As per Intent Market Research, the All Terrain Vehicle Lighting System Market was valued at USD 1.9 Billion in 2024-e and will surpass USD 4.2 Billion by 2030; growing at a CAGR of 13.7% during 2025-2030.

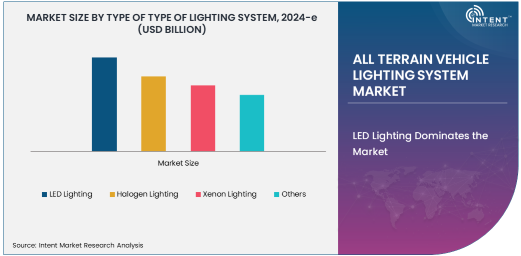

LED lighting dominates the all-terrain vehicle (ATV) lighting system market due to its energy efficiency, durability, and long lifespan. LEDs provide superior brightness and clarity, which is essential for off-road and utility vehicles that require reliable lighting in challenging environments. The growing preference for energy-efficient solutions and the increasing adoption of LED lighting systems in the automotive industry have further accelerated their growth in the ATV lighting sector.

Moreover, LED lights are more robust than traditional lighting solutions, making them ideal for the demanding conditions of off-roading. The ability of LEDs to withstand shocks, vibrations, and extreme temperatures adds to their appeal for vehicles that navigate rough terrains. This segment is set to continue growing as ATV manufacturers increasingly integrate LED lights into new models to meet consumer demand for high-performance, low-maintenance lighting systems.

Aftermarket Segment Experiences Significant Growth in the ATV Lighting System Market

The aftermarket segment is witnessing the fastest growth within the ATV lighting system market. As more consumers personalize and upgrade their all-terrain vehicles, the demand for aftermarket lighting solutions has surged. ATV owners are increasingly investing in advanced lighting systems to improve vehicle performance, aesthetics, and safety during off-road adventures. Aftermarket lighting systems, such as auxiliary lights and light bars, provide enhanced visibility, especially in low-light and off-road conditions, which is essential for safety.

The customization trend, coupled with the rising popularity of off-road sports and recreational activities, is driving significant demand in the aftermarket segment. Additionally, aftermarket lighting solutions are often more versatile and offer a broader range of designs and features, making them highly appealing to ATV enthusiasts who want to tailor their vehicles to their specific needs and preferences.

North America Holds the Largest Share in the ATV Lighting System Market

North America is the dominant region in the all-terrain vehicle lighting system market, driven by the high popularity of off-roading and recreational vehicle usage in the region. The U.S. and Canada have a strong base of ATV enthusiasts, and the growing trend of outdoor sports, such as motocross and off-road racing, continues to drive the demand for specialized lighting systems. North America also benefits from a well-established automotive aftermarket sector, further supporting the growth of aftermarket lighting systems for ATVs.

Additionally, the presence of key ATV manufacturers and lighting system providers in North America has facilitated the development and distribution of advanced lighting solutions for the region's off-road and utility vehicles. As the market for recreational activities and off-roading continues to expand, North America is expected to maintain its leadership position in the global ATV lighting system market.

Competitive Landscape: Key Players and Market Dynamics

The all-terrain vehicle lighting system market is highly competitive, with major players such as Rigid Industries, KC Hilites, Lazer Star Lights, and PIAA Corporation dominating the landscape. These companies focus on innovation, product differentiation, and expanding their product portfolios to cater to the growing demand for high-performance lighting systems. Leading manufacturers are also incorporating advanced technologies like smart lighting, which can adjust based on environmental conditions, further enhancing their offerings in the ATV lighting market.

Strategic partnerships with OEMs, as well as a focus on expanding presence in emerging markets, are key strategies for growth. With the increasing trend toward customization and the growing popularity of off-roading activities, the competitive landscape will continue to evolve, with companies focusing on both technological innovation and robust distribution networks to stay ahead in the market.

Recent Developments:

- Hella GmbH & Co. KGaA introduced a new range of LED lighting systems tailored for off-road vehicles, offering improved durability and brightness for extreme conditions.

- Osram Licht AG expanded its product portfolio with a new series of xenon lights for utility vehicles to enhance performance in low-light environments.

- Koito Manufacturing Co., Ltd. launched a robust all-terrain vehicle lighting system with advanced LED technology for better visibility and energy efficiency.

- Philips Lighting partnered with leading ATV manufacturers to integrate its state-of-the-art LED lighting systems into new vehicle models.

- Truck-Lite Co., LLC unveiled a new aftermarket lighting solution that offers enhanced off-road visibility for all-terrain vehicles, using the latest LED technology.

List of Leading Companies:

- Hella GmbH & Co. KGaA

- Osram Licht AG

- Koito Manufacturing Co., Ltd.

- Philips Lighting

- Valeo SA

- Grote Industries, Inc.

- Truck-Lite Co., LLC

- Vision X Lighting, Inc.

- KC HiLiTES, Inc.

- Rigid Industries LED Lighting

- Nite Lights Inc.

- Lazer Lamps Ltd.

- Warn Industries, Inc.

- LED Autolamps

- Lightforce USA

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 4.2 Billion |

|

CAGR (2025 – 2030) |

13.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

All-In-One Infrastructure Market By Type of Infrastructure (Cloud Infrastructure, On-Premises Infrastructure, Hybrid Infrastructure), By End-Use Application (IT & Telecommunications, BFSI: Banking, Financial Services & Insurance, Retail & E-Commerce, Healthcare & Life Sciences, Government & Public Sector, Manufacturing & Logistics), and By Deployment Type (Private, Public, Hybrid) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Hella GmbH & Co. KGaA, Osram Licht AG, Koito Manufacturing Co., Ltd., Philips Lighting, Valeo SA, Grote Industries, Inc., Truck-Lite Co., LLC, Vision X Lighting, Inc., KC HiLiTES, Inc., Rigid Industries LED Lighting, Nite Lights Inc., Lazer Lamps Ltd., Warn Industries, Inc., LED Autolamps, Lightforce USA |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. All Terrain Vehicle Lighting System Market, by Type of Lighting System (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. LED Lighting |

|

4.2. Halogen Lighting |

|

4.3. Xenon Lighting |

|

4.4. Others |

|

5. All Terrain Vehicle Lighting System Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Off-Road Vehicles |

|

5.2. Utility Vehicles |

|

5.3. Sports & Recreational Vehicles |

|

6. All Terrain Vehicle Lighting System Market, by Sales Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. OEM (Original Equipment Manufacturer) |

|

6.2. Aftermarket |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America All Terrain Vehicle Lighting System Market, by Type of Lighting System |

|

7.2.7. North America All Terrain Vehicle Lighting System Market, by Application |

|

7.2.8. North America All Terrain Vehicle Lighting System Market, by Sales Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US All Terrain Vehicle Lighting System Market, by Type of Lighting System |

|

7.2.9.1.2. US All Terrain Vehicle Lighting System Market, by Application |

|

7.2.9.1.3. US All Terrain Vehicle Lighting System Market, by Sales Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Hella GmbH & Co. KGaA |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Osram Licht AG |

|

9.3. Koito Manufacturing Co., Ltd. |

|

9.4. Philips Lighting |

|

9.5. Valeo SA |

|

9.6. Grote Industries, Inc. |

|

9.7. Truck-Lite Co., LLC |

|

9.8. Vision X Lighting, Inc. |

|

9.9. KC HiLiTES, Inc. |

|

9.10. Rigid Industries LED Lighting |

|

9.11. Nite Lights Inc. |

|

9.12. Lazer Lamps Ltd. |

|

9.13. Warn Industries, Inc. |

|

9.14. LED Autolamps |

|

9.15. Lightforce USA |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the All Terrain Vehicle Lighting System Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the All Terrain Vehicle Lighting System Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the All Terrain Vehicle Lighting System Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA