As per Intent Market Research, the Anti-Neprilysin Market was valued at USD 1.6 Billion in 2024-e and will surpass USD 4.9 Billion by 2030; growing at a CAGR of 20.7% during 2025 - 2030.

The anti-neprilysin market focuses on drugs that target neprilysin, an enzyme responsible for breaking down peptides that regulate blood pressure and fluid balance. Neprilysin inhibitors, including monoclonal antibodies and small molecules, have become a significant area of research and development due to their potential to treat various cardiovascular diseases, neurological disorders, and cancer. Neprilysin inhibition is most notably used in the treatment of heart failure, where it can enhance natriuretic peptide levels and help improve cardiac function. Additionally, the promising applications in Alzheimer’s disease and cancer treatment are further propelling growth in this market.

The market for anti-neprilysin drugs is expected to expand significantly due to the increasing prevalence of heart failure, Alzheimer’s disease, and cancer, combined with growing interest from pharmaceutical and biotechnology companies in developing new therapies. As researchers continue to explore the broad potential of neprilysin inhibitors, the market is poised to evolve with innovations in drug formulations and delivery methods. The demand for effective therapies across these critical conditions is driving investment in this space, with a particular emphasis on improving patient outcomes and reducing the burden on healthcare systems globally.

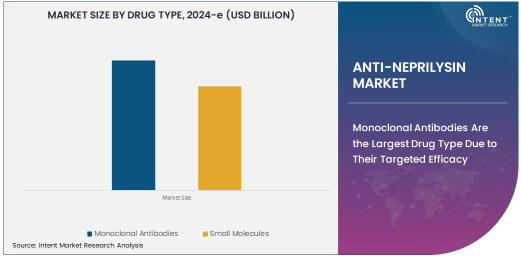

Monoclonal Antibodies Are the Largest Drug Type Due to Their Targeted Efficacy

Monoclonal antibodies (mAbs) are the largest drug type in the anti-neprilysin market, largely due to their ability to provide highly targeted therapy for diseases like heart failure, Alzheimer’s, and cancer. These biologic agents are designed to bind to specific targets—in this case, neprilysin—offering more precise action with fewer side effects compared to traditional drugs. Their growing adoption in clinical practice is attributed to their proven efficacy in reducing symptoms and improving patient quality of life, particularly in heart failure treatments, where neprilysin inhibitors work by enhancing the effects of natriuretic peptides, which help regulate blood pressure and volume.

The development of monoclonal antibody therapies has revolutionized the treatment landscape for several diseases, and their role in neprilysin inhibition is no different. As these treatments progress through clinical trials and enter the market, they are expected to dominate the space due to their highly specialized, targeted mechanisms of action and their broader therapeutic potential in complex diseases like Alzheimer’s and cancer.

Hospital Pharmacies Are the Largest Distribution Channel Due to Prescription Reliance

Hospital pharmacies represent the largest distribution channel for anti-neprilysin drugs, primarily because many of these drugs are prescribed and administered in healthcare settings where patients are closely monitored. Hospital pharmacies play a crucial role in providing medications for patients with serious conditions such as heart failure, Alzheimer’s disease, and cancer, where anti-neprilysin treatments are often part of comprehensive management plans. Due to the need for specialized care, these drugs are more commonly dispensed in hospital environments, where doctors can assess patients’ responses and adjust treatments as necessary.

The centralized role of hospital pharmacies in the distribution of these treatments ensures that patients receive appropriate counseling and monitoring, which is especially important for biologic therapies like monoclonal antibodies. As such, hospital pharmacies will continue to be the primary distribution channel for anti-neprilysin drugs, particularly for patients in critical care or undergoing intensive treatment regimens.

North America Is the Largest Region Due to Advanced Healthcare Infrastructure

North America holds the largest share of the anti-neprilysin market, driven by its advanced healthcare infrastructure, high healthcare spending, and the presence of leading pharmaceutical and biotechnology companies. The region is home to several key players in the development of neprilysin inhibitors, and its well-established healthcare system ensures that new therapies can be quickly integrated into clinical practice. Additionally, North America has a large and aging population, leading to a higher incidence of heart failure and Alzheimer’s disease, which drives demand for effective treatments in these areas.

The region's regulatory environment, along with extensive research funding, also fosters innovation in drug development, including the pursuit of new anti-neprilysin therapies. As the treatment of heart failure, Alzheimer’s disease, and cancer continues to evolve, North America remains the dominant market due to its investment in medical research and a high level of healthcare access, making it a critical region for market growth.

Competitive Landscape and Key Players

The anti-neprilysin market is competitive, with major pharmaceutical and biotechnology companies leading the development of neprilysin inhibitors. Key players in this market include Novartis, Pfizer, and Amgen, which are focusing on monoclonal antibody therapies and other novel drug classes. These companies are not only advancing their product pipelines but are also working to improve the delivery and efficacy of neprilysin inhibitors through innovative research.

As the market evolves, these players are investing heavily in clinical trials to expand the use of neprilysin inhibitors in other therapeutic areas, such as cancer and neurodegenerative diseases like Alzheimer’s. The competitive landscape is shaped by significant partnerships, research collaborations, and mergers, all aimed at bringing new, more effective therapies to market. As more drugs enter the pipeline, the market is expected to see increased innovation and a growing range of treatment options, ultimately enhancing patient care and outcomes.

Recent Developments:

- Amgen launched increased doses of its anti-neprilysin drug for improved efficacy in chronic heart failure treatment.

- Novartis entered a collaboration agreement with Roche to co-develop a neprilysin inhibitor for Alzheimer’s disease.

- Bayer introduced a novel formulation of its anti-neprilysin agent for better patient adherence in heart failure treatment.

- Pfizer initiated clinical trials for a new small-molecule neprilysin inhibitor targeting both heart failure and dementia.

- Johnson & Johnson announced a strategic partnership with Regeneron Pharmaceuticals to develop dual-targeting therapy combining neprilysin inhibition and anti-amyloid therapies.

List of Leading Companies:

- Amgen Inc.

- Novartis AG

- Bayer AG

- Eli Lilly and Co.

- Roche Holding AG

- Pfizer Inc.

- Sanofi S.A.

- Johnson & Johnson

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Regeneron Pharmaceuticals, Inc.

- Gilead Sciences, Inc.

- AbbVie Inc.

- Abbott Laboratories

- Teva Pharmaceutical Industries Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.6 Billion |

|

Forecasted Value (2030) |

USD 4.9 Billion |

|

CAGR (2025 – 2030) |

20.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Neprilysin Market by Drug Type (Monoclonal Antibodies, Small Molecules), by End-Use Industry (Pharmaceutical Companies, Biotechnology Companies), by Application (Heart Failure Treatment, Alzheimer’s Disease Treatment, Cancer Treatment), by Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amgen Inc., Novartis AG, Bayer AG, Eli Lilly and Co., Roche Holding AG, Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., Bristol-Myers Squibb Company, Regeneron Pharmaceuticals, Inc., Gilead Sciences, Inc., AbbVie Inc., Teva Pharmaceutical Industries Ltd.

|

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Neprilysin Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Monoclonal Antibodies |

|

4.2. Small Molecules |

|

5. Anti-Neprilysin Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Pharmaceutical Companies |

|

5.2. Biotechnology Companies |

|

6. Anti-Neprilysin Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Heart Failure Treatment |

|

6.2. Alzheimer’s Disease Treatment |

|

6.3. Cancer Treatment |

|

7. Anti-Neprilysin Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospital Pharmacies |

|

7.2. Online Pharmacies |

|

7.3. Retail Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anti-Neprilysin Market, by Drug Type |

|

8.2.7. North America Anti-Neprilysin Market, by End-Use Industry |

|

8.2.8. North America Anti-Neprilysin Market, by Application |

|

8.2.9. North America Anti-Neprilysin Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anti-Neprilysin Market, by Drug Type |

|

8.2.10.1.2. US Anti-Neprilysin Market, by End-Use Industry |

|

8.2.10.1.3. US Anti-Neprilysin Market, by Application |

|

8.2.10.1.4. US Anti-Neprilysin Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Amgen Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Novartis AG |

|

10.3. Bayer AG |

|

10.4. Eli Lilly and Co. |

|

10.5. Roche Holding AG |

|

10.6. Pfizer Inc. |

|

10.7. Sanofi S.A. |

|

10.8. Johnson & Johnson |

|

10.9. Merck & Co., Inc. |

|

10.10. Bristol-Myers Squibb Company |

|

10.11. Regeneron Pharmaceuticals, Inc. |

|

10.12. Gilead Sciences, Inc. |

|

10.13. AbbVie Inc. |

|

10.14. Abbott Laboratories |

|

10.15. Teva Pharmaceutical Industries Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Neprilysin Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Neprilysin Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Neprilysin Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA