As per Intent Market Research, the Alkaline Fuel Cells Market was valued at USD 1.2 billion in 2023 and will surpass USD 2.7 billion by 2030; growing at a CAGR of 11.7% during 2024 - 2030.

The alkaline fuel cells (AFC) market is experiencing significant growth due to their application in clean energy solutions and power generation systems. Alkaline fuel cells, known for their high efficiency and environmentally friendly operation, use an alkaline electrolyte for the electrochemical reaction to generate electricity. They are highly suitable for a range of applications, from automotive power systems to stationary power generation. With increasing environmental concerns and the shift towards renewable energy sources, AFCs are gaining traction as a clean alternative to traditional power generation methods.

One of the key drivers in the AFC market is the demand for more efficient, sustainable power solutions across various industries. These fuel cells are being increasingly deployed in backup power systems, automotive applications, and portable power devices, where their low environmental impact and high energy efficiency make them an attractive option. As technology advances, the market for alkaline fuel cells is poised for further expansion, with innovations focusing on increasing power output, reducing operational costs, and improving durability.

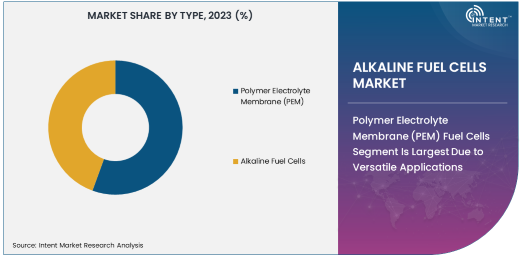

Polymer Electrolyte Membrane (PEM) Fuel Cells Segment Is Largest Due to Versatile Applications

The Polymer Electrolyte Membrane (PEM) fuel cells segment is the largest in the alkaline fuel cells market, owing to their versatility and wide range of applications. PEM fuel cells are used in diverse fields, including automotive, portable power devices, and backup power systems. Their compact design, quick start-up times, and high power output efficiency make them ideal for use in electric vehicles (EVs) and other mobile applications. PEM fuel cells are also highly scalable, allowing them to be used in small devices as well as large power generation systems.

The growing focus on fuel cell vehicles, such as hydrogen-powered cars and buses, has significantly contributed to the dominance of the PEM segment in the AFC market. Moreover, their efficiency in converting chemical energy into electrical energy, coupled with low operating temperatures, makes PEM fuel cells a preferred choice in applications requiring rapid energy output.

Low Power Output Segment Is Fastest Growing Due to Increased Use in Portable Devices

The low power output (<100W) segment is the fastest growing in the alkaline fuel cells market, driven by the increasing demand for portable power devices. Low-power alkaline fuel cells are ideal for use in applications such as mobile phones, laptops, small electronics, and portable energy storage systems. These fuel cells provide an efficient and environmentally friendly alternative to traditional battery solutions, offering longer runtime and faster recharging times.

As the use of portable electronic devices continues to rise globally, coupled with the increasing focus on reducing the environmental impact of battery disposal, low-power alkaline fuel cells are becoming an attractive solution. The ability to produce consistent and reliable power over extended periods positions these fuel cells as a key technology in the portable power device market.

Automotive End-Use Segment Is Largest Due to Adoption of Fuel Cell Vehicles

The automotive end-use segment is the largest in the alkaline fuel cells market, mainly driven by the growing adoption of fuel cell electric vehicles (FCEVs). Automakers are increasingly focusing on hydrogen-powered vehicles to meet global emissions targets and reduce dependency on fossil fuels. Alkaline fuel cells are a key technology used in these vehicles due to their ability to efficiently convert hydrogen into electricity, providing long driving ranges and faster refueling times compared to conventional electric vehicles.

In addition to passenger cars, hydrogen-powered buses and trucks are also gaining traction, further boosting the demand for alkaline fuel cells in the automotive sector. As governments around the world implement stricter environmental regulations, the push for zero-emission vehicles is expected to drive the growth of the automotive end-use segment.

Asia Pacific Region Is Largest Region Due to Growing Hydrogen Infrastructure

The Asia Pacific region is the largest in the alkaline fuel cells market, driven by the significant investments in hydrogen infrastructure and renewable energy in countries like Japan, China, and South Korea. Japan, in particular, has been at the forefront of adopting hydrogen fuel cells for both automotive and stationary power generation applications. The government’s strong focus on developing hydrogen-powered transport and energy systems has led to the establishment of extensive hydrogen refueling stations and the widespread use of fuel cell vehicles.

Additionally, China’s rapid development of clean energy technologies and its efforts to reduce carbon emissions are driving the demand for alkaline fuel cells, especially in the transportation sector. With these countries positioning themselves as leaders in hydrogen technology, the Asia Pacific region is expected to maintain its dominance in the alkaline fuel cells market.

Leading Companies and Competitive Landscape

The alkaline fuel cells market is highly competitive, with leading companies such as Ballard Power Systems, Plug Power, and Toshiba driving innovation and growth in the sector. These companies are focusing on improving fuel cell efficiency, reducing production costs, and expanding their product offerings for various applications, including automotive, stationary power generation, and portable devices. Ballard Power Systems, for instance, is actively involved in the development of fuel cells for heavy-duty transport and has formed strategic partnerships with automakers to advance the adoption of hydrogen fuel cell vehicles.

The market is also witnessing the entry of new players that are developing advanced fuel cell technologies to meet the increasing demand for clean energy solutions. As the hydrogen economy continues to grow, competition will intensify, and collaborations between fuel cell manufacturers, automotive companies, and energy providers will play a pivotal role in shaping the market’s future.

Recent Developments:

- In December 2024, Ballard Power Systems announced the successful deployment of their alkaline fuel cell systems in a commercial electric vehicle.

- In November 2024, Plug Power Inc. entered into a strategic partnership with a European utility company to integrate alkaline fuel cells into renewable energy projects.

- In October 2024, Hydrogenics Corporation launched a new line of high-efficiency alkaline fuel cells for stationary power generation.

- In September 2024, Cummins Inc. acquired a leading fuel cell manufacturer to expand its offerings in the alkaline fuel cell market.

- In August 2024, Panasonic Corporation unveiled an advanced alkaline fuel cell system designed for residential backup power applications.

List of Leading Companies:

- Ballard Power Systems

- Plug Power Inc.

- Hydrogenics Corporation

- Bloom Energy

- Panasonic Corporation

- Doosan Fuel Cell America, Inc.

- Cummins Inc.

- Toshiba Energy Systems & Solutions Corporation

- Proton OnSite

- FuelCell Energy, Inc.

- UTC Power

- SFC Energy

- Altergy Systems

- Hydrogenious LOHC Technologies

- FuelCell Store

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.2 billion |

|

Forecasted Value (2030) |

USD 2.7 billion |

|

CAGR (2024 – 2030) |

11.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Alkaline Fuel Cells Market By Type (Polymer Electrolyte Membrane (PEM), Alkaline Fuel Cells), By Component (Electrodes, Electrolyte, Catalyst, Bipolar Plates), By Power Output (Low Power (<100W), Medium Power (100W - 1kW), High Power (>1kW)), By End-Use (Automotive, Stationary Power Generation, Portable Power Devices, Backup Power Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Ballard Power Systems, Plug Power Inc., Hydrogenics Corporation, Bloom Energy, Panasonic Corporation, Doosan Fuel Cell America, Inc., Cummins Inc., Toshiba Energy Systems & Solutions Corporation, Proton OnSite, FuelCell Energy, Inc., UTC Power, SFC Energy, Altergy Systems, Hydrogenious LOHC Technologies, FuelCell Store |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

NA

A comprehensive market research approach was employed to gather and analyze data on the Alkaline Fuel Cells Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Alkaline Fuel Cells Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Alkaline Fuel Cells Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA