As per Intent Market Research, the Anti-Money Laundering Tools Market was valued at USD 2.2 Billion in 2024-e and will surpass USD 5.6 Billion by 2030; growing at a CAGR of 16.8% during 2025 - 2030.

The anti-money laundering (AML) tools market plays a crucial role in protecting financial institutions and organizations from being used for illicit activities such as money laundering and terrorist financing. As global regulations become stricter, the demand for robust AML solutions has surged, particularly within sectors like banking, financial services, and e-commerce. With increasing sophistication in money laundering schemes and the rise of digital currencies, organizations across industries are focusing on the adoption of advanced technology to detect suspicious activities, mitigate risks, and ensure compliance with regulatory frameworks. AML tools are essential in helping organizations adhere to legal requirements while safeguarding their reputation and financial stability.

The market is expected to grow steadily, driven by the need for enhanced security, data analytics, and real-time monitoring to detect and prevent financial crimes. Key factors contributing to the market's growth include the implementation of stringent regulations globally, a rise in financial crimes, and the increasing complexity of money laundering activities. As regulatory pressures continue to mount, organizations are increasingly relying on AML software and services to enhance their compliance management and risk assessment processes.

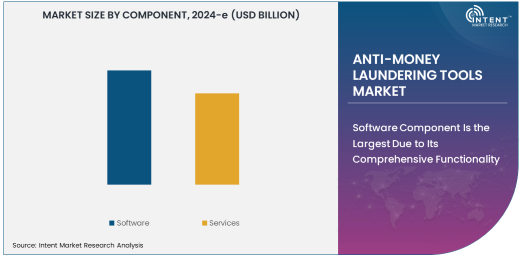

Software Component Is the Largest Due to Its Comprehensive Functionality

The software component holds the largest share of the anti-money laundering tools market, primarily due to its ability to provide comprehensive functionalities such as transaction monitoring, customer due diligence, risk assessment, and reporting. AML software solutions are designed to automate the detection of suspicious financial transactions, ensuring that organizations can monitor, analyze, and report activities in real time. This automation helps financial institutions reduce the time and resources required to manually detect money laundering activities while enhancing their ability to stay compliant with anti-money laundering regulations.

Additionally, AML software allows organizations to implement more effective data analysis and pattern recognition, which is essential in identifying complex and evolving financial crimes. With increasing regulatory scrutiny, organizations are heavily investing in AML software to streamline operations, improve accuracy in compliance reporting, and minimize the risks of fines or sanctions for non-compliance. This growing need for more advanced AML software solutions continues to drive its dominance in the market.

Cloud-Based Deployment Is the Fastest Growing Due to Flexibility and Scalability

Cloud-based deployment is the fastest growing segment in the anti-money laundering tools market, driven by the demand for flexibility, scalability, and cost-effectiveness. Cloud-based AML solutions provide organizations with the ability to access and manage AML tools remotely, enabling them to scale their operations without the need for significant on-premise infrastructure. This is particularly appealing to small and medium-sized businesses and e-commerce platforms that require robust AML compliance solutions without the financial burden of traditional on-premise systems.

The scalability of cloud-based AML tools is a key advantage, allowing businesses to easily adapt to growing data volumes and the expanding scope of regulatory requirements. Cloud-based solutions also offer quicker updates and real-time monitoring, ensuring that organizations stay ahead of evolving threats. As businesses seek more agile and efficient compliance tools, cloud-based AML solutions are becoming the preferred choice, driving rapid growth in this segment.

Banking Sector Is the Largest End-Use Industry Due to Regulatory Requirements

The banking sector is the largest end-use industry for anti-money laundering tools, owing to its critical role in preventing financial crimes and its strict regulatory obligations. Financial institutions, including banks, are at the forefront of AML compliance due to their high transaction volumes and exposure to illicit financial activities. As a result, banks invest heavily in AML solutions to monitor customer transactions, identify suspicious activities, and comply with global and local anti-money laundering regulations.

Banking institutions are also under constant scrutiny from regulators, making it essential for them to adopt advanced AML tools to avoid hefty penalties, maintain trust with customers, and protect their financial infrastructure. The high demand for AML compliance and risk management in the banking sector, coupled with the increasing complexity of financial transactions, continues to make banking the largest market segment in the anti-money laundering tools industry.

North America Is the Largest Region Due to Strong Regulatory Frameworks

North America is the largest region in the anti-money laundering tools market, primarily driven by the robust regulatory frameworks and the high adoption of AML technologies across various industries. The United States, in particular, has established stringent anti-money laundering regulations such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, requiring financial institutions to implement comprehensive AML programs. Additionally, the increasing number of financial institutions and growing concerns about cybersecurity and financial crime contribute to the demand for AML solutions in this region.

The presence of key market players in North America further accelerates the adoption of AML tools. As financial institutions continue to enhance their compliance processes and manage increasing regulatory demands, North America remains the dominant market for AML tools. The region is also witnessing a rise in the use of advanced technologies, such as artificial intelligence and machine learning, to detect and prevent money laundering activities.

Competitive Landscape and Key Players

The anti-money laundering tools market is highly competitive, with key players such as ACI Worldwide, SAS Institute, FIS Global, and NICE Actimize leading the way. These companies offer a range of AML solutions, including software for transaction monitoring, customer due diligence, risk assessment, and reporting. Many of these providers are incorporating advanced technologies such as artificial intelligence, machine learning, and big data analytics into their offerings to improve detection rates and enhance the efficiency of AML systems.

As the demand for more sophisticated AML solutions grows, competition in the market intensifies. Companies are focusing on innovation and strategic partnerships to expand their product offerings and provide comprehensive compliance solutions. With increasing regulatory pressures and the rising complexity of financial crimes, these leading players are working closely with financial institutions, government agencies, and e-commerce platforms to provide tailored anti-money laundering solutions, helping organizations mitigate risks and stay compliant in an increasingly complex financial landscape.

Recent Developments:

- FICO launched an advanced AML solution combining artificial intelligence with machine learning for better fraud detection.

- SAS Institute expanded its AML toolset to include enhanced data analytics and reporting capabilities for financial institutions.

- Refinitiv announced a partnership with HSBC to integrate AML transaction monitoring solutions to detect fraudulent activities.

- Nice Actimize rolled out a new compliance module offering enhanced features for KYC (Know Your Customer) and customer risk profiling.

- Oracle introduced a cloud-based AML platform to help financial services streamline compliance and detect suspicious transactions more effectively.

List of Leading Companies:

- FICO (Fair Isaac Corporation)

- SAS Institute Inc.

- Oracle Corporation

- ACI Worldwide

- Nice Actimize

- Refinitiv

- Thomson Reuters

- Pega Systems Inc.

- Actico GmbH

- Tata Consultancy Services (TCS)

- Softlink International

- InfrasoftTech

- Vanguard Integrity Professionals

- Fintelekt Advisory Services

- Experian

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.2 Billion |

|

Forecasted Value (2030) |

USD 5.6 Billion |

|

CAGR (2025 – 2030) |

16.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Money Laundering Tools Market by Component (Software, Services), by Deployment Type (On-Premise, Cloud-Based), by End-Use Industry (Banking, Financial Institutions, Government, Insurance, E-Commerce), by Application (Transaction Monitoring, Customer Due Diligence, Compliance Management, Risk Assessment, Reporting and Audit); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

FICO (Fair Isaac Corporation), SAS Institute Inc., Oracle Corporation, ACI Worldwide, Nice Actimize, Refinitiv, Pega Systems Inc., Actico GmbH, Tata Consultancy Services (TCS), Softlink International, InfrasoftTech, Vanguard Integrity Professionals, Experian |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Money Laundering Tools Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Software |

|

4.2. Services |

|

5. Anti-Money Laundering Tools Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. On-Premise |

|

5.2. Cloud-Based |

|

6. Anti-Money Laundering Tools Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Banking |

|

6.2. Financial Institutions |

|

6.3. Government |

|

6.4. Insurance |

|

6.5. E-Commerce |

|

7. Anti-Money Laundering Tools Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Transaction Monitoring |

|

7.2. Customer Due Diligence |

|

7.3. Compliance Management |

|

7.4. Risk Assessment |

|

7.5. Reporting and Audit |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anti-Money Laundering Tools Market, by Component |

|

8.2.7. North America Anti-Money Laundering Tools Market, by Deployment Type |

|

8.2.8. North America Anti-Money Laundering Tools Market, by End-Use Industry |

|

8.2.9. North America Anti-Money Laundering Tools Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anti-Money Laundering Tools Market, by Component |

|

8.2.10.1.2. US Anti-Money Laundering Tools Market, by Deployment Type |

|

8.2.10.1.3. US Anti-Money Laundering Tools Market, by End-Use Industry |

|

8.2.10.1.4. US Anti-Money Laundering Tools Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. FICO (Fair Isaac Corporation) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. SAS Institute Inc. |

|

10.3. Oracle Corporation |

|

10.4. ACI Worldwide |

|

10.5. Nice Actimize |

|

10.6. Refinitiv |

|

10.7. Thomson Reuters |

|

10.8. Pega Systems Inc. |

|

10.9. Actico GmbH |

|

10.10. Tata Consultancy Services (TCS) |

|

10.11. Softlink International |

|

10.12. InfrasoftTech |

|

10.13. Vanguard Integrity Professionals |

|

10.14. Fintelekt Advisory Services |

|

10.15. Experian |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Money Laundering Tools Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Money Laundering Tools Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Money Laundering Tools Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA