As per Intent Market Research, the Artificial Grass Market was valued at USD 4.2 billion in 2023 and will surpass USD 5.6 billion by 2030; growing at a CAGR of 4.1% during 2024 - 2030.

Artificial grass, often referred to as synthetic turf, has gained considerable traction across various sectors, including residential landscaping, sports fields, commercial applications, and urban infrastructure. As advancements in technology and material science have led to the development of more realistic and durable products, artificial grass has become an attractive alternative to natural grass. This market is driven by factors such as water conservation, reduced maintenance costs, and the growing demand for eco-friendly landscaping solutions.

The market is poised for substantial growth due to the increasing adoption of artificial grass across various regions. In this report, we explore the key segments of the artificial grass market, including product types, end-use applications, and geographical trends. We analyze the largest and fastest-growing subsegments in each category to provide a comprehensive overview of the market’s trajectory and the driving forces behind it.

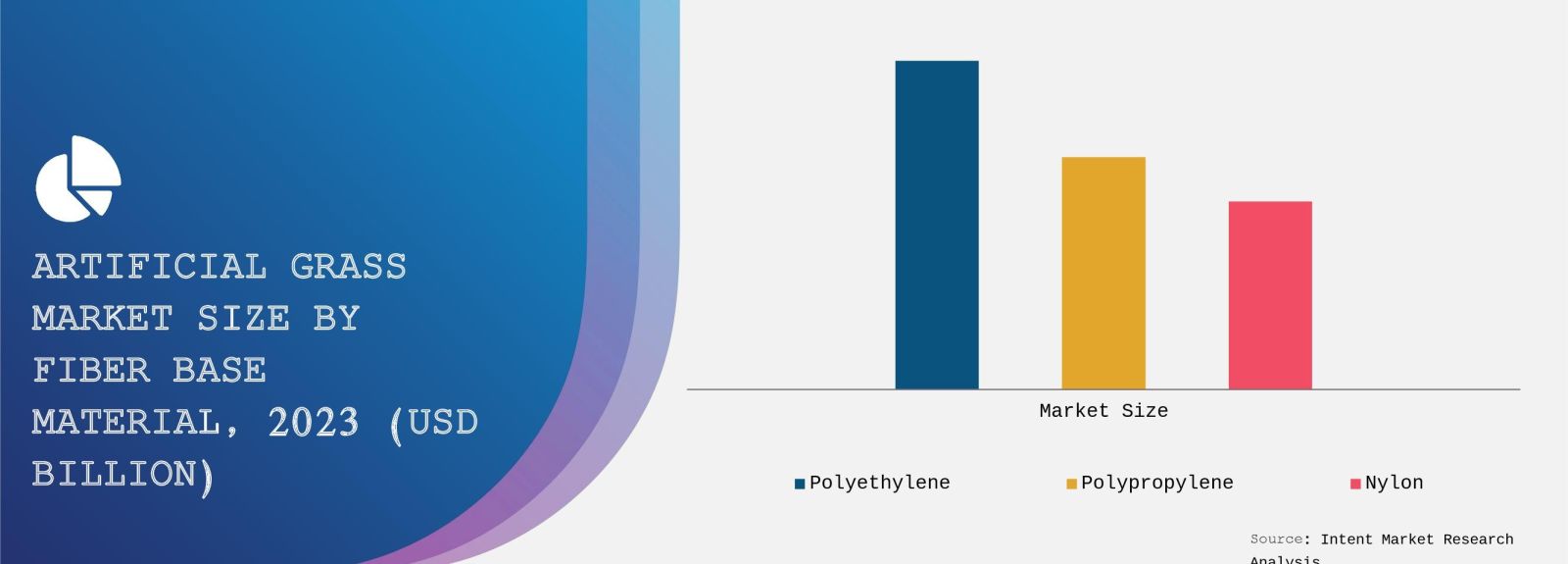

Nylon-Based Artificial Grass Segment is Largest Owing to Durability and Performance

The Nylon-Based Artificial Grass segment holds the largest share in the artificial grass market, owing to its exceptional durability and performance characteristics. Nylon, being a strong and resilient material, offers superior resistance to wear and tear, making it ideal for high-traffic areas, particularly in sports applications such as football and soccer fields. Additionally, nylon-based artificial grass provides excellent elasticity, ensuring that the turf retains its shape and appearance even after prolonged use.

Nylon's superior strength and ability to withstand harsh weather conditions have made it the preferred choice for outdoor applications where durability is essential. The increasing demand for sports facilities and outdoor recreational spaces is expected to sustain the growth of the nylon-based artificial grass segment. As the need for long-lasting, high-performance synthetic turf continues to rise, nylon remains the material of choice for a variety of commercial, residential, and sports-related applications, making it the largest subsegment within the market.

Polypropylene-Based Artificial Grass Segment is Fastest Growing Due to Cost-Effectiveness

The Polypropylene-Based Artificial Grass segment is witnessing the fastest growth in the market, primarily due to its cost-effectiveness and versatility. Polypropylene is a lightweight material that offers a budget-friendly alternative to more expensive options like nylon and polyethylene. This has made polypropylene-based artificial grass highly attractive for residential applications and low-traffic commercial spaces. It is particularly well-suited for decorative landscaping, garden lawns, and smaller sports fields where high durability may not be as critical.

Polypropylene artificial grass also boasts excellent color retention and UV resistance, making it a viable option for applications that require aesthetics and longevity without the premium price tag. As the market for artificial grass expands into more cost-sensitive regions and sectors, polypropylene is expected to see the fastest growth. This trend is driven by a growing demand for affordable, low-maintenance landscaping solutions, particularly in developing economies, where budget constraints are a key consideration.

Sports Segment is Largest Due to Increased Demand for Professional Sports Fields

The Sports segment is the largest end-use category for artificial grass, driven by the growing demand for synthetic turf in professional and recreational sports facilities. Artificial grass offers several advantages in sports applications, such as enhanced durability, reduced maintenance, and the ability to provide a consistent playing surface under various weather conditions. Football, soccer, rugby, and tennis are among the key sports that extensively use artificial grass, as it ensures a high-quality playing surface that can withstand high-frequency usage without the need for frequent replacement.

With increasing investments in sports infrastructure worldwide, the adoption of artificial grass in sports fields has been rapidly growing. Many professional sports leagues and organizations are opting for artificial grass fields due to their long-term cost-effectiveness, which reduces the need for constant turf maintenance and water consumption. As the demand for modern sports facilities continues to rise, the sports segment is expected to remain the largest and most prominent application category for artificial grass throughout the forecast period.

Residential Landscaping Segment is Fastest Growing Owing to Rising Demand for Low-Maintenance Solutions

The Residential Landscaping segment is the fastest-growing end-use category for artificial grass, driven by the increasing demand for low-maintenance, aesthetic landscaping solutions. Homeowners are increasingly opting for artificial grass for their lawns, gardens, and outdoor spaces due to its ease of maintenance, water-saving properties, and year-round greenery. The appeal of artificial grass lies in its ability to maintain a pristine appearance without the need for regular mowing, watering, or fertilizing, making it a convenient and environmentally friendly option.

The rising awareness of water conservation, coupled with the growing trend of outdoor living spaces, has contributed to the rapid adoption of artificial grass in residential areas. As consumers seek to create beautiful, sustainable outdoor environments without the time and effort involved in natural grass maintenance, the residential landscaping segment is expected to continue its fast-paced growth. This shift towards artificial grass is also supported by the increasing availability of high-quality, realistic-looking synthetic turf, further driving its popularity in residential landscaping.

North America is Largest Region Due to High Adoption in Sports and Residential Applications

North America holds the largest share of the artificial grass market, driven by the extensive adoption of synthetic turf in sports fields, commercial spaces, and residential applications. The United States, in particular, has witnessed a significant increase in the number of artificial grass installations, particularly in professional sports stadiums and recreational sports fields. The region’s focus on sustainable landscaping solutions and water conservation has also bolstered the demand for artificial grass, particularly in regions with water scarcity issues.

In addition, the residential landscaping segment in North America has experienced substantial growth, as homeowners increasingly turn to artificial grass for its aesthetic and maintenance benefits. With a large number of well-established manufacturers and suppliers in the region, North America remains the dominant market for artificial grass, and its growth is expected to continue throughout the forecast period. Moreover, the expansion of sports infrastructure and the rising popularity of artificial turf for commercial applications further solidify North America's position as the largest regional market.

Leading Companies and Competitive Landscape

The Artificial Grass Market is highly competitive, with several key players focusing on innovation, product quality, and expanding their geographical presence. Leading companies such as Shaw Industries Group, Inc., FieldTurf (Tarkett Group), Global Syn-Turf, Inc., and AstroTurf dominate the market, offering a wide range of synthetic turf products for various applications. These companies are heavily investing in R&D to enhance the durability, aesthetics, and environmental performance of their products, thereby catering to the growing demand for high-quality artificial grass solutions.

Strategic partnerships, mergers, and acquisitions are common in this space, as companies look to expand their product portfolios and reach new markets. The growing emphasis on sustainability has led to the development of eco-friendly artificial grass options, such as those made from recycled materials or designed for easier recycling at the end of their lifecycle. This focus on sustainability is becoming a key differentiator for companies in the market, as consumers and businesses alike increasingly prioritize environmentally responsible products. The competitive landscape will continue to evolve as innovation and sustainability drive the market forward.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Report Objectives:

The report will help you answer some of the most critical questions in the Artificial Grass Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Artificial Grass Market?

- What is the size of the Artificial Grass Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.2 billion |

|

Forecasted Value (2030) |

USD 5.6 billion |

|

CAGR (2024 – 2030) |

4.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Artificial Grass Market By Installation (Flooring, Wall Cladding), By Fiber Base Material (Polyethylene, Polypropylene, Nylon), and By Infill Material (Petroleum-Based Infills, Sand Infill, Plant-Based Infills), By Application (Contact Sports, Non-Contact Sports, Leisure, Landscaping) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Artificial Grass Market, by Installation (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Flooring |

|

4.2. Wall Cladding |

|

5. Artificial Grass Market, by Fiber Base Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Polyethylene |

|

5.2. Polypropylene |

|

5.3. Nylon |

|

6. Artificial Grass Market, by Infill Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Petroleum-Based Infills |

|

6.1.1. Styrene-Butadiene Rubber |

|

6.1.2. Ethylene Propylene Diene Monomers |

|

6.1.3. Thermoplastic Elastomers |

|

6.1.4. Others |

|

6.2. Sand Infill |

|

6.3. Plant-Based Infills |

|

7. Artificial Grass Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Contact Sports |

|

7.1.1. Football |

|

7.1.2. Rugby |

|

7.1.3. Hockey |

|

7.1.4. Others |

|

7.2. Non-Contact Sports |

|

7.2.1. Tennis |

|

7.2.2. Golf |

|

7.2.3. Others |

|

7.3. Leisure |

|

7.4. Landscaping |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Artificial Grass Market, by Installation |

|

8.2.7. North America Artificial Grass Market, by Fiber Base Material |

|

8.2.8. North America Artificial Grass Market, by Infill Material |

|

8.2.9. North America Artificial Grass Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Artificial Grass Market, by Installation |

|

8.2.10.1.2. US Artificial Grass Market, by Fiber Base Material |

|

8.2.10.1.3. US Artificial Grass Market, by Infill Material |

|

8.2.10.1.4. US Artificial Grass Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Act Global |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Controlled Products |

|

10.3. Dow |

|

10.4. Limonta Sport S.p.A. |

|

10.5. Shaw Industries Group |

|

10.6. SportGroup |

|

10.7. Sportlink Franchising Ltda. |

|

10.8. Tarkett |

|

10.9. TigerTurf |

|

10.10. Victoria PLC |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Artificial Grass Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Artificial Grass Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Artificial Grass ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Artificial Grass Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA