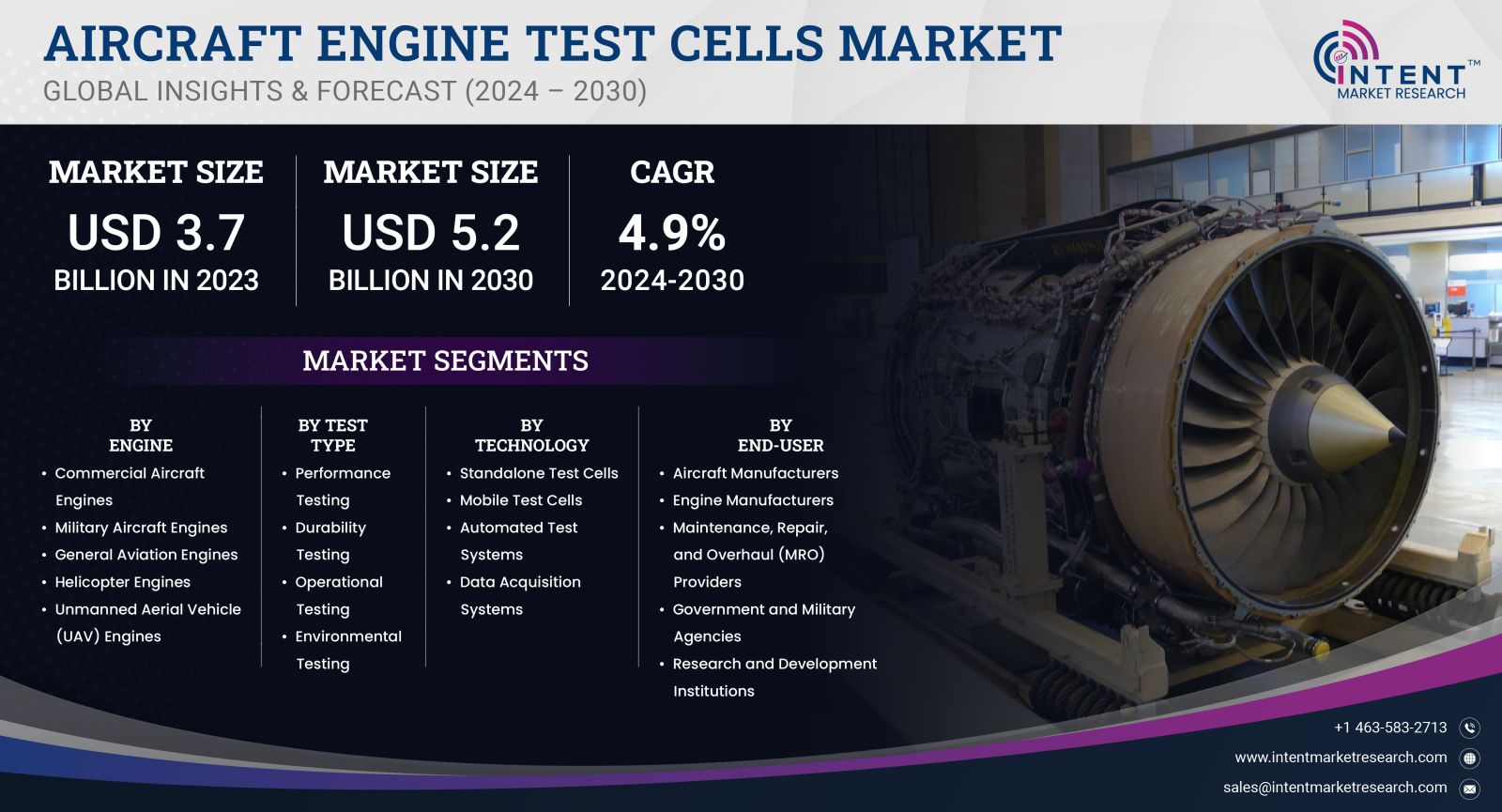

As per Intent Market Research, the Aircraft Engine Test Cells Market was valued at USD 3.7 billion in 2023 and will surpass USD 5.2 billion by 2030; growing at a CAGR of 4.9% during 2024 - 2030.

The Aircraft Engine Test Cells Market is a vital segment within the aerospace and defense industry, responsible for evaluating the performance and efficiency of aircraft engines under controlled conditions. These specialized facilities provide a range of tests, including performance evaluations, emissions analysis, and noise measurement, which are essential for ensuring the safety and reliability of modern aircraft. As air traffic continues to increase globally, the demand for advanced testing facilities is rising, driven by the need for compliance with stringent regulatory standards and the growing emphasis on sustainable aviation practices.

Engine Test Cells Segment is Largest Owing to Increased Demand for Engine Performance Testing

Among the various segments of the Aircraft Engine Test Cells Market, the engine test cells segment is the largest, primarily due to the rising demand for engine performance testing. Aircraft engines are subjected to rigorous testing to ensure they meet performance, reliability, and safety standards. These test cells are equipped with state-of-the-art technology to simulate various flight conditions, allowing manufacturers to assess engine performance before deployment. With the aerospace industry experiencing a robust recovery post-pandemic, the need for comprehensive testing solutions has surged, making this segment a critical player in the market.

The demand for engine test cells is expected to remain strong, particularly as new technologies emerge, including hybrid-electric and sustainable aviation fuel-powered engines. This shift towards innovative engine designs necessitates advanced testing capabilities to validate their performance and environmental impact. As a result, companies investing in modern test cells equipped with cutting-edge technology will gain a competitive advantage, ensuring compliance with increasingly stringent regulations and catering to the evolving needs of aircraft manufacturers.

Component Testing Segment is Fastest Growing Owing to Technological Advancements

The component testing segment is the fastest-growing area within the Aircraft Engine Test Cells Market, fueled by rapid technological advancements and increasing complexity in aircraft engine components. As manufacturers integrate more sophisticated materials and systems, the need for detailed component testing has escalated. This segment includes the evaluation of critical engine parts such as fuel systems, turbines, and electronic control units, which require precise testing to ensure optimal performance and reliability.

With the ongoing innovation in aerospace technology, particularly the adoption of smart materials and advanced manufacturing techniques, the component testing segment is projected to experience exponential growth. The increasing focus on reducing operational costs and improving efficiency drives demand for thorough testing processes. As airlines and manufacturers prioritize safety and performance, investing in advanced component testing capabilities will be essential to meet these expectations and maintain a competitive edge in the market.

Services Segment is Largest Owing to Ongoing Maintenance Needs

Within the Aircraft Engine Test Cells Market, the services segment stands out as the largest category, primarily due to the ongoing maintenance needs of aircraft engines. Regular maintenance and performance checks are crucial for ensuring the longevity and safety of engines, and as airlines operate fleets with increased flight hours, the demand for testing services has grown significantly. This segment encompasses a range of services, including routine inspections, repairs, and upgrades, all of which are critical to maintaining engine performance.

The increasing emphasis on operational efficiency and regulatory compliance among airlines further enhances the significance of the services segment. As airlines seek to optimize their operations and reduce costs, investing in comprehensive testing services becomes essential. This trend is expected to continue, with the services segment remaining a key revenue generator for companies operating within the Aircraft Engine Test Cells Market.

Commercial Aviation Segment is Fastest Growing Owing to Rising Air Travel

The commercial aviation segment is the fastest-growing area of the Aircraft Engine Test Cells Market, driven by the resurgence of global air travel and the expansion of low-cost carriers. As passenger traffic increases, airlines are investing in new aircraft to meet demand, subsequently driving the need for effective engine testing solutions. This segment's growth is further fueled by the rise in aircraft deliveries and the replacement of older aircraft models with more fuel-efficient alternatives, requiring rigorous testing to validate engine performance.

Moreover, the growing focus on sustainability within the commercial aviation sector is prompting manufacturers to develop engines that comply with stringent emission regulations. As a result, the demand for advanced testing facilities that can accurately evaluate these innovative engines will continue to rise. The commercial aviation segment is poised for remarkable growth, presenting lucrative opportunities for stakeholders involved in the Aircraft Engine Test Cells Market.

Military Aviation Segment is Largest Owing to Increased Defense Spending

The military aviation segment is the largest within the Aircraft Engine Test Cells Market, primarily due to increased defense spending across various nations. Governments are investing heavily in modernizing their military fleets, which includes the procurement of advanced aircraft engines. The need for reliable and efficient engines in military operations necessitates rigorous testing to ensure operational readiness and performance under challenging conditions.

With geopolitical tensions rising in several regions, defense budgets are expected to expand, further driving the demand for military aircraft and, consequently, for testing services. The military aviation segment's dominance reflects the importance of ensuring that military aircraft operate at peak performance, underscoring the critical role of aircraft engine test cells in the defense sector.

Regional Analysis: North America is Largest Region Owing to Technological Leadership

North America emerges as the largest region in the Aircraft Engine Test Cells Market, owing to its technological leadership and a well-established aerospace and defense industry. The presence of key players, extensive research and development facilities, and a strong regulatory framework contribute to the region's dominance. The United States, in particular, is home to several major aerospace companies that prioritize engine testing to ensure compliance with stringent safety standards.

Additionally, the region's focus on innovation, coupled with government support for aerospace initiatives, fosters a conducive environment for the growth of the Aircraft Engine Test Cells Market. As advancements in technology continue to shape the industry, North America is expected to maintain its leading position, driving significant investments in aircraft engine testing capabilities.

Competitive Landscape and Leading Companies

The competitive landscape of the Aircraft Engine Test Cells Market is characterized by the presence of several leading companies that are continuously innovating to enhance their testing capabilities. Key players such as Rolls-Royce, Pratt & Whitney, General Electric, and Honeywell are at the forefront of developing advanced testing technologies and solutions. These companies focus on strategic partnerships, collaborations, and mergers and acquisitions to expand their market presence and enhance their product offerings.

As the market evolves, companies are increasingly investing in research and development to stay ahead of technological advancements and meet the changing demands of customers. The focus on sustainability and regulatory compliance is also shaping the competitive landscape, prompting companies to develop more efficient and environmentally friendly testing solutions. With ongoing investments in technology and an emphasis on quality and performance, the competitive dynamics in the Aircraft Engine Test Cells Market are expected to intensify, presenting both challenges and opportunities for stakeholders.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.7 billion |

|

Forecasted Value (2030) |

USD 5.2 billion |

|

CAGR (2024 – 2030) |

4.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aircraft Engine Test Cells Market By Engine (Commercial Aircraft Engines, Military Aircraft Engines, General Aviation Engines, Helicopter Engines, Unmanned Aerial Vehicle (UAV) Engines), By Test Type (Performance Testing, Durability Testing, Operational Testing, Environmental Testing), By Technology (Standalone Test Cells, Mobile Test Cells, Automated Test Systems, Data Acquisition Systems), and By End-User (Aircraft Manufacturers, Engine Manufacturers, Maintenance, Repair, and Overhaul (MRO) Providers, Government and Military Agencies, Research and Development Institutions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aircraft Engine Test Cells Market, by Engine (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Commercial Aircraft Engines |

|

4.2. Military Aircraft Engines |

|

4.3. General Aviation Engines |

|

4.4. Helicopter Engines |

|

4.5. Unmanned Aerial Vehicle (UAV) Engines |

|

5. Aircraft Engine Test Cells Market, by Test Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Performance Testing |

|

5.2. Durability Testing |

|

5.3. Operational Testing |

|

5.4. Environmental Testing |

|

6. Aircraft Engine Test Cells Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Standalone Test Cells |

|

6.2. Mobile Test Cells |

|

6.3. Automated Test Systems |

|

6.4. Data Acquisition Systems |

|

7. Aircraft Engine Test Cells Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Aircraft Manufacturers |

|

7.2. Engine Manufacturers |

|

7.3. Maintenance, Repair, and Overhaul (MRO) Providers |

|

7.4. Government and Military Agencies |

|

7.5. Research and Development Institutions |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Aircraft Engine Test Cells Market, by Engine |

|

8.2.7. North America Aircraft Engine Test Cells Market, by Test Type |

|

8.2.8. North America Aircraft Engine Test Cells Market, by Technology |

|

8.2.9. North America Aircraft Engine Test Cells Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Aircraft Engine Test Cells Market, by Engine |

|

8.2.10.1.2. US Aircraft Engine Test Cells Market, by Test Type |

|

8.2.10.1.3. US Aircraft Engine Test Cells Market, by Technology |

|

8.2.10.1.4. US Aircraft Engine Test Cells Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Aerojet Rocketdyne |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Airbus |

|

10.3. Boeing |

|

10.4. Curtiss-Wright |

|

10.5. General Electric |

|

10.6. Honeywell |

|

10.7. MTU Aero Engines |

|

10.8. Raytheon Technologies |

|

10.9. Rolls-Royce |

|

10.10. Safran |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aircraft Engine Test Cells Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aircraft Engine Test Cells Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aircraft Engine Test Cells ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aircraft Engine Test Cells Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA