling personalized treatment and improved operational workflows. Hospitals and clinics increasingly rely on AI robots to address the growing demand for efficient and error-free healthcare services, solidifying this segment's dominance.

North America Leads the Market Owing to Technological Advancements

North America is the largest region in the AI robots market, driven by robust investments in AI and robotics technologies. The region's focus on innovation, coupled with a strong presence of leading AI robotics companies, propels its dominance.

Industries across North America, from manufacturing to healthcare, are integrating AI robots to enhance efficiency and competitiveness. Government support and strategic collaborations between tech giants and industries further bolster market growth in the region.

Leading Companies and Competitive Landscape

The AI robots market is characterized by intense competition, with leading players continuously innovating to maintain their market positions. Companies like Boston Dynamics, NVIDIA Corporation, and ABB Ltd are at the forefront, offering advanced AI robotics solutions across various industries.

Collaborations, acquisitions, and product launches remain key strategies among competitors. As technology evolves, the market is likely to witness increased customization and integration of AI robots, enabling businesses to achieve higher levels of automation and efficiency.

Recent Developments:

- Boston Dynamics launched its new line of AI-powered robots designed for warehouse logistics and complex material handling.

- SoftBank completed an acquisition of a leading AI robotics firm, expanding its capabilities in healthcare and industrial automation.

- KUKA AG unveiled a new AI-driven robotics system for precision manufacturing, enhancing efficiency in automotive assembly lines.

- iRobot launched a new series of AI-enabled home robots focusing on smart cleaning and adaptive navigation.

- NVIDIA Corporation introduced an AI platform for robotics development, enabling real-time decision-making in autonomous machines.

List of Leading Companies:

- ABB Ltd

- Boston Dynamics

- Boston Scientific Corporation

- Fanuc Corporation

- KUKA AG

- NVIDIA Corporation

- Google LLC

- iRobot Corporation

- SoftBank Group

- Amazon Robotics

- Hanson Robotics

- Blue Frog Robotics

- Clearpath Robotics

- Honda Motor Co., Ltd.

- Locus Robotics

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.4 billion |

|

Forecasted Value (2030) |

USD 24.9 billion |

|

CAGR (2025 – 2030) |

28.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Artificial Intelligence Robots Market By Product Type (Machine Learning, Natural Language Processing, Computer Vision, Autonomous Systems), By Application (Industrial Automation, Healthcare Assistance, Security & Surveillance, Logistics & Warehousing), By Deployment Type (On-Premises, Cloud-Based, Edge Computing), and By End-User Industry (Manufacturing, Healthcare, Retail, Defense & Aerospace) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ABB Ltd, Boston Dynamics, Boston Scientific Corporation, Fanuc Corporation, KUKA AG, NVIDIA Corporation, Google LLC, iRobot Corporation, SoftBank Group, Amazon Robotics, Hanson Robotics, Blue Frog Robotics, Clearpath Robotics, Honda Motor Co., Ltd., Locus Robotics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Artificial Intelligence Robots Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Natural Language Processing |

|

4.3. Computer Vision |

|

4.4. Autonomous Systems |

|

5. Artificial Intelligence Robots Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Industrial Automation |

|

5.2. Healthcare Assistance |

|

5.3. Security & Surveillance |

|

5.4. Logistics & Warehousing |

|

6. Artificial Intelligence Robots Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. On-Premises |

|

6.2. Cloud-Based |

|

6.3. Edge Computing |

|

7. Artificial Intelligence Robots Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Manufacturing |

|

7.2. Healthcare |

|

7.3. Retail |

|

7.4. Defense & Aerospace |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Artificial Intelligence Robots Market, by Technology |

|

8.2.7. North America Artificial Intelligence Robots Market, by Application |

|

8.2.8. North America Artificial Intelligence Robots Market, by Deployment Type |

|

8.2.9. North America Artificial Intelligence Robots Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Artificial Intelligence Robots Market, by Technology |

|

8.2.10.1.2. US Artificial Intelligence Robots Market, by Application |

|

8.2.10.1.3. US Artificial Intelligence Robots Market, by Deployment Type |

|

8.2.10.1.4. US Artificial Intelligence Robots Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. ABB Ltd |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Boston Dynamics |

|

10.3. Boston Scientific Corporation |

|

10.4. Fanuc Corporation |

|

10.5. KUKA AG |

|

10.6. NVIDIA Corporation |

|

10.7. Google LLC |

|

10.8. iRobot Corporation |

|

10.9. SoftBank Group |

|

10.10. Amazon Robotics |

|

10.11. Hanson Robotics |

|

10.12. Blue Frog Robotics |

|

10.13. Clearpath Robotics |

|

10.14. Honda Motor Co., Ltd. |

|

10.15. Locus Robotics |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the AI in Artificial Intelligence Robots Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the AI in Artificial Intelligence Robots Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the AI in Artificial Intelligence Robots Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA