As per Intent Market Research, the Anti-Radiation Drugs Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 1.8 Billion by 2030; growing at a CAGR of 8.0% during 2025 - 2030.

The anti-radiation drugs market is critical for mitigating the harmful effects of radiation exposure, which can occur during nuclear accidents, diagnostic procedures, or environmental contamination. These drugs are designed to protect individuals from the detrimental effects of radiation, such as DNA damage and tissue destruction. With the increasing prevalence of nuclear-related events and the need for effective radiation exposure treatments, the market for anti-radiation drugs has gained significant importance. The market is driven by growing concerns regarding nuclear disasters, advancements in medical treatments for radiation exposure, and the increasing demand for diagnostic imaging procedures that involve radiation.

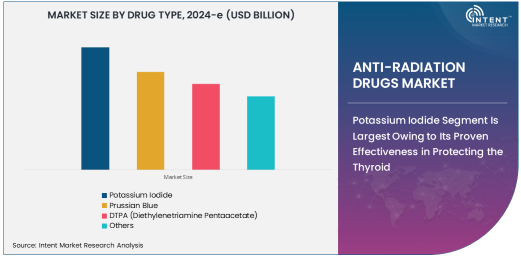

Potassium Iodide Segment Is Largest Owing to Its Proven Effectiveness in Protecting the Thyroid

The potassium iodide (KI) segment is the largest in the anti-radiation drugs market, owing to its proven effectiveness in preventing thyroid cancer and other thyroid-related conditions caused by radiation exposure. Potassium iodide works by saturating the thyroid gland with non-radioactive iodine, preventing the absorption of radioactive iodine during radiation exposure.

Potassium iodide is widely used in emergency situations, particularly in the event of nuclear accidents or radiation leaks, where radioactive iodine may be released into the environment. Its availability and proven track record in protecting individuals from radiation-induced thyroid damage have made it the preferred choice among healthcare providers, making it the dominant drug type in the market.

Prussian Blue Segment Is Fastest Growing Owing to Its Role in Treating Radioactive Cesium and Thallium Poisoning

The Prussian blue segment is the fastest-growing in the anti-radiation drugs market, driven by its effectiveness in treating poisoning caused by radioactive cesium and thallium. Prussian blue is a well-established chelating agent that binds to radioactive materials in the gastrointestinal tract, preventing their absorption into the bloodstream and aiding in their excretion.

As nuclear and radiological emergencies continue to pose risks globally, the demand for effective chelation therapies like Prussian blue has increased. The growth of this segment is also supported by the expanding use of Prussian blue in medical settings where patients have been exposed to radioactive elements through accidents or diagnostic procedures. The growing awareness of its ability to treat radiation poisoning further propels this segment's rapid growth.

Radiation Exposure Treatment Segment Is Largest Application Due to High Incidence of Radiation Risks

The radiation exposure treatment segment is the largest application within the anti-radiation drugs market, driven by the need to address the immediate and long-term effects of radiation exposure. These drugs are critical in preventing or reducing the damage caused by radiation, whether it is from nuclear accidents, radiological exposure in medical settings, or other environmental sources of radiation.

The global focus on preparedness for radiation exposure, particularly in the wake of nuclear accidents or incidents involving radiological materials, has increased the demand for effective treatment options. Anti-radiation drugs play a vital role in reducing the severity of radiation sickness, enhancing recovery, and improving survival rates, making radiation exposure treatment the largest application area in the market.

Hospitals Segment Is Largest End-Use Industry Owing to Central Role in Radiation Exposure Management

The hospitals segment is the largest end-use industry in the anti-radiation drugs market, owing to the central role hospitals play in managing radiation exposure and treating individuals affected by it. Hospitals are the primary facilities where patients are administered anti-radiation drugs following exposure to radioactive materials, either due to nuclear accidents, radiation therapy, or diagnostic procedures.

Hospitals provide specialized medical care, including radiation sickness treatment and emergency interventions, making them critical hubs for the administration of anti-radiation drugs. The increasing frequency of medical imaging procedures, as well as global concerns regarding nuclear safety, continues to drive the demand for these drugs in hospital settings.

North America Is Largest Region Owing to Strong Regulatory Framework and Preparedness

North America is the largest region for the anti-radiation drugs market, driven by strong regulatory frameworks, well-established healthcare infrastructure, and a heightened focus on nuclear safety and emergency preparedness. The United States, in particular, has a robust medical infrastructure for responding to nuclear incidents and providing radiation exposure treatments, including anti-radiation drugs like potassium iodide and Prussian blue.

North America also benefits from substantial research and development investments in medical treatments for radiation exposure, leading to advanced therapeutic solutions and improving patient outcomes. Government agencies and emergency response units in this region continue to implement safety measures and protocols for radiation emergencies, further bolstering the demand for anti-radiation drugs.

Competitive Landscape and Key Players

The anti-radiation drugs market is highly competitive, with key players such as Bayer AG, Sanofi, Amgen Inc., and Pfizer, alongside specialized companies like Bracco Imaging and Solvay Pharmaceuticals, dominating the landscape. These companies provide a range of anti-radiation drugs, from potassium iodide to chelating agents like Prussian blue, catering to various radiation exposure scenarios.

The competitive environment is driven by continuous innovation, strategic partnerships, and regulatory approvals aimed at expanding the availability of effective radiation treatments. Leading players are also focusing on enhancing the efficacy, safety, and accessibility of anti-radiation drugs, ensuring they are equipped to address the growing global demand for radiation exposure management in both emergency and routine medical contexts.

Recent Developments:

- Pfizer Inc. announced the successful development of a new radioprotective drug to be used in emergencies.

- Bracco Imaging S.p.A. introduced a new radiation treatment agent for use in nuclear medicine diagnostics.

- Teva Pharmaceuticals received regulatory approval for its new anti-radiation medication to be distributed in nuclear emergency zones.

- Amgen Inc. completed a collaboration agreement with government agencies for the distribution of radiation countermeasures.

- Eli Lilly and Company unveiled a new formulation of potassium iodide aimed at increasing the efficiency of radiation protection during nuclear accidents.

List of Leading Companies:

- Bracco Imaging S.p.A.

- Neumedicines, Inc.

- Pfizer Inc.

- Amgen Inc.

- Novartis AG

- Sanofi S.A.

- Bayer AG

- Eli Lilly and Company

- Mylan N.V.

- Bristol-Myers Squibb

- Merck & Co., Inc.

- Teva Pharmaceuticals

- Sandoz International GmbH

- Sarepta Therapeutics, Inc.

- Shionogi & Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 1.8 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Radiation Drugs Market by Drug Type (Potassium Iodide, Prussian Blue, DTPA, Others), by Application (Radiation Exposure Treatment, Nuclear Accidents, Diagnostic Procedures), by End-Use Industry (Hospitals, Government Agencies, Emergency Response Units); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bracco Imaging S.p.A., Neumedicines, Inc., Pfizer Inc., Amgen Inc., Novartis AG, Sanofi S.A., Eli Lilly and Company, Mylan N.V., Bristol-Myers Squibb, Merck & Co., Inc., Teva Pharmaceuticals, Sandoz International GmbH, Shionogi & Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Radiation Drugs Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Potassium Iodide |

|

4.2. Prussian Blue |

|

4.3. DTPA (Diethylenetriamine Pentaacetate) |

|

4.4. Others |

|

5. Anti-Radiation Drugs Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Radiation Exposure Treatment |

|

5.2. Nuclear Accidents |

|

5.3. Diagnostic Procedures |

|

6. Anti-Radiation Drugs Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Government Agencies |

|

6.3. Emergency Response Units |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Anti-Radiation Drugs Market, by Drug Type |

|

7.2.7. North America Anti-Radiation Drugs Market, by Application |

|

7.2.8. North America Anti-Radiation Drugs Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Anti-Radiation Drugs Market, by Drug Type |

|

7.2.9.1.2. US Anti-Radiation Drugs Market, by Application |

|

7.2.9.1.3. US Anti-Radiation Drugs Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Bracco Imaging S.p.A. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Neumedicines, Inc. |

|

9.3. Pfizer Inc. |

|

9.4. Amgen Inc. |

|

9.5. Novartis AG |

|

9.6. Sanofi S.A. |

|

9.7. Bayer AG |

|

9.8. Eli Lilly and Company |

|

9.9. Mylan N.V. |

|

9.10. Bristol-Myers Squibb |

|

9.11. Merck & Co., Inc. |

|

9.12. Teva Pharmaceuticals |

|

9.13. Sandoz International GmbH |

|

9.14. Sarepta Therapeutics, Inc. |

|

9.15. Shionogi & Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Radiation Drugs Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Radiation Drugs Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Radiation Drugs Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA