As per Intent Market Research, the Anesthesia Video Laryngoscope Market was valued at USD 0.6 billion in 2023 and will surpass USD 1.1 billion by 2030; growing at a CAGR of 10.4% during 2024 - 2030.

The anesthesia video laryngoscope market is witnessing significant growth due to increasing demand for advanced, minimally invasive procedures and the rising focus on patient safety during surgeries. These devices enhance the ability to visualize the airway during intubation, improving accuracy and reducing complications. The market is segmented by product type, technology, application, and end-user, each exhibiting unique trends and dynamics. As healthcare systems continue to prioritize better outcomes and efficiency, video laryngoscopes, particularly those offering improved visualization and ease of use, are gaining traction. Let’s delve into the leading segments and the fastest growing sub-segments within each category.

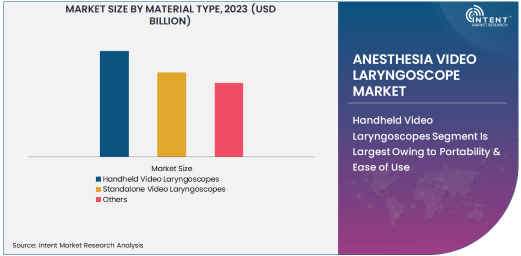

Handheld Video Laryngoscopes Segment Is Largest Owing to Portability & Ease of Use

Within the product type category, handheld video laryngoscopes emerge as the largest segment, driven by their portability, ease of use, and flexibility. These devices are favored in emergency care settings, where rapid response and mobility are essential. Handheld models allow healthcare professionals to quickly adapt to various clinical environments, whether in the operating room or in field operations like ambulances. The compact nature of handheld laryngoscopes makes them easier to transport and store compared to their stationary counterparts, making them indispensable in critical care scenarios.

Moreover, the increasing prevalence of out-of-hospital emergency care and the growing adoption of mobile healthcare solutions are contributing to the segment's dominance. As these devices are increasingly being used in ambulances, field hospitals, and in-home care, their accessibility and efficiency are enhancing their appeal, further solidifying their position as the largest product type within the market.

Disposable Technology Segment Is Fastest Growing Owing to Infection Control Needs

In terms of technology, the disposable laryngoscope segment is the fastest growing, largely due to the heightened awareness of infection control in medical procedures. Disposable video laryngoscopes are designed for single-use, reducing the risk of cross-contamination between patients. This feature is particularly appealing in high-turnover environments such as emergency departments and surgical centers where time and hygiene are of utmost importance.

The COVID-19 pandemic further amplified the need for disposable devices, as it emphasized the importance of preventing healthcare-associated infections. As hospitals and healthcare providers seek to implement safer, more efficient procedures, disposable video laryngoscopes are rapidly becoming the preferred choice in a variety of settings. This trend is expected to continue as healthcare systems worldwide prioritize patient safety and infection control measures.

Emergency Care Application Segment Is Largest Owing to Critical Intubation Needs

In the application segment, emergency care is the largest segment within the anesthesia video laryngoscope market. The need for rapid and accurate airway management during emergencies makes video laryngoscopes indispensable in this field. Whether in pre-hospital settings or emergency departments, these devices provide critical real-time visualization of the airway, enabling clinicians to perform intubation with greater precision and fewer complications. This is especially important for patients who have difficult airways or are at high risk of complications during intubation.

The prevalence of emergency medical conditions, such as trauma, respiratory failure, and cardiac arrest, is driving the demand for video laryngoscopes in emergency care settings. Additionally, the rise in out-of-hospital care, including the use of video laryngoscopes by paramedics, is fueling further adoption of these devices in emergency care.

Hospitals End-User Segment Is Largest Owing to High Procedure Volume

Hospitals represent the largest end-user segment in the anesthesia video laryngoscope market. As primary centers for surgeries, diagnostics, and emergency care, hospitals account for a significant share of the market due to the high volume of procedures performed daily. These devices are essential in enhancing procedural efficiency, improving patient safety, and reducing the incidence of complications during surgeries and intubations.

The growing number of surgeries performed in hospitals, alongside increasing awareness of the benefits of advanced intubation technologies, is contributing to the widespread use of video laryngoscopes. Furthermore, with hospitals investing in more sophisticated medical devices to meet evolving patient care standards, video laryngoscopes are becoming a standard tool for airway management, further cementing their dominance in the end-user segment.

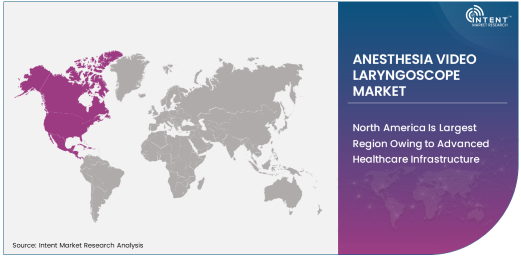

North America Is Largest Region Owing to Advanced Healthcare Infrastructure

North America dominates the anesthesia video laryngoscope market, holding the largest regional share. This is primarily due to the advanced healthcare infrastructure and high adoption rate of innovative medical technologies in the region. The United States, in particular, is a leader in medical device consumption and has seen an increasing number of healthcare institutions incorporating video laryngoscopes into their clinical practice.

The region's robust healthcare system, high levels of research and development, and significant healthcare expenditure have facilitated the widespread integration of these devices. Furthermore, North America’s emphasis on patient safety, coupled with regulatory support for innovative medical devices, is fostering the continued growth of the anesthesia video laryngoscope market. The demand is also driven by the rising number of surgeries and emergency procedures, requiring precise airway management tools, which further boosts the region’s market share.

Leading Companies & Competitive Landscape

The anesthesia video laryngoscope market is highly competitive, with several key players holding substantial market shares. Leading companies in this sector include Medtronic, Ambu A/S, Smiths Medical, and Karl Storz. These companies are continuously innovating and expanding their product portfolios to cater to the evolving needs of healthcare professionals. With a focus on improving patient outcomes, these organizations are investing heavily in research and development to create advanced video laryngoscopes that offer better image quality, ease of use, and enhanced portability.

The competitive landscape is marked by significant collaborations, mergers, and acquisitions, as companies aim to strengthen their market positions and expand their geographical reach. As the demand for video laryngoscopes increases across hospitals, clinics, and emergency care settings, these companies are focusing on enhancing product features, reducing costs, and ensuring regulatory compliance. The market also sees the entry of regional players aiming to cater to local demands, thus further intensifying competition within the market..

Recent Developments:

- In November 2024, Medtronic launched an advanced video laryngoscope aimed at improving visualization during difficult intubations.

- In October 2024, Ambu A/S expanded its portfolio of video laryngoscopes with a new, portable version designed for emergency care settings.

- In September 2024, Olympus Corporation acquired a leading airway management company to strengthen its position in the video laryngoscope market.

- In August 2024, Fujifilm launched a next-generation video laryngoscope featuring AI technology to assist in airway visualization and analysis.

- In July 2024, Medtronic received FDA approval for its new video laryngoscope, which offers improved imaging capabilities and user interface.

List of Leading Companies:

- Medtronic

- Olympus Corporation

- Karl Storz GmbH & Co. KG

- Smiths Medical

- Ambu A/S

- Pentax Medical

- ConMed Corporation

- Vyaire Medical, Inc.

- Fujifilm Holdings Corporation

- Becton, Dickinson and Company

- Intersurgical Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Welch Allyn (Hill-Rom Holdings, Inc.)

- Richard Wolf GmbH

- Surgical Design Solutions, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 0.6 Billion |

|

Forecasted Value (2030) |

USD 1.1 Billion |

|

CAGR (2024 – 2030) |

10.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Anesthesia Video Laryngoscope Market By Product Type (Handheld Video Laryngoscopes, Standalone Video Laryngoscopes), By Technology (Disposable, Reusable), By Application (General Surgery, Emergency Care, Diagnostic Procedures), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers), and By Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Olympus Corporation, Karl Storz GmbH & Co. KG, Smiths Medical, Ambu A/S, Pentax Medical, Vyaire Medical, Inc., Fujifilm Holdings Corporation, Becton, Dickinson and Company, Intersurgical Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Welch Allyn (Hill-Rom Holdings, Inc.), Surgical Design Solutions, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Anesthesia Video Laryngoscope Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Handheld Video Laryngoscopes |

|

4.2. Standalone Video Laryngoscopes |

|

4.3. Others |

|

5. Anesthesia Video Laryngoscope Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Disposable |

|

5.2. Reusable |

|

5.3. Others |

|

6. Anesthesia Video Laryngoscope Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. General Surgery |

|

6.2. Emergency Care |

|

6.3. Diagnostic Procedures |

|

6.4. Others |

|

7. Anesthesia Video Laryngoscope Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Ambulatory Surgical Centers |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Anesthesia Video Laryngoscope Market, by Product Type |

|

8.2.7. North America Anesthesia Video Laryngoscope Market, by Technology |

|

8.2.8. North America Anesthesia Video Laryngoscope Market, by Application |

|

8.2.9. North America Anesthesia Video Laryngoscope Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Anesthesia Video Laryngoscope Market, by Product Type |

|

8.2.10.1.2. US Anesthesia Video Laryngoscope Market, by Technology |

|

8.2.10.1.3. US Anesthesia Video Laryngoscope Market, by Application |

|

8.2.10.1.4. US Anesthesia Video Laryngoscope Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Medtronic |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Olympus Corporation |

|

10.3. Karl Storz GmbH & Co. KG |

|

10.4. Smiths Medical |

|

10.5. Ambu A/S |

|

10.6. Pentax Medical |

|

10.7. ConMed Corporation |

|

10.8. Vyaire Medical, Inc. |

|

10.9. Fujifilm Holdings Corporation |

|

10.10. Becton, Dickinson and Company |

|

10.11. Intersurgical Ltd. |

|

10.12. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

|

10.13. Welch Allyn (Hill-Rom Holdings, Inc.) |

|

10.14. Richard Wolf GmbH |

|

10.15. Surgical Design Solutions, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Anesthesia Video Laryngoscope Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Anesthesia Video Laryngoscope Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Anesthesia Video Laryngoscope Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA