sales@intentmarketresearch.com

+1 463-583-2713

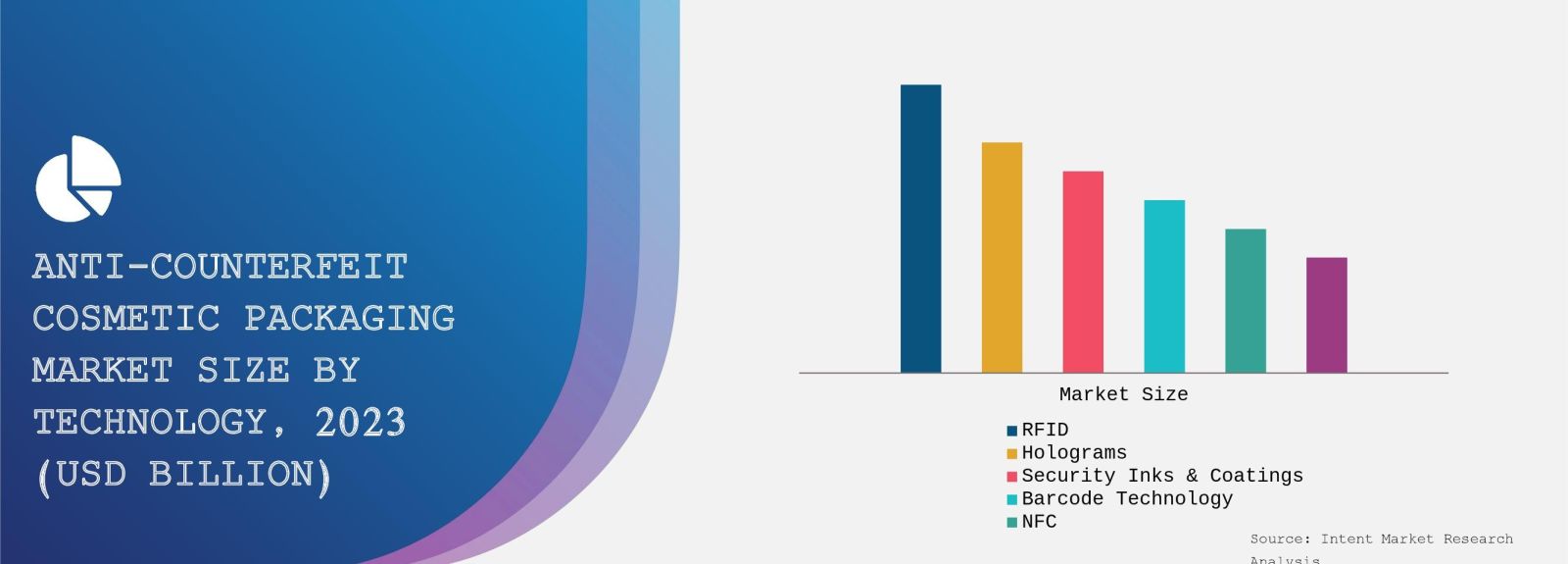

Anti-Counterfeit Cosmetic Packaging Market By Technology (RFID, Holograms, Security Inks & Coatings, Barcode Technology, NFC), By Packaging Type (Bottles, Tubes, Jars, Sachets), By Application (Skin Care, Hair Care, Makeup, Fragrances), By End-User (Luxury Cosmetics, Mass Market Cosmetics), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Anti-Counterfeit Cosmetic Packaging Market was valued at USD 2.7 billion in 2023 and will surpass USD 4.3 billion by 2030; growing at a CAGR of 6.8% during 2024 - 2030.

The anti-counterfeit cosmetic packaging market is experiencing significant growth as the beauty and personal care industry increasingly prioritizes brand integrity and consumer safety. The rise of counterfeit products, which can pose serious health risks and erode consumer trust, has prompted manufacturers to adopt innovative packaging solutions designed to authenticate products. This market encompasses a wide range of technologies and materials aimed at preventing counterfeiting, including holograms, QR codes, RFID tags, and specialized inks.

In the wake of heightened awareness surrounding counterfeit cosmetics, regulatory bodies are also intensifying efforts to combat fraudulent practices. As a result, cosmetics brands are investing in advanced packaging technologies that not only deter counterfeiters but also enhance the overall customer experience. The integration of digital solutions, such as smartphone applications for product verification, is gaining traction, offering consumers a seamless way to verify product authenticity. As the anti-counterfeit cosmetic packaging market continues to evolve, it is becoming an essential component of brand strategy for cosmetics companies looking to protect their reputation and foster consumer loyalty.

Holograms Segment is Largest Owing to High Visibility and Security

The holograms segment is the largest within the anti-counterfeit cosmetic packaging market, primarily due to their high visibility and security features. Holograms are three-dimensional images created through the interference of light beams, making them difficult to replicate. As a result, they serve as an effective deterrent against counterfeiters who seek to imitate popular cosmetic brands. Brands often utilize holographic labels on their products to enhance authenticity, as consumers easily recognize and trust these visually striking security features.

In addition to their security benefits, holograms offer aesthetic appeal, enhancing the overall presentation of cosmetic products. This combination of functionality and visual attraction makes holograms a preferred choice for many brands in the beauty industry. As consumer awareness of counterfeit products continues to grow, the demand for holographic packaging solutions is expected to rise, solidifying its position as a dominant segment in the anti-counterfeit cosmetic packaging market.

QR Codes Segment is Fastest Growing Owing to Consumer Engagement

The QR codes segment is the fastest growing in the anti-counterfeit cosmetic packaging market, driven by the increasing use of smartphones and the demand for interactive consumer experiences. QR codes allow consumers to verify product authenticity by scanning the code with their smartphones, which directs them to a secure website or application. This technology not only helps prevent counterfeiting but also enhances customer engagement by providing access to product information, promotional offers, and brand stories.

As consumers become more tech-savvy, the incorporation of QR codes into packaging has gained popularity among cosmetics brands looking to connect with their audience on a deeper level. The ease of use and immediate access to information makes QR codes an attractive solution for brands aiming to foster trust and transparency. With the rising emphasis on consumer engagement and brand loyalty, the QR codes segment is expected to witness rapid growth, contributing significantly to the overall expansion of the anti-counterfeit cosmetic packaging market.

RFID Tags Segment is Largest Owing to Enhanced Tracking Capabilities

The RFID (Radio Frequency Identification) tags segment is the largest in the anti-counterfeit cosmetic packaging market, primarily due to its enhanced tracking capabilities and security features. RFID technology allows for real-time tracking of products throughout the supply chain, providing manufacturers and retailers with valuable insights into inventory management and distribution processes. This visibility helps to identify potential counterfeit products before they reach consumers, thus enhancing product integrity.

Furthermore, RFID tags can be embedded within various packaging types, making them versatile solutions for different cosmetic products. As the beauty industry increasingly adopts digital solutions for inventory tracking and anti-counterfeiting measures, the RFID tags segment is expected to maintain its dominance in the market. The combination of improved operational efficiency and enhanced security makes RFID tags an essential component of modern anti-counterfeit strategies in the cosmetics sector.

Flexible Packaging Segment is Fastest Growing Owing to Lightweight and Sustainable Options

The flexible packaging segment is the fastest growing in the anti-counterfeit cosmetic packaging market, driven by the rising demand for lightweight and sustainable packaging solutions. Flexible packaging, which includes pouches, bags, and wraps, offers significant advantages over traditional rigid packaging in terms of material usage and transportation efficiency. As brands seek to reduce their environmental impact, flexible packaging options that incorporate anti-counterfeit technologies are becoming increasingly popular.

The integration of anti-counterfeit features, such as holograms and QR codes, into flexible packaging solutions allows brands to maintain product integrity while catering to consumer preferences for sustainable packaging. Additionally, the ability to customize flexible packaging designs enhances brand differentiation and appeal. As sustainability continues to be a major focus for consumers, the flexible packaging segment is poised for rapid growth, becoming a key player in the anti-counterfeit cosmetic packaging market.

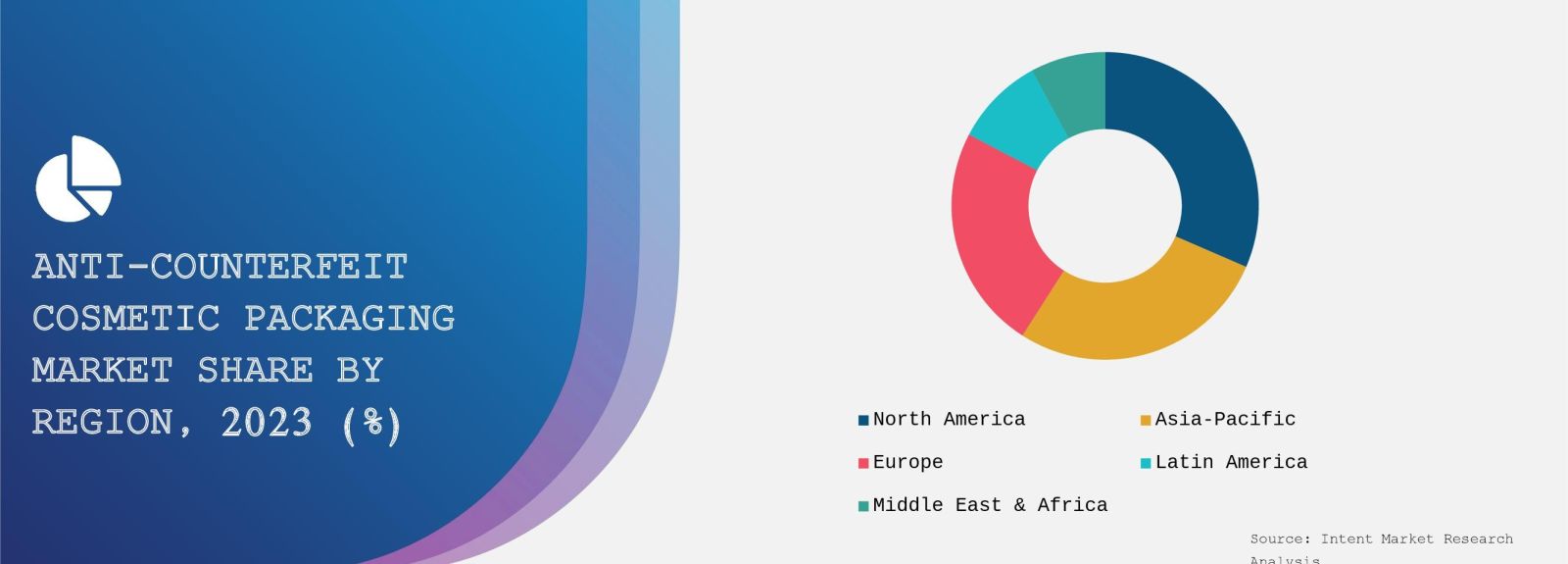

Largest Region: North America is Largest Owing to Strict Regulations and High Awareness

North America is the largest region in the anti-counterfeit cosmetic packaging market, primarily due to stringent regulations and high consumer awareness regarding counterfeit products. The region is home to several major cosmetics brands that prioritize brand protection and consumer safety, leading to increased investments in anti-counterfeit packaging solutions. Regulatory agencies in North America, such as the FDA, impose strict guidelines on cosmetic packaging, pushing companies to adopt advanced security features.

Moreover, the growing trend of e-commerce in the beauty industry has heightened concerns about counterfeit products, particularly in online sales. As consumers increasingly rely on online platforms for purchasing cosmetics, brands are implementing robust anti-counterfeit measures to protect their reputation and maintain customer trust. The combination of regulatory pressure and consumer awareness positions North America as a leader in the anti-counterfeit cosmetic packaging market, with continued growth expected in the coming years.

Competitive Landscape of Leading Companies

The competitive landscape of the anti-counterfeit cosmetic packaging market is characterized by the presence of several leading companies that are actively innovating and expanding their product offerings. Some of the top players in this market include:

- Avery Dennison Corporation: A global leader in label and packaging materials, Avery Dennison offers a range of anti-counterfeit solutions, including holographic labels and RFID technology.

- SICPA Holding SA: Known for its advanced security inks and packaging solutions, SICPA provides brands with tools to combat counterfeiting effectively.

- DuPont: A major player in the materials science industry, DuPont develops innovative packaging solutions with embedded security features to enhance product authenticity.

- Zebra Technologies Corporation: Zebra specializes in RFID and barcode solutions, offering advanced tracking and authentication technologies for the cosmetics industry.

- Schreiner Group GmbH & Co. KG: This company focuses on providing secure labeling solutions, including holograms and smart labels, to help brands protect their products from counterfeiting.

- Inksure Technologies: A leader in digital security solutions, Inksure offers anti-counterfeiting technologies that enhance brand protection and consumer engagement.

- Holostik India Ltd.: Known for its holographic and anti-counterfeiting solutions, Holostik provides innovative packaging technologies tailored for the cosmetic sector.

- Keystone Folding Box Company: Keystone specializes in custom packaging solutions, offering brands secure and innovative packaging options that deter counterfeiting.

- Tesa SE: Tesa produces a range of adhesive products, including anti-counterfeit solutions that enhance the security of cosmetic packaging.

- Robertet Group: A prominent player in the fragrance and flavor industry, Robertet also offers anti-counterfeit packaging solutions to protect brand integrity in the cosmetics market.

The competitive landscape in the anti-counterfeit cosmetic packaging market is dynamic, with companies continually investing in research and development to enhance their offerings. Strategic partnerships, mergers, and acquisitions are common as firms aim to strengthen their market positions and expand their product portfolios. The focus on technological innovation and sustainability positions these companies well to capitalize on the growing demand for anti-counterfeit solutions in the cosmetic packaging sector.

Report Objectives:

The report will help you answer some of the most critical questions in the Anti-Counterfeit Cosmetic Packaging Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Anti-Counterfeit Cosmetic Packaging Market?

- What is the size of the Anti-Counterfeit Cosmetic Packaging Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.7 billion |

|

Forecasted Value (2030) |

USD 4.3 billion |

|

CAGR (2024 – 2030) |

6.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Anti-Counterfeit Cosmetic Packaging Market By Technology (RFID, Holograms, Security Inks & Coatings, Barcode Technology, NFC), By Packaging Type (Bottles, Tubes, Jars, Sachets), By Application (Skin Care, Hair Care, Makeup, Fragrances), By End-User (Luxury Cosmetics, Mass Market Cosmetics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Counterfeit Cosmetic Packaging Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. RFID |

|

4.2. Holograms |

|

4.3. Security Inks & Coatings |

|

4.4. Barcode Technology |

|

4.5. NFC |

|

4.6. Others |

|

5. Anti-Counterfeit Cosmetic Packaging Market, by Packaging Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Bottles |

|

5.2. Tubes |

|

5.3. Jars |

|

5.4. Sachets |

|

5.5. Others |

|

6. Anti-Counterfeit Cosmetic Packaging Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Skin Care |

|

6.2. Hair Care |

|

6.3. Makeup |

|

6.4. Fragrances |

|

6.5. Others |

|

7. Anti-Counterfeit Cosmetic Packaging Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Luxury Cosmetics |

|

7.2. Mass Market Cosmetics |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anti-Counterfeit Cosmetic Packaging Market, by Technology |

|

8.2.7. North America Anti-Counterfeit Cosmetic Packaging Market, by Packaging Type |

|

8.2.8. North America Anti-Counterfeit Cosmetic Packaging Market, by Application |

|

8.2.9. North America Anti-Counterfeit Cosmetic Packaging Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anti-Counterfeit Cosmetic Packaging Market, by Technology |

|

8.2.10.1.2. US Anti-Counterfeit Cosmetic Packaging Market, by Packaging Type |

|

8.2.10.1.3. US Anti-Counterfeit Cosmetic Packaging Market, by Application |

|

8.2.10.1.4. US Anti-Counterfeit Cosmetic Packaging Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AlpVision |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Authentix |

|

10.3. Avery Dennison |

|

10.4. CCL Industries |

|

10.5. Impinj |

|

10.6. Schreiner Group |

|

10.7. Sicpa |

|

10.8. Systech International |

|

10.9. Tracelink |

|

10.10. Zebra Technologies |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Anti-Counterfeit Cosmetic Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Counterfeit Cosmetic Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the anti-counterfeit cosmetic packaging ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Counterfeit Cosmetic Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats