As per Intent Market Research, the Anti-Ageing Treatment Market was valued at USD 41.6 Billion in 2024-e and will surpass USD 70.9 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The Anti-Ageing Treatment market has gained significant traction as the demand for aesthetic enhancements and preventive ageing solutions continues to rise globally. With advancements in technology and increasing consumer awareness, the market is expanding across various treatment types, target areas, and end-user categories. Innovations in injectables, topical products, and energy-based devices are meeting the needs of a diverse demographic, from those seeking subtle rejuvenation to individuals requiring comprehensive surgical procedures.

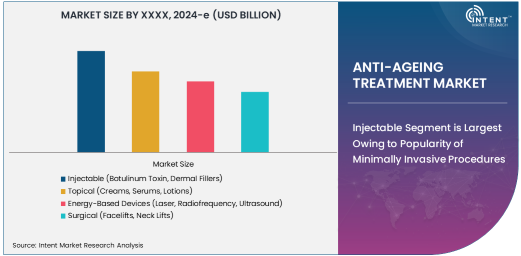

Injectable Segment is Largest Owing to Popularity of Minimally Invasive Procedures

The Injectable segment, which includes botulinum toxin and dermal fillers, is the largest in the Anti-Ageing Treatment market. This dominance is attributed to the growing preference for minimally invasive procedures that offer immediate results with minimal downtime. Botulinum toxin is widely used for reducing dynamic wrinkles, while dermal fillers effectively address volume loss and fine lines. The appeal of injectables lies in their ability to provide a natural, youthful appearance without the risks associated with surgical procedures.

Additionally, the expanding applications of injectables, such as in lip augmentation and jawline contouring, are broadening their consumer base. Increased awareness and the availability of skilled practitioners are further fueling the demand for injectable treatments worldwide.

Energy-Based Devices Segment is Fastest Growing Due to Technological Advancements

The Energy-Based Devices segment, comprising laser, radiofrequency, and ultrasound technologies, is the fastest-growing segment in the market. These devices provide non-invasive or minimally invasive solutions for skin tightening, wrinkle reduction, and overall rejuvenation. Advances in technology have made treatments more effective, safer, and accessible, contributing to their rapid adoption.

Energy-based treatments also offer long-lasting results and are increasingly used as preventive solutions for ageing. As more consumers seek alternatives to surgical options, this segment is expected to witness sustained growth, especially in regions where aesthetic technology adoption is on the rise.

Face Target Area is Largest Owing to High Consumer Demand

The Face segment is the largest target area within the Anti-Ageing Treatment market, driven by consumer focus on facial aesthetics and the visibility of ageing signs in this area. Treatments targeting wrinkles, fine lines, and skin laxity on the face are highly sought after, making this category a priority for both consumers and service providers.

Advanced technologies and treatments, including injectables, laser resurfacing, and facelifts, cater specifically to facial rejuvenation. The prominence of facial aesthetics in personal confidence and social interactions ensures sustained demand for solutions targeting this area.

Homecare Segment is Fastest Growing Owing to Convenience and Cost-Effectiveness

The Homecare segment is the fastest-growing end-user category as consumers increasingly prefer at-home anti-ageing solutions for convenience and cost-effectiveness. Devices and products designed for personal use, such as LED masks, microcurrent devices, and high-performance skincare formulations, are gaining traction.

The COVID-19 pandemic has further accelerated this trend, with consumers opting for at-home treatments due to restrictions on clinic visits. The growth of e-commerce platforms and advancements in user-friendly devices are also driving the expansion of this segment.

Asia-Pacific Region is Fastest Growing Due to Rising Aesthetic Awareness

Asia-Pacific is the fastest-growing region in the Anti-Ageing Treatment market, supported by rising consumer awareness, increasing disposable incomes, and a strong emphasis on beauty and skincare. Countries like China, Japan, and South Korea are at the forefront of this growth, with their established cosmetic industries and early adoption of innovative treatments.

The region’s cultural focus on youthful appearances and the influence of media and beauty standards contribute to the demand for anti-ageing solutions. Additionally, a growing network of aesthetic clinics and trained professionals further supports market expansion.

Competitive Landscape and Leading Companies

The Anti-Ageing Treatment market is highly competitive, with leading companies such as Allergan Aesthetics (AbbVie), L'Oréal, and Procter & Gamble driving innovation through advanced formulations and technologies. Companies are focusing on mergers, acquisitions, and collaborations to expand their product portfolios and geographical reach.

The competitive landscape is marked by continuous advancements in treatment options, such as the development of more effective injectables and energy-based devices. Additionally, sustainability and safety in product development are becoming key differentiators, as companies aim to meet the evolving expectations of a well-informed consumer base

Recent Developments:

- Allergan Aesthetics Expands Portfolio with FDA Approval for New Injectable Wrinkle Treatment

- L'Oréal Partners with Biotechnology Firms to Launch Advanced Anti-Ageing Serums

- Procter & Gamble Acquires Skincare Brand to Enhance Anti-Ageing Product Offerings

- Cynosure Introduces Next-Generation Laser Technology for Non-Invasive Skin Tightening

- Hologic Inc. Gains Regulatory Approval for New Radiofrequency Device in Aesthetic Applications

List of Leading Companies:

- Allergan Aesthetics (AbbVie)

- L'Oréal

- Procter & Gamble (P&G)

- Johnson & Johnson

- Unilever

- Estée Lauder Companies Inc.

- Cynosure

- Beiersdorf AG

- Shiseido Company

- Hologic Inc.

- Candela Medical

- Pierre Fabre Laboratories

- Revance Therapeutics

- Amorepacific Corporation

- Lumenis Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 41.6 Billion |

|

Forecasted Value (2030) |

USD 70.9 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Anti-Ageing Treatment Market By Treatment Type (Injectable, Topical, Energy-Based Devices, Surgical), Target Area (Face, Neck, Hands, Body), End-User (Dermatology Clinics, Hospitals, Spas & Beauty Centers, Homecare), and Region; Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Allergan Aesthetics (AbbVie), L'Oréal, Procter & Gamble (P&G), Johnson & Johnson, Unilever, Estée Lauder Companies Inc., Cynosure, Beiersdorf AG, Shiseido Company, Hologic Inc., Candela Medical, Pierre Fabre Laboratories, Revance Therapeutics, Amorepacific Corporation, Lumenis Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anti-Ageing Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Injectable (Botulinum Toxin, Dermal Fillers) |

|

4.2. Topical (Creams, Serums, Lotions) |

|

4.3. Energy-Based Devices (Laser, Radiofrequency, Ultrasound) |

|

4.4. Surgical (Facelifts, Neck Lifts) |

|

5. Anti-Ageing Treatment Market, by Target Area (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Face |

|

5.2. Neck |

|

5.3. Hands |

|

5.4. Body |

|

6. Anti-Ageing Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Dermatology Clinics |

|

6.2. Hospitals |

|

6.3. Spas & Beauty Centers |

|

6.4. Homecare |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Anti-Ageing Treatment Market, by Treatment Type |

|

7.2.7. North America Anti-Ageing Treatment Market, by Target Area |

|

7.2.8. North America Anti-Ageing Treatment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Anti-Ageing Treatment Market, by Treatment Type |

|

7.2.9.1.2. US Anti-Ageing Treatment Market, by Target Area |

|

7.2.9.1.3. US Anti-Ageing Treatment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Allergan Aesthetics (AbbVie) |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. L'Oréal |

|

9.3. Procter & Gamble (P&G) |

|

9.4. Johnson & Johnson |

|

9.5. Unilever |

|

9.6. Estée Lauder Companies Inc. |

|

9.7. Cynosure |

|

9.8. Beiersdorf AG |

|

9.9. Shiseido Company |

|

9.10. Hologic Inc. |

|

9.11. Candela Medical |

|

9.12. Pierre Fabre Laboratories |

|

9.13. Revance Therapeutics |

|

9.14. Amorepacific Corporation |

|

9.15. Lumenis Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anti-Ageing Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anti-Ageing Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anti-Ageing Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA