As per Intent Market Research, the Aluminum Window Profile Market was valued at USD 0.1 Billion in 2024-e and will surpass USD 0.1 Billion by 2030; growing at a CAGR of 5.7% during 2025-2030.

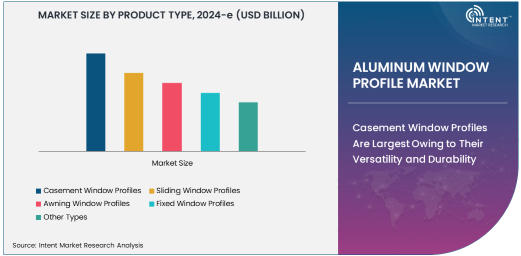

The aluminum window profile market is diverse, offering various types of window systems suited to different architectural and functional requirements. Among these, casement window profiles are the largest segment, primarily due to their versatility, durability, and energy efficiency. Casement windows are hinged at the side, allowing them to open outward, which provides excellent ventilation and an unobstructed view. Their robust construction, combined with the ability to customize for different home and commercial needs, positions them as the preferred choice for many building projects.

Casement Window Profiles Are Largest Owing to Their Versatility and Durability

Casement windows are particularly favored in residential applications due to their ability to offer large, uninterrupted glass panes, enhancing both natural light and aesthetic appeal. Their design also promotes better sealing against the elements, providing improved insulation and energy efficiency. As sustainability becomes a stronger focus in architecture, casement aluminum window profiles offer long-term benefits like reduced energy consumption, contributing to the segment’s dominance in the market. The growing demand for energy-efficient and aesthetically pleasing solutions in the residential sector continues to drive the preference for casement window profiles.

The growth of this segment is driven by the increasing demand for quick and reliable diagnostic solutions. Immunoassays are also cost-effective compared to other diagnostic methods, making them a preferred choice for healthcare providers. As the awareness of Lyme disease rises globally, the adoption of immunoassay tests is expected to continue expanding, especially in regions with high incidences of the disease.

Residential Segment Is Fastest Growing Owing to Increasing Housing Demand

The aluminum window profile market’s application spectrum spans residential, commercial, and industrial sectors. Among these, the residential segment is the fastest-growing. The global demand for housing, particularly in urban areas, is escalating as more people seek modern, energy-efficient homes. Aluminum window profiles, with their lightweight yet strong characteristics, are ideal for residential buildings, offering both functional and aesthetic advantages. In addition, the growing trend toward sustainable construction materials and energy-efficient solutions further drives the residential application.

Homeowners and builders are increasingly opting for aluminum window profiles because of their design flexibility, durability, and low maintenance requirements. The sector’s growth is also supported by trends in smart homes, where window profiles are integrated with advanced systems to optimize comfort and energy use. As the housing market expands, particularly in developing regions, the demand for aluminum window profiles in residential applications is set to continue growing, making it the fastest-growing segment in the market.

Construction Segment Is Largest Owing to Project Scale and Demand

The construction sector is the largest end-user industry for aluminum window profiles. This segment encompasses both new build and renovation projects, where aluminum windows are chosen for their strength, aesthetic appeal, and energy efficiency. Aluminum profiles are especially popular in commercial and residential buildings, as they offer a long lifespan, low maintenance needs, and excellent thermal performance. Builders and contractors value the material’s versatility, as aluminum can be fabricated into a wide variety of designs while maintaining structural integrity.

In the construction industry, aluminum window profiles have become the go-to solution for architects and contractors looking to meet strict energy efficiency regulations while achieving a modern, sleek look. The growing focus on green building standards and sustainability further fuels the demand for aluminum window profiles, contributing to the construction sector’s dominance in the market. As the global demand for new construction projects remains high, particularly in fast-developing regions, this segment will continue to lead the market.

Asia-Pacific Leads Owing to Rapid Urbanization and Infrastructure Growth

In terms of region, Asia-Pacific is the largest market for aluminum window profiles, driven by rapid urbanization, infrastructure development, and increasing construction activity in countries like China, India, and Southeast Asian nations. The region’s expanding middle class and rising disposable incomes are fueling the demand for modern residential and commercial buildings, where aluminum window profiles are increasingly preferred for their durability and aesthetic appeal.

As governments in Asia-Pacific continue to invest in smart cities, green buildings, and sustainable infrastructure projects, aluminum window profiles are becoming integral to new construction. The region’s fast-paced growth, combined with its push for energy-efficient and environmentally friendly buildings, will sustain Asia-Pacific’s leadership in the global aluminum window profile market in the coming years.

Competitive Landscape: Leading Companies Drive Innovation and Market Growth

The global aluminum window profile market is highly competitive, with several key players leading the charge in product innovation and market expansion. Major companies such as YKK AP Inc., Hydro Extrusion, Schüco International KG, and Reynaers Aluminium dominate the market by offering high-quality and customizable window profiles that cater to both residential and commercial needs. These companies focus on enhancing energy efficiency, design versatility, and sustainability in their product offerings, aligning with the growing demand for eco-friendly building materials.

As the market becomes more competitive, these players are expanding their product portfolios, forming strategic partnerships, and leveraging advanced manufacturing technologies to maintain their market positions. Additionally, some companies are focusing on acquiring regional players to strengthen their foothold in emerging markets such as Asia-Pacific and Latin America. The competitive landscape is poised to evolve further as companies continue to innovate and respond to the growing demand for sustainable, high-performance aluminum window profiles.

Recent Developments:

- YKK AP Inc. announced the launch of a new line of aluminum window profiles with enhanced thermal insulation properties, aimed at improving energy efficiency in commercial buildings.

- Hydro Extrusion completed an acquisition of a major competitor, expanding its capabilities in the aluminum window profile market and reinforcing its position in Europe.

- Schüco International KG introduced a new range of highly customizable aluminum window profiles designed for smart homes, integrating IoT technology for enhanced user control.

- Reynaers Aluminium expanded its product portfolio with a new line of aluminum window profiles featuring improved sustainability standards, aligning with the latest European energy regulations.

- Jindal Aluminium Ltd. unveiled a cutting-edge range of aluminum window frames designed specifically for high-rise buildings, offering improved strength and durability for urban construction projects.

List of Leading Companies:

- YKK AP Inc.

- Hydro Extrusion

- FONTAINE S.A.

- AluK S.p.A.

- Sapa Group

- Schüco International KG

- Reynaers Aluminium

- Jindal Aluminium Ltd.

- U.S. Aluminum

- Aluminum Corporation of China Limited (CHALCO)

- Kawneer Company, Inc.

- Ponzio S.p.A.

- Friedrich Künz GmbH

- Exlabesa

- Mival Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.1 Billion |

|

Forecasted Value (2030) |

USD 0.1 Billion |

|

CAGR (2025 – 2030) |

5.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aluminum Window Profile Market By Product Type (Casement Window Profiles, Sliding Window Profiles, Awning Window Profiles, Fixed Window Profiles), By Application (Residential, Commercial, Industrial), By End-User Industry (Construction, Real Estate, Renovation & Remodeling) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

YKK AP Inc., Hydro Extrusion, FONTAINE S.A., AluK S.p.A., Sapa Group, Schüco International KG, Reynaers Aluminium, Jindal Aluminium Ltd., U.S. Aluminum, Aluminum Corporation of China Limited (CHALCO), Kawneer Company, Inc., Ponzio S.p.A., Friedrich Künz GmbH, Exlabesa, Mival Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aluminum Window Profile Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Casement Window Profiles |

|

4.2. Sliding Window Profiles |

|

4.3. Awning Window Profiles |

|

4.4. Fixed Window Profiles |

|

4.5. Other Types |

|

5. Aluminum Window Profile Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Residential |

|

5.2. Commercial |

|

5.3. Industrial |

|

5.4. Others |

|

6. Aluminum Window Profile Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Construction |

|

6.2. Real Estate |

|

6.3. Renovation & Remodeling |

|

6.4. Other Industries |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Aluminum Window Profile Market, by Product Type |

|

7.2.7. North America Aluminum Window Profile Market, by Application |

|

7.2.8. North America Aluminum Window Profile Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Aluminum Window Profile Market, by Product Type |

|

7.2.9.1.2. US Aluminum Window Profile Market, by Application |

|

7.2.9.1.3. US Aluminum Window Profile Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. YKK AP Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Hydro Extrusion |

|

9.3. FONTAINE S.A. |

|

9.4. AluK S.p.A. |

|

9.5. Sapa Group |

|

9.6. Schüco International KG |

|

9.7. Reynaers Aluminium |

|

9.8. Jindal Aluminium Ltd. |

|

9.9. U.S. Aluminum |

|

9.10. Aluminum Corporation of China Limited (CHALCO) |

|

9.11. Kawneer Company, Inc. |

|

9.12. Ponzio S.p.A. |

|

9.13. Friedrich Künz GmbH |

|

9.14. Exlabesa |

|

9.15. Mival Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aluminum Window Profile Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aluminum Window Profile Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aluminum Window Profile Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA