As per Intent Market Research, the AR and VR Headsets Market was valued at USD 5.7 billion in 2023 and will surpass USD 27.8 billion by 2030; growing at a CAGR of 25.3% during 2024 - 2030.

The global AR and VR headsets market has experienced significant growth in recent years, driven by advancements in technology, increasing demand for immersive experiences, and broader adoption across various industries. The market encompasses AR, VR, and mixed reality headsets, each offering unique features and applications. AR headsets overlay digital elements onto the real world, providing interactive and enhanced visual experiences, while VR headsets immerse users completely in virtual environments. Mixed reality (MR) headsets combine both AR and VR capabilities, enabling interaction with both virtual and physical objects. These headsets are finding applications across sectors such as gaming, healthcare, automotive, education, military, and entertainment, making them a vital part of the broader tech landscape.

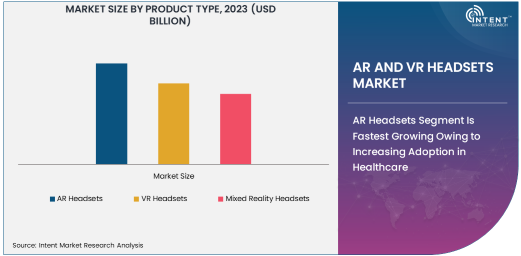

AR Headsets Segment Is Fastest Growing Owing to Increasing Adoption in Healthcare

Among the different types of AR headsets, the healthcare industry is driving the fastest growth. AR headsets have gained traction in healthcare applications for surgical planning, diagnostic imaging, and patient care. Surgeons and medical professionals are using AR to overlay critical information on a patient's body during surgeries, improving accuracy and reducing the risk of errors. Additionally, AR is being used in medical training, enabling students and professionals to interact with 3D models of human anatomy, which enhances learning and decision-making capabilities. The continued development of lightweight, user-friendly AR devices is fueling its adoption in this industry, with medical professionals seeking to enhance their skills and improve patient outcomes.

VR Headsets Segment Is Largest Due to Dominance in Gaming and Entertainment

The VR headsets segment continues to be the largest owing to its dominance in the gaming and entertainment industry. VR technology has revolutionized the gaming experience, providing users with fully immersive environments that simulate real-world experiences. VR headsets such as Oculus Rift, HTC Vive, and PlayStation VR are popular in the gaming sector, offering advanced features such as motion tracking, haptic feedback, and high-definition graphics. Additionally, VR is expanding into the entertainment industry beyond gaming, with applications in virtual reality cinema, immersive theater, and live events. The large consumer base and increasing demand for immersive gaming experiences make VR headsets the largest segment in the AR and VR headsets market.

Mixed Reality Headsets Segment Is Fastest Growing in Industrial Applications

Mixed reality (MR) headsets are the fastest-growing segment in the AR and VR headset market, particularly in industrial applications. MR headsets combine the features of both AR and VR, enabling users to interact with both virtual and real-world elements simultaneously. In the industrial sector, MR is transforming how workers interact with complex systems, machinery, and infrastructure. For example, MR devices help technicians in manufacturing and maintenance by providing real-time data, interactive 3D models, and hands-on guidance during repairs. This technology also enables remote collaboration between engineers and field technicians, reducing downtime and improving productivity. The growing adoption of MR headsets in industries like automotive, aerospace, and manufacturing is contributing to their rapid growth.

Gaming and Entertainment Industry Is Largest End-User Industry for AR and VR Headsets

The gaming and entertainment industry remains the largest end-user of AR and VR headsets, driven by the increasing popularity of immersive gaming experiences and virtual entertainment. VR gaming, in particular, offers an unmatched level of immersion, where players can explore virtual worlds and engage with characters and environments in a way that traditional gaming systems cannot match. The integration of AR into gaming also enhances interactive elements by merging real-world objects with virtual content. These technologies are not only reshaping gaming but also providing new forms of entertainment, such as virtual concerts, 360-degree movies, and VR theme park experiences. The massive consumer base and continuous demand for more immersive gaming experiences are key drivers for the growth of this segment.

Hardware Components Segment Is Largest Due to Critical Role in Headset Performance

The hardware components segment holds the largest share in the AR and VR headset market, as these components are integral to the performance and functionality of headsets. Key hardware elements such as displays, sensors, cameras, and controllers determine the user experience, including visual fidelity, tracking accuracy, and interactivity. Display technologies such as OLED and LCD panels provide the high-resolution, wide field of view required for an immersive experience. Sensors and cameras are essential for motion tracking, enabling users to interact naturally with virtual environments. The ongoing improvement in hardware performance, along with advancements in lightweight designs and ergonomic comfort, has been crucial in driving the widespread adoption of AR and VR headsets.

Software Segment Is Growing Due to Increasing Demand for Content and Applications

The software segment is experiencing significant growth in response to the increasing demand for content and applications that leverage AR and VR headsets. With a growing number of industries adopting AR and VR technologies, there is a need for specialized software platforms that can support diverse applications, from gaming and entertainment to healthcare and education. Software development for VR games, AR applications for surgical visualization, and MR simulations for industrial operations are all contributing to the expanding software market. Additionally, the rise of cloud computing and real-time collaboration platforms is creating new opportunities for software solutions that enable users to access and share immersive content seamlessly. As the demand for AR and VR experiences grows, the software segment will continue to see rapid growth.

North America Is the Largest Region Owing to Strong Technological Adoption

North America holds the largest share of the AR and VR headsets market due to the region’s strong technological adoption, established infrastructure, and significant investments in research and development. The United States, in particular, leads in both consumer and enterprise applications of AR and VR technologies, with widespread adoption in sectors such as gaming, healthcare, military, and education. Major companies in the region, such as Meta (formerly Facebook), Microsoft, and Sony, are leading the way in developing innovative AR and VR products. Furthermore, North America benefits from a robust network of tech startups, research institutions, and venture capital funding, which supports continuous innovation and development in the AR and VR space. This combination of technological infrastructure and market demand ensures that North America remains the largest region for AR and VR headsets.

Competitive Landscape and Leading Companies

The AR and VR headsets market is highly competitive, with several global players leading the innovation and development of new products. Meta Platforms (Oculus), Sony, HTC, and Microsoft are the primary players in the VR and AR headset space, with significant market shares driven by their immersive and high-performance headsets. Additionally, companies like Magic Leap and Pico Interactive are gaining traction in the mixed reality segment. These companies are investing heavily in research and development to create more immersive and comfortable devices, improve user experience, and expand their application across industries. The competitive landscape is also influenced by collaborations and partnerships, with tech companies partnering with software developers to create tailored solutions for vertical markets. This intense competition is expected to continue driving innovation, leading to more advanced, cost-effective, and diverse AR and VR headset offerings in the coming years

Recent Developments:

- Meta Platforms (Oculus) has recently launched its new VR headset, the Oculus Quest 3, which is gaining popularity in the gaming community due to its advanced features.

- Sony Corporation has announced the launch of PlayStation VR2, which includes enhanced visual and sensory technologies to improve gaming experiences for its users.

- HTC Corporation has launched the HTC Vive XR Elite, a hybrid VR and AR headset, expanding its presence in the mixed-reality segment of the market.

- Microsoft continues to expand its AR headset offerings through its HoloLens 2, which has been widely adopted by enterprise customers for remote collaboration and industrial applications.

- Apple Inc. has announced the release of its first AR/VR headset, signaling its entry into the market and further intensifying competition in the AR/VR space.

List of Leading Companies:

- Sony Corporation

- Microsoft Corporation

- Oculus (Meta Platforms, Inc.)

- HTC Corporation

- Samsung Electronics Co., Ltd.

- Magic Leap, Inc.

- Google LLC

- Apple Inc.

- Pico Interactive, Inc.

- Varjo Technologies

- Epson America, Inc.

- Vuzix Corporation

- Lenovo Group Limited

- Huawei Technologies Co., Ltd.

- Zebra Medical Vision

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.7 Billion |

|

Forecasted Value (2030) |

USD 27.8 Billion |

|

CAGR (2024 – 2030) |

25.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

AR and VR Headsets Market By Product Type (AR Headsets, VR Headsets, Mixed Reality Headsets), By End-User Industry (Gaming and Entertainment, Healthcare, Education and Training, Industrial Applications, Retail and E-commerce, Automotive, Military and Defense), By Component (Hardware, Software), and By Technology (Optical See-Through AR Headsets, Video See-Through AR Headsets, Mobile VR Headsets, Tethered VR Headsets) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sony Corporation, Microsoft Corporation, Oculus (Meta Platforms, Inc.), HTC Corporation, Samsung Electronics Co., Ltd., Magic Leap, Inc., Google LLC, Apple Inc., Pico Interactive, Inc., Varjo Technologies, Epson America, Inc., Vuzix Corporation, Lenovo Group Limited, Huawei Technologies Co., Ltd., Zebra Medical Vision |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. AR and VR Headsets Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. AR Headsets |

|

4.2. VR Headsets |

|

4.3. Mixed Reality Headsets |

|

5. AR and VR Headsets Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Gaming and Entertainment |

|

5.2. Healthcare |

|

5.3. Education and Training |

|

5.4. Industrial Applications |

|

5.5. Retail and E-commerce |

|

5.6. Automotive |

|

5.7. Military and Defense |

|

5.8. Others |

|

6. AR and VR Headsets Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hardware |

|

6.1.1. Display |

|

6.1.2. Sensors |

|

6.1.3. Cameras |

|

6.1.4. Power Supply |

|

6.1.5. Controllers |

|

6.2. Software |

|

6.2.1. Application Software |

|

6.2.2. Platform Software |

|

7. AR and VR Headsets Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Optical See-Through AR Headsets |

|

7.2. Video See-Through AR Headsets |

|

7.3. Mobile VR Headsets |

|

7.4. Tethered VR Headsets |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America AR and VR Headsets Market, by Product Type |

|

8.2.7. North America AR and VR Headsets Market, by End-User Industry |

|

8.2.8. North America AR and VR Headsets Market, by Component |

|

8.2.9. North America AR and VR Headsets Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US AR and VR Headsets Market, by Product Type |

|

8.2.10.1.2. US AR and VR Headsets Market, by End-User Industry |

|

8.2.10.1.3. US AR and VR Headsets Market, by Component |

|

8.2.10.1.4. US AR and VR Headsets Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Sony Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Microsoft Corporation |

|

10.3. Oculus (Meta Platforms, Inc.) |

|

10.4. HTC Corporation |

|

10.5. Samsung Electronics Co., Ltd. |

|

10.6. Magic Leap, Inc. |

|

10.7. Google LLC |

|

10.8. Apple Inc. |

|

10.9. Pico Interactive, Inc. |

|

10.10. Varjo Technologies |

|

10.11. Epson America, Inc. |

|

10.12. Vuzix Corporation |

|

10.13. Lenovo Group Limited |

|

10.14. Huawei Technologies Co., Ltd. |

|

10.15. Zebra Medical Vision |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the AR and VR Headsets Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the AR and VR Headsets Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the AR and VR Headsets Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA