As per Intent Market Research, the Anti-Psychotic Drugs Market was valued at USD 12.5 Billion in 2024-e and will surpass USD 19.0 Billion by 2030; growing at a CAGR of 7.3% during 2025 - 2030.

The anti-psychotic drugs market focuses on therapies designed to manage and treat various psychiatric conditions, such as schizophrenia, bipolar disorder, and major depressive disorder. With an increasing global prevalence of mental health disorders and growing awareness about the importance of mental well-being, the market for anti-psychotic drugs is expanding rapidly. These drugs aim to alleviate symptoms such as delusions, hallucinations, and mood instability, significantly improving patients' quality of life and functioning.

The demand for anti-psychotic drugs is driven by both an aging population, which is prone to developing psychiatric disorders, and advancements in drug formulations and treatment modalities. The market is experiencing continuous growth, with a strong pipeline of new drugs aimed at offering more effective, safer treatments.

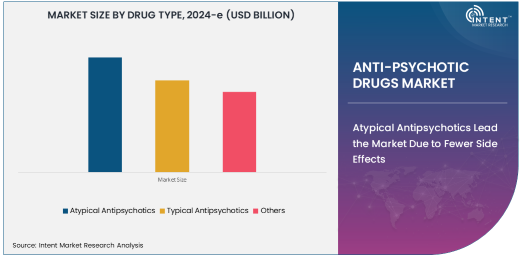

Atypical Antipsychotics Lead the Market Due to Fewer Side Effects

Atypical antipsychotics are the largest and most rapidly growing drug class in the anti-psychotic drugs market. These medications, including risperidone, olanzapine, and quetiapine, are preferred over typical antipsychotics due to their improved safety profile and reduced side effects, such as sedation and motor disturbances. Atypical antipsychotics target both dopamine and serotonin receptors, addressing the broad spectrum of symptoms associated with conditions like schizophrenia and bipolar disorder.

The growth of atypical antipsychotics can be attributed to their effectiveness in treating a wider range of symptoms and their relatively lower risk of causing severe side effects, such as extrapyramidal symptoms. As a result, these drugs have become the first-line treatment for many psychiatric conditions, contributing to their dominance in the market.

Injectable Anti-Psychotic Drugs Gaining Popularity for Enhanced Patient Compliance

Injectable anti-psychotic drugs have witnessed a notable rise in adoption, particularly for patients with chronic psychiatric conditions who have difficulty adhering to oral medication regimens. Long-acting injectable formulations, such as paliperidone palmitate and aripiprazole lauroxil, are gaining traction as they offer sustained symptom management with less frequent dosing (typically monthly or quarterly).

These injectable formulations provide significant benefits for patients who experience difficulty remembering or consistently taking oral medications, ultimately enhancing treatment adherence and improving long-term outcomes. The growth of this segment is poised to continue, especially as more long-acting injectable anti-psychotic drugs enter the market.

Schizophrenia Treatment Is the Largest Application Segment

Schizophrenia treatment is the largest application segment in the anti-psychotic drugs market. Schizophrenia, a chronic mental disorder affecting millions worldwide, requires long-term treatment with anti-psychotics to control symptoms and improve patients' quality of life. Atypical and typical antipsychotics are commonly used to manage the diverse and often debilitating symptoms of this disorder, including delusions, hallucinations, and cognitive disturbances.

Schizophrenia treatment continues to be a critical area of focus for pharmaceutical companies, with ongoing research aimed at developing more effective and safer treatments. As awareness and diagnosis rates increase, the demand for antipsychotic drugs in treating schizophrenia will continue to rise.

Hospitals Are the Largest End-Use Industry due to their role in Diagnosing and managing severe Psychiatric Disorders

Hospitals represent the largest end-use industry for anti-psychotic drugs due to their role in diagnosing and managing severe psychiatric disorders. Hospitals provide a controlled environment for administering anti-psychotic medications, especially for patients requiring immediate or intensive care. These institutions are also pivotal in monitoring and adjusting treatment plans, particularly for individuals experiencing acute psychiatric episodes.

Moreover, hospitals play a key role in the early detection of psychiatric conditions and in providing comprehensive care, including both pharmacological and psychosocial interventions. Their importance in the anti-psychotic drug market will continue to grow as demand for mental health services increases globally.

North America Leads the Market Driven by High Healthcare Spending

North America is the largest regional market for anti-psychotic drugs, driven by the region's high healthcare spending, advanced medical infrastructure, and a rising prevalence of mental health disorders. In the U.S., mental health conditions are a leading cause of disability, which contributes to the growing demand for anti-psychotic treatments. The presence of major pharmaceutical companies and research institutions further supports the market in this region, driving the development of new treatments.

Moreover, mental health awareness campaigns and greater societal acceptance of psychiatric care in North America have contributed to the growing demand for anti-psychotic medications. As such, North America is expected to maintain its dominance in the global anti-psychotic drugs market.

Competitive Landscape and Key Players

The anti-psychotic drugs market is highly competitive, with key players including Johnson & Johnson, Eli Lilly and Company, Otsuka Pharmaceutical Co., Ltd., and AstraZeneca. These companies dominate the market with their extensive portfolios of anti-psychotic medications, including both atypical and typical drugs, as well as newer long-acting injectable formulations.

The competitive landscape is further influenced by ongoing research into novel treatments for psychiatric disorders, including personalized medicine and drug formulations that target specific neurochemical pathways. As the market continues to evolve, these key players will likely engage in strategic collaborations, mergers, and acquisitions to expand their offerings and maintain a competitive edge.

Recent Developments:

- Eli Lilly and Company launched a new atypical antipsychotic drug for the treatment of schizophrenia.

- AstraZeneca PLC received FDA approval for its bipolar disorder medication.

- Janssen Pharmaceuticals expanded its antipsychotic drug portfolio with an innovative injectable formulation.

- Otsuka Pharmaceutical Co., Ltd. completed a strategic acquisition of a leading mental health pharmaceutical company.

- Pfizer Inc. announced promising clinical trial results for a new bipolar disorder treatment.

List of Leading Companies:

- Janssen Pharmaceuticals

- Eli Lilly and Company

- AstraZeneca PLC

- Pfizer Inc.

- Roche Holding AG

- Otsuka Pharmaceutical Co., Ltd.

- GlaxoSmithKline plc

- Sanofi S.A.

- Bristol-Myers Squibb

- Takeda Pharmaceutical Company Limited

- Novartis AG

- AbbVie Inc.

- Sumitomo Dainippon Pharma Co., Ltd.

- Mylan N.V.

- Lupin Pharmaceuticals

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 12.5 Billion |

|

Forecasted Value (2030) |

USD 19.0 Billion |

|

CAGR (2025 – 2030) |

7.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Psychotic Drugs Market by Drug Type (Atypical Antipsychotics, Typical Antipsychotics, Others), by Application (Schizophrenia Treatment, Bipolar Disorder, Major Depressive Disorder, Anxiety and Panic Disorders), by Route of Administration (Oral, Injectable), by End-Use Industry (Hospitals, Mental Health Clinics, Retail Pharmacies); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Janssen Pharmaceuticals, Eli Lilly and Company, AstraZeneca PLC, Pfizer Inc., Roche Holding AG, Otsuka Pharmaceutical Co., Ltd., Sanofi S.A., Bristol-Myers Squibb, Takeda Pharmaceutical Company Limited, Novartis AG, AbbVie Inc., Sumitomo Dainippon Pharma Co., Ltd., Lupin Pharmaceuticals |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Psychotic Drugs Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Atypical Antipsychotics |

|

4.2. Typical Antipsychotics |

|

4.3. Others |

|

5. Anti-Psychotic Drugs Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Schizophrenia Treatment |

|

5.2. Bipolar Disorder |

|

5.3. Major Depressive Disorder |

|

5.4. Anxiety and Panic Disorders |

|

6. Anti-Psychotic Drugs Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oral |

|

6.2. Injectable |

|

7. Anti-Psychotic Drugs Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Mental Health Clinics |

|

7.3. Retail Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anti-Psychotic Drugs Market, by Drug Type |

|

8.2.7. North America Anti-Psychotic Drugs Market, by Application |

|

8.2.8. North America Anti-Psychotic Drugs Market, by Route of Administration |

|

8.2.9. North America Anti-Psychotic Drugs Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anti-Psychotic Drugs Market, by Drug Type |

|

8.2.10.1.2. US Anti-Psychotic Drugs Market, by Application |

|

8.2.10.1.3. US Anti-Psychotic Drugs Market, by Route of Administration |

|

8.2.10.1.4. US Anti-Psychotic Drugs Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Janssen Pharmaceuticals |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Eli Lilly and Company |

|

10.3. AstraZeneca PLC |

|

10.4. Pfizer Inc. |

|

10.5. Roche Holding AG |

|

10.6. Otsuka Pharmaceutical Co., Ltd. |

|

10.7. GlaxoSmithKline plc |

|

10.8. Sanofi S.A. |

|

10.9. Bristol-Myers Squibb |

|

10.10. Takeda Pharmaceutical Company Limited |

|

10.11. Novartis AG |

|

10.12. AbbVie Inc. |

|

10.13. Sumitomo Dainippon Pharma Co., Ltd. |

|

10.14. Mylan N.V. |

|

10.15. Lupin Pharmaceuticals |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Psychotic Drugs Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Psychotic Drugs Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Psychotic Drugs Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA