As per Intent Market Research, the Aircraft Landing Gears Market was valued at USD 8.8 billion in 2023 and will surpass USD 13.0 billion by 2030; growing at a CAGR of 5.7% during 2024 - 2030.

The Aircraft Landing Gears Market is a critical component of the global aerospace industry, encompassing a diverse range of products designed to support various aircraft during landing, takeoff, and taxiing. As aircraft manufacturing expands, driven by increasing air travel, growing defense budgets, and technological advancements, the demand for landing gear systems continues to rise. From commercial aircraft to military jets, landing gears play an essential role in ensuring the safety and efficiency of operations. According to market estimates, the Aircraft Landing Gears

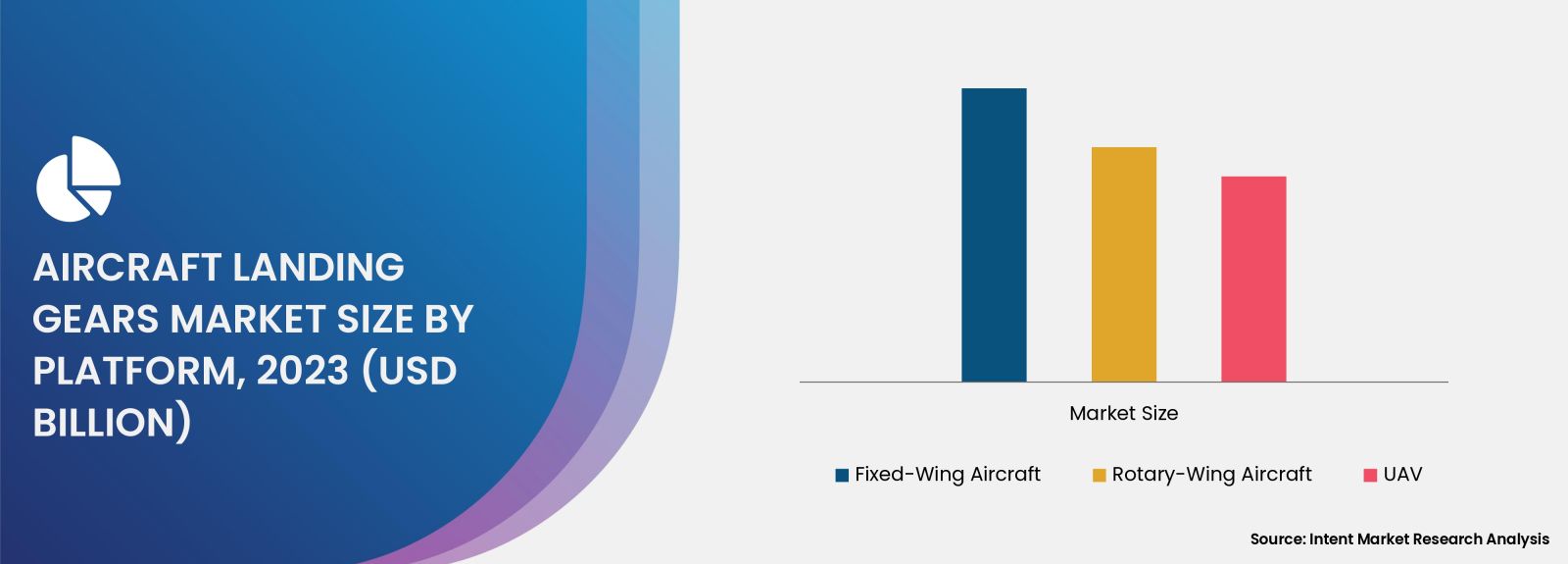

Fixed-Wing Aircraft Segment is the Largest Owing to High Demand for Commercial Airliners

The fixed-wing aircraft segment holds the largest share of the aircraft landing gears market, driven by the massive global fleet of commercial airliners and business jets. Fixed-wing aircraft, known for their horizontal wings, require robust and sophisticated landing gear systems that can withstand the high speeds and heavy loads involved during takeoff and landing. This segment benefits greatly from the rising demand for air travel, fleet expansion by major airlines, and the growing trend of business aviation. As more countries expand their air travel infrastructure and tourism, the demand for fixed-wing aircraft landing gears is projected to remain dominant through 2030.

Within this segment, commercial airliners represent the largest subsegment, primarily due to the vast fleet of narrow-body and wide-body aircraft in operation worldwide. With an increasing focus on reducing aircraft weight to improve fuel efficiency, manufacturers are investing in lightweight landing gear systems made from composite materials. This trend, coupled with fleet modernization efforts across the globe, positions the fixed-wing aircraft segment as a significant contributor to the overall growth of the aircraft landing gears market.

Rotary-Wing Aircraft Segment is the Fastest Growing Owing to Increased Demand for Helicopters

While the fixed-wing aircraft segment dominates in terms of market size, the rotary-wing aircraft segment is projected to witness the fastest growth over the forecast period. Rotary-wing aircraft, such as helicopters, require specialized landing gear systems that are designed to handle vertical takeoffs and landings. The versatility of helicopters in applications such as medical evacuation, search and rescue, oil and gas exploration, and military operations has led to a surge in demand, particularly in regions with challenging terrain and limited infrastructure.

The fastest-growing subsegment within the rotary-wing aircraft category is military helicopters. Increased defense spending by countries worldwide and a growing emphasis on aerial combat and surveillance operations have bolstered the demand for military helicopters equipped with advanced landing gear systems. As countries focus on modernizing their defense fleets, the rotary-wing aircraft segment is expected to exhibit robust growth through 2030, contributing significantly to the overall aircraft landing gears market.

Main Landing Gear Segment is the Largest Owing to Its Critical Functionality in Aircraft Operations

The main landing gear segment is the largest in the aircraft landing gears market, primarily due to its critical role in supporting the bulk of an aircraft's weight during landing and takeoff. The main landing gear is responsible for absorbing the impact upon landing and providing stability during taxiing, making it an essential component of any aircraft. This segment benefits from advancements in material science, particularly the use of titanium and carbon composites, which reduce the overall weight of the landing gear while maintaining structural integrity.

Within this segment, commercial fixed-wing aircraft represent the largest subsegment. Airlines are increasingly prioritizing the use of lightweight landing gear systems to improve fuel efficiency and reduce operational costs. As a result, manufacturers are focusing on innovations such as retractable landing gear systems and advanced braking mechanisms that enhance performance. The rising demand for commercial aircraft, combined with ongoing technological advancements, positions the main landing gear segment as a dominant force in the market through 2030.

Nose Landing Gear Segment is Fastest Growing Owing to Advancements in Automation and Electronics

The nose landing gear segment is expected to experience the fastest growth during the forecast period, driven by advancements in automation and electronic systems integrated into aircraft designs. The nose landing gear, located at the front of the aircraft, plays a crucial role in steering and guiding the aircraft during takeoff, landing, and taxiing. Innovations such as electronically controlled steering systems and anti-skid technologies have significantly enhanced the performance and safety of nose landing gears.

The fastest-growing subsegment within this category is unmanned aerial vehicles (UAVs) or drones. As UAVs become increasingly sophisticated, there is a growing demand for advanced landing gear systems that can support both automated and manual operations. The use of UAVs in military surveillance, commercial delivery services, and emergency response operations has led to a surge in demand for nose landing gears with enhanced durability and precision. This trend is expected to drive the growth of the nose landing gear segment at a rapid pace through 2030.

Hydraulic Landing Gear Segment is the Largest Owing to Its Widespread Application in Aircraft Systems

The hydraulic landing gear segment holds the largest share in the market, attributed to the widespread use of hydraulic systems in both commercial and military aircraft. Hydraulic landing gears are known for their reliability, strength, and ability to handle high loads, making them the preferred choice for large aircraft. These systems are integral to the safe operation of landing gears, enabling smooth retraction and extension during takeoff and landing.

Within this segment, narrow-body commercial aircraft represent the largest subsegment. As the global aviation industry experiences a rise in short-haul flights, the demand for narrow-body aircraft has increased. These aircraft rely heavily on hydraulic landing gear systems to optimize performance and reduce maintenance costs. The robust nature of hydraulic systems and their ability to support heavy aircraft make them indispensable in this market segment, ensuring their continued dominance through 2030.

Electric Landing Gear Segment is Fastest Growing Owing to the Push for Green Aviation Solutions

The electric landing gear segment is anticipated to witness the fastest growth over the forecast period, driven by the push for greener aviation solutions and the integration of more electric aircraft (MEA) technologies. Electric landing gears offer significant advantages over traditional hydraulic systems, including reduced weight, lower maintenance costs, and increased fuel efficiency. These benefits align with the growing industry focus on sustainability and reducing carbon emissions.

The fastest-growing subsegment within the electric landing gear category is the regional jet sector. As regional airlines look for more sustainable and cost-effective solutions, the adoption of electric landing gears is gaining traction. Electric systems are particularly appealing for regional jets operating short-haul routes, where fuel efficiency and reduced maintenance are critical. This trend is expected to drive the rapid growth of the electric landing gear segment in the coming years.

Asia-Pacific Region is the Fastest Growing Owing to Expanding Aviation Industry and Infrastructure Development

The Asia-Pacific region is projected to be the fastest-growing market for aircraft landing gears, owing to rapid expansion in the aviation sector and significant infrastructure development in emerging economies such as China, India, and Southeast Asian countries. The region's growing middle-class population, increased air travel demand, and rising defense budgets have created a surge in aircraft procurement, fueling the demand for landing gear systems.

Countries like China and India are witnessing substantial growth in both commercial aviation and military aircraft fleets, with government initiatives aimed at modernizing air transportation infrastructure and enhancing defense capabilities. As a result, the Asia-Pacific region is expected to dominate the market in terms of growth, with a significant portion of aircraft landing gear demand coming from this region through 2030.

Competitive Landscape: Key Players and Market Dynamics

The aircraft landing gears market is highly competitive, with several leading companies dominating the space through continuous innovation and strategic partnerships. Major players in this market include Safran S.A., Collins Aerospace (a division of Raytheon Technologies), Liebherr Aerospace, and Heroux-Devtek Inc. These companies are focused on developing lightweight, durable, and technologically advanced landing gear systems that meet the evolving needs of the aviation industry.

The competitive landscape is marked by a strong emphasis on research and development (R&D), with companies investing heavily in the development of electric and automated landing gear systems. Additionally, strategic collaborations between OEMs and landing gear manufacturers are shaping the future of the market. As airlines and defense organizations prioritize fleet modernization and fuel efficiency, the demand for innovative landing gear solutions is expected to rise, intensifying competition among key market players through 2030.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.8 billion |

|

Forecasted Value (2030) |

USD 13.0 billion |

|

CAGR (2024 – 2030) |

5.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aircraft Landing Gears Market By Component (Landing Gear System, Actuation System, Braking System, Tires), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, UAV), By Material (Aluminum Alloys, Steel Alloys, Composite Materials, Titanium Alloys), and By End-User (OEM, Aftermarket) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aircraft Landing Gears Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Landing Gear System |

|

4.2. Actuation System |

|

4.3. Braking System |

|

4.4. Tires |

|

4.5. Others |

|

5. Aircraft Landing Gears Market, by Platform (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Fixed-Wing Aircraft |

|

5.1.1. Commercial Aircraft |

|

5.1.1.1. Narrow-Body Aircraft |

|

5.1.1.2. Wide-Body Aircraft |

|

5.1.1.3. Regional Jets |

|

5.1.2. Military Aircraft |

|

5.1.2.1. Fighter Aircraft |

|

5.1.2.2. Transport Aircraft |

|

5.1.2.3. Surveillance & Reconnaissance Aircraft |

|

5.1.3. General Aviation |

|

5.1.3.1. Business Jets |

|

5.1.3.2. Light Aircraft |

|

5.1.3.3. Training Aircraft |

|

5.2. Rotary-Wing Aircraft |

|

5.2.1. Civil Helicopters |

|

5.2.2. Military Helicopters |

|

5.3. UAV |

|

6. Aircraft Landing Gears Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Aluminum Alloys |

|

6.2. Steel Alloys |

|

6.3. Composite Materials |

|

6.4. Titanium Alloys |

|

6.5. Others |

|

7. Aircraft Landing Gears Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. OEM |

|

7.2. Aftermarket |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Aircraft Landing Gears Market, by Component |

|

8.2.7. North America Aircraft Landing Gears Market, by Platform |

|

8.2.8. North America Aircraft Landing Gears Market, by Material |

|

8.2.9. North America Aircraft Landing Gears Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Aircraft Landing Gears Market, by Component |

|

8.2.10.1.2. US Aircraft Landing Gears Market, by Platform |

|

8.2.10.1.3. US Aircraft Landing Gears Market, by Material |

|

8.2.10.1.4. US Aircraft Landing Gears Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AAR Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. CIRCOR Aerospace |

|

10.3. Eaton |

|

10.4. GKN Aerospace |

|

10.5. Heroux-Devtek |

|

10.6. Honeywell |

|

10.7. Liebherr Aerospace |

|

10.8. Magellan Aerospace |

|

10.9. Mitsubishi Heavy Industries |

|

10.10. Moog Inc. |

|

10.11. Parker Hannifin |

|

10.12. RTX Corporation |

|

10.13. Safran Landing Systems |

|

10.14. Sumitomo |

|

10.15. Triumph Group |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aircraft Landing Gears Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aircraft Landing Gears Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aircraft Landing Gears ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aircraft Landing Gears Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA