As per Intent Market Research, the Apple Fiber Market was valued at USD 1.3 billion in 2023 and will surpass USD 2.2 billion by 2030; growing at a CAGR of 7.7% during 2024 - 2030.

The global apple fiber market is witnessing significant growth as consumers increasingly seek healthier, plant-based ingredients in food and beverage products. Apple fiber, derived from byproducts of apple processing like the pulp, pomace, peel, and seeds, has gained popularity due to its high nutritional value and functional properties. Apple fiber is recognized for its rich content of both soluble and insoluble fiber, which aids in digestive health, cholesterol regulation, and weight management. The demand for apple fiber spans across several industries, including food and beverage, pharmaceuticals, cosmetics, and animal feed, driven by its natural, plant-based profile and versatility in various applications.

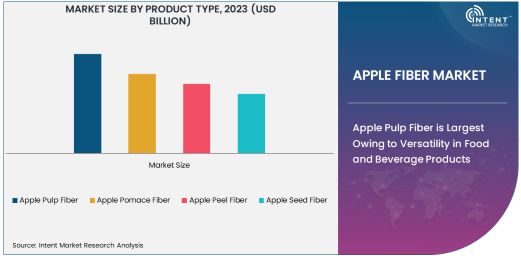

Apple Pulp Fiber is Largest Owing to Versatility in Food and Beverage Products

Among the various types of apple fiber, apple pulp fiber holds the largest market share due to its broad application in the food and beverage industry. Apple pulp is the solid residue that remains after juice extraction and contains both soluble and insoluble fiber. This fiber is primarily used to enhance the texture and nutritional profile of food products, especially in functional foods and beverages. Its ability to improve the moisture content and mouthfeel of products like juices, smoothies, and baked goods makes it a favored choice among manufacturers. Additionally, its natural composition and health benefits further drive its demand in functional food formulations.

The use of apple pulp fiber is expanding as more consumers turn to healthier food options. It is increasingly being incorporated into a wide range of products such as bakery items, dairy products, and fruit-based beverages. As the demand for clean-label and minimally processed ingredients rises, the inclusion of apple pulp fiber in food formulations aligns with consumer preferences for natural, plant-based products that provide additional health benefits.

Food & Beverage Industry is Largest Owing to Rising Health Consciousness

The food and beverage industry is the largest end-user of apple fiber, driven by a growing consumer demand for healthy, functional, and dietary-enhancing ingredients. As more people focus on health and wellness, there has been a notable rise in the use of plant-based, high-fiber ingredients that offer digestive health benefits. Apple fiber, particularly from apple pomace and pulp, is being used extensively in functional foods and beverages such as smoothies, juices, snack bars, and energy drinks.

The demand for fiber-rich products has surged due to increasing awareness of the benefits of fiber in maintaining digestive health and managing chronic conditions like obesity and diabetes. Additionally, the clean-label trend, which calls for fewer artificial ingredients in food products, is further boosting the market for natural fibers like apple fiber. The versatility of apple fiber allows it to be used in various formulations, from dairy and frozen products to functional snacks, making it an essential ingredient for food manufacturers aiming to meet consumer expectations for healthy and nutritious food options.

Powder Form is Largest Owing to Ease of Use and Incorporation in Food Products

Among the different forms of apple fiber, powder is the largest segment, owing to its ease of use and incorporation in food products. Apple fiber in powdered form is highly versatile and can be seamlessly integrated into a wide range of food formulations, from beverages and baked goods to dietary supplements and functional foods. Its ability to dissolve easily in liquids and blend well with other ingredients makes it a preferred choice for manufacturers.

Powdered apple fiber is especially popular in health-focused products, where it adds not only fiber content but also enhances the texture and consistency of the final product. For instance, it is used in powdered drink mixes, smoothies, and protein shakes, providing additional nutritional benefits without compromising the product's flavor or appearance. As consumer demand for convenient, on-the-go health solutions grows, the use of powdered apple fiber in ready-to-consume beverages and snacks is expected to continue to rise.

Direct Sales is Largest Owing to Strong B2B Relationships

In terms of distribution channels, direct sales hold the largest share of the apple fiber market. Many apple fiber producers prefer to sell directly to manufacturers, food processors, and other bulk purchasers, ensuring better control over pricing, product quality, and customer relationships. This direct approach also allows companies to cater to the specific needs of large-scale food manufacturers and suppliers, offering tailored products and services.

Direct sales channels provide manufacturers with a streamlined process for sourcing high-quality apple fiber in bulk, which is crucial for consistent production. By working directly with suppliers, companies can also ensure the traceability and sustainability of the ingredients used in their products. As the demand for clean, sustainable, and locally sourced ingredients rises, direct sales channels will continue to play a pivotal role in the apple fiber market.

Functional Foods & Beverages is Fastest Growing Owing to Health Trends

The functional foods and beverages application segment is the fastest growing, driven by the increasing consumer focus on health and wellness. Apple fiber is gaining traction in functional food formulations due to its high fiber content and associated health benefits, including improved digestion, weight management, and reduced cholesterol levels. It is widely used in a variety of health-oriented products, such as energy bars, nutritional drinks, and fortified snacks, which are designed to offer more than basic nutrition.

As consumers become more aware of the impact of their diet on overall health, the demand for functional foods that provide added health benefits, such as fiber supplementation, is expanding rapidly. Apple fiber, with its natural, plant-based origin, aligns perfectly with these health trends, making it an ideal ingredient in the growing functional foods sector. This trend is expected to continue, further driving the growth of the apple fiber market in the coming years.

North America is Largest Region Owing to Health-Conscious Consumer Base

North America is the largest region for the apple fiber market, owing to the high demand for healthy, functional ingredients in food products. The region has a large consumer base that is highly health-conscious, with increasing awareness about the benefits of fiber in maintaining digestive health and preventing chronic diseases. The U.S. and Canada are significant contributors to the demand for apple fiber, with a growing preference for plant-based and clean-label products.

The rise of functional foods and dietary supplements in North America is a key driver for the apple fiber market in this region. Additionally, the increasing adoption of fiber-enriched diets among consumers is contributing to the expansion of apple fiber's application in various food products. As the market for healthy, high-fiber foods continues to grow, North America is expected to maintain its dominant position in the global apple fiber market.

Competitive Landscape: Leading Companies Driving Market Innovation

The apple fiber market is highly competitive, with a mix of established players and emerging companies offering a variety of products to meet the growing demand. Leading companies such as Herbstreith & Fox, Ingredion, and Cargill are at the forefront, continually innovating to meet the needs of the food, beverage, and pharmaceutical industries. These companies are focusing on expanding their product portfolios with organic and clean-label apple fiber variants to cater to the increasing consumer demand for healthier and more sustainable ingredients.

In addition to product innovation, companies are also leveraging strategic partnerships and acquisitions to enhance their market presence. For example, mergers and acquisitions in the fiber production space are helping companies improve their manufacturing capabilities and broaden their distribution networks. As the market continues to grow, these companies will focus on improving product quality, diversifying applications, and meeting the evolving preferences of health-conscious consumers.

Recent Developments:

- Herbstreith & Fox KG announced the launch of a new organic apple fiber product line designed to meet the increasing demand for plant-based, sustainable ingredients in the food and beverage sector.

- Ingredion Incorporated entered into a strategic partnership with a leading nutrition company to develop innovative apple fiber-based products aimed at improving digestive health and meeting the growing demand for plant-based ingredients.

- Tate & Lyle PLC expanded its portfolio with the introduction of a new apple fiber powder that enhances the texture and nutritional profile of plant-based beverages, tapping into the growing vegan product market.

- Cargill, Incorporated received approval from the European Food Safety Authority (EFSA) for its new apple pomace fiber ingredient, which will be marketed as a healthy and functional addition to dietary supplements.

- Fiberstar, Inc. completed an acquisition of a fiber processing technology firm, further strengthening its position in the apple fiber market. The acquisition will allow Fiberstar to enhance its fiber extraction process and meet rising consumer demand for plant-based ingredients.

List of Leading Companies:

- Herbstreith & Fox KG

- JRS Pharma

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Cargill, Incorporated

- FutureCeuticals, Inc.

- Foodchem International Corporation

- The Green Labs LLC

- Apple Fiber Co.

- M.H. Fox & Sons Limited

- Fiberstar, Inc.

- NutraScience Labs

- DuPont Nutrition & Biosciences

- Zhejiang Tianyu Food Co

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.3 Billion |

|

Forecasted Value (2030) |

USD 2.2 Billion |

|

CAGR (2024 – 2030) |

7.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Apple Fiber Market By Product Type (Apple Pulp Fiber, Apple Pomace Fiber, Apple Peel Fiber, Apple Seed Fiber), By End-User Industry (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Animal Feed), By Form (Powder, Granules, Liquid), By Distribution Channel (Direct Sales, Retail, Online Sales), and By Application (Functional Foods & Beverages, Dietary Supplements, Bakery & Confectionery, Dairy & Frozen Products, Animal Nutrition) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Herbstreith & Fox KG, JRS Pharma, Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, Cargill, Incorporated, FutureCeuticals, Inc., Foodchem International Corporation, The Green Labs LLC, Apple Fiber Co., M.H. Fox & Sons Limited, Fiberstar, Inc., NutraScience Labs, DuPont Nutrition & Biosciences, Zhejiang Tianyu Food Co |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Apple Fiber Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Apple Pulp Fiber |

|

4.2. Apple Pomace Fiber |

|

4.3. Apple Peel Fiber |

|

4.4. Apple Seed Fiber |

|

5. Apple Fiber Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Food & Beverage |

|

5.2. Pharmaceuticals |

|

5.3. Cosmetics & Personal Care |

|

5.4. Animal Feed |

|

5.5. Others |

|

6. Apple Fiber Market, by Form (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Powder |

|

6.2. Granules |

|

6.3. Liquid |

|

7. Apple Fiber Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Direct Sales |

|

7.2. Retail |

|

7.3. Online Sales |

|

8. Apple Fiber Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Functional Foods & Beverages |

|

8.2. Dietary Supplements |

|

8.3. Bakery & Confectionery |

|

8.4. Dairy & Frozen Products |

|

8.5. Animal Nutrition |

|

8.6. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Apple Fiber Market, by Product Type |

|

9.2.7. North America Apple Fiber Market, by End-User Industry |

|

9.2.8. North America Apple Fiber Market, by Form |

|

9.2.9. North America Apple Fiber Market, by Distribution Channel |

|

9.2.10. North America Apple Fiber Market, by |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Apple Fiber Market, by Product Type |

|

9.2.11.1.2. US Apple Fiber Market, by End-User Industry |

|

9.2.11.1.3. US Apple Fiber Market, by Form |

|

9.2.11.1.4. US Apple Fiber Market, by Distribution Channel |

|

9.2.11.1.5. US Apple Fiber Market, by |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Herbstreith & Fox KG |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. JRS Pharma |

|

11.3. Archer Daniels Midland Company |

|

11.4. Ingredion Incorporated |

|

11.5. Tate & Lyle PLC |

|

11.6. Cargill, Incorporated |

|

11.7. FutureCeuticals, Inc. |

|

11.8. Foodchem International Corporation |

|

11.9. The Green Labs LLC |

|

11.10. Apple Fiber Co. |

|

11.11. M.H. Fox & Sons Limited |

|

11.12. Fiberstar, Inc. |

|

11.13. NutraScience Labs |

|

11.14. DuPont Nutrition & Biosciences |

|

11.15. Zhejiang Tianyu Food Co |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Apple Fiber Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Apple Fiber Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Apple Fiber Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA