As per Intent Market Research, the Allergic Conjunctivitis Market was valued at USD 2.6 Billion in 2024-e and will surpass USD 5.0 Billion by 2030; growing at a CAGR of 11.1% during 2025-2030.

Allergic conjunctivitis, a common eye condition caused by allergic reactions, results in inflammation of the conjunctiva and is often triggered by pollen, dust, mold, and pet dander. The global market for allergic conjunctivitis treatment is expanding due to rising awareness, increased environmental allergens, and higher diagnosis rates. The market includes a wide range of treatments aimed at relieving symptoms such as itching, redness, and swelling of the eyes.

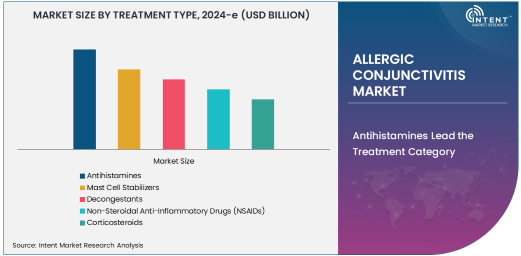

Antihistamines Lead the Treatment Category

Antihistamines, both oral and topical, are the most commonly used treatments for allergic conjunctivitis, as they directly target histamine receptors to reduce allergic symptoms. Oral antihistamines are often the first line of treatment for individuals with systemic allergies, while topical antihistamines are preferred for more localized relief in the eye area.

Topical antihistamines, such as ketotifen and olopatadine, are widely available as over-the-counter treatments and are known for their ability to rapidly alleviate symptoms. Oral antihistamines, including cetirizine and loratadine, are effective for patients who experience symptoms beyond the eyes, such as sneezing or nasal congestion.

The increasing availability of prescription-strength and over-the-counter antihistamines is expected to drive growth in the allergic conjunctivitis treatment market. Their easy accessibility and quick onset of action make antihistamines a popular choice among patients and healthcare providers alike.

Mast Cell Stabilizers and Corticosteroids for Severe Cases

Mast cell stabilizers, such as cromolyn sodium, work by preventing the release of histamine and other chemicals from mast cells, which can help reduce allergic reactions. These treatments are particularly effective for patients who experience frequent or seasonal allergic conjunctivitis. However, mast cell stabilizers may take longer to show effects compared to antihistamines, making them more suitable for preventive care.

For more severe cases of allergic conjunctivitis, corticosteroids may be prescribed by healthcare professionals. Corticosteroids, including prednisolone acetate and dexamethasone, are powerful anti-inflammatory agents that can provide rapid relief from symptoms. However, due to potential side effects with prolonged use, corticosteroids are typically prescribed for short-term use only under medical supervision.

Decongestants and Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) also play a role in treating allergic conjunctivitis by reducing swelling and providing symptomatic relief. These are often used in combination with antihistamines to maximize therapeutic benefits.

Hospitals and Clinics Lead the End-User Segment

Hospitals and clinics remain the primary end-users for allergic conjunctivitis treatments, as healthcare providers are able to assess the condition and prescribe medications based on the severity of the symptoms. These facilities are also equipped to offer advanced treatments for patients with severe or chronic allergic conjunctivitis, including corticosteroid eye drops and other prescription medications.

Additionally, hospitals and clinics provide essential services like allergy testing, which helps identify specific allergens and tailor treatments accordingly. This trend is expected to continue, especially with the growing prevalence of allergies and the increased demand for specialized care.

Homecare Settings Gaining Popularity

Homecare settings are witnessing increased adoption as patients opt for more convenient ways to manage their symptoms. The availability of over-the-counter antihistamines, mast cell stabilizers, and eye drops has made it easier for patients to manage allergic conjunctivitis at home. Furthermore, the growing preference for telemedicine consultations allows patients to receive advice on treatment options and obtain prescriptions remotely, expanding the reach of at-home care.

Distribution Channels: Retail Pharmacies and Online Retail Lead

Retail pharmacies continue to be the leading distribution channel for allergic conjunctivitis treatments, due to their widespread accessibility and availability of over-the-counter medications. Pharmacies offer a wide range of topical and oral treatments, which are easily accessible to patients without the need for a prescription.

Online pharmacies are also gaining traction as a distribution channel, offering the convenience of home delivery and the ability to consult with pharmacists online. The ease of purchasing medications online, coupled with the growth of e-commerce, is expected to contribute to the expansion of the online retail segment. The increasing adoption of online pharmacies, especially for repeat purchases of non-prescription treatments, is expected to significantly impact the market dynamics.

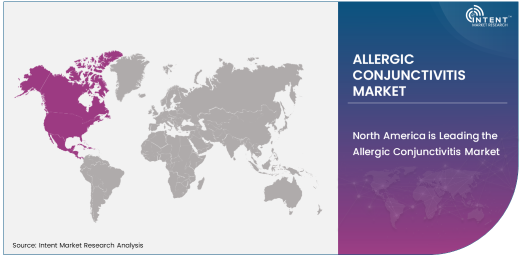

North America is Leading the Allergic Conjunctivitis Market

North America is the largest market for allergic conjunctivitis treatments, driven by the high prevalence of allergic disorders, a well-established healthcare system, and the availability of a wide range of treatment options. The United States is at the forefront of the market, where oral antihistamines, topical antihistamines, mast cell stabilizers, and corticosteroids are commonly prescribed for managing allergic conjunctivitis. Additionally, strong market players such as Allergan and Novartis are contributing to the development and distribution of effective treatments.

The U.S. is also witnessing a growing adoption of online pharmacies, making treatments more accessible to individuals with allergic conjunctivitis, particularly during allergy seasons. The continuous advancement in pharmacological treatments, such as over-the-counter antihistamines and corticosteroid eye drops, plays a pivotal role in North America’s dominance. Increased awareness of eye health and the impact of allergies on quality of life further drives the demand for treatments in this region.

Market Trends and Competitive Landscape

The allergic conjunctivitis market is characterized by a wide variety of treatment options, including over-the-counter medications and prescription therapies. Major players in the market include companies such as Allergan, Novartis, and Roche, which are focused on expanding their product portfolios and innovating in the treatment of allergic conjunctivitis. With an increasing focus on personalized medicine and the development of new therapies, the market is expected to experience steady growth in the coming years.

Recent Developments:

- Novartis International AG launched a new eye drop formulation for allergic conjunctivitis, providing quicker relief from symptoms.

- Allergan plc introduced a new antihistamine eye drop treatment for seasonal allergic conjunctivitis.

- Bausch & Lomb Incorporated received FDA approval for a new topical corticosteroid for allergic conjunctivitis.

- Teva Pharmaceutical Industries Ltd. expanded its portfolio with a new oral antihistamine for managing allergic conjunctivitis.

- Santen Pharmaceutical Co., Ltd. unveiled a new mast cell stabilizer for the treatment of chronic allergic conjunctivitis.

List of Leading Companies:

- Novartis International AG

- Allergan plc

- Bausch & Lomb Incorporated

- Johnson & Johnson

- Pfizer Inc.

- Santen Pharmaceutical Co., Ltd.

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd.

- AbbVie Inc.

- Sanofi S.A.

- Mylan N.V.

- Akorn, Inc.

- Astellas Pharma Inc.

- Hikma Pharmaceuticals PLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.6 Billion |

|

Forecasted Value (2030) |

USD 5.0 Billion |

|

CAGR (2025 – 2030) |

11.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Allergic Conjunctivitis Market By Treatment Type (Antihistamines: Oral Antihistamines, Topical Antihistamines, Mast Cell Stabilizers, Decongestants, Non-Steroidal Anti-Inflammatory Drugs, Corticosteroids), By Route of Administration (Oral, Topical), By End-User (Hospitals and Clinics, Homecare Settings), and By Distribution Channel (Direct Sales, Retail Pharmacies, Online Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Novartis International AG, Allergan plc, Bausch & Lomb Incorporated, Johnson & Johnson, Pfizer Inc., Santen Pharmaceutical Co., Ltd., Merck & Co., Inc., GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., AbbVie Inc., Sanofi S.A., Mylan N.V., Akorn, Inc., Astellas Pharma Inc., Hikma Pharmaceuticals PLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Allergic Conjunctivitis Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Antihistamines |

|

4.1.1. Oral Antihistamines |

|

4.1.2. Topical Antihistamines |

|

4.2. Mast Cell Stabilizers |

|

4.3. Decongestants |

|

4.4. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) |

|

4.5. Corticosteroids |

|

5. Allergic Conjunctivitis Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Oral |

|

5.2. Topical |

|

6. Allergic Conjunctivitis Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Homecare Settings |

|

7. Allergic Conjunctivitis Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Retail Pharmacies |

|

7.3. Online Pharmacies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Allergic Conjunctivitis Market, by Treatment Type |

|

8.2.7. North America Allergic Conjunctivitis Market, by Route of Administration |

|

8.2.8. North America Allergic Conjunctivitis Market, by End-User |

|

8.2.9. North America Allergic Conjunctivitis Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Allergic Conjunctivitis Market, by Treatment Type |

|

8.2.10.1.2. US Allergic Conjunctivitis Market, by Route of Administration |

|

8.2.10.1.3. US Allergic Conjunctivitis Market, by End-User |

|

8.2.10.1.4. US Allergic Conjunctivitis Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Novartis International AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Allergan plc |

|

10.3. Bausch & Lomb Incorporated |

|

10.4. Johnson & Johnson |

|

10.5. Pfizer Inc. |

|

10.6. Santen Pharmaceutical Co., Ltd. |

|

10.7. Merck & Co., Inc. |

|

10.8. GlaxoSmithKline plc |

|

10.9. Teva Pharmaceutical Industries Ltd. |

|

10.10. AbbVie Inc. |

|

10.11. Sanofi S.A. |

|

10.12. Mylan N.V. |

|

10.13. Akorn, Inc. |

|

10.14. Astellas Pharma Inc. |

|

10.15. Hikma Pharmaceuticals PLC |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Allergic Conjunctivitis Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Allergic Conjunctivitis Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Allergic Conjunctivitis Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA