As per Intent Market Research, the Anti-Venom Market was valued at USD 1.7 Billion in 2024-e and will surpass USD 3.2 Billion by 2030; growing at a CAGR of 11.5% during 2025 - 2030.

The anti-venom market is vital in the global healthcare landscape, as venomous animal bites and stings continue to pose a significant threat to public health, particularly in regions with high biodiversity and limited access to medical care. Anti-venoms, developed to counteract the toxins from snake bites, insect stings, and other animal envenomations, are essential for saving lives and preventing long-term damage. The market for anti-venoms is driven by the increasing awareness of the risks associated with bites and stings, advancements in venom research, and the growing accessibility of healthcare facilities in high-risk areas.

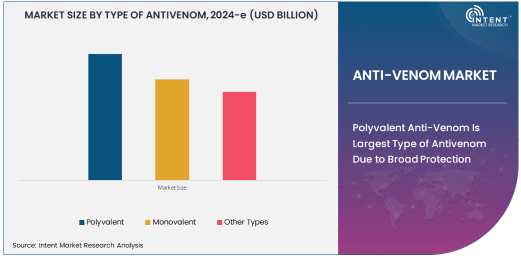

Polyvalent Anti-Venom Is Largest Type of Antivenom Due to Broad Protection

Polyvalent anti-venoms are the largest type in the anti-venom market due to their broad-spectrum efficacy in treating bites from multiple species of venomous snakes. These anti-venoms are designed to neutralize venom from different snake species, providing crucial protection in regions where various venomous snakes coexist.

Polyvalent anti-venoms are preferred in emergency medical settings as they offer a comprehensive solution to snakebite victims who may not know the specific species responsible for the bite. Their wide applicability, especially in rural and remote areas where medical facilities may not be equipped to diagnose the species of snake involved, has made them the most widely used type of anti-venom worldwide. These factors contribute to their dominance in the market.

Viper Bites Are Largest Snake Bite Type Due to High Incidence

Viper bites are the largest snake bite category in the anti-venom market, primarily due to the widespread presence of venomous viper species across multiple continents, including Asia, Africa, and Europe. Vipers are responsible for a significant proportion of snakebite incidents, with their venom often leading to severe symptoms such as hemorrhaging, tissue damage, and death if untreated.

Anti-venoms for viper bites are crucial in managing these serious cases, and the development of specific anti-venoms has helped improve survival rates and reduce long-term complications. The market for viper bite-specific anti-venoms remains robust, as ongoing efforts to improve access to medical treatment in regions with high rates of snakebites continue to drive demand for these life-saving drugs.

Hospitals and Clinics Are Largest End-Use Industry Due to Emergency Care Requirements

Hospitals and clinics represent the largest end-use industry for anti-venoms due to the urgent need for medical intervention in cases of venomous bites and stings. These healthcare facilities are equipped to provide immediate care, administer anti-venoms, and monitor patients for potential complications.

The importance of anti-venoms in hospitals and clinics cannot be overstated, as they play a central role in reducing mortality and morbidity from venomous animal bites. These institutions are typically the first point of contact for individuals suffering from bites or stings, and as such, they rely heavily on anti-venoms to treat patients effectively. The ability of hospitals to provide rapid, life-saving interventions has cemented their place as the primary end-use industry for anti-venom products.

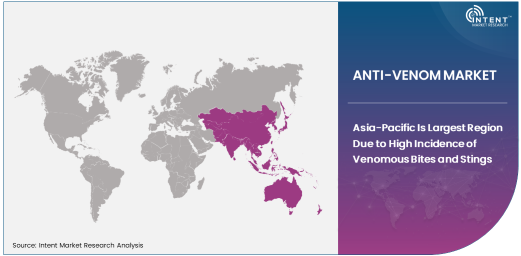

Asia-Pacific Is Largest Region Due to High Incidence of Venomous Bites and Stings

Asia-Pacific is the largest region in the anti-venom market, driven by the high incidence of venomous snakebites, insect stings, and other animal-related envenomations. Countries in Southeast Asia, South Asia, and the Pacific Islands have some of the highest rates of venomous animal bites, and the need for anti-venoms is critical in managing these incidents.

Additionally, Asia-Pacific has made significant advancements in anti-venom production, with local manufacturers developing affordable and region-specific anti-venoms to meet the growing demand. The presence of a diverse range of venomous species in the region, combined with the expansion of healthcare infrastructure, continues to propel the demand for anti-venoms in this high-risk area.

Competitive Landscape and Key Players

The anti-venom market is competitive, with key players including companies such as Sanofi, CSL Limited, and Haffkine Bio-Pharmaceutical Corporation. These companies are major producers of anti-venoms, focusing on the development and distribution of both monovalent and polyvalent anti-venoms.

The competitive landscape is shaped by the need for continuous innovation, especially in terms of improving the efficacy and safety profiles of anti-venoms. Additionally, companies are increasingly collaborating with research institutions and governments to improve accessibility and affordability, particularly in low-income regions where snakebites and venomous stings are a significant public health threat. Ongoing efforts to expand production capacity and enhance distribution channels are key to meeting the growing global demand for anti-venoms, ensuring timely access to treatment and saving lives.

Recent Developments:

- Pfizer Inc. expanded its portfolio by acquiring a leading anti-venom producer, strengthening its global reach in the envenomation treatment market.

- Merck & Co., Inc. partnered with a non-profit organization to increase access to anti-snake venom in developing countries with high snakebite incidences.

- Sanofi S.A. announced the development of a new polyvalent anti-venom targeting several dangerous snake species in the African continent.

- Serum Institute of India launched a cost-effective anti-scorpion venom in India, addressing a high number of scorpion-related incidents.

- CSL Limited received regulatory approval for a new anti-venom product aimed at treating venomous insect bites, particularly in tropical regions.

List of Leading Companies:

- Pfizer Inc.

- Baxter International Inc.

- Merck & Co., Inc.

- Sanofi S.A.

- Serum Institute of India Pvt. Ltd.

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- VINS Bioproducts Ltd.

- Instituto Clodomiro Picado

- Biological E. Limited

- Indian Immunologicals Ltd.

- Venom Immunochemistry, Inc.

- Ozone Biopharma

- Alphamab Biopharmaceuticals

- CSL Limited

- Lifeline Biotech

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.7 Billion |

|

Forecasted Value (2030) |

USD 3.2 Billion |

|

CAGR (2025 – 2030) |

11.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Venom Market by Type of Antivenom (Polyvalent, Monovalent, Other Types), by Snake Bites (Viper Bites, Cobra Bites, Rattlesnake Bites, Other Snake Bites), by Other Animal Bites (Spider Bites, Scorpion Stings, Insect Stings, Marine Animal Stings), by End-Use Industry (Hospitals and Clinics, Ambulance Services, Research and Laboratories); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., Baxter International Inc., Merck & Co., Inc., Sanofi S.A., Serum Institute of India Pvt. Ltd., Haffkine Bio-Pharmaceutical Corporation Ltd., Instituto Clodomiro Picado, Biological E. Limited, Indian Immunologicals Ltd., Venom Immunochemistry, Inc., Ozone Biopharma, Alphamab Biopharmaceuticals, Lifeline Biotech |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Venom Market, by Type of Antivenom (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Polyvalent |

|

4.2. Monovalent |

|

4.3. Other Types |

|

5. Anti-Venom Market, by Snake Bites (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Viper Bites |

|

5.2. Cobra Bites |

|

5.3. Rattlesnake Bites |

|

5.4. Other Snake Bites |

|

6. Anti-Venom Market, by Other Animal Bites (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Spider Bites |

|

6.2. Scorpion Stings |

|

6.3. Insect Stings |

|

6.4. Marine Animal Stings |

|

7. Anti-Venom Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals and Clinics |

|

7.2. Ambulance Services |

|

7.3. Research and Laboratories |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anti-Venom Market, by Type of Antivenom |

|

8.2.7. North America Anti-Venom Market, by Snake Bites |

|

8.2.8. North America Anti-Venom Market, by Other Animal Bites |

|

8.2.9. North America Anti-Venom Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anti-Venom Market, by Type of Antivenom |

|

8.2.10.1.2. US Anti-Venom Market, by Snake Bites |

|

8.2.10.1.3. US Anti-Venom Market, by Other Animal Bites |

|

8.2.10.1.4. US Anti-Venom Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Pfizer Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Baxter International Inc. |

|

10.3. Merck & Co., Inc. |

|

10.4. Sanofi S.A. |

|

10.5. Serum Institute of India Pvt. Ltd. |

|

10.6. Haffkine Bio-Pharmaceutical Corporation Ltd. |

|

10.7. VINS Bioproducts Ltd. |

|

10.8. Instituto Clodomiro Picado |

|

10.9. Biological E. Limited |

|

10.10. Indian Immunologicals Ltd. |

|

10.11. Venom Immunochemistry, Inc. |

|

10.12. Ozone Biopharma |

|

10.13. Alphamab Biopharmaceuticals |

|

10.14. CSL Limited |

|

10.15. Lifeline Biotech |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Venom Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Venom Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Venom Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA