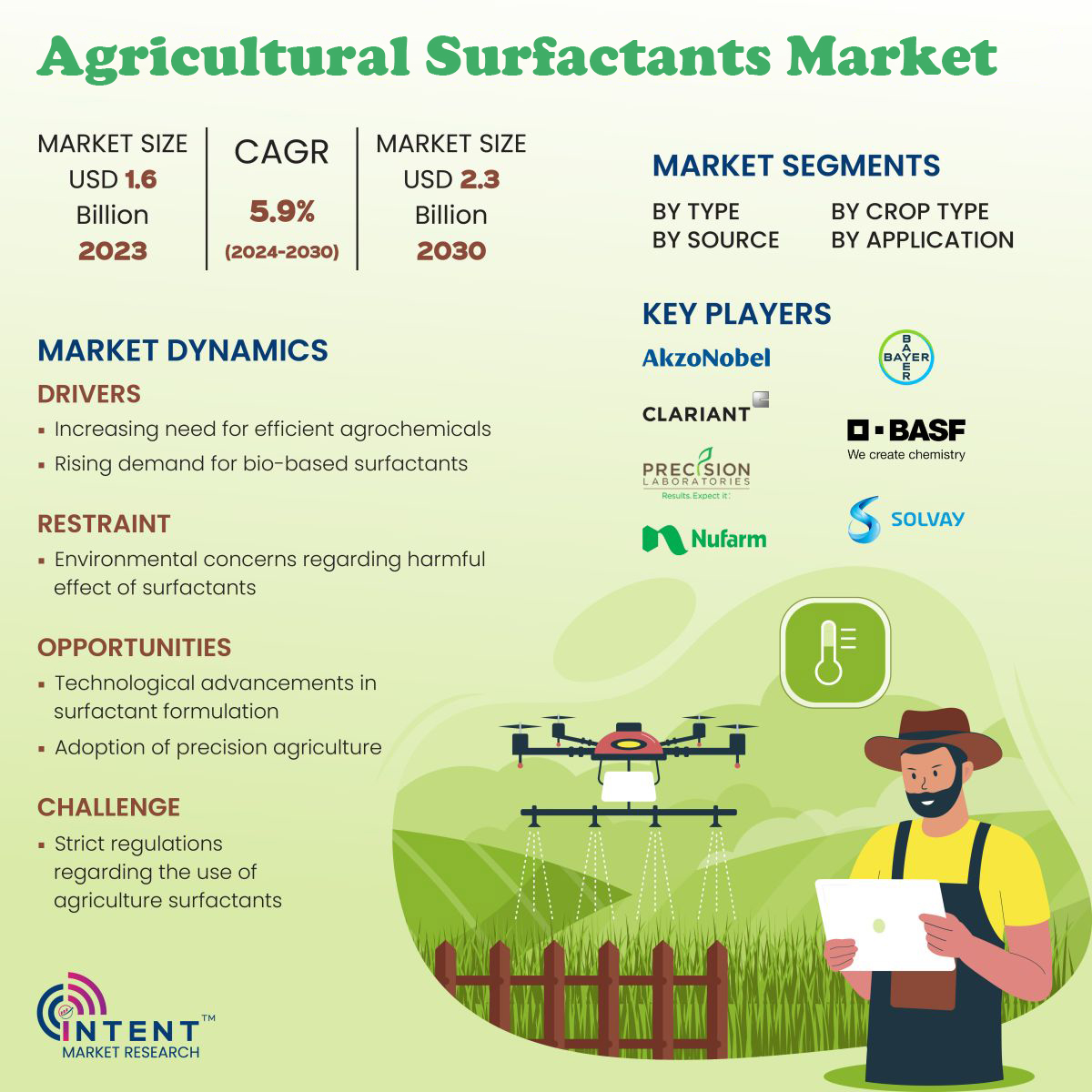

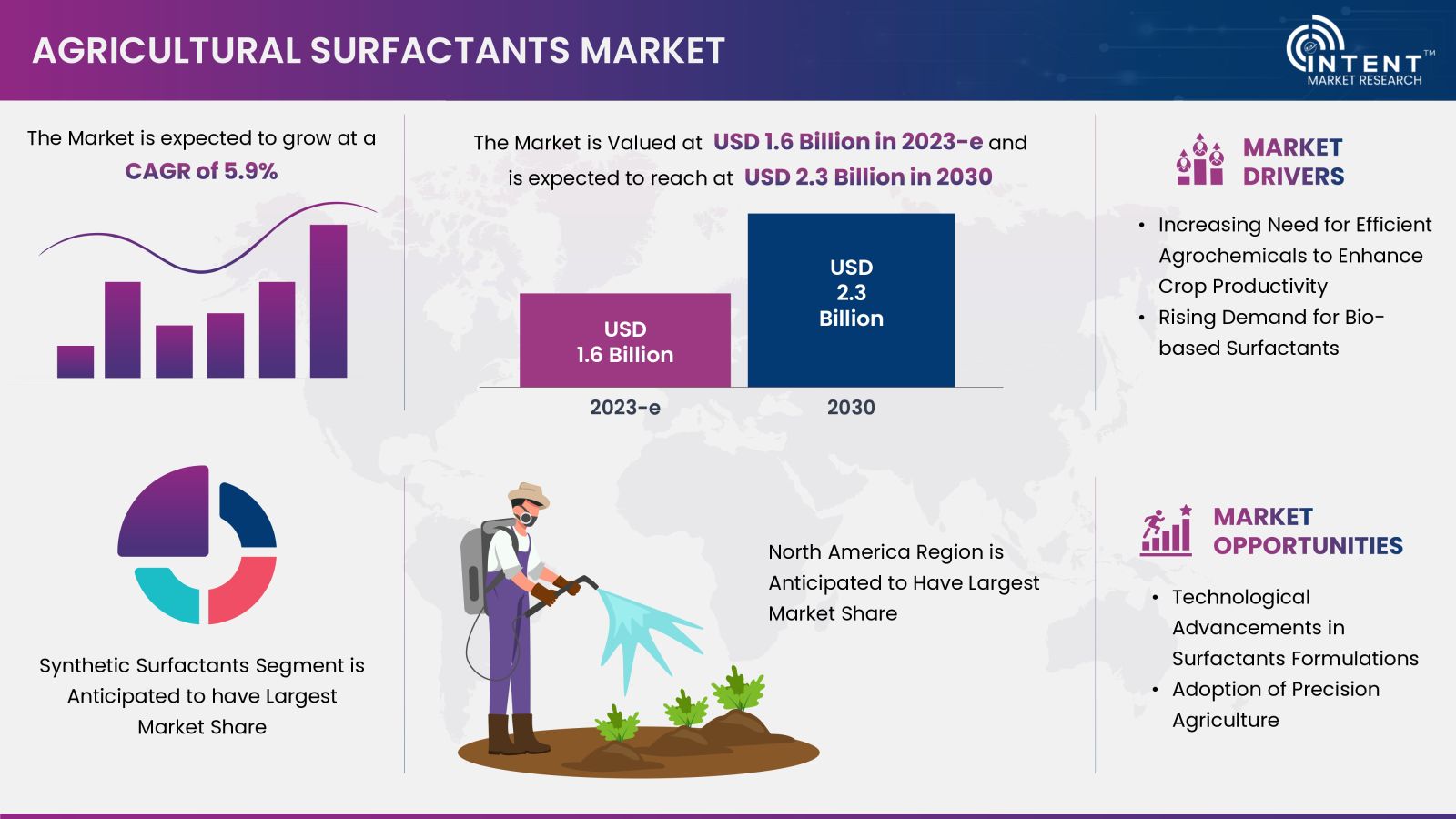

The Agricultural Surfactants Market size accounted for USD 1.6 billion in 2023-e and is projected to grow at a CAGR of 5.9% over the forecast period from 2024 to 2030. The agricultural surfactant is a competitive market, the prominent players in the global market include Akzo Nobel, Attune Agriculture, BASF, Bayer, Clariant, Ingevity, Miller Chemical, Nufarm, Precision Laboratories, Solvay, UPL, Wilbur-Ellis, and WinField. The rising need for efficient agrochemical formulations is driving the market growth.

Click here to: Get FREE Sample Pages of this Report

The agricultural surfactants market is expected to grow significantly over the forecast period due to the rising need for crop protection and improved productivity. Agriculture surfactants have ability to lower spray droplet surface tension, which improves plant surface adhesion and coverage. Surfactants are used to increase agrochemical penetration and their efficacy. By mitigating the evaporation of spray droplets, these surfactants extend the duration it takes for agrochemicals to reach their intended targets, thereby optimizing their performance.

Agricultural surfactants are a kind of adjuvants used to enhance a pesticide spray mixture's absorbing, spreading, penetrating, sticking, and dispersing/emulsifying qualities. Surfactants increase the compatibility of different agrochemicals, which improves their performance and efficacy. This result may lessen the need for effort in the process of effective crop management that ultimately leads to increased crop yields and better quality.

These agents act as activators to improve performance by boosting leaf penetration, decreasing runoff, and increasing surface contact. These could be wetting agents, emulsifiers, stickers, or spreaders. Agricultural surfactants are further distinguished into four categories including cationic, anionic, non-ionic, and amphoteric surfactants.

The demand for agricultural surfactants continues to grow due to the rising need for effective agrochemicals that can improve crop productivity and reduce its toxic effect on the environment.

Agricultural Surfactants Market Dynamics

Increasing Need for Efficient Agrochemicals to Enhance Efficiency and Crop Productivity will Drive the Market

The agricultural surfactants demand is increasing owing to the rising demand to enhance crop productivity and overall yield. The agriculture surfactants improve the soil fertility, water penetration and retention rate into the soil. This leads to increased productivity and quality of crops which help fungicides stay on plant surfaces longer and increase their efficacy.

The total production of primary crops is increasing due to the usage of effective chemicals across the globe. For instance, a report published in 2022 by the Food and Agriculture Organization (FAO) revealed a remarkable 52% increase, reaching 9.3 billion tonnes in 2020. Notably, half of the world's primary crop output in 2020 was contributed by four major crops: wheat, rice, maize, and sugar cane. Additionally, fruit production witnessed a significant 55% increase, while vegetable production surged by 65% during the same period worldwide.

Environmental Concerns Regarding the Harmful Effect of Surfactants may Hinder the Market Growth

Concerns related to environmental impact arising from the utilization of synthetic agricultural surfactants could impede market expansion, given the emission of harmful gases and the release of toxic chemicals into the atmosphere. Global governmental and regulatory bodies are imposing stringent measures regarding the use of such hazardous agricultural surfactants, recognizing their adverse effects on the environment and beyond.

The considerable Eco toxicity and potential health risks associated with surfactants in the environment highlight significant concerns. Certain surfactants and their transformed derivatives, characterized by non-degradability, persistence, and toxicity, pose severe environmental repercussions. Therefore, the equilibrium and sustainability of natural ecosystems can be safeguarded through a comprehensive approach involving assessment, practical analysis, and effective treatment of surfactants.

Agricultural Surfactants Market Segment Insights

The Non-Ionic Segment Held the Predominant Market Share

The non-ionic surfactants are anticipated to hold the predominant market share due to their superior stability in a variety of pH ranges, ease of compatibility with hard water, and reduced chemical reactivity rendering them perfect for an extensive array of agricultural uses. Non-ionic surfactants, such as alcohol ethoxylates, phenol ethoxylates, and alkyl polyglycosides, remain uncharged when dissolved in water, unlike ionized surfactants that separate into positive and negative ions.

Non-ionic surfactants are frequently used as wetting agents, emulsifiers, and dispersants. These surfactants are used to increase the effectiveness of pesticides, herbicides, and fertilizers. Major market players are developing certain kinds of non-ionic animal feed and soil conditioners to optimize soil performance and crop productivity. For instance, in October 2023, Nouryon announced the launch of a next-generation non-ionic surfactant Berol Nexxt. Berol Nexxt is a non-ionic surfactant designed to optimize the performance of agrochemicals in which Berol can act as a co-surfactant.

.jpg)

The Synthetic Segment is Anticipated to Witness Significant Growth Due to Performance and Effectiveness in Agricultural Chemicals

Synthetic agricultural surfactants are chemical substances developed especially to enhance the capabilities and efficacy of pesticides, herbicides, insecticides, and fungicides that are mainly used to control pests and weed growth in farming. These artificially produced and developed surfactants have specific properties for the application, transmission, and penetration of agrochemicals on plant surfaces.

In response to the increasing demand for surfactants in agriculture, driven by the expansion of the sector, market players are innovating and introducing new products. For instance, in March 2020, Wilbur-Ellis Company, a leading figure in crop protection and precision agriculture, unveiled EMBRECE-EA, a novel surfactant blend designed to enhance the performance of insecticides, fungicides, and miticides. This innovative product improves spray material wetting and spreading through a combination of nonionic surfactants, providing growers with superior coverage and wetting for more effective pest control. The introduction of such products contributes to the growth of the synthetic surfactants market.

The Cereals and Grains Segment Held the Largest Share in the Agricultural Surfactants Market

The cereals & grains accounted for the largest share of the agricultural surfactant market due to increasing demand for primary crops such as wheat, rice, and corn along with several others. Herbicides mixed with surfactants are mainly intended to protect these crops from insect and plant disease which results in improved crop production. The rising demand for food across the globe has led to increased use of surfactants in crop production to fulfill the demand.

Widespread Use of Herbicides in Crop Production Across the Globe to Boost the Market Growth

The herbicide segment accounted for a significant market share in the agricultural surfactants market due to the rising use of herbicides to remove weeds and other unwanted plants that can reduce the farm yield. The growth in this segment is attributed to the extensive use of herbicides such as glyphosate and glufosinate mixed with surfactants to improve absorption rate and penetration rate, resulted in enhanced food productivity.

The increase in product demand for a variety of crops, including cotton, rice, fruits, and vegetables, is the reason for this growth. For instance, in July 2022, according to a research published in Agronomy, a Switzerland-based open access journal, stated that more than 1,800 weed species reduced plant productivity by 31.5%, resulting in annual economic losses of USD 32 billion. The herbicide consumption rose to 1.4 million metric tons in 2021 to reduce the negative effect of weeds across the globe.

North America is Poised for Significant Market Growth in the Forecast Period

North America held the largest market share of in overall agricultural surfactants market. The increasing government support to enhance crop production is driving the growth of this region. The market in the region is experiencing growth due to factors like advancing farming practices, including precision agriculture, the adoption of cutting-edge farming technologies, heightened awareness of agriculture's environmental impact, and a growing interest in sustainable production systems. These elements collectively contribute to the upward trajectory of the market.

Major Industry Players are Focusing on Research and Innovation to Strengthen their Market Position

The market is characterized by intense competition due to the presence of numerous international and domestic players. The agricultural surfactants market, in particular, is dominated by key players such as Akzo Nobel, Attune Agriculture, BASF, Bayer, Clariant, Helena, Ingevity, Miller Chemical, Nufarm, Precision Laboratories, Solvay, Stepan, UPL, Wilbur-Ellis, and WinField. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs. The success of market players is heavily dependent on their ability to adapt to changing market trends and consumer preferences.

- In April 2022, Lamberti announced the acquisition of Turftech International for an undisclosed amount. Through this acquisition, Lamberti increases its development capabilities and distribution channel for unique surfactants for turf and horticultural uses.

- In January 2023, Lavoro acquired Cromo Química to strengthen its position in Latin America. The acquisition aims to improve Crop Care's standing in the market for agricultural enhancers and high-performance surfactants.

Get your custom research report today

Agricultural Surfactants Market Coverage

The report provides key insights into the agricultural surfactants market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.6 billion |

|

Forecast Revenue (2030) |

USD 2.3 billion |

|

CAGR (2024-2030) |

5.9 % |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Type (Anionic, Cationic, Non-ionic, Amphoteric), By Source (Bio-based, Synthetic), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), By Application (Herbicides, Insecticides, Fungicides, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Akzo Nobel, Attune Agriculture, BASF, Bayer, Clariant, Helena, Ingevity, Miller Chemical, Nufarm, Precision Laboratories, Solvay, Stepan, UPL, Wilbur-Ellis, and WinField |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Increasing need for efficient agrochemicals |

|

4.1.2.Rising demand for bio-based surfactants |

|

4.1.3. Growing demand for crop protection products |

|

4.2. Market Growth Restraints |

|

4.2.1.Environmental concerns regarding harmful effect of surfactants |

|

4.3. Market Growth Opportunities |

|

4.3.1.Growing adoption of precision agriculture |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Technology Trends |

|

5.3.Patent Analysis |

|

5.4.Impact of COVID-19 and Russia-Ukraine conflict on the agricultural surfactants market |

|

6.Market Segment Outlook |

|

6.1.Segment Synopsis |

|

6.2.By Type |

|

6.2.1.Anionic |

|

6.2.2.Cationic |

|

6.2.3.Non-ionic |

|

6.2.4.Amphoteric |

|

6.3.By Source |

|

6.3.1.Bio-based |

|

6.3.2.Synthetic |

|

6.4.By Crop Type |

|

6.4.1.Cereals and Grains |

|

6.4.2.Oilseeds and Pulses |

|

6.4.3.Fruits and Vegetables |

|

6.5.By Application |

|

6.5.1.Herbicides |

|

6.5.2.Insecticides |

|

6.5.3.Fungicides |

|

7.Regional Outlook |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Agricultural Surfactants Market Outlook |

|

7.2.2.USA |

|

7.2.2.1.USA Agricultural Surfactants Market, By Type |

|

7.2.2.2.USA Agricultural Surfactants Market, By Source |

|

7.2.2.3.USA Agricultural Surfactants Market, By Crop Type |

|

7.2.2.4.USA Agricultural Surfactants Market, By Application |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.2.4.Mexico |

|

7.3.Europe |

|

7.3.1.Europe Agricultural Surfactants Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Spain |

|

7.3.6.Italy |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Agricultural Surfactants Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Agricultural Surfactants Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Argentina |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Agricultural Surfactants Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Agricultural Surfactants Companies (Supply-Side) |

|

9.1.1.Akzo Nobel |

|

9.1.1.1.Company Synopsis |

|

9.1.1.2.Company Financials |

|

9.1.1.3.Product/Service Portfolio |

|

9.1.1.4.Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2.Attune Agriculture |

|

9.1.3.BASF |

|

9.1.4.Bayer |

|

9.1.5.Clariant |

|

9.1.6.Helena |

|

9.1.7.Ingevity |

|

9.1.8.Miller Chemical |

|

9.1.9.Nufarm |

|

9.1.10.Precision Laboratories |

|

9.1.11.Solvay |

|

9.1.12.Stepan |

|

9.1.13.UPL |

|

9.1.14.WinField |

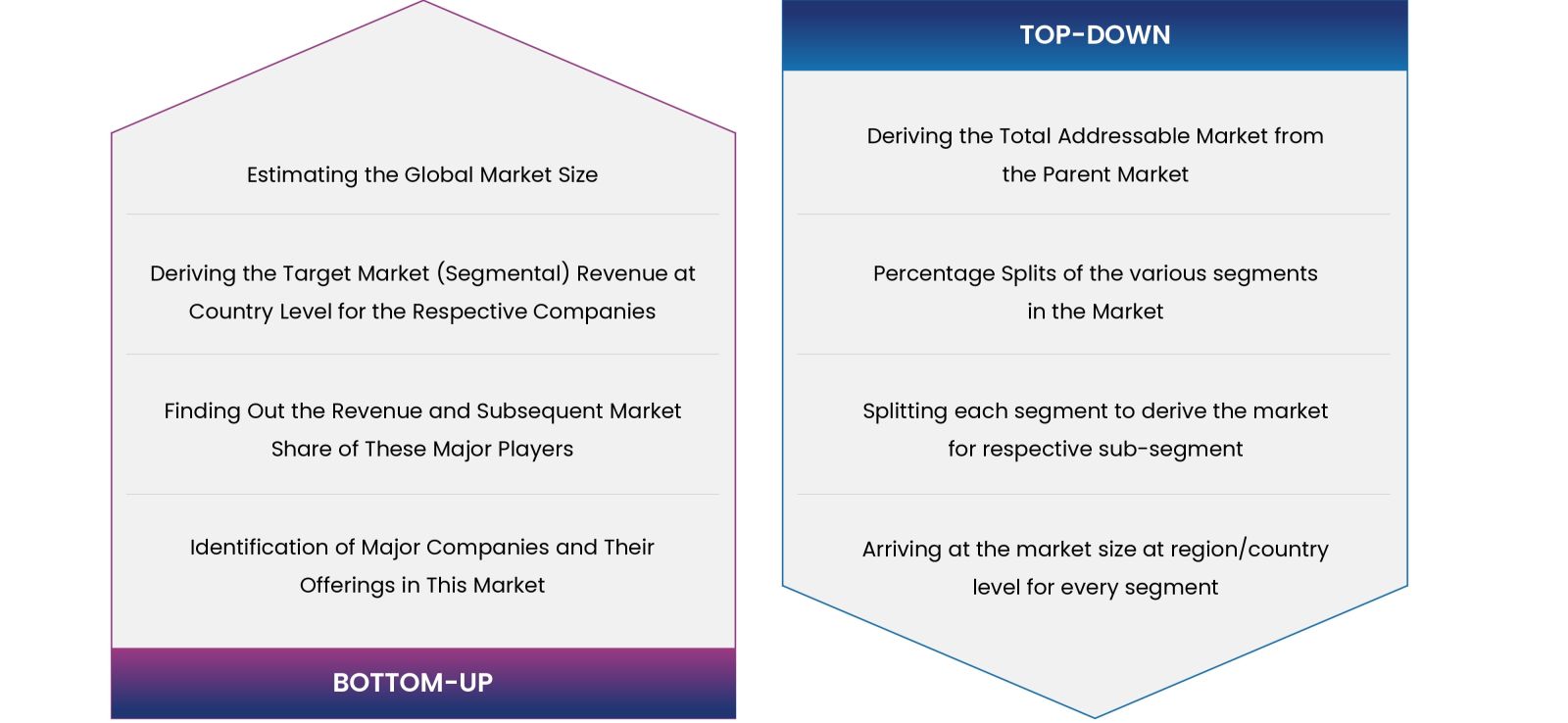

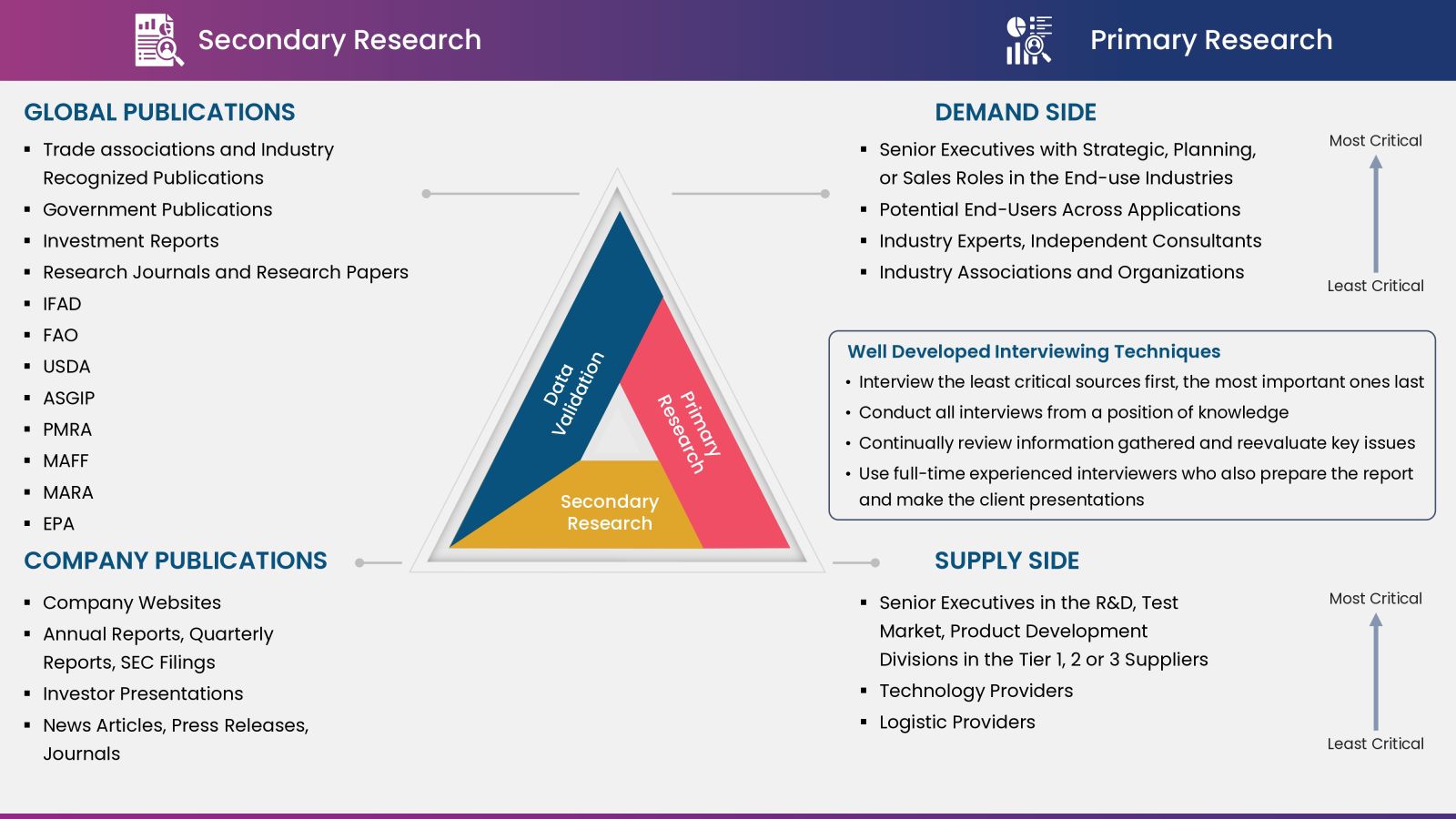

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.