sales@intentmarketresearch.com

+1 463-583-2713

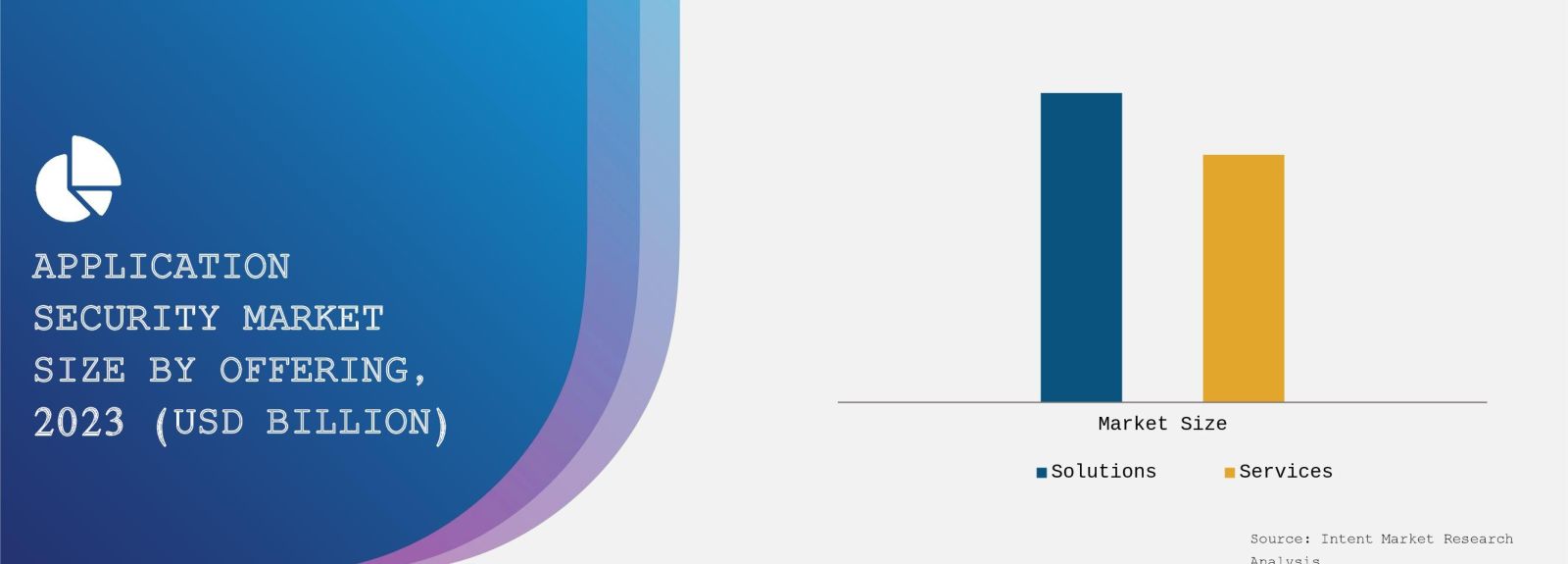

Application Security Market By Offering (Solutions, Services), By Deployment Type (On-Premises, Cloud-Based), By Application (Web Application Security, Mobile Application Security, API Security), By Industry Vertical (BFSI, Retail, Government, Healthcare, IT & Telecommunications), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Application Security Market was valued at USD 38.7 billion in 2023 and will surpass USD 64.4 billion by 2030; growing at a CAGR of 7.5% during 2024 - 2030.

The Application Security Market is rapidly evolving as organizations recognize the critical importance of safeguarding their applications against an increasing range of cyber threats. With the proliferation of digital transformation initiatives and the rising adoption of cloud-based services, the demand for robust application security solutions has surged. As enterprises strive to enhance their security posture, a myriad of segments and subsegments within the application security landscape are gaining traction, driven by specific market needs and technological advancements.

Web Application Security Segment is Largest Owing to Increasing Cyber Threats

The Web Application Security segment is the largest within the Application Security Market, primarily due to the escalating number of cyber threats targeting web applications. As organizations increasingly rely on web applications for their operations, the vulnerability of these applications has become a significant concern. Attack vectors such as SQL injection, cross-site scripting (XSS), and distributed denial-of-service (DDoS) attacks have prompted businesses to invest heavily in web application security solutions. This segment encompasses a variety of solutions, including web application firewalls (WAFs), intrusion detection systems (IDS), and secure coding practices, making it essential for businesses seeking to protect their critical assets and customer data.

Moreover, the need for compliance with stringent regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), further drives investment in web application security. Companies are increasingly adopting automated security solutions to enhance their defenses, streamline security processes, and reduce the risk of human error. This trend is expected to continue as organizations prioritize their cybersecurity strategies, thereby solidifying the web application security segment's position as the largest within the Application Security Market.

Mobile Application Security Segment is Fastest Growing Owing to Smartphone Penetration

The Mobile Application Security segment is witnessing the fastest growth within the Application Security Market, driven by the explosive increase in smartphone penetration and mobile app usage. With the rise of mobile banking, e-commerce, and social networking applications, organizations are compelled to ensure the security of their mobile applications to protect sensitive user data and maintain customer trust. The proliferation of mobile threats, such as malware, phishing attacks, and insecure application programming interfaces (APIs), has intensified the focus on mobile application security solutions, which include mobile app security testing and mobile threat defense platforms.

Additionally, the growing trend of bring-your-own-device (BYOD) policies in organizations has further fueled the demand for mobile application security solutions. Companies are now more vigilant in securing mobile applications to prevent data breaches and mitigate risks associated with unauthorized access. As a result, the mobile application security segment is projected to experience significant growth in the coming years, as organizations increasingly recognize the importance of protecting their mobile applications from evolving threats.

Cloud Application Security Segment is Largest Owing to Cloud Adoption

The Cloud Application Security segment has emerged as the largest within the Application Security Market, primarily driven by the widespread adoption of cloud services by businesses of all sizes. As organizations migrate their applications and data to the cloud, the need for effective cloud application security solutions becomes paramount to protect sensitive information and ensure compliance with various regulations. This segment includes solutions such as cloud security posture management (CSPM), cloud workload protection platforms (CWPP), and identity and access management (IAM), all designed to safeguard cloud-based applications and mitigate risks associated with shared infrastructure.

Furthermore, the increasing complexity of cloud environments, characterized by multi-cloud and hybrid cloud deployments, necessitates a more comprehensive security approach. Organizations are adopting cloud-native security solutions that offer real-time visibility, threat detection, and automated response capabilities to address potential vulnerabilities. As cloud adoption continues to accelerate, the cloud application security segment is expected to maintain its position as the largest segment within the Application Security Market, driven by the need for enhanced security measures in cloud environments.

API Security Segment is Fastest Growing Owing to Digital Transformation

The API Security segment is rapidly becoming the fastest growing segment within the Application Security Market, fueled by the ongoing digital transformation efforts across industries. As businesses increasingly leverage APIs to facilitate communication between applications and services, the potential attack surface has expanded, making API security a top priority. Cybercriminals often exploit vulnerabilities in APIs to gain unauthorized access to sensitive data, leading to data breaches and financial losses. Consequently, organizations are investing in API security solutions, such as API gateways and security testing tools, to safeguard their APIs and maintain the integrity of their applications.

Moreover, the adoption of microservices architecture and serverless computing models has further increased the need for robust API security measures. As organizations transition to these modern development practices, they must ensure that their APIs are secure by design, implementing stringent authentication and authorization protocols. The API security segment's rapid growth reflects the critical role APIs play in contemporary application development and the pressing need to address associated security challenges.

DevSecOps Segment is Largest Owing to Integrated Security Practices

The DevSecOps segment is recognized as the largest within the Application Security Market, driven by the growing demand for integrated security practices throughout the software development lifecycle. As organizations adopt DevOps methodologies to enhance collaboration and accelerate software delivery, the need for embedding security into development processes has become increasingly evident. DevSecOps emphasizes the importance of integrating security practices into every stage of the development pipeline, from coding and testing to deployment and monitoring, ensuring that security is not an afterthought but a fundamental component of application development.

The increasing recognition of the benefits of DevSecOps has led to the widespread adoption of tools and practices that facilitate secure coding, automated security testing, and continuous security monitoring. Organizations are prioritizing the implementation of security-as-code principles, allowing them to detect vulnerabilities early in the development process and reduce the overall risk of security incidents. As a result, the DevSecOps segment is poised for sustained growth, reflecting a shift towards a more proactive and holistic approach to application security.

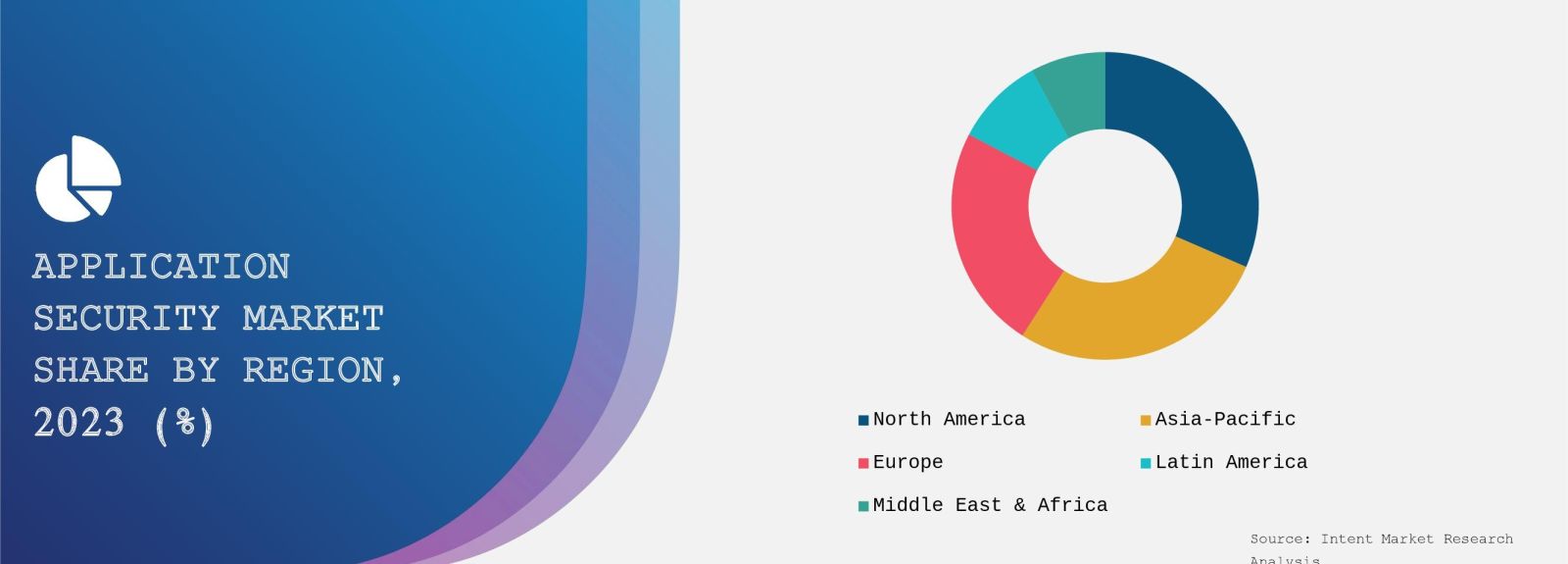

North America is Largest Region Owing to Advanced Cybersecurity Infrastructure

North America stands as the largest region in the Application Security Market, largely owing to its advanced cybersecurity infrastructure and the presence of major technology companies. The region has consistently been at the forefront of technological innovation, leading to a high demand for application security solutions across various industries, including finance, healthcare, and retail. Additionally, the increasing number of cyberattacks and data breaches in North America has prompted organizations to prioritize their application security strategies, resulting in substantial investments in security technologies.

Furthermore, the presence of established cybersecurity vendors and a robust ecosystem of startups in North America has fostered a competitive landscape that drives continuous innovation in application security solutions. With regulatory compliance requirements becoming more stringent, organizations in this region are more inclined to adopt comprehensive security measures to protect their applications and data. As a result, North America is expected to maintain its position as the largest region in the Application Security Market throughout the forecast period.

Competitive Landscape and Leading Companies

The Application Security Market is characterized by a highly competitive landscape, with several key players vying for market share. Leading companies in this space include Akamai Technologies, Veracode, Checkmarx, and Synopsys, all of which offer a range of application security solutions tailored to meet the diverse needs of organizations. These companies are continuously innovating and expanding their product offerings to address emerging threats and evolving market demands.

In addition to established players, numerous startups are entering the market, introducing innovative solutions that challenge traditional approaches to application security. This dynamic environment encourages collaboration and partnerships among companies, further enhancing the overall growth of the Application Security Market. As organizations increasingly prioritize application security in their digital transformation journeys, the competitive landscape is expected to evolve, with new entrants and existing players striving to provide comprehensive and effective security solutions.

Report Objectives:

The report will help you answer some of the most critical questions in the Application Security Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Application Security Market?

- What is the size of the Application Security Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 38.7 billion |

|

Forecasted Value (2030) |

USD 64.4 billion |

|

CAGR (2024 – 2030) |

7.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Application Security Market By Offering (Solutions, Services), By Deployment Type (On-Premises, Cloud-Based), By Application (Web Application Security, Mobile Application Security, API Security), By Industry Vertical (BFSI, Retail, Government, Healthcare, IT & Telecommunications) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Application Security Market, by Offering (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Solutions |

|

4.1.1. Static Application Security Testing (SAST) |

|

4.1.2. Dynamic Application Security Testing (DAST) |

|

4.1.3. Interactive Application Security Testing (IAST) |

|

4.1.4. Runtime Application Self-Protection (RASP) |

|

4.1.5. Web Application Firewalls (WAF) |

|

4.1.6. API Security Solutions |

|

4.1.7. Cloud Security Solutions |

|

4.1.8. Others |

|

4.2. Services |

|

5. Application Security Market, by Deployment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. On-Premises |

|

5.2. Cloud-Based |

|

6. Application Security Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Web Application Security |

|

6.2. Mobile Application Security |

|

6.3. API Security |

|

6.4. Others |

|

7. Application Security Market, by Industry Vertical (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. BFSI |

|

7.2. Retail |

|

7.3. Government |

|

7.4. Healthcare |

|

7.5. IT & Telecommunications |

|

7.6. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Application Security Market, by Offering |

|

8.2.7. North America Application Security Market, by Deployment Type |

|

8.2.8. North America Application Security Market, by Application |

|

8.2.9. North America Application Security Market, by Industry Vertical |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Application Security Market, by Offering |

|

8.2.10.1.2. US Application Security Market, by Deployment Type |

|

8.2.10.1.3. US Application Security Market, by Application |

|

8.2.10.1.4. US Application Security Market, by Industry Vertical |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Checkmarx |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Fortinet |

|

10.3. IBM |

|

10.4. Open Text |

|

10.5. Palo Alto Networks |

|

10.6. Qualys |

|

10.7. Rapid7 |

|

10.8. Synopsys |

|

10.9. Veracode |

|

10.10. WhiteHat IT Security |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Application Security Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Application Security Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Application Security ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Application Security Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats