As per Intent Market Research, the Anti-Androgen Monotherapy Market was valued at USD 4.8 Billion in 2024-e and will surpass USD 8.9 Billion by 2030; growing at a CAGR of 10.8% during 2025 - 2030.

The anti-androgen monotherapy market has emerged as a crucial segment in the treatment of androgen-related disorders. Anti-androgens are primarily used to block or inhibit the effects of androgens (male hormones) in conditions like prostate cancer, polycystic ovary syndrome (PCOS), and hirsutism. These therapies play a vital role in managing conditions where excess androgen activity is a concern. The growing prevalence of androgen-related disorders, combined with advancements in treatment options, is driving the demand for anti-androgen therapies. The market is also influenced by ongoing research into the efficacy and safety of oral and injectable anti-androgens, offering new hope for patients across different demographics.

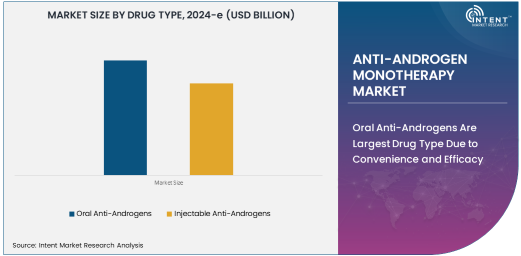

Oral Anti-Androgens Are Largest Drug Type Due to Convenience and Efficacy

Oral anti-androgens represent the largest drug type in the anti-androgen monotherapy market due to their ease of use and proven efficacy. These medications are typically taken as daily pills, offering a convenient and non-invasive treatment option for patients. Oral anti-androgens, such as finasteride and spironolactone, are widely used in the treatment of conditions like hirsutism and PCOS, where they help reduce excessive hair growth and other androgenic symptoms.

The popularity of oral anti-androgens is also driven by their cost-effectiveness and the availability of generic versions, which make them more accessible to a larger patient population. These factors contribute to their dominance in the market, with oral treatments being the first choice for many patients and healthcare providers, particularly in outpatient settings.

Prostate Cancer Is Largest Indication Due to High Prevalence and Severity

Prostate cancer is the largest indication for anti-androgen monotherapy, primarily because of the high prevalence and severity of the disease. Anti-androgens, such as bicalutamide and flutamide, are commonly used in the treatment of advanced prostate cancer to block the effects of testosterone, which can stimulate the growth of cancer cells. These therapies are often used in conjunction with other treatments like surgery or radiation therapy to manage prostate cancer and slow disease progression.

The growing incidence of prostate cancer, especially in aging populations, has fueled the demand for anti-androgen treatments. As prostate cancer continues to be one of the most common types of cancer among men worldwide, anti-androgen monotherapy remains a critical part of the treatment regimen, providing significant therapeutic benefits in managing the disease.

Hospitals and Clinics Are Largest End-Use Industry Due to Advanced Care and Monitoring

Hospitals and clinics represent the largest end-use industry for anti-androgen monotherapy due to their role in providing advanced care and continuous monitoring for patients with androgen-related disorders. These medical settings are equipped with specialized professionals and technologies to assess the effectiveness of anti-androgen treatments and manage any side effects. Hospitals and clinics also provide a controlled environment for patients undergoing complex therapies, such as those for prostate cancer.

In these settings, healthcare providers can closely monitor treatment progress and adjust therapy as needed, ensuring optimal outcomes for patients. The availability of comprehensive medical support in hospitals and clinics further drives the demand for anti-androgen therapies, making them the primary location for administering these treatments.

North America Is Largest Region Due to Advanced Healthcare Systems and High Incidence Rates

North America is the largest region in the anti-androgen monotherapy market, driven by the advanced healthcare infrastructure and the high incidence of androgen-related disorders, particularly prostate cancer and PCOS. The region has well-established healthcare systems that provide access to effective treatments, making anti-androgens a common part of therapeutic regimens for managing these conditions.

In addition, North America benefits from a high level of awareness about androgen-related disorders, which encourages patients to seek treatment early. The robust pharmaceutical industry in the region also ensures a steady supply of anti-androgen drugs, further fueling the growth of the market. The combination of high disease prevalence, accessible healthcare, and innovative treatment options makes North America the dominant region in the anti-androgen monotherapy market.

Competitive Landscape and Key Players

The anti-androgen monotherapy market is competitive, with key players including AstraZeneca, Johnson & Johnson, and Sanofi, which offer a range of anti-androgen medications used for prostate cancer, PCOS, and other androgen-related disorders. These companies lead the market by providing both oral and injectable anti-androgens, with ongoing efforts to improve the efficacy and safety of these therapies.

In the competitive landscape, there is a focus on expanding treatment options, particularly through the development of more targeted therapies and the exploration of combination therapies for prostate cancer. Research into improving the long-term outcomes and reducing side effects of anti-androgen treatments remains a key area of focus. With continuous innovation and strategic partnerships with research institutions, the leading players in this market are positioned to meet the growing demand for effective treatments for androgen-related conditions.

Recent Developments:

- Astellas Pharma Inc. expanded its portfolio of anti-androgen therapies with the launch of a new oral anti-androgen drug for prostate cancer treatment.

- Bayer AG received approval for a new injectable anti-androgen therapy aimed at managing prostate cancer progression.

- AbbVie Inc. announced the successful completion of a clinical trial for bicalutamide in combination with other therapies for prostate cancer.

- Ipsen entered into a strategic partnership to develop a next-generation anti-androgen monotherapy for advanced prostate cancer.

- Johnson & Johnson introduced a new version of enzalutamide with improved efficacy for prostate cancer patients, strengthening its presence in the anti-androgen market.

List of Leading Companies:

- Astellas Pharma Inc.

- Bayer AG

- AbbVie Inc.

- Ipsen

- Johnson & Johnson

- Merck & Co., Inc.

- Ferring Pharmaceuticals

- Endo International

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals

- Mylan N.V.

- Mundipharma International Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.8 Billion |

|

Forecasted Value (2030) |

USD 8.9 Billion |

|

CAGR (2025 – 2030) |

10.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Anti-Androgen Monotherapy Market by Drug Type (Oral Anti-Androgens, Injectable Anti-Androgens), by Indication (Prostate Cancer, Polycystic Ovary Syndrome (PCOS), Hirsutism, Other Androgen-Related Disorders), by End-Use Industry (Hospitals and Clinics, Homecare Settings, Research and Laboratories); Insights & Forecast (2024 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Astellas Pharma Inc., Bayer AG, AbbVie Inc., Ipsen, Johnson & Johnson, Merck & Co., Inc., Endo International, Sun Pharmaceutical Industries Ltd., Novartis AG, Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals, Mundipharma International Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Androgen Monotherapy Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Oral Anti-Androgens |

|

4.2. Injectable Anti-Androgens |

|

5. Anti-Androgen Monotherapy Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Prostate Cancer |

|

5.2. Polycystic Ovary Syndrome (PCOS) |

|

5.3. Hirsutism |

|

5.4. Other Androgen-Related Disorders |

|

6. Anti-Androgen Monotherapy Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Homecare Settings |

|

6.3. Research and Laboratories |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Anti-Androgen Monotherapy Market, by Drug Type |

|

7.2.7. North America Anti-Androgen Monotherapy Market, by Indication |

|

7.2.8. North America Anti-Androgen Monotherapy Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Anti-Androgen Monotherapy Market, by Drug Type |

|

7.2.9.1.2. US Anti-Androgen Monotherapy Market, by Indication |

|

7.2.9.1.3. US Anti-Androgen Monotherapy Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Astellas Pharma Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bayer AG |

|

9.3. AbbVie Inc. |

|

9.4. Ipsen |

|

9.5. Johnson & Johnson |

|

9.6. Merck & Co., Inc. |

|

9.7. Ferring Pharmaceuticals |

|

9.8. Endo International |

|

9.9. Sun Pharmaceutical Industries Ltd. |

|

9.10. Novartis AG |

|

9.11. Eli Lilly and Company |

|

9.12. Teva Pharmaceutical Industries Ltd. |

|

9.13. Hikma Pharmaceuticals |

|

9.14. Mylan N.V. |

|

9.15. Mundipharma International Limited |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Androgen Monotherapy Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Androgen Monotherapy Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Androgen Monotherapy Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA