As per Intent Market Research, the Alginate Market was valued at USD 1.0 Billion in 2024-e and will surpass USD 1.5 Billion by 2030; growing at a CAGR of 6.3% during 2025-2030.

The alginate market is experiencing steady growth, driven by the expanding applications of alginates across industries such as food, pharmaceuticals, textiles, and cosmetics. Alginate, a natural polysaccharide derived from brown seaweed, is known for its gelling, thickening, and stabilizing properties. It is increasingly utilized in various sectors for a range of applications, from food production to wound dressings. As sustainability and natural ingredients become key factors in product development, alginates are increasingly preferred as eco-friendly alternatives to synthetic additives.

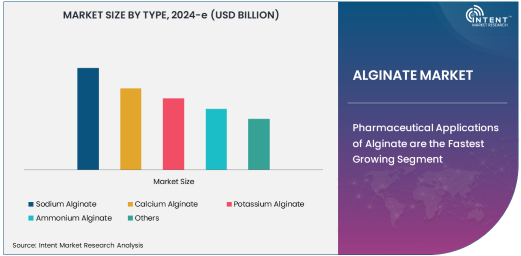

Among the various types of alginate, sodium alginate holds the largest market share. Its widespread use in the food and beverage industry as a thickening agent, stabilizer, and gelling agent makes it highly sought after. In food processing, it is commonly used in products such as jams, jellies, sauces, and dairy products. Furthermore, sodium alginate is extensively used in pharmaceuticals for drug formulation and in wound dressings due to its biocompatibility and ability to form hydrogels. The versatility of sodium alginate, along with its functional properties, cements its position as the largest subsegment in the global alginate market.

Pharmaceutical Applications of Alginate are the Fastest Growing Segment

While sodium alginate dominates the market, the pharmaceutical sector is the fastest growing end-use application for alginates. Alginate’s biocompatibility, non-toxicity, and ability to form gels make it an ideal material for drug formulation and wound care. In drug formulation, alginates are used in controlled-release medications, oral delivery systems, and as excipients in tablet formulations. Additionally, in wound care, alginates are used in the form of dressings to manage exudate, promote healing, and prevent infection. This demand for alginate-based products is growing due to the increasing need for advanced drug delivery systems and the rise in chronic wounds, particularly in the aging population.

The rapid growth in the pharmaceutical sector is largely driven by the expanding use of alginates in developing new drug delivery systems. With an increasing focus on controlled-release medications, alginate's ability to encapsulate active ingredients and release them gradually is gaining prominence. Moreover, alginate-based wound dressings are increasingly being used in hospitals and clinics due to their superior performance in managing complex wounds. This surge in demand for pharmaceutical applications of alginate makes it the fastest growing subsegment within the market.

Liquid Form of Alginate is the Fastest Growing Form

In terms of form, the liquid variant of alginate is the fastest growing. Liquid alginate is primarily used in applications where ease of mixing, spreading, or application is crucial. In the food industry, liquid alginate is often used in beverage production, especially in fruit juices and smoothies, to enhance texture and mouthfeel. It is also employed in cosmetics and personal care products, such as skin care and hair care formulations, due to its moisturizing and emulsifying properties. As liquid alginate offers greater ease of incorporation into formulations and end products, its use across these industries is expected to increase, making it the fastest growing form in the alginate market.

The liquid form of alginate is particularly favored in industries where precise viscosity control and consistency are essential. In pharmaceutical applications, liquid alginate is used in the formulation of syrups, gels, and liquid suspensions, which are easier to ingest and dose compared to solid forms. The increasing demand for convenience in both food and personal care products, along with the benefits of liquid alginate in terms of solubility and functionality, supports its growth in various sectors.

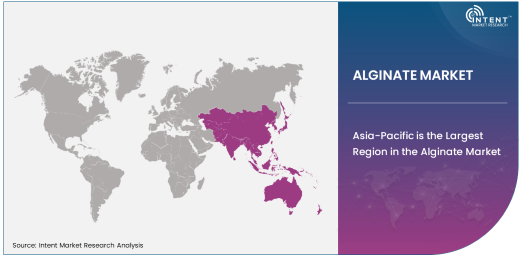

Asia-Pacific is the Largest Region in the Alginate Market

Asia-Pacific is the largest region in the alginate market, driven by the significant production of alginate derived from brown seaweed, particularly in countries such as China, Japan, and South Korea. The region is home to several major alginate manufacturers and is a key exporter of alginate-based products. The increasing demand for alginate in food processing, pharmaceuticals, and cosmetics in emerging economies such as China and India further strengthens the region’s dominance.

In the food and beverage industry, the increasing demand for natural and functional ingredients is contributing to the growth of alginate consumption. The pharmaceutical sector in Asia-Pacific is also expanding rapidly, particularly with the rise in healthcare spending and the growing focus on wound care. The region’s strong manufacturing capabilities and the rising popularity of eco-friendly and sustainable products are expected to drive continued growth in the alginate market.

Competitive Landscape: Leading Players and Strategic Initiatives

The global alginate market is highly competitive, with several established players focusing on innovation, product development, and strategic acquisitions to maintain their market position. Key players in the market include companies such as DuPont, Ashland, DSM, and KIMICA, among others. These companies are investing in research and development to explore new applications for alginate and expand their product offerings. Additionally, several regional players are strengthening their positions by increasing production capacities and offering tailored solutions to meet the specific needs of various industries.

To remain competitive, many companies are focusing on sustainability and sourcing raw materials responsibly. As consumer demand for natural and biodegradable products continues to rise, alginate producers are prioritizing sustainable practices in their operations. Furthermore, collaborations with key end-users in the food, pharmaceutical, and cosmetics industries are enabling alginate producers to develop innovative and high-quality products that cater to the evolving needs of these sectors. The competitive landscape in the alginate market is expected to continue evolving with new entrants, technological advancements, and growing demand for multifunctional alginate-based products.

Recent Developments:

- DuPont de Nemours, Inc. announced the expansion of its alginate production facility to meet the rising demand for natural food and beverage ingredients.

- Nouryon launched a new line of high-quality alginates for use in the pharmaceutical and cosmetic industries.

- Kerry Group acquired a leading alginate supplier to strengthen its position in the food and beverage sector.

- Algaia partnered with a biotechnology company to develop innovative alginate-based solutions for sustainable packaging.

- Cargill, Incorporated expanded its alginate portfolio to include bio-based gelling agents for the cosmetics and personal care industry.

List of Leading Companies:

- DuPont de Nemours, Inc.

- Nouryon

- ISP (International Specialty Products)

- Algaia

- Kerry Group

- Cargill, Incorporated

- Shanghai ShanChun Industry Co., Ltd.

- Sanyo Chemical Industries, Ltd.

- IRO Group, Inc.

- Qingdao Bright Moon Seaweed Group Co., Ltd.

- Jinan Yinhai Alginate Co., Ltd.

- Weifang Haizhijiao Biotech Co., Ltd.

- Sigma-Aldrich (Merck)

- Gelymar S.A.

- Hongyu Seaweed Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.0 Billion |

|

Forecasted Value (2030) |

USD 1.5 Billion |

|

CAGR (2025 – 2030) |

6.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Alginate Market By Type (Sodium Alginate, Calcium Alginate, Potassium Alginate, Ammonium Alginate, Others), By Form (Powder, Gel, Liquid), and By End-Use Application (Food & Beverages: Food Processing, Beverage Production, Pharmaceuticals: Drug Formulation, Wound Dressings, Cosmetics & Personal Care: Skin Care, Hair Care, Textile Industry: Dyeing, Printing, Paper & Pulp: Coating, Paper Strengthening, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

DuPont de Nemours, Inc., Nouryon, ISP (International Specialty Products), Algaia, Kerry Group, Cargill, Incorporated, Shanghai ShanChun Industry Co., Ltd., Sanyo Chemical Industries, Ltd., IRO Group, Inc., Qingdao Bright Moon Seaweed Group Co., Ltd., Jinan Yinhai Alginate Co., Ltd., Weifang Haizhijiao Biotech Co., Ltd., Sigma-Aldrich (Merck), Gelymar S.A., Hongyu Seaweed Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Alginate Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Sodium Alginate |

|

4.2. Calcium Alginate |

|

4.3. Potassium Alginate |

|

4.4. Ammonium Alginate |

|

4.5. Others |

|

5. Alginate Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Powder |

|

5.2. Gel |

|

5.3. Liquid |

|

6. Alginate Market, by End-Use Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food & Beverages |

|

6.1.1. Food Processing |

|

6.1.2. Beverage Production |

|

6.2. Pharmaceuticals |

|

6.2.1. Drug Formulation |

|

6.2.2. Wound Dressings |

|

6.3. Cosmetics & Personal Care |

|

6.3.1. Skin Care |

|

6.3.2. Hair Care |

|

6.4. Textile Industry |

|

6.4.1. Dyeing |

|

6.4.2. Printing |

|

6.5. Paper & Pulp |

|

6.5.1. Coating |

|

6.5.2. Paper Strengthening |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Alginate Market, by Type |

|

7.2.7. North America Alginate Market, by Form |

|

7.2.8. North America Alginate Market, by End-Use Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Alginate Market, by Type |

|

7.2.9.1.2. US Alginate Market, by Form |

|

7.2.9.1.3. US Alginate Market, by End-Use Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. DuPont de Nemours, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Nouryon |

|

9.3. ISP (International Specialty Products) |

|

9.4. Algaia |

|

9.5. Kerry Group |

|

9.6. Cargill, Incorporated |

|

9.7. Shanghai ShanChun Industry Co., Ltd. |

|

9.8. Sanyo Chemical Industries, Ltd. |

|

9.9. IRO Group, Inc. |

|

9.10. Qingdao Bright Moon Seaweed Group Co., Ltd. |

|

9.11. Jinan Yinhai Alginate Co., Ltd. |

|

9.12. Weifang Haizhijiao Biotech Co., Ltd. |

|

9.13. Sigma-Aldrich (Merck) |

|

9.14. Gelymar S.A. |

|

9.15. Hongyu Seaweed Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Alginate Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Alginate Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Alginate Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA