As per Intent Market Research, the Artificial Intelligence Engineering Market was valued at USD 7.0 Billion in 2024-e and will surpass USD 39.0 Billion by 2030; growing at a CAGR of 27.7% during 2025-2030.

Artificial Intelligence (AI) Engineering is revolutionizing industries by providing advanced capabilities to automate processes, enhance decision-making, and enable predictive insights. As businesses continue to prioritize data-driven strategies, the AI Engineering market is witnessing substantial growth across various sectors, including healthcare, finance, retail, and technology. The market is segmented into various areas such as technology, application, deployment type, and end-user, offering a diverse range of solutions to meet the needs of different industries. With ongoing advancements in machine learning, deep learning, and natural language processing, AI is becoming more accessible and integral to business operations globally.

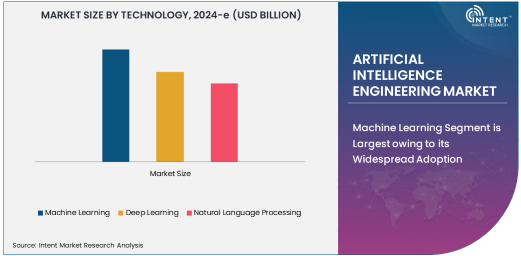

Machine Learning Segment is Largest owing to its Widespread Adoption

Machine Learning (ML) stands as the largest subsegment within the Artificial Intelligence Engineering market, primarily due to its extensive applications and capabilities in handling complex data-driven tasks. The adoption of ML has accelerated across various industries, including finance, healthcare, retail, and manufacturing, as organizations seek to optimize operations, improve customer experience, and predict market trends. ML enables businesses to automate repetitive tasks, enhance decision-making processes, and improve efficiency through predictive analytics and pattern recognition. As organizations continue to generate vast amounts of data, the demand for ML solutions is expected to grow, solidifying its position as a leading force in AI engineering.

Natural Language Processing (NLP) Subsegment is Fastest Growing Due to Its Versatility

Natural Language Processing (NLP) has emerged as the fastest-growing subsegment within the Artificial Intelligence Engineering market, owing to its ability to bridge the gap between human and machine interaction. Organizations across sectors are adopting NLP to create intelligent systems capable of understanding, interpreting, and responding to natural language. From chatbots and virtual assistants to sentiment analysis and language translation, NLP offers a wide range of applications that enhance customer engagement, support content creation, and improve communication across businesses. With advancements in deep learning models and data analytics, NLP continues to evolve, driving its adoption at a rapid pace.

Deep Learning as a Core Component Drives Innovation Across Applications

Deep Learning (DL) is playing a pivotal role in advancing AI capabilities within various applications, making it a significant subsegment in the AI Engineering market. By mimicking the human brain’s neural network structure, deep learning enables machines to process large volumes of data and perform complex tasks such as image recognition, medical diagnostics, and fraud detection. As industries prioritize innovation and require high-level computational power, deep learning continues to be a driving force behind cutting-edge AI solutions. Its integration with technologies such as IoT and edge computing is further expanding its applications across smart devices, autonomous vehicles, and predictive healthcare.

APAC Region is Fastest Growing in AI Engineering Market

The Asia-Pacific (APAC) region is emerging as the fastest-growing market for Artificial Intelligence Engineering. This growth is driven by rapid technological adoption, significant investments in digital infrastructure, and a burgeoning demand for innovative AI solutions. Countries like China, India, South Korea, and Japan are at the forefront, leveraging AI to enhance sectors such as healthcare, finance, e-commerce, and smart cities. With a growing tech-savvy population, strong government initiatives, and increasing collaboration between industries and academia, APAC is expected to maintain its upward trajectory in AI innovation and deployment. The region’s dynamic business environment and focus on data analytics are fueling rapid advancements in AI engineering.

Leading Companies and Competitive Landscape

The Artificial Intelligence Engineering market is highly competitive, with major players continuously developing advanced AI solutions to stay ahead in a rapidly evolving landscape. Leading technology companies, including IBM, Microsoft, Google, and Amazon Web Services, dominate the market with comprehensive AI platforms and robust ecosystems. These companies invest heavily in research and development, acquiring startups, and fostering partnerships to maintain a competitive edge. Additionally, a growing number of specialized AI solution providers and niche players are entering the market, further intensifying competition and driving innovation. As a result, the market is characterized by dynamic collaborations, mergers, and innovations to meet the diverse needs of industries worldwide.

Recent Developments:

- IBM Launches AI Engineering Platform: IBM introduced its AI Engineering platform aimed at enhancing the development and deployment of AI applications across various industries.

- Microsoft Partners with OpenAI for AI Solutions: Microsoft expanded its partnership with OpenAI to develop AI-powered solutions tailored for business intelligence and automation.

- NVIDIA Acquires Mellanox Technologies: NVIDIA acquired Mellanox Technologies to bolster its AI computing capabilities, focusing on AI-driven data center solutions.

- SAP Introduces AI-Driven Customer Insights: SAP launched an AI-powered analytics solution to provide real-time insights into customer behaviors and preferences.

- TCS Enhances AI Capabilities in Healthcare: TCS announced the deployment of advanced AI solutions for predictive analytics and clinical decision-making in the healthcare sector.

List of Leading Companies:

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services (AWS)

- Intel Corporation

- NVIDIA Corporation

- Salesforce

- Oracle Corporation

- Cisco Systems, Inc.

- Accenture

- SAP SE

- Infosys Limited

- TCS (Tata Consultancy Services)

- HPE (Hewlett Packard Enterprise)

- Palantir Technologies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.0 Billion |

|

Forecasted Value (2030) |

USD 39.0 Billion |

|

CAGR (2025 – 2030) |

27.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Artificial Intelligence Engineering Market By Technology (Machine Learning, Deep Learning, Natural Language Processing), By Application (Natural Language Processing, Computer Vision, Predictive Analytics), By Deployment Type (Cloud-Based, On-Premises, Hybrid), and By End-User Industry (IT & Telecom, Healthcare, Financial Services) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM Corporation, Google LLC, Microsoft Corporation, Amazon Web Services (AWS), Intel Corporation, NVIDIA Corporation, Salesforce, Oracle Corporation, Cisco Systems, Inc., Accenture, SAP SE, Infosys Limited, TCS (Tata Consultancy Services), HPE (Hewlett Packard Enterprise), Palantir Technologies |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Artificial Intelligence Engineering Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Deep Learning |

|

4.3. Natural Language Processing |

|

5. Artificial Intelligence Engineering Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Natural Language Processing |

|

5.2. Computer Vision |

|

5.3. Predictive Analytics |

|

6. Artificial Intelligence Engineering Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Cloud-Based |

|

6.2. On-Premises |

|

6.3. Hybrid |

|

7. Artificial Intelligence Engineering Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. IT & Telecom |

|

7.2. Healthcare |

|

7.3. Financial Services |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Artificial Intelligence Engineering Market, by Technology |

|

8.2.7. North America Artificial Intelligence Engineering Market, by Application |

|

8.2.8. North America Artificial Intelligence Engineering Market, by Deployment Type |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Artificial Intelligence Engineering Market, by Technology |

|

8.2.9.1.2. US Artificial Intelligence Engineering Market, by Application |

|

8.2.9.1.3. US Artificial Intelligence Engineering Market, by Deployment Type |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. IBM Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Google LLC |

|

10.3. Microsoft Corporation |

|

10.4. Amazon Web Services (AWS) |

|

10.5. Intel Corporation |

|

10.6. NVIDIA Corporation |

|

10.7. Salesforce |

|

10.8. Oracle Corporation |

|

10.9. Cisco Systems, Inc. |

|

10.10. Accenture |

|

10.11. SAP SE |

|

10.12. Infosys Limited |

|

10.13. TCS (Tata Consultancy Services) |

|

10.14. HPE (Hewlett Packard Enterprise) |

|

10.15. Palantir Technologies |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Artificial Intelligence Engineering Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Artificial Intelligence Engineering Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Artificial Intelligence Engineering Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA