As per Intent Market Research, the Anti-Counterfeit Pharmaceutical Packaging Market was valued at USD 4.3 Billion in 2024-e and will surpass USD 6.8 Billion by 2030; growing at a CAGR of 8.0% during 2025 - 2030.

The anti-counterfeit pharmaceutical packaging market is critical for ensuring the safety, efficacy, and authenticity of pharmaceutical products. Counterfeit drugs present a major global challenge, threatening public health and undermining trust in the pharmaceutical industry. As counterfeiters become more sophisticated, pharmaceutical companies, healthcare providers, and contract packaging companies are increasingly turning to advanced packaging solutions to protect products and prevent tampering. Technologies such as RFID, QR codes, and holograms are transforming the packaging landscape, offering innovative ways to track, trace, and authenticate pharmaceutical products throughout their lifecycle. The market's growth is driven by stringent regulations, rising awareness about the dangers of counterfeit drugs, and the need for enhanced security in pharmaceutical supply chains.

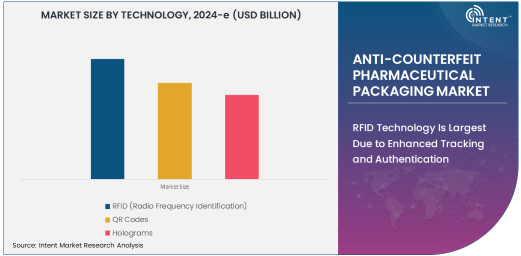

RFID Technology Is Largest Due to Enhanced Tracking and Authentication

RFID (Radio Frequency Identification) technology leads the anti-counterfeit pharmaceutical packaging market, owing to its ability to offer real-time tracking and authentication of products. RFID tags can be embedded in packaging to provide unique identification for each product, making it easier to verify the authenticity of drugs as they move through the supply chain. These tags communicate with RFID readers, allowing for seamless and efficient tracking of pharmaceuticals from manufacturing to distribution and retail.

The growing adoption of RFID technology in pharmaceutical packaging is driven by its ability to reduce fraud, prevent counterfeit drugs from reaching consumers, and comply with regulatory requirements. With increased concerns about drug safety and the global trade of counterfeit medicines, RFID has become the most widely adopted technology in the anti-counterfeit packaging market. Its use provides a significant layer of protection against counterfeit drugs, making it the dominant technology segment.

Labels Are Fastest Growing Packaging Type Due to Consumer Engagement and Visibility

Labels are the fastest growing packaging type in the anti-counterfeit pharmaceutical packaging market, driven by their ability to engage consumers directly and provide visible proof of authenticity. Anti-counterfeit labels often feature technologies such as QR codes, holograms, and tamper-evident seals, which allow consumers to verify the authenticity of pharmaceutical products using smartphones or specialized devices. The ease of use and relatively low cost of label-based solutions are key factors contributing to their rapid adoption.

As consumer awareness about counterfeit drugs increases, labels with built-in security features have become essential for establishing trust in pharmaceutical brands. Labels not only help prevent counterfeiting but also improve brand recognition and customer loyalty by allowing consumers to easily check the authenticity of products. As a result, the demand for labels equipped with anti-counterfeit technologies is growing at an accelerated pace within the pharmaceutical packaging sector.

Pharmaceutical Companies Are Largest End-Use Industry Due to Regulatory Compliance and Product Protection

Pharmaceutical companies are the largest end-use industry in the anti-counterfeit pharmaceutical packaging market, primarily due to the increasing need for regulatory compliance and product protection. Pharmaceutical manufacturers are under constant pressure to safeguard their products from counterfeiters, who pose significant risks to public health, brand reputation, and revenue. By adopting advanced packaging solutions, such as RFID and tamper-evident seals, pharmaceutical companies can ensure that their products reach consumers in their original, unaltered form.

The pharmaceutical industry is heavily regulated, with governments around the world implementing strict rules to protect consumers from counterfeit drugs. Packaging solutions that help pharmaceutical companies comply with these regulations, enhance supply chain visibility, and ensure product authenticity are critical. As counterfeit drugs continue to pose a global threat, pharmaceutical companies are expected to remain the leading adopters of anti-counterfeit packaging technologies.

North America Is Largest Region Due to Regulatory Pressure and Technological Advancements

North America is the largest region in the anti-counterfeit pharmaceutical packaging market, driven by stringent regulatory requirements and technological advancements. In countries like the United States, regulatory bodies such as the FDA (Food and Drug Administration) have introduced policies requiring serialization and unique identifiers for pharmaceutical products. This has led to a heightened demand for anti-counterfeit packaging solutions that can meet these regulatory standards and ensure product integrity throughout the supply chain.

The region also benefits from advanced technological infrastructure, making it easier for pharmaceutical companies to implement RFID, QR codes, and other security features in their packaging. With a strong focus on innovation, North America is at the forefront of adopting cutting-edge anti-counterfeit technologies. As counterfeit drugs continue to be a concern, North America is expected to maintain its dominance in the global anti-counterfeit pharmaceutical packaging market.

Competitive Landscape and Key Players

The anti-counterfeit pharmaceutical packaging market is highly competitive, with key players such as Avery Dennison, 3M, Tetra Pak, and SICPA leading the way. These companies offer a wide range of packaging solutions, including RFID-based systems, tamper-evident seals, and holographic labels, to help pharmaceutical manufacturers secure their products against counterfeiting.

The competitive landscape is shaped by continuous innovation, with companies investing in R&D to develop more effective and cost-efficient anti-counterfeit solutions. Strategic partnerships, mergers, and acquisitions are also common in the market as players seek to expand their portfolios and strengthen their positions. As the demand for secure pharmaceutical packaging continues to rise, these key players are likely to drive the evolution of the market, offering increasingly advanced and integrated packaging solutions.

Recent Developments:

- Avery Dennison Corporation launched a new anti-counterfeit solution integrating advanced RFID technology to improve traceability and authentication of pharmaceutical products.

- Systech International partnered with a global pharmaceutical company to enhance serialization and track & trace systems for more effective anti-counterfeit measures.

- HP Inc. introduced a new holographic printing solution for pharmaceutical packaging, aimed at preventing counterfeiting while offering enhanced security features.

- Antares Vision S.p.A. signed a major deal with several pharmaceutical manufacturers to implement serialization systems that improve product security and ensure regulatory compliance.

- Toppan Printing Co., Ltd. expanded its anti-counterfeit packaging portfolio by launching new tamper-evident seals integrated with QR codes for enhanced product authentication.

List of Leading Companies:

- Avery Dennison Corporation

- Systech International

- Zebra Technologies Corporation

- 3M Company

- Giesecke+Devrient GmbH

- HP Inc.

- Multinational Pharmaceutical Packaging Solutions

- Antares Vision S.p.A.

- IntegriChain

- GEODIS

- ArjoWiggins Security

- Toppan Printing Co., Ltd.

- Krones AG

- NXP Semiconductors

- Crown Holdings, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.3 Billion |

|

Forecasted Value (2030) |

USD 6.8 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Counterfeit Pharmaceutical Packaging Market by Technology (RFID, QR Codes, Holograms, Tamper-Evident Seals, Barcodes), by Packaging Type (Labels, Containers, Boxes, Cartons), by End-Use Industry (Pharmaceutical Companies, Healthcare Providers, Contract Packaging Companies); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Avery Dennison Corporation, Systech International, Zebra Technologies Corporation, 3M Company, Giesecke+Devrient GmbH, HP Inc., Antares Vision S.p.A., IntegriChain, GEODIS, ArjoWiggins Security, Toppan Printing Co., Ltd., Krones AG, Crown Holdings, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Counterfeit Pharmaceutical Packaging Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. RFID (Radio Frequency Identification) |

|

4.2. QR Codes |

|

4.3. Holograms |

|

4.4. Tamper-Evident Seals |

|

4.5. Barcodes |

|

5. Anti-Counterfeit Pharmaceutical Packaging Market, by Packaging Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Labels |

|

5.2. Containers |

|

5.3. Boxes |

|

5.4. Cartons |

|

6. Anti-Counterfeit Pharmaceutical Packaging Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Pharmaceutical Companies |

|

6.2. Healthcare Providers |

|

6.3. Contract Packaging Companies |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Anti-Counterfeit Pharmaceutical Packaging Market, by Technology |

|

7.2.7. North America Anti-Counterfeit Pharmaceutical Packaging Market, by Packaging Type |

|

7.2.8. North America Anti-Counterfeit Pharmaceutical Packaging Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Anti-Counterfeit Pharmaceutical Packaging Market, by Technology |

|

7.2.9.1.2. US Anti-Counterfeit Pharmaceutical Packaging Market, by Packaging Type |

|

7.2.9.1.3. US Anti-Counterfeit Pharmaceutical Packaging Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Avery Dennison Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Systech International |

|

9.3. Zebra Technologies Corporation |

|

9.4. 3M Company |

|

9.5. Giesecke+Devrient GmbH |

|

9.6. HP Inc. |

|

9.7. Multinational Pharmaceutical Packaging Solutions |

|

9.8. Antares Vision S.p.A. |

|

9.9. IntegriChain |

|

9.10. GEODIS |

|

9.11. ArjoWiggins Security |

|

9.12. Toppan Printing Co., Ltd. |

|

9.13. Krones AG |

|

9.14. NXP Semiconductors |

|

9.15. Crown Holdings, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Counterfeit Pharmaceutical Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Counterfeit Pharmaceutical Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Counterfeit Pharmaceutical Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA