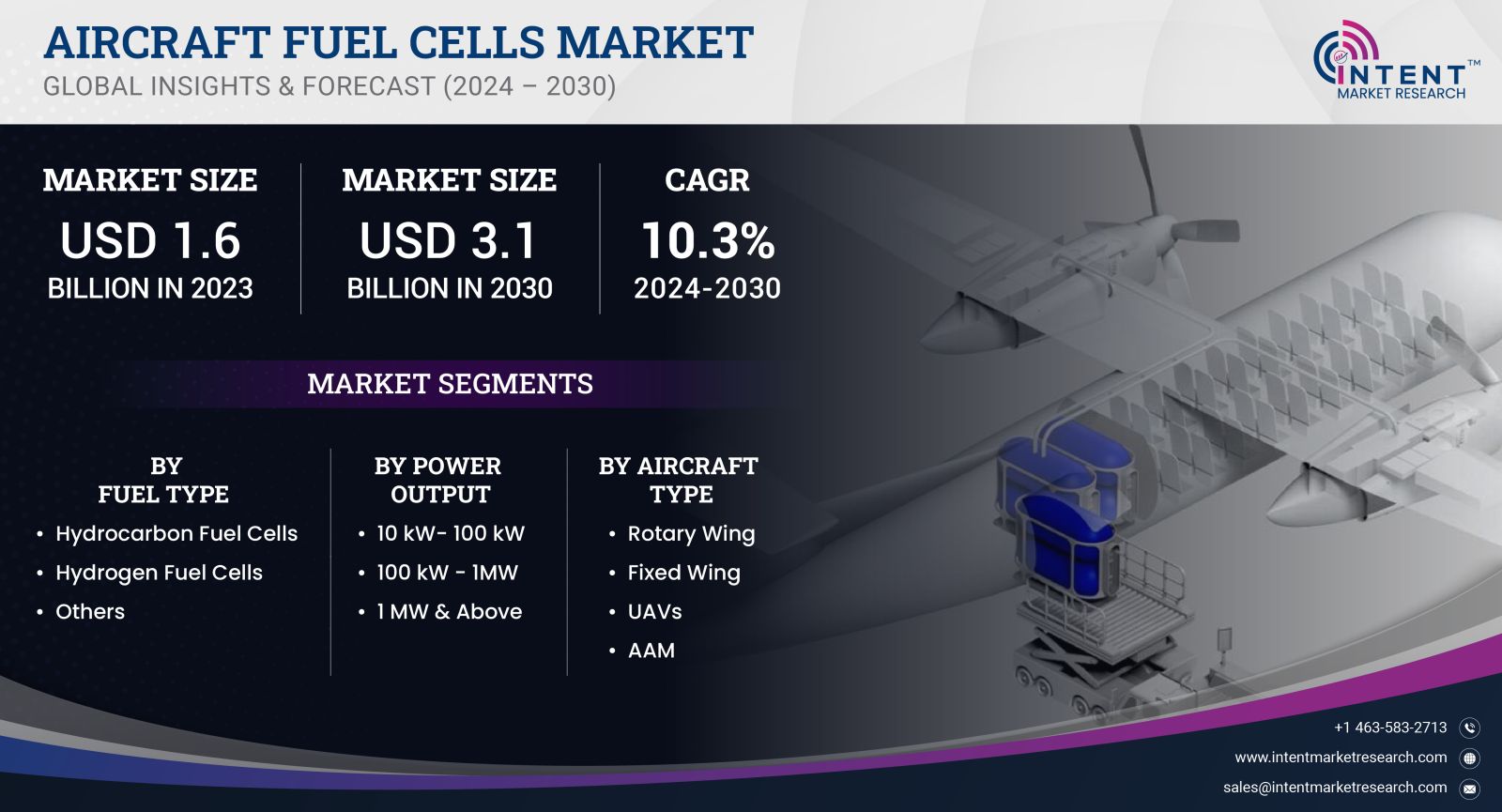

As per Intent Market Research, the Aircraft Fuel Cells Market was valued at USD 1.6 billion in 2023-e and will surpass USD 3.1 billion by 2030; growing at a CAGR of 10.3% during 2024 - 2030.

The market comprises various segments, including product type, application, platform, and region. Each segment is characterized by distinct subsegments that cater to specific industry needs. Understanding these segments and their dynamics is crucial for stakeholders looking to invest or expand in the aircraft fuel cells market. This report delves into the leading subsegments within each segment, highlighting their growth potential and market impact, along with regional insights and competitive landscape analysis.

Product Segment is Fastest Growing Owing to Technological Advancements

Among the various product types in the Aircraft Fuel Cells Market, hydrogen fuel cells are emerging as the fastest-growing segment. This surge is primarily attributed to their high efficiency and environmentally friendly nature, positioning them as a viable alternative to traditional power sources. Hydrogen fuel cells convert chemical energy from hydrogen into electricity, emitting only water vapor as a byproduct. The aviation industry’s focus on reducing greenhouse gas emissions and enhancing energy efficiency is fueling the adoption of this technology.

Furthermore, advancements in hydrogen production methods and storage technologies are significantly contributing to the growth of hydrogen fuel cells in aviation. Governments and private entities are investing heavily in research and development to improve the efficiency and cost-effectiveness of hydrogen production, making it a more accessible option for airlines. As infrastructure for hydrogen refueling continues to expand, the market for hydrogen fuel cells is expected to gain momentum, setting a robust growth trajectory through 2030.

Application Segment is Largest Owing to Commercial Aviation Demand

Within the application segment of the Aircraft Fuel Cells Market, the commercial aviation subsegment stands out as the largest, driven by the high demand for passenger and cargo air travel. With increasing global air traffic and a growing middle class, commercial aviation is under pressure to innovate and enhance fuel efficiency. Aircraft fuel cells offer an attractive solution, providing lightweight, efficient power sources that can help airlines meet rising operational demands while reducing emissions.

The commercial aviation sector is also witnessing a trend towards more sustainable practices, with major airlines committing to net-zero emissions targets. This shift is propelling investments in new aircraft designs and retrofitting existing fleets with fuel cell technology. As airlines look for alternative energy sources to complement or replace conventional jet fuels, the commercial aviation subsegment is set to maintain its dominance in the market, ensuring a steady demand for aircraft fuel cells.

Platform Segment is Largest Owing to Increased Military Investments

In the platform segment of the Aircraft Fuel Cells Market, the military aviation subsegment is recognized as the largest, largely due to substantial investments in advanced military aircraft technologies. Governments worldwide are increasingly focusing on enhancing the capabilities of their armed forces, leading to the development of next-generation aircraft that require more efficient and sustainable power sources. Fuel cells offer several advantages, including reduced noise and heat signatures, making them particularly appealing for military applications.

Moreover, the military’s commitment to achieving energy independence and sustainability further bolsters the demand for fuel cells. Programs aimed at developing hybrid-electric and fully electric military aircraft are gaining traction, with fuel cells serving as a crucial component in these systems. As defense budgets continue to expand, investments in aircraft fuel cells are expected to rise, driving growth in the military aviation subsegment through 2030.

Region Segment is Fastest Growing Owing to Supportive Regulations

In terms of regional dynamics, the Asia-Pacific region is poised to be the fastest-growing market for aircraft fuel cells, primarily due to favorable government policies and increasing investments in aviation infrastructure. Countries such as China, Japan, and South Korea are leading the charge in promoting sustainable aviation initiatives, aligning with global efforts to mitigate climate change. The region’s focus on technological innovation and infrastructure development creates a conducive environment for the adoption of aircraft fuel cells.

Additionally, the rising demand for air travel in emerging economies is propelling the growth of the aviation sector, further amplifying the need for efficient and sustainable power solutions. With the Asia-Pacific region's commitment to reducing emissions and investing in next-generation technologies, the aircraft fuel cells market is expected to flourish, presenting significant opportunities for manufacturers and stakeholders.

Competitive Landscape and Leading Companies

The Aircraft Fuel Cells Market is characterized by a competitive landscape with several key players at the forefront of innovation and technology. Leading companies such as Ballard Power Systems, Plug Power, Hydrogenics, and UTC Aerospace Systems are actively involved in research and development to enhance the performance and efficiency of fuel cell systems for aviation applications. These companies are forming strategic partnerships and collaborations to expand their product offerings and strengthen their market position.

As the market evolves, companies are also focusing on sustainability and reducing costs associated with fuel cell production. The competitive dynamics are further influenced by regulatory pressures and the push for greener technologies, prompting industry players to invest in developing advanced fuel cell systems. With ongoing advancements and increasing adoption of fuel cells in the aviation sector, the competitive landscape is expected to intensify, driving innovation and growth in the Aircraft Fuel Cells Market.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.6 billion |

|

Forecasted Value (2030) |

USD 3.1 billion |

|

CAGR (2024-2030) |

10.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aircraft Fuel Cells Market By Fuel Type (Hydrogen, Hydrocarbon), By Power Output (10kW-100kW, 100kW-1MW, 1MW & Above), By Aircraft Type (Rotary Wing, Fixed Wing, UAVs, AAMs) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Aircraft Fuel Cells Market, by Fuel Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Hydrocarbon Fuel Cells |

|

4.2.Hydrogen Fuel Cells |

|

4.3.Others |

|

5.Aircraft Fuel Cells Market, by Power Output (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.10 kW- 100 kW |

|

5.2.100 kW - 1MW |

|

5.3.1 MW & Above |

|

6.Aircraft Fuel Cells Market, by Aircraft Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Rotary Wing |

|

6.2.Fixed Wing |

|

6.3.UAVs |

|

6.4.AAM |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Aircraft Fuel Cells Market, by Fuel Type |

|

7.2.7.North America Aircraft Fuel Cells Market, by Power Output |

|

7.2.8.North America Aircraft Fuel Cells Market, by Aircraft Type |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Aircraft Fuel Cells Market, by Fuel Type |

|

7.3.1.2.US Aircraft Fuel Cells Market, by Power Output |

|

7.3.1.3.US Aircraft Fuel Cells Market, by Aircraft Type |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each regional and country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.7.Latin America |

|

7.8.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.ZeroAvia |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Piasecki Aircraft Corporation |

|

9.3.Intelligent Energy Limited |

|

9.4.Doosan Mobility Innovation |

|

9.5.H3 Dynamics |

|

9.6.Airbus |

|

9.7.Aerovironment |

|

9.8.Apus Group |

|

9.9.Universal Hydrogen |

|

9.10.Embraer |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aircraft Fuel Cells Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the aircraft fuel cells Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the aircraft fuel cells ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the aircraft fuel cells market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA