As per Intent Market Research, the Online Therapy Services Market was valued at USD 3.0 billion in 2024-e and will surpass USD 7.6 billion by 2030; growing at a CAGR of 16.4% during 2025 - 2030.

The online therapy services market is expanding rapidly as individuals increasingly seek mental health support through digital platforms. This growth is driven by the rising awareness of mental health issues, coupled with the increasing demand for flexible, accessible, and convenient mental health services. The stigma surrounding mental health has been decreasing in recent years, and more people are recognizing the importance of seeking therapy to address issues such as stress, anxiety, depression, and relationship difficulties. The availability of therapy services via online platforms provides patients with the opportunity to access professional care without the need to visit a clinic in person, making mental health services more accessible to people in remote areas and those with busy schedules.

Advancements in technology have further fueled the growth of online therapy services, making it easier for users to connect with licensed therapists via video, text, or voice-based consultations. These virtual services offer individuals a range of therapy options tailored to their needs, with platforms often providing anonymity and confidentiality, which encourages more people to seek help. As digital healthcare continues to evolve and society becomes more accepting of mental health treatment, the online therapy services market is expected to expand, offering greater support to individuals seeking mental wellness.

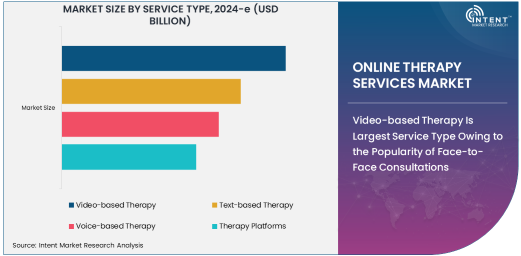

Video-based Therapy Is Largest Service Type Owing to the Popularity of Face-to-Face Consultations

Video-based therapy is the largest service type in the online therapy services market, as it allows for real-time, face-to-face consultations between therapists and clients. This mode of therapy offers the closest experience to in-person consultations, with the added convenience of being able to attend sessions from anywhere. Video-based therapy has become increasingly popular, particularly during and after the COVID-19 pandemic, as people sought remote alternatives to in-person therapy due to restrictions and safety concerns. Video therapy sessions provide a high level of personal interaction, which is essential for building trust and rapport between therapists and clients, a crucial factor in the effectiveness of therapy.

The ability to see body language and facial expressions during video therapy sessions enhances communication, enabling therapists to better assess their clients' emotions and mental state. This is especially important for addressing complex mental health issues such as depression and anxiety, where non-verbal cues can provide additional insights. With its ability to replicate the traditional therapy experience while offering flexibility, video-based therapy is expected to remain the dominant service type in the market, continuing to meet the growing demand for virtual mental health care.

Mental Health Support Is Largest Application Segment Driven by Growing Awareness of Mental Health Issues

Mental health support is the largest application segment in the online therapy services market, driven by the increasing prevalence of mental health disorders globally and the growing awareness of the importance of mental well-being. Conditions such as anxiety, depression, and stress are becoming more common, with many individuals seeking professional help to manage these issues. The stigma surrounding mental health has reduced, leading to more people seeking therapy and counseling services. As a result, mental health support has become the core focus of online therapy platforms, with services tailored to address a wide range of emotional and psychological concerns.

The rise in mental health support services has been further amplified by the digital transformation of healthcare, which has made mental health services more accessible and affordable. Online therapy platforms provide individuals with the convenience of receiving care from the comfort of their homes, which can be particularly beneficial for people who are hesitant to attend in-person therapy sessions. As the demand for mental health services grows, online therapy providers are continuously expanding their offerings to meet the evolving needs of individuals, making mental health support the largest application segment in the market.

Individuals Are Largest End-User Segment Due to Increased Self-Advocacy for Mental Health

Individuals represent the largest end-user segment in the online therapy services market, driven by the growing trend of self-advocacy for mental health. More people are taking proactive steps to address their mental health needs and are seeking convenient, anonymous options to receive therapy. The increased availability and affordability of online therapy services have made mental health support more accessible, particularly for individuals who may not have access to in-person therapy due to geographical or logistical barriers. The anonymity offered by online therapy platforms is another significant factor contributing to their popularity, as individuals feel more comfortable discussing sensitive issues in a private, virtual setting.

The growing demand for mental health services among individuals has been spurred by the increasing recognition of the importance of mental well-being, particularly in the context of stressful life events, work pressures, and global challenges. The flexibility of online therapy, which allows individuals to choose from video, text, or voice consultations, makes it an attractive option for those seeking help. With rising awareness of mental health issues and the convenience of digital solutions, individuals are expected to remain the dominant end-user segment, propelling the continued growth of the online therapy services market.

Corporate Wellness Programs Are Fastest Growing End-User Segment Due to Focus on Employee Well-being

Corporate wellness programs are the fastest growing end-user segment in the online therapy services market, as businesses increasingly recognize the importance of supporting the mental health and well-being of their employees. Mental health issues can have a significant impact on employee productivity, job satisfaction, and overall company performance. As a result, companies are investing in employee wellness programs that include access to online therapy services. These programs offer employees confidential and convenient access to mental health support, which helps to reduce stress, manage anxiety, and address personal issues that may affect their work.

By offering online therapy services as part of their wellness programs, companies can foster a healthier work environment, reduce absenteeism, and improve employee engagement. This trend has accelerated in recent years, as businesses place greater emphasis on mental health and recognize the benefits of supporting their workforce. As the demand for corporate wellness initiatives grows, online therapy services are becoming an integral part of many workplace health programs, contributing to their rapid expansion and making corporate wellness programs the fastest growing end-user segment.

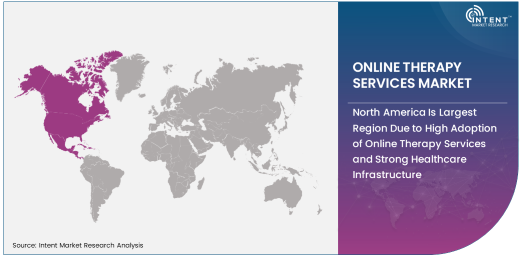

North America Is Largest Region Due to High Adoption of Online Therapy Services and Strong Healthcare Infrastructure

North America is the largest region in the online therapy services market, driven by its robust healthcare infrastructure, high internet penetration, and widespread acceptance of telemedicine. The United States, in particular, has seen significant growth in the adoption of online therapy services, as individuals and healthcare providers increasingly embrace digital solutions for mental health care. The rise of telehealth during the COVID-19 pandemic has accelerated the use of online therapy platforms, with many therapists offering virtual consultations to meet the rising demand for mental health services.

North America's strong healthcare systems, coupled with its tech-savvy population, have made it an ideal market for the adoption of online therapy services. In addition, the growing awareness of mental health issues and the increasing focus on mental well-being have contributed to the high demand for online therapy in the region. As online therapy platforms continue to expand and more individuals seek remote care, North America is expected to maintain its position as the largest region in the market.

Leading Companies and Competitive Landscape

The online therapy services market is highly competitive, with several key players leading the way in providing digital mental health solutions. Notable companies in this space include Talkspace, BetterHelp, and MDLive, which offer a range of therapy options through online platforms, including video, text, and voice-based consultations. These companies are capitalizing on the growing demand for convenient, accessible mental health services and are continually enhancing their offerings with features such as AI-powered matching of clients to therapists, as well as the integration of mental health tools and resources.

The competitive landscape is characterized by a mix of established telehealth providers and emerging startups, all competing to capture market share by offering user-friendly platforms, affordable pricing models, and diverse therapy options. Additionally, companies are focusing on expanding their reach by forming partnerships with healthcare providers, corporations, and wellness programs to offer integrated mental health services. As the market grows, competition is expected to intensify, with companies striving to differentiate themselves through technology, customer experience, and the scope of services provided.

Recent Developments:

- In December 2024, BetterHelp expanded its virtual therapy services by adding new features for couples therapy and family counseling.

- In November 2024, Talkspace partnered with a major healthcare provider to offer online therapy services to a broader audience.

- In October 2024, 7 Cups launched a new mobile app aimed at providing immediate mental health support to users in crisis.

- In September 2024, Thriveworks announced the addition of AI-driven personalized therapy sessions to its platform.

- In August 2024, Ginger introduced a new service focused on stress management and wellness for corporate employees.

List of Leading Companies:

- BetterHelp

- Talkspace

- Regain

- Ginger

- 7 Cups

- Calmerry

- Amwell

- Thriveworks

- Online-Therapy.com

- Doctor On Demand

- MyTherapist

- LifeStance Health

- ReGain

- MDLive

- TherapyRoute

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 billion |

|

Forecasted Value (2030) |

USD 7.6 billion |

|

CAGR (2025 – 2030) |

16.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Online Therapy Services Market By Service Type (Video-based Therapy, Text-based Therapy, Voice-based Therapy, Therapy Platforms), By Application (Mental Health Support, Stress Management, Relationship Counseling, Addiction Counseling), By End-User (Individuals, Healthcare Providers, Corporate Wellness Programs) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BetterHelp, Talkspace, Regain, Ginger, 7 Cups, Calmerry, Amwell, Thriveworks, Online-Therapy.com, Doctor On Demand, MyTherapist, LifeStance Health, ReGain, MDLive, TherapyRoute |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Online Therapy Services Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Video-based Therapy |

|

4.1.1. Live Sessions |

|

4.1.2. On-Demand Sessions |

|

4.2. Text-based Therapy |

|

4.3. Voice-based Therapy |

|

4.4. Therapy Platforms |

|

4.4.1. Mobile-based Platforms |

|

4.4.2. Web-based Platforms |

|

5. Online Therapy Services Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Mental Health Support |

|

5.2. Stress Management |

|

5.3. Relationship Counseling |

|

5.4. Addiction Counseling |

|

5.5. Others |

|

6. Online Therapy Services Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Individuals |

|

6.2. Healthcare Providers |

|

6.3. Corporate Wellness Programs |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Online Therapy Services Market, by Service Type |

|

7.2.7. North America Online Therapy Services Market, by Application |

|

7.2.8. North America Online Therapy Services Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Online Therapy Services Market, by Service Type |

|

7.2.9.1.2. US Online Therapy Services Market, by Application |

|

7.2.9.1.3. US Online Therapy Services Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BetterHelp |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Talkspace |

|

9.3. Regain |

|

9.4. Ginger |

|

9.5. 7 Cups |

|

9.6. Calmerry |

|

9.7. Amwell |

|

9.8. Thriveworks |

|

9.9. Online-Therapy.com |

|

9.10. Doctor On Demand |

|

9.11. MyTherapist |

|

9.12. LifeStance Health |

|

9.13. ReGain |

|

9.14. MDLive |

|

9.15. TherapyRoute |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Online Therapy Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Online Therapy Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Online Therapy Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA