As per Intent Market Research, the Anti-Submarine Warfare Systems was valued at USD 17.2 billion in 2023 and will surpass USD 25.2 billion by 2030; growing at a CAGR of 5.6% during 2024 - 2030.

As major naval powers such as the United States, China, and Russia modernize their fleets, ASW systems have become an indispensable part of military preparedness, aiming to safeguard strategic waters and critical maritime trade routes. This report will delve into the key segments driving the market and analyze the largest and fastest-growing subsegments that are shaping the future of ASW systems.

Sonar Systems Segment is Largest Owing to High Demand for Detection Capabilities

Sonar systems represent the largest segment within the ASW systems market, driven by their essential role in detecting underwater threats. Sonar systems use sound waves to detect and locate submarines, torpedoes, and other underwater objects, making them critical in anti-submarine operations. This segment dominates the market due to the continued investments in upgrading sonar technologies, especially passive and active sonar systems, which are pivotal for long-range detection in both deep and shallow waters.

Among the various types of sonar systems, passive sonar is the largest subsegment. Its ability to detect enemy submarines without revealing the host vessel’s location makes it indispensable in stealth operations. The growing preference for these systems, particularly in naval defense strategies, has made passive sonar the preferred choice for major naval forces. Additionally, advancements in signal processing and artificial intelligence (AI) integration have enhanced the operational capabilities of these systems, contributing to their sustained dominance in the market.

Underwater Drones Segment is Fastest Growing Owing to Increased Adoption of Autonomous Systems

The underwater drones segment is the fastest-growing within the ASW systems market, driven by the rising demand for autonomous and unmanned systems in naval operations. Underwater drones, also known as unmanned underwater vehicles (UUVs), have seen rapid adoption due to their ability to operate in high-risk areas without putting human lives at risk. These drones are capable of performing reconnaissance, surveillance, and mine countermeasures, making them versatile assets in ASW operations.

Among underwater drones, autonomous underwater vehicles (AUVs) are the fastest-growing subsegment. Their ability to operate independently for extended periods and conduct complex missions, including deep-sea exploration and enemy submarine tracking, has propelled their demand. The integration of AI, advanced sensors, and longer battery life has significantly improved the operational efficiency of AUVs, making them a key focus for future naval investments. The flexibility and lower operational costs associated with AUVs are also key drivers for their accelerated growth in the ASW systems market.

Weapons Systems Segment is Largest Owing to Continuous Modernization of Naval Armaments

Weapons systems are another critical segment in the ASW systems market, with torpedoes and anti-submarine missiles playing a significant role in neutralizing underwater threats. This segment remains one of the largest due to the constant need for navies to upgrade their offensive capabilities, ensuring they can effectively engage and eliminate enemy submarines.

Within the weapons systems segment, lightweight torpedoes are the largest subsegment. These torpedoes are favored for their versatility and ease of deployment from various platforms, including helicopters, surface ships, and submarines. With a growing emphasis on rapid response and precision strikes, lightweight torpedoes have become the weapon of choice for many naval forces. Additionally, recent advancements in propulsion technologies and guidance systems have further improved their accuracy and lethality, ensuring their continued prominence in the ASW systems market.

Detection and Tracking Systems Segment is Fastest Growing Owing to AI-Driven Innovations

Detection and tracking systems form a crucial part of ASW operations, enabling the identification and monitoring of enemy submarines. This segment is witnessing rapid growth, with technological advancements in radar, magnetic anomaly detection (MAD) systems, and AI-powered tracking solutions.

Among these, AI-enhanced tracking systems are the fastest-growing subsegment. The integration of AI into tracking systems has revolutionized the way submarines are detected and monitored. AI algorithms can analyze vast amounts of sonar and radar data in real-time, significantly improving the accuracy and speed of threat identification. These systems are also capable of predicting enemy movements based on historical data, allowing for more strategic decision-making during ASW operations. As naval forces continue to invest in AI-driven solutions, this subsegment is expected to witness exponential growth during the forecast period.

Airborne ASW Platforms Segment is Largest Owing to Versatile Deployment Capabilities

Airborne ASW platforms represent a significant part of the ASW systems market, providing flexibility and rapid response in maritime defense operations. These platforms, which include helicopters, fixed-wing aircraft, and drones, are essential for detecting and engaging submarines across vast oceanic expanses. The airborne platforms segment is one of the largest due to the strategic importance of aerial reconnaissance and strike capabilities in modern naval warfare.

Among airborne platforms, helicopters are the largest subsegment. Helicopters offer unmatched versatility, being able to deploy sonar buoys, launch torpedoes, and perform real-time surveillance. Their ability to operate from both land and sea-based platforms, including aircraft carriers and frigates, enhances their tactical value. As a result, navies around the world continue to invest in helicopter-based ASW systems to bolster their maritime defense capabilities.

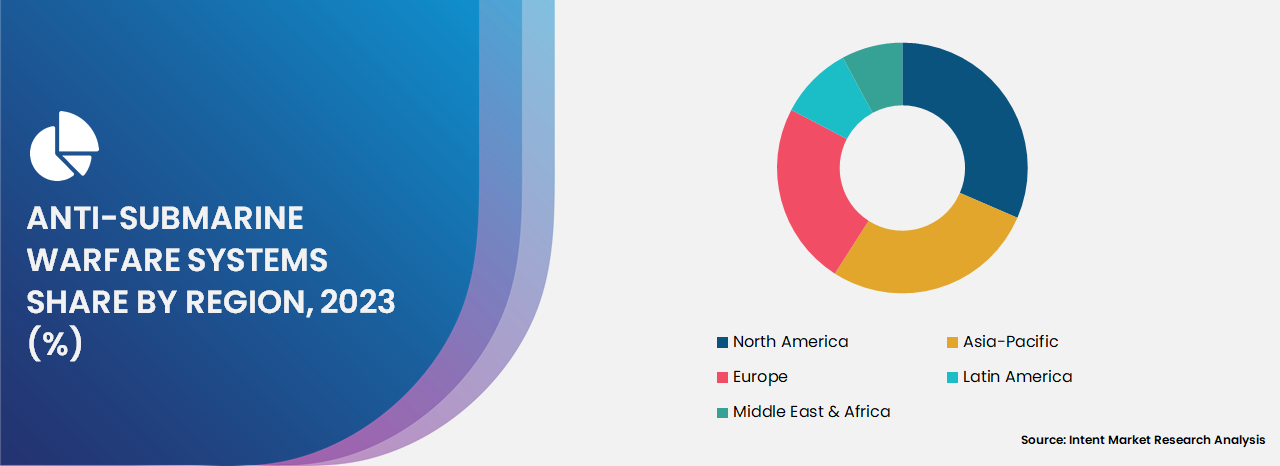

North America is Largest Region Owing to Strong Naval Investments

Geographically, North America holds the largest share in the ASW systems market, driven by the substantial investments made by the United States in naval modernization. The U.S. Navy, one of the most advanced and well-funded naval forces globally, continues to allocate significant resources toward enhancing its ASW capabilities, particularly in response to growing submarine threats from rival nations such as China and Russia.

In addition to the U.S., Canada is also contributing to the region’s dominance in the market, with ongoing naval expansion programs aimed at strengthening its maritime defense infrastructure. The focus on upgrading ASW systems, combined with cutting-edge technological advancements in sonar, underwater drones, and AI-driven tracking systems, is expected to keep North America at the forefront of the global ASW systems market throughout the forecast period.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape of the ASW systems market is characterized by the presence of several key players, including Lockheed Martin Corporation, Raytheon Technologies, Thales Group, General Dynamics Corporation, and BAE Systems. These companies are at the forefront of innovation, consistently investing in research and development to enhance the capabilities of their ASW systems.

Mergers, acquisitions, and strategic partnerships are common competitive strategies in this market, as companies look to expand their product portfolios and strengthen their foothold in different regions. The growing demand for integrated ASW solutions has also led to increased collaboration between defense contractors and government agencies, further intensifying the competitive dynamics of the market.

Report Objectives:

The report will help you answer some of the most critical questions in the Anti-Submarine Warfare Systems. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Anti-Submarine Warfare Systems?

- What is the size of the Anti-Submarine Warfare Systems based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 17.2 billion |

|

Forecasted Value (2030) |

USD 25.2 billion |

|

CAGR (2024 – 2030) |

5.6% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Anti-Submarine Warfare Systems By System (Sensors, Electronic Support Measures, Armament), By Platform (Submarines, Surface Ships, Helicopters, Maritime Patrol Aircraft, Unmanned Systems), By Industry Verticals (Metal Industry, Military & Defense) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Submarine Warfare Systems Market, by System (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Sensors |

|

4.2. Electronic Support Measures |

|

4.3. Armament |

|

5. Anti-Submarine Warfare Systems Market, by Platform (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Submarines |

|

5.2. Surface Ships |

|

5.3. Helicopters |

|

5.4. Maritime Patrol Aircraft |

|

5.5. Unmanned Systems |

|

6. Anti-Submarine Warfare Systems Market, by Industry Verticals (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Metal Industry |

|

6.2. Military & Defense |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Anti-Submarine Warfare Systems Market, by System |

|

7.2.7. North America Anti-Submarine Warfare Systems Market, by Platform |

|

7.2.8. North America Anti-Submarine Warfare Systems Market, by Industry Verticals |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Anti-Submarine Warfare Systems Market, by System |

|

7.2.9.1.2. US Anti-Submarine Warfare Systems Market, by Platform |

|

7.2.9.1.3. US Anti-Submarine Warfare Systems Market, by Industry Verticals |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BAE Systems |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Elbit Systems Ltd. |

|

9.3. General Dynamics Mission Systems, Inc. |

|

9.4. Kongsberg Defence & Aerospace |

|

9.5. L3Harris Technologies Inc. |

|

9.6. Lockheed Martin Corporation |

|

9.7. Northrop Grumman Corporation |

|

9.8. RTX |

|

9.9. Saab AB |

|

9.10. Safran |

|

9.11. Thales Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Submarine Warfare Systems. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Submarine Warfare Systems. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Anti-Submarine Warfare Systems ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Submarine Warfare Systems. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA