As per Intent Market Research, the Aircraft Actuators Market was valued at USD 9.6 billion in 2023 and will surpass USD 16.4 billion by 2030; growing at a CAGR of 7.9% during 2024 - 2030.

The Aircraft Actuators Market is anticipated to witness significant growth from 2024 to 2030, driven by technological advancements, increasing air travel demand, and the need for enhanced aircraft efficiency. Actuators play a pivotal role in converting energy into mechanical motion within aircraft systems, allowing for precise control over various functions such as landing gear, flight control, and engines. As the aviation industry focuses on fuel efficiency, reduced emissions, and automation, aircraft actuators are becoming an essential component, contributing to both performance improvements and sustainability initiatives.

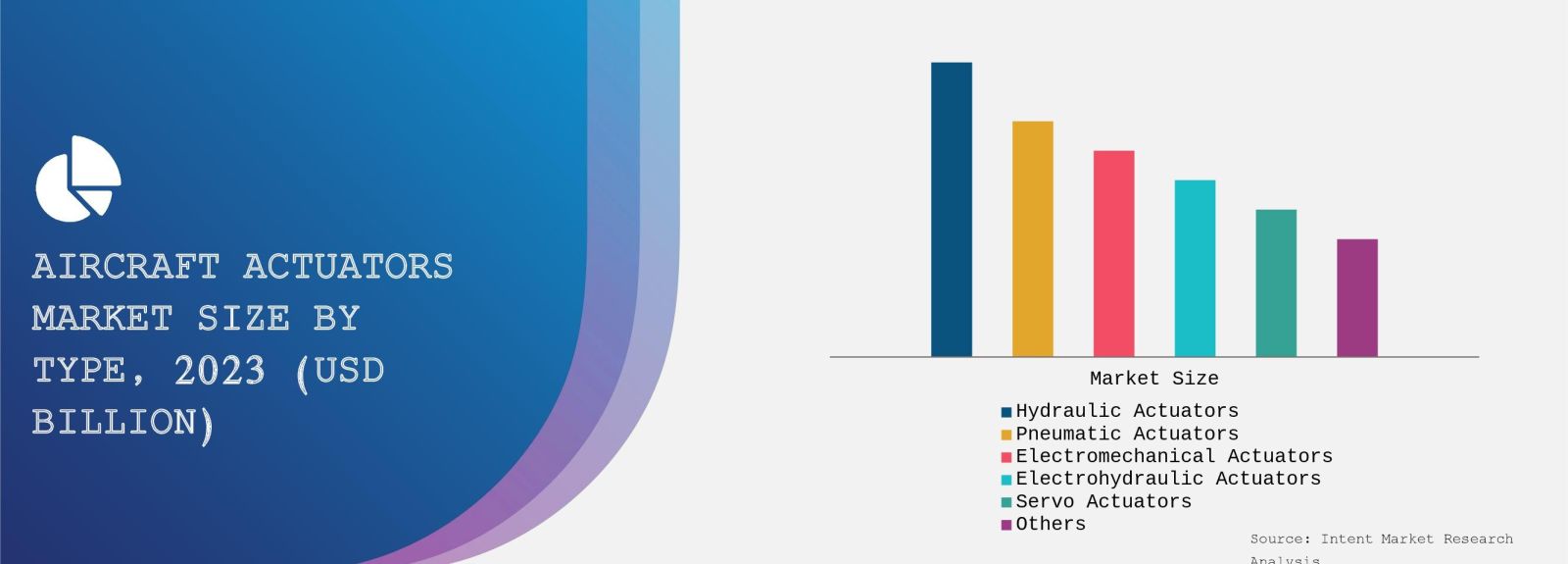

Hydraulic Actuators Segment is Largest Owing to Extensive Applications

Hydraulic actuators dominate the aircraft actuators market due to their extensive application in high-power operations and critical flight functions. Hydraulic systems are known for their ability to generate significant force, making them ideal for applications such as landing gear and flight control surfaces, where reliability and power are essential.

The largest subsegment within the hydraulic actuators category is the flight control actuators. These actuators are responsible for controlling the movement of a plane's ailerons, elevators, and rudder, which are critical for maneuvering the aircraft during flight. The high reliability, durability, and power-to-weight ratio of hydraulic actuators make them indispensable in commercial and military aircraft alike. As newer aircraft models are designed to be lighter and more fuel-efficient, the demand for sophisticated hydraulic actuator systems is expected to remain robust, cementing their position as the largest segment.

Electric Actuators Segment is Fastest Growing Owing to Demand for More-Electric Aircraft

The electric actuators segment is experiencing the fastest growth, fueled by the aviation industry's shift toward more-electric aircraft (MEA) that rely on electric systems for various operations. Electric actuators are favored for their energy efficiency, lower maintenance, and ability to reduce the weight of aircraft by eliminating the need for complex hydraulic systems.

Within this segment, the landing gear actuation systems are the fastest-growing subsegment. The growing adoption of electric landing gear systems in modern aircraft, such as the Boeing 787 and Airbus A350, highlights the industry's focus on reducing fuel consumption and maintenance costs. These systems are not only more energy-efficient but also contribute to improved overall aircraft performance, making them a crucial area of investment for airlines and aircraft manufacturers alike.

Pneumatic Actuators Segment is Largest Owing to Simplicity and Cost-Effectiveness

Pneumatic actuators hold a significant share in the aircraft actuators market due to their simplicity, reliability, and cost-effectiveness. These actuators are commonly used in non-critical functions where high force is not required but rapid response and lightweight designs are beneficial.

The aircraft cabin systems subsegment is the largest within the pneumatic actuators segment. Pneumatic actuators are widely used in cabin pressurization, door control systems, and passenger seating adjustments. The increasing focus on enhancing passenger comfort and safety in aircraft is driving demand for these systems. In addition, their ease of installation and lower operational costs make pneumatic actuators an attractive choice for aircraft manufacturers.

Mechanical Actuators Segment is Fastest Growing Owing to Lightweight Design and Simplicity

Mechanical actuators are gaining traction as the aviation industry looks for solutions that combine simplicity, reliability, and lightweight construction. These actuators are often used in secondary applications that do not require the high power output of hydraulic or electric systems but still need to function reliably in demanding environments.

The flap actuation systems within the mechanical actuators segment are the fastest growing. As aircraft manufacturers prioritize weight reduction to improve fuel efficiency, mechanical actuators, known for their low weight and straightforward design, are increasingly being used in the wing flap systems of modern aircraft. This growing trend is expected to drive the demand for mechanical actuators in the coming years, particularly in commercial and regional aircraft.

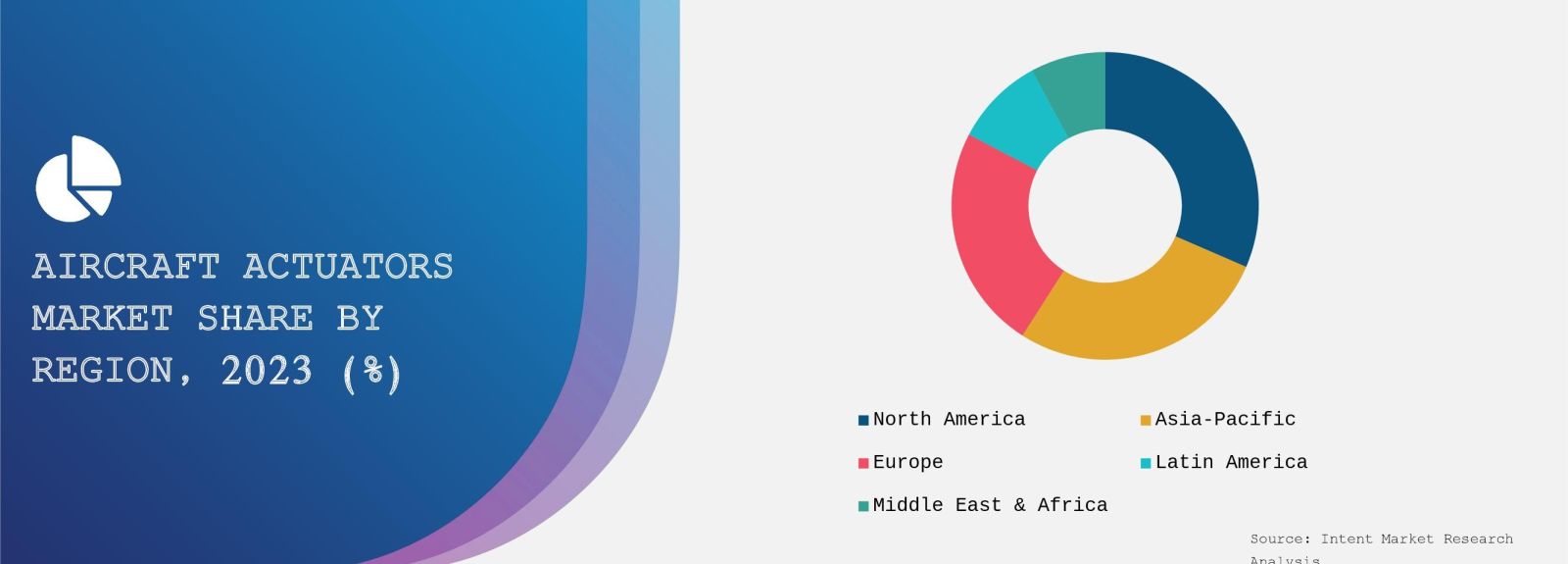

North America is the Largest Region Owing to Strong Aerospace Industry

North America is the largest region in the aircraft actuators market, accounting for a significant share due to the strong presence of major aircraft manufacturers and a well-established aerospace industry. The region is home to leading companies such as Boeing and Lockheed Martin, which are at the forefront of innovation and technology development in the aviation sector.

In addition to its dominance in aircraft production, North America is a hub for technological advancements, particularly in electric and hydraulic actuator systems. The region's defense sector, which invests heavily in advanced military aircraft, also drives demand for high-performance actuators. Moreover, the region's focus on modernizing its fleet of commercial and defense aircraft will continue to sustain its leadership position throughout the forecast period.

Competitive Landscape and Leading Companies

The aircraft actuators market is highly competitive, with several key players competing to develop advanced solutions that meet the evolving demands of the aviation industry. Leading companies such as Honeywell International Inc., Parker Hannifin Corporation, Safran S.A., Collins Aerospace, and Moog Inc. are actively investing in research and development to enhance the efficiency, reliability, and performance of their actuator systems.

These companies are focusing on strategic partnerships and collaborations with aircraft manufacturers to gain a competitive edge. Additionally, the growing emphasis on electric and lightweight actuator systems is prompting companies to innovate and expand their product portfolios. The competitive landscape is expected to intensify as companies strive to meet the rising demand for next-generation aircraft actuators in both commercial and military sectors.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 9.6 billion |

|

Forecasted Value (2030) |

USD 16.4 billion |

|

CAGR (2024 – 2030) |

7.9% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aircraft Actuators Market By Type (Linear, Rotary), By Technology (Hydraulic Actuators, Pneumatic Actuators, Electromechanical Actuators, Electrohydraulic Actuators, Servo Actuators), By Aircraft Type (Commercial Aircraft, Military Aircraft, Business Jets, Helicopters, UAV), By Application (Flight Control Systems, Landing Gear Systems, Thrust Reversers, Auxiliary Control Systems, Braking Systems), By Installation Type (OEM, Retrofit) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aircraft Actuators Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Linear |

|

4.2. Rotary |

|

5. Aircraft Actuators Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hydraulic Actuators |

|

5.2. Pneumatic Actuators |

|

5.3. Electromechanical Actuators |

|

5.4. Electrohydraulic Actuators |

|

5.5. Servo Actuators |

|

5.6. Others |

|

6. Aircraft Actuators Market, by Aircraft Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Commercial Aircraft |

|

6.2. Military Aircraft |

|

6.3. Business Jets |

|

6.4. Helicopters |

|

6.5. UAV |

|

7. Aircraft Actuators Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Flight Control Systems |

|

7.2. Landing Gear Systems |

|

7.3. Thrust Reversers |

|

7.4. Auxiliary Control Systems |

|

7.5. Braking Systems |

|

7.6. Others |

|

8. Aircraft Actuators Market, by Installation Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. OEM |

|

8.2. Retrofit |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Aircraft Actuators Market, by Type |

|

9.2.7. North America Aircraft Actuators Market, by Technology |

|

9.2.8. North America Aircraft Actuators Market, by Aircraft Type |

|

9.2.9. North America Aircraft Actuators Market, by Application |

|

9.2.10. North America Aircraft Actuators Market, by Installation Type |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Aircraft Actuators Market, by Type |

|

9.2.11.1.2. US Aircraft Actuators Market, by Technology |

|

9.2.11.1.3. US Aircraft Actuators Market, by Aircraft Type |

|

9.2.11.1.4. US Aircraft Actuators Market, by Application |

|

9.2.11.1.5. US Aircraft Actuators Market, by Installation Type |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Curtiss-Wright |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Eaton |

|

11.3. Honeywell |

|

11.4. Liebherr |

|

11.5. Moog Inc. |

|

11.6. Parker Hannifin |

|

11.7. RTX Corporation |

|

11.8. Safran |

|

11.9. Triumph Group |

|

11.10. Woodward |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aircraft Actuators Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aircraft Actuators Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aircraft Actuators ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aircraft Actuators Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA