As per Intent Market Research, the Antimicrobial Additives Market was valued at USD 2.9 billion in 2023 and will surpass USD 5.4 billion by 2030; growing at a CAGR of 9.3% during 2024 - 2030.

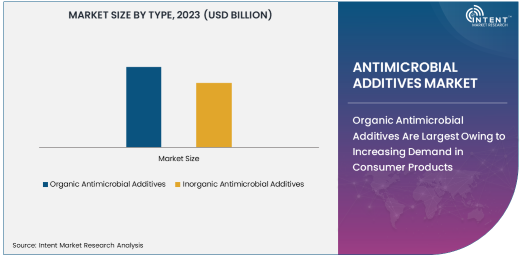

The antimicrobial additives market is a rapidly expanding sector driven by the growing demand for materials that resist microbial contamination. These additives are incorporated into products across various industries to enhance durability, hygiene, and product lifespan. Among the different types of antimicrobial additives, organic antimicrobial additives have emerged as the largest subsegment due to their widespread use in consumer products such as textiles, plastics, and coatings.

Organic Antimicrobial Additives Are Largest Owing to Increasing Demand in Consumer Products

Organic antimicrobial additives are particularly favored for their effectiveness against a broad spectrum of microorganisms, including bacteria, fungi, and algae. Their popularity is primarily attributed to their ability to be easily incorporated into a variety of materials without affecting the material’s physical properties. This makes them ideal for applications in healthcare, textiles, and consumer goods, where hygiene and safety are paramount. Furthermore, organic additives are considered environmentally friendly and safer for consumer use, driving their preference in the market.

Plastics Application Is Fastest Growing Due to Demand for Hygienic Materials

The antimicrobial additives market in plastics is experiencing robust growth, making it the fastest-growing application subsegment. The increasing use of antimicrobial additives in plastics is primarily driven by the rising consumer demand for hygiene-focused products, particularly in healthcare, packaging, and consumer goods sectors. Plastics are used extensively in medical devices, food packaging, and personal care items, where antimicrobial properties are crucial for preventing bacterial and fungal growth.

As industries seek to improve product safety and longevity, plastics treated with antimicrobial additives are being adopted in more applications. This is especially true in food packaging, where antimicrobial plastics help extend the shelf life of products by reducing microbial contamination. Additionally, the growing trend of using antimicrobial plastics in medical devices such as catheters and surgical instruments is further propelling market growth. The ability of plastics to be easily molded and integrated with antimicrobial agents makes them a key area of focus for manufacturers, contributing to the segment's rapid expansion.

Healthcare Industry Drives Largest Share with Focus on Infection Control

The healthcare industry remains the largest end-use segment for antimicrobial additives, driven by the increasing need for infection control and hygienic products. With a rising global focus on health and safety, the demand for antimicrobial-treated products in medical equipment, healthcare textiles, and pharmaceuticals has surged. Antimicrobial additives play a vital role in preventing the growth of bacteria, fungi, and other microorganisms on surfaces, thereby reducing the risk of infections in healthcare settings.

In hospitals and healthcare facilities, antimicrobial additives are incorporated into a wide range of products, including surgical drapes, wound care materials, catheters, and hospital furniture. These additives help reduce the risk of healthcare-associated infections (HAIs), which are a major concern for both patients and healthcare providers. As the healthcare sector continues to emphasize infection control, the demand for antimicrobial solutions is expected to remain strong, maintaining its position as the largest end-use industry in the antimicrobial additives market.

Liquid Form Is Fastest Growing Due to Versatility in Applications

The liquid form of antimicrobial additives is the fastest-growing subsegment in the market, owing to its versatility and effectiveness in a wide range of applications. Liquid formulations offer several advantages, including ease of application and the ability to be incorporated into various manufacturing processes, making them ideal for industries such as textiles, coatings, and healthcare. These additives are especially beneficial in situations where uniform distribution across surfaces is crucial.

Liquid antimicrobial additives are increasingly used in industries such as textiles, where they are applied to fabrics to provide long-lasting protection against bacteria and fungi. Additionally, their use in coatings for industrial and consumer applications is rising, as liquid additives can be easily mixed into paints and coatings to provide surface-level protection. The flexibility of liquid formulations, combined with their ability to deliver durable antimicrobial effects, is driving their rapid adoption across a variety of sectors, making them the fastest-growing formulation type in the antimicrobial additives market.

Bacteriostatic Function Dominates Market Owing to Broad Efficacy

Bacteriostatic antimicrobial additives are the dominant function type in the market, owing to their broad-spectrum efficacy in inhibiting bacterial growth. These additives work by preventing bacteria from multiplying, thereby reducing the risk of contamination and extending the product lifespan. Bacteriostatic additives are particularly important in industries such as healthcare, textiles, and food packaging, where microbial control is critical for maintaining hygiene and product quality.

The widespread adoption of bacteriostatic additives is driven by their ability to protect against harmful bacteria in a variety of applications. In healthcare, for example, bacteriostatic-treated medical devices and hospital linens help prevent the spread of infections. In the food and beverage industry, bacteriostatic additives are used in food packaging to prevent spoilage and extend shelf life. This versatility and effectiveness in controlling bacterial growth across diverse applications make bacteriostatic additives the largest function type in the antimicrobial additives market.

North America Is Largest Market Owing to Strong Demand in Healthcare and Consumer Products

North America holds the largest share of the antimicrobial additives market, driven by strong demand across key sectors such as healthcare, consumer products, and food packaging. The region's advanced healthcare infrastructure, coupled with a growing emphasis on hygiene and infection control, contributes significantly to the market's expansion. In addition, the rising adoption of antimicrobial-treated consumer goods, such as textiles and plastics, is further boosting market growth.

The healthcare sector in North America is particularly influential in driving demand for antimicrobial additives. With increasing concerns over healthcare-associated infections and the need for hygienic medical devices, the region remains a major market for antimicrobial solutions. Additionally, the growing awareness of environmental sustainability and safety regulations is driving the adoption of antimicrobial additives in consumer products, packaging, and textiles. As a result, North America continues to be the largest region in the antimicrobial additives market, with strong growth prospects in the coming years.

Competitive Landscape: Leading Companies Shape Market Growth Through Innovation and Strategic Partnerships

The antimicrobial additives market is characterized by the presence of several key players that dominate the competitive landscape. Leading companies such as BASF, Clariant, Lonza Group, and Microban International have established strong footholds in the market through continuous innovation, product development, and strategic partnerships. These companies are increasingly focused on expanding their product portfolios to cater to the growing demand for antimicrobial solutions across various end-use industries.

The competitive landscape is also marked by mergers and acquisitions (M&A), as companies seek to enhance their market position and access new technologies. For instance, Clariant's acquisition of antimicrobial technology firms has strengthened its offerings in the healthcare and textiles sectors. Moreover, collaborations with manufacturers across industries, including healthcare, construction, and packaging, are becoming more common, allowing companies to tap into new markets and expand their global reach. As the demand for antimicrobial additives continues to grow, leading companies are expected to maintain their competitive edge through innovation and strategic market initiatives.

Recent Developments:

- BASF introduced a new antimicrobial additive designed to enhance the durability and cleanliness of plastics used in healthcare and consumer products.

- Microban and Addmaster have teamed up to offer a broader selection of antimicrobial solutions for textiles and coatings.

- Lonza launched a new line of antimicrobial coatings, offering improved efficiency and durability for use in healthcare and industrial applications.

- Clariant acquired a leading antimicrobial technology company to strengthen its position in the home care and healthcare markets.

- Teijin’s new antimicrobial additives for the textile market have received regulatory approval in Europe, meeting stringent safety standards for consumer use.

List of Leading Companies:

- BASF

- Clariant

- Lonza Group

- AkzoNobel N.V.

- Microban International

- Dow Inc.

- Antimicrobial Solutions

- Addmaster (UK) Ltd.

- Sanitized AG

- Kingfisher Biotech

- Biocote Ltd.

- Teijin Limited

- A. Schulman, Inc.

- Sumitomo Chemical Co., Ltd.

- Kraton Polymers

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.9 Billion |

|

Forecasted Value (2030) |

USD 5.4 Billion |

|

CAGR (2024 – 2030) |

9.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Antimicrobial Additives Market by Type (Organic Antimicrobial Additives, Inorganic Antimicrobial Additives), by Application (Plastics, Coatings, Textiles, Paints & Coatings, Construction Materials, Wood & Wood Products), by End-Use Industry (Healthcare, Construction, Food & Beverages, Textile & Apparel, Automotive, Electronics), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), by Formulation (Powder Form, Liquid Form), and by Function (Bacteriostatic, Fungistatic, Algaecide) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF, Clariant, Lonza Group, AkzoNobel N.V., Microban International, Dow Inc., Antimicrobial Solutions, Addmaster (UK) Ltd., Sanitized AG, Kingfisher Biotech, Biocote Ltd., Teijin Limited, A. Schulman, Inc., Sumitomo Chemical Co., Ltd., Kraton Polymers |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Antimicrobial Additives Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Organic Antimicrobial Additives |

|

4.2. Inorganic Antimicrobial Additives |

|

5. Antimicrobial Additives Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plastics |

|

5.2. Coatings |

|

5.3. Textiles |

|

5.4. Paints & Coatings |

|

5.5. Construction Materials |

|

5.6. Wood & Wood Products |

|

5.7. Others |

|

6. Antimicrobial Additives Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Healthcare |

|

6.2. Construction |

|

6.3. Food & Beverages |

|

6.4. Textile & Apparel |

|

6.5. Automotive |

|

6.6. Electronics |

|

6.7. Others |

|

7. Antimicrobial Additives Market, by Formulation (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Powder Form |

|

7.2. Liquid Form |

|

8. Antimicrobial Additives Market, by Function (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Bacteriostatic |

|

8.2. Fungistatic |

|

8.3. Algaecide |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Antimicrobial Additives Market, by Type |

|

9.2.7. North America Antimicrobial Additives Market, by Application |

|

9.2.8. North America Antimicrobial Additives Market, by End-Use Industry |

|

9.2.9. North America Antimicrobial Additives Market, by Formulation |

|

9.2.10. North America Antimicrobial Additives Market, by Function |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Antimicrobial Additives Market, by Type |

|

9.2.11.1.2. US Antimicrobial Additives Market, by Application |

|

9.2.11.1.3. US Antimicrobial Additives Market, by End-Use Industry |

|

9.2.11.1.4. US Antimicrobial Additives Market, by Formulation |

|

9.2.11.1.5. US Antimicrobial Additives Market, by Function |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. BASF |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Clariant |

|

11.3. Lonza Group |

|

11.4. AkzoNobel N.V. |

|

11.5. Microban International |

|

11.6. Dow Inc. |

|

11.7. Antimicrobial Solutions |

|

11.8. Addmaster (UK) Ltd. |

|

11.9. Sanitized AG |

|

11.10. Kingfisher Biotech |

|

11.11. Biocote Ltd. |

|

11.12. Teijin Limited |

|

11.13. A. Schulman, Inc. |

|

11.14. Sumitomo Chemical Co., Ltd. |

|

11.15. Kraton Polymers |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Antimicrobial Additives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Antimicrobial Additives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Antimicrobial Additives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA