As per Intent Market Research, the Aircraft Fuel Systems Market was valued at USD 8.5 billion in 2023 and will surpass USD 13.1 billion by 2030; growing at a CAGR of 6.5% during 2024 - 2030.

The Aircraft Fuel Systems Market comprises several segments, including Commercial Aviation, Military Aviation, Business Aviation, and General Aviation. Each of these segments is influenced by unique market dynamics, technological innovations, and regulatory frameworks, driving the demand for various types of fuel systems. As the industry transitions toward more efficient and sustainable practices, the focus on advanced fuel systems will intensify, fostering opportunities for growth and innovation.

Commercial Aviation Segment is Largest Owing to Increased Air Travel

The commercial aviation segment dominates the Aircraft Fuel Systems Market, driven primarily by the rising number of air travelers globally and the consequent demand for new aircraft. In recent years, there has been a significant increase in air traffic, with the International Air Transport Association (IATA) forecasting that the number of air passengers will reach approximately 8.2 billion by 2037. This surge in passenger demand has propelled airlines to invest in modernizing their fleets, thereby necessitating advanced aircraft fuel systems to enhance fuel efficiency and minimize operational costs.

One of the largest subsegments within commercial aviation is the Fuel Tank and Fuel Management System. These systems are pivotal for ensuring optimal fuel storage and distribution, leading to improved aircraft performance and safety. Innovations in fuel management technologies, such as real-time monitoring and automated fuel management systems, are being widely adopted by airlines to enhance fuel efficiency and reduce wastage. As a result, this subsegment is expected to maintain a significant market share, aligning with the increasing focus on sustainability in the aviation sector.

Military Aviation Segment is Fastest Growing Owing to Enhanced Defense Spending

The military aviation segment is anticipated to be the fastest-growing area within the Aircraft Fuel Systems Market. Governments worldwide are increasing their defense budgets in response to evolving geopolitical challenges and the need for modernized military capabilities. This increase in defense spending is expected to drive demand for advanced military aircraft, which in turn necessitates state-of-the-art fuel systems designed to support high-performance military operations.

The fastest-growing subsegment in military aviation is the Advanced Fuel Systems, which includes specialized fuel management systems that enhance aircraft operational efficiency and safety during complex military missions. These systems are engineered to meet the unique requirements of military aircraft, providing superior fuel handling and storage solutions. As countries focus on upgrading their air forces with advanced technologies, the demand for innovative fuel systems tailored for military applications is expected to rise significantly, further propelling growth in this segment.

Business Aviation Segment is Largest Owing to Corporate Travel Resurgence

The business aviation segment has gained prominence due to the resurgence in corporate travel and the increasing preference for private jets among high-net-worth individuals and corporations. Business aviation offers enhanced flexibility, time savings, and privacy, making it an attractive option for executives and corporate teams. The segment is poised for growth as more companies recognize the value of business aviation in enhancing productivity and operational efficiency.

The largest subsegment within business aviation is the Jet Fuel Systems segment. These systems are crucial for the operation of business jets, providing reliable fuel management solutions that ensure optimal performance and safety. As manufacturers continue to innovate with advanced fuel systems that enhance the performance and efficiency of business jets, the demand for jet fuel systems is expected to remain robust. Additionally, the growing emphasis on sustainable aviation fuels (SAFs) will further enhance the appeal of jet fuel systems, as businesses seek to reduce their environmental impact.

General Aviation Segment is Fastest Growing Owing to Technological Innovations

The general aviation segment is experiencing rapid growth, driven by technological advancements and a burgeoning interest in private flying, recreational flying, and flight training. The rise of affordable and technologically advanced general aviation aircraft has made flying more accessible to a broader audience, stimulating demand in this segment. The growth of flight schools and personal flying is further propelling the general aviation market.

The fastest-growing subsegment in general aviation is the Fuel Injection Systems. These systems are gaining popularity due to their efficiency and ability to improve aircraft performance. Modern fuel injection systems offer enhanced fuel economy and reduced emissions, aligning with the industry's shift toward sustainability. As more general aviation pilots and operators seek to optimize fuel usage and performance, the demand for advanced fuel injection systems is expected to rise, positioning this subsegment for substantial growth in the coming years.

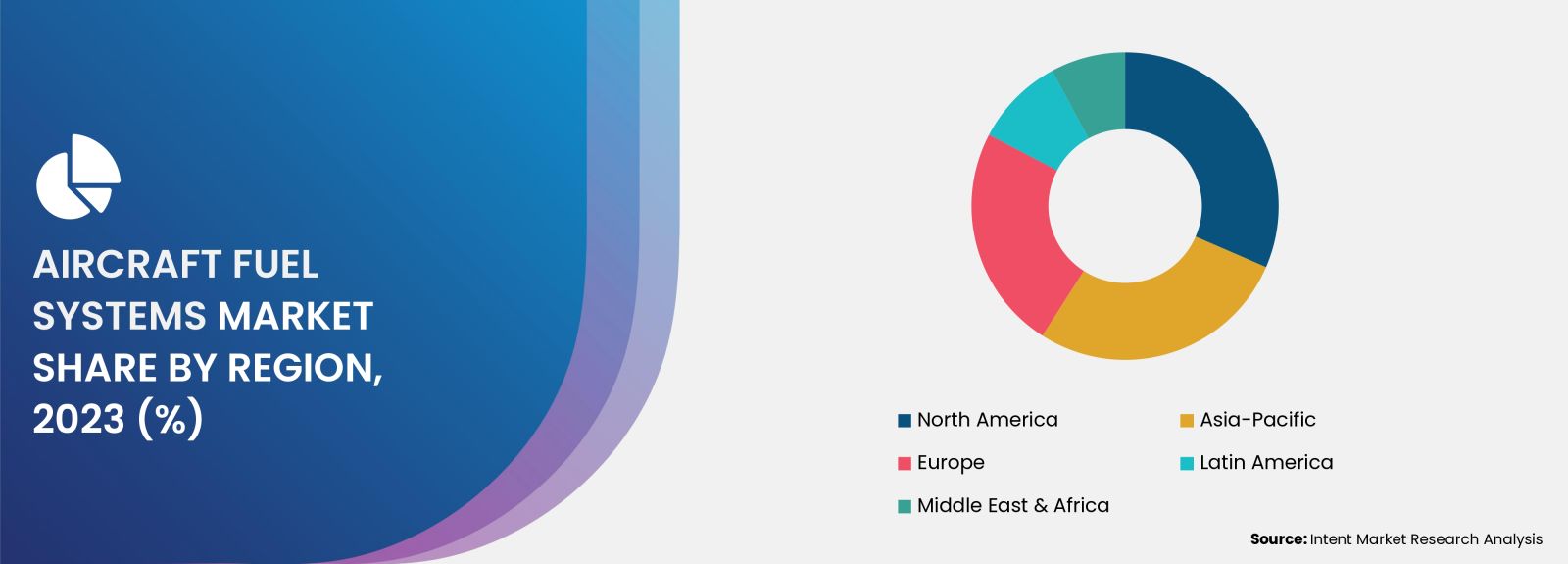

Regional Overview: North America is Largest Region Owing to Aerospace Dominance

North America is the largest region in the Aircraft Fuel Systems Market, largely attributed to its well-established aerospace industry and the presence of major aircraft manufacturers and fuel system suppliers. The United States, in particular, boasts a robust aviation market, characterized by a diverse range of commercial, military, and general aviation activities. The region's advanced infrastructure, research and development capabilities, and strong regulatory frameworks contribute to its dominance in the global aircraft fuel systems landscape.

In addition to being the largest market, North America is also witnessing a shift toward innovative fuel systems that enhance efficiency and comply with stringent environmental regulations. As a result, key players in the region are focusing on the development and deployment of advanced fuel management systems and sustainable aviation fuels, ensuring that North America maintains its leadership in the aircraft fuel systems sector through 2030.

Competitive Landscape: Leading Companies Shaping the Future

The Aircraft Fuel Systems Market is characterized by the presence of several leading companies that are continuously innovating and expanding their product offerings to maintain a competitive edge. Prominent players in this market include Honeywell International Inc., Parker Hannifin Corporation, Safran S.A., and Eaton Corporation PLC, among others. These companies invest heavily in research and development to create advanced fuel systems that meet the evolving needs of the aerospace industry.

The competitive landscape is shaped by strategic partnerships, mergers and acquisitions, and collaborations that enhance product portfolios and market reach. As the demand for sustainable aviation solutions grows, companies are increasingly focusing on developing environmentally friendly fuel systems and alternative fuels to align with global sustainability initiatives. This dynamic competitive environment is expected to foster innovation and drive growth in the Aircraft Fuel Systems Market over the forecast period from 2024 to 2030.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.5 billion |

|

Forecasted Value (2030) |

USD 13.1 billion |

|

CAGR (2024 – 2030) |

6.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aircraft Fuel Systems Market By Application (Commercial, Military, UAV), By Engine Type (Turboprop Engine, UAV Engine, Jet Engine, Helicopter Engine), By Component (Valves, Gauges, Piping, Inerting Systems, Pumps), By Technology (Fuel Injection, Pump Feed, Gravity Feed) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

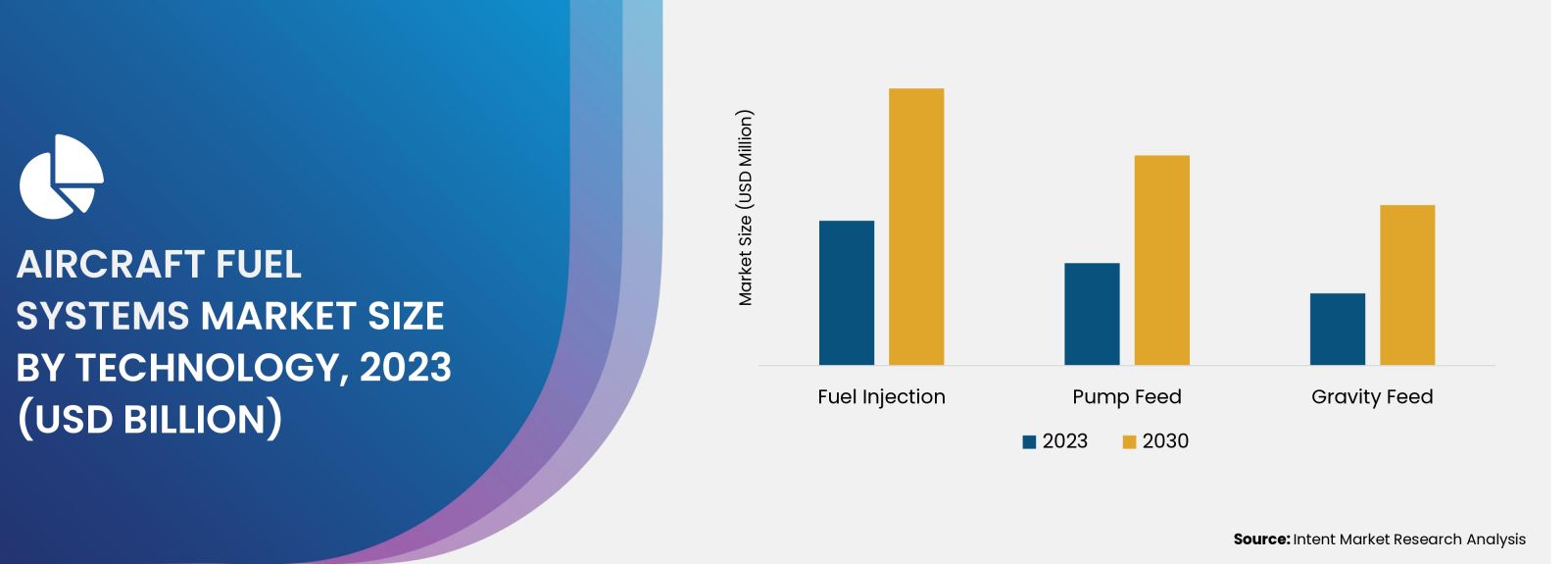

4. Aircraft Fuel Systems Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Fuel Injection |

|

4.2. Pump Feed |

|

4.3. Gravity Feed |

|

5. Aircraft Fuel Systems Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Valves |

|

5.2. Gauges |

|

5.3. Piping |

|

5.4. Inerting Systems |

|

5.5. Pumps |

|

5.6. Others |

|

6. Aircraft Fuel Systems Market, by Engine Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Turboprop Engine |

|

6.2. UAV Engine |

|

6.3. Jet Engine |

|

6.4. Helicopter Engine |

|

7. Aircraft Fuel Systems Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Commercial |

|

7.2. Military |

|

7.3. UAV |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Aircraft Fuel Systems Market, by Technology |

|

8.2.7. North America Aircraft Fuel Systems Market, by Component |

|

8.2.8. North America Aircraft Fuel Systems Market, by Engine Type |

|

8.2.9. North America Aircraft Fuel Systems Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Aircraft Fuel Systems Market, by Technology |

|

8.2.10.1.2. US Aircraft Fuel Systems Market, by Component |

|

8.2.10.1.3. US Aircraft Fuel Systems Market, by Engine Type |

|

8.2.10.1.4. US Aircraft Fuel Systems Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Collins Aerospace |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Crane Aerospace & Electronics |

|

10.3. Eaton |

|

10.4. GKN Aerospace |

|

10.5. Honeywell International, Inc. |

|

10.6. Parker Hannifin Corporation |

|

10.7. Safran Aerosystems |

|

10.8. Triumph Group |

|

10.9. United Technologies Corporation |

|

10.10. Woodward |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aircraft Fuel Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aircraft Fuel Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aircraft Fuel Systems ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aircraft Fuel Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment

NA