As per Intent Market Research, the Amino Acid Market was valued at USD 28.9 Billion in 2024-e and will surpass USD 47.0 Billion by 2030; growing at a CAGR of 8.5% during 2025-2030.

The global amino acid market has witnessed significant growth, driven by the increasing demand for amino acids in industries such as animal feed, food and beverages, pharmaceuticals, personal care, and nutritional supplements. Amino acids are crucial for protein synthesis, which is essential for multiple biological functions. The market is experiencing a surge in demand, particularly in emerging economies, where the growing focus on health, nutrition, and sustainable agriculture is fueling the consumption of amino acid products. The market segmentation is diverse, with key variations in demand across product types, applications, and end-user industries, creating a dynamic competitive landscape.

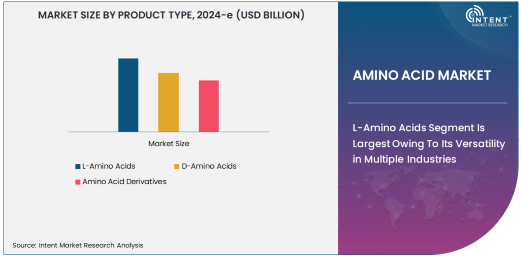

L-Amino Acids Segment Is Largest Owing To Its Versatility in Multiple Industries

L-amino acids dominate the global amino acid market due to their widespread use across various applications. They play a pivotal role in animal feed, pharmaceuticals, food and beverages, and cosmetics industries. L-amino acids are the building blocks of proteins, making them essential for growth and development in animals, as well as in human nutrition. They are commonly used in animal feed formulations to improve growth rates and feed efficiency, and in food and beverages to enhance nutritional value and taste. Furthermore, L-amino acids are vital in pharmaceutical formulations, particularly in the production of protein-based drugs and nutritional supplements. This versatility has made L-amino acids the largest subsegment in the global amino acid market.

The demand for L-amino acids is expected to continue rising due to the increasing global population, which is driving the need for more efficient food production systems. Additionally, the growing awareness of the health benefits of amino acids is contributing to their widespread use in dietary supplements and functional foods, further strengthening their position in the market.

Animal Feed Application Is Largest Owing To Rising Demand for Livestock Nutrition

The animal feed application holds the largest share in the amino acid market, driven by the rising demand for livestock products across the globe. Amino acids are vital for animal health and growth, improving feed efficiency and overall productivity. L-lysine, L-methionine, and L-threonine are some of the most commonly used amino acids in animal feed, and their use helps enhance the nutritional value of feed and ensure optimal growth in livestock. As the global population continues to grow, the demand for meat, dairy, and other animal-based products has surged, pushing the need for high-quality animal feed containing amino acids.

The increasing trend of industrial farming, particularly in emerging economies in Asia-Pacific and Latin America, is expected to drive further growth in the animal feed segment. Livestock producers are becoming more focused on improving feed efficiency and reducing production costs, which amino acids can help achieve. This trend will likely sustain the dominance of the animal feed application in the amino acid market for the foreseeable future.

Animal Nutrition End-User Industry Is Largest Owing To Increased Focus on Livestock Health

Animal nutrition is the largest end-user industry in the global amino acid market. Animal feed producers are placing a greater emphasis on ensuring the health and growth of livestock, with amino acids playing a crucial role in maintaining the balance of proteins in animals. This has led to an increase in demand for amino acids in various types of animal feed, ranging from those used for poultry, swine, and cattle to those for aquaculture. As a result, animal nutrition continues to be the largest end-user industry in this market segment.

With the growing global demand for meat, dairy, and other animal-based products, the need for high-quality animal nutrition products is expected to grow steadily. The focus on improving animal health and maximizing production efficiency through the use of amino acids is further intensifying, making the animal nutrition industry a key player in the global amino acid market.

Dry Amino Acids Form Is Largest Owing To Easy Storage and Handling

Dry amino acids are the largest segment in the amino acid market by form, owing to their ease of storage, transportation, and handling. The stability of dry amino acids makes them highly preferred for use in food, feed, and pharmaceutical applications. They have a long shelf life and do not require special storage conditions, making them ideal for large-scale production and distribution. Additionally, the dry form is easier to incorporate into formulations for various products, including animal feed, dietary supplements, and pharmaceuticals.

The demand for dry amino acids is expected to remain strong due to their widespread use and the growth of industries requiring bulk quantities of amino acids. The ease of handling and cost-effectiveness of dry amino acids continue to drive their dominance in the market, particularly in the animal feed and pharmaceutical industries.

Asia-Pacific Region Is Fastest Growing Owing To Expanding Demand in Emerging Economies

The Asia-Pacific region is the fastest-growing market for amino acids, driven by the expanding economies in countries like China and India. The region is home to a large and growing population, leading to increased demand for protein-rich foods, which in turn drives the need for amino acids in food and animal feed applications. Additionally, the rise in industrial farming practices and the focus on improving livestock health in countries such as China and India are contributing to the growth of the amino acid market in the region.

As the Asia-Pacific region continues to urbanize and industrialize, the demand for amino acids in animal feed, food, and pharmaceutical applications is expected to grow rapidly. The presence of major players in the amino acid industry, such as CJ CheilJedang and Ajinomoto, further accelerates the growth of this region in the global market.

Competitive Landscape of the Amino Acid Market

The amino acid market is highly competitive, with a mix of global and regional players vying for market share. Leading companies such as Ajinomoto, Evonik Industries, and BASF dominate the market, leveraging their strong brand presence and extensive distribution networks. These companies have a broad product portfolio that caters to various applications, including animal feed, food and beverages, pharmaceuticals, and personal care. They also focus on innovation and the development of new amino acid derivatives to meet the evolving needs of the market.

In addition to large multinational corporations, there are several regional players making strides in the amino acid market, particularly in Asia-Pacific. These companies focus on developing cost-effective and high-quality amino acid products, with a particular emphasis on the animal feed and nutrition industries. Strategic partnerships, acquisitions, and collaborations are common in this market, as companies aim to expand their product offerings and enhance their market presence.

Recent Developments:

- Ajinomoto introduced a new L-amino acid product aimed at the pharmaceutical sector, improving formulations for protein-based drugs.

- Evonik Industries announced the expansion of its amino acid production facilities in Asia to meet growing demand in the animal feed and nutrition industries.

- Kyowa Hakko Bio received regulatory approval from the European Union for a new amino acid supplement, expected to bolster its nutritional product line.

- BASF entered a strategic partnership with a leading animal feed manufacturer to supply a new range of amino acids designed to improve livestock growth and health.

List of Leading Companies:

- ADM (Archer Daniels Midland Company)

- Ajinomoto Co., Inc.

- Evonik Industries AG

- CJ CheilJedang Corporation

- Kyowa Hakko Bio Co., Ltd.

- BASF SE

- DuPont de Nemours, Inc.

- Nouryon (AkzoNobel)

- Mitsui & Co., Ltd.

- Daesang Corporation

- Solvay S.A.

- DSM Nutritional Products

- Archer Daniels Midland Company

- Kemin Industries, Inc.

- Amino GmbH

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 28.9 Billion |

|

Forecasted Value (2030) |

USD 47.0 Billion |

|

CAGR (2025 – 2030) |

8.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Amino Acid Market By Product Type (L-Amino Acids, D-Amino Acids, Amino Acid Derivatives), By Application (Animal Feed, Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Nutritional Supplements), By End-User Industry (Animal Nutrition, Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Agriculture & Horticulture), By Form (Dry Amino Acids, Liquid Amino Acids) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ADM (Archer Daniels Midland Company), Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., BASF SE, DuPont de Nemours, Inc., Nouryon (AkzoNobel), Mitsui & Co., Ltd., Daesang Corporation, Solvay S.A., DSM Nutritional Products, Archer Daniels Midland Company, Kemin Industries, Inc., Amino GmbH |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Amino Acid Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. L-Amino Acids |

|

4.2. D-Amino Acids |

|

4.3. Amino Acid Derivatives |

|

5. Amino Acid Market, by By Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Animal Feed |

|

5.2. Food & Beverages |

|

5.3. Pharmaceuticals |

|

5.4. Personal Care & Cosmetics |

|

5.5. Nutritional Supplements |

|

5.6. Others |

|

6. Amino Acid Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Animal Nutrition |

|

6.2. Food & Beverages |

|

6.3. Pharmaceuticals |

|

6.4. Cosmetics & Personal Care |

|

6.5. Agriculture & Horticulture |

|

6.6. Other Industries |

|

7. Amino Acid Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Dry Amino Acids |

|

7.2. Liquid Amino Acids |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Amino Acid Market, by Product Type |

|

8.2.7. North America Amino Acid Market, by By Application |

|

8.2.8. North America Amino Acid Market, by End-User Industry |

|

8.2.9. North America Amino Acid Market, by Form |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Amino Acid Market, by Product Type |

|

8.2.10.1.2. US Amino Acid Market, by By Application |

|

8.2.10.1.3. US Amino Acid Market, by End-User Industry |

|

8.2.10.1.4. US Amino Acid Market, by Form |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. ADM (Archer Daniels Midland Company) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Ajinomoto Co., Inc. |

|

10.3. Evonik Industries AG |

|

10.4. CJ CheilJedang Corporation |

|

10.5. Kyowa Hakko Bio Co., Ltd. |

|

10.6. BASF SE |

|

10.7. DuPont de Nemours, Inc. |

|

10.8. Nouryon (AkzoNobel) |

|

10.9. Mitsui & Co., Ltd. |

|

10.10. Daesang Corporation |

|

10.11. Solvay S.A. |

|

10.12. DSM Nutritional Products |

|

10.13. Archer Daniels Midland Company |

|

10.14. Kemin Industries, Inc. |

|

10.15. Amino GmbH |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Amino Acid Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Amino Acid Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Amino Acid Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA