As per Intent Market Research, the Air Traffic Control (ATC) Equipment Market was valued at USD 9.8 billion in 2023 and will surpass USD 16.6 billion by 2030; growing at a CAGR of 7.8% during 2024 - 2030.

The Air Traffic Control (ATC) Equipment Market is witnessing significant growth driven by the increasing volume of air traffic and the need for advanced air safety solutions. With the global aviation industry expanding, the demand for precise and efficient air traffic management systems has become a critical focus for both government bodies and commercial stakeholders. The market, which includes communication systems, surveillance systems, navigation equipment, and automation systems, plays a crucial role in ensuring the safe, efficient, and reliable management of air traffic

Communication Segment is Largest Owing to Rising Need for Seamless Connectivity

The Communication Segment of the ATC Equipment market holds the largest share due to the growing need for seamless and secure communication between air traffic controllers and pilots. As air traffic continues to grow globally, robust communication infrastructure is critical to manage the complexity of modern airspace. This segment includes equipment like Very High Frequency (VHF) and Ultra High Frequency (UHF) radios, data communication systems, and voice communication control systems.

Among the subsegments, VHF radios hold the dominant position, driven by the increasing adoption of this technology for civil aviation due to its extensive range and reliability in congested airspaces. The expansion of long-haul and cross-border flights has also pushed the demand for advanced VHF radios, especially in regions with high flight density. As airspace becomes more crowded, innovations in digital voice communication and data exchange are further solidifying this subsegment’s lead.

Surveillance Segment is Fastest Growing Owing to Increasing Focus on Airspace Safety

The Surveillance Segment is anticipated to be the fastest growing due to the rising emphasis on airspace safety and situational awareness. Surveillance systems are pivotal for detecting and tracking aircraft, providing real-time information on aircraft positions, speeds, and altitudes. This segment is seeing accelerated investment as governments and aviation authorities prioritize improved air traffic monitoring to prevent accidents and enhance overall flight safety.

Within this segment, the Automatic Dependent Surveillance-Broadcast (ADS-B) subsegment is experiencing rapid growth. The adoption of ADS-B technology, which uses satellite navigation to broadcast an aircraft's position, is being mandated in many countries to enhance situational awareness in both controlled and uncontrolled airspace. ADS-B is also preferred for its ability to provide more accurate tracking in remote or oceanic regions, where traditional radar systems are less effective. The push for global ADS-B adoption, supported by regulatory bodies like the FAA and Eurocontrol, is driving the fast-paced growth of this subsegment.

Navigation Segment is Largest Owing to Increasing Dependence on Precision Systems

The Navigation Segment is another critical area within the ATC Equipment market, and it holds a significant portion of market share due to the growing dependence on precision navigation systems for both commercial and military aircraft. Navigation systems help ensure that aircraft follow the correct flight paths and reach their destinations safely, even in poor weather conditions or during congested flight periods.

Instrument Landing Systems (ILS) represent the largest subsegment within this segment, primarily because of their widespread use in aiding aircraft landings, especially in low-visibility conditions. The adoption of ILS is extensive in high-traffic airports that require advanced guidance systems to handle large volumes of flights efficiently. With increasing airport expansions and the upgrading of landing systems worldwide, the demand for ILS continues to grow, especially in regions with harsh weather conditions or high air traffic density.

Automation Systems Segment is Fastest Growing Owing to Demand for Efficient Air Traffic Management

The Automation Systems Segment is expected to witness the fastest growth during the forecast period, as automation becomes central to the modernization of air traffic management. Automation systems reduce the workload of air traffic controllers, minimize human error, and enhance operational efficiency, which is vital in managing the increasing air traffic volumes.

The Air Traffic Management (ATM) Software Solutions subsegment is growing rapidly due to advancements in artificial intelligence (AI) and machine learning (ML) technologies. These solutions enable real-time decision-making, predictive analytics, and the efficient management of complex airspace environments. The growing trend of integrating AI-powered tools into ATM systems to optimize flight routing, reduce delays, and enhance fuel efficiency is driving the demand for advanced automation solutions.

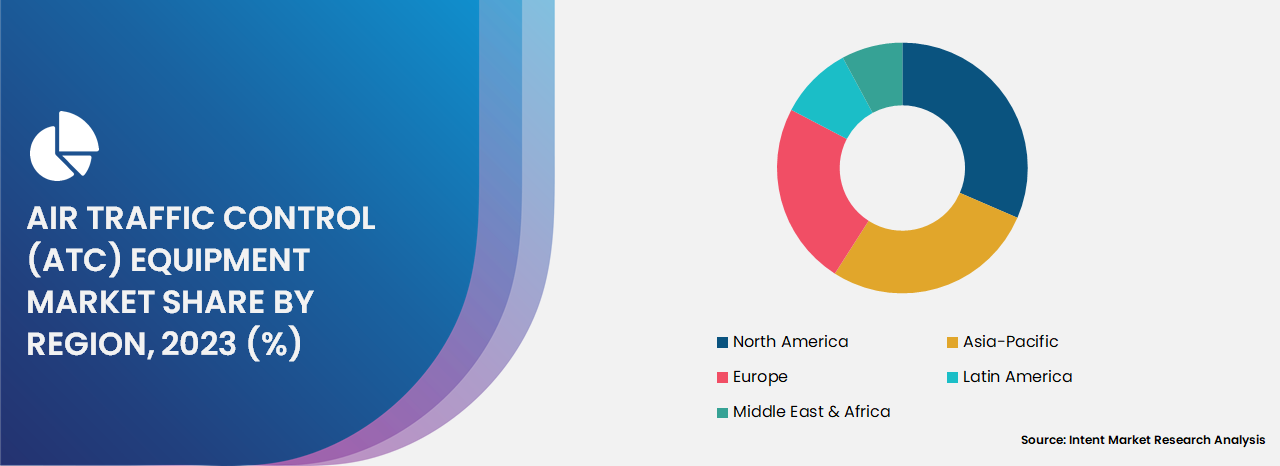

North America is Largest Region Owing to Technological Advancements and High Air Traffic

North America dominates the ATC equipment market due to its advanced aviation infrastructure, high air traffic volumes, and strong presence of key ATC equipment manufacturers. The region, led by the United States, boasts a well-established network of airports and air traffic management systems, which require continual upgrades to maintain operational efficiency and safety standards.

Technological advancements, such as the implementation of the Next Generation Air Transportation System (NextGen) in the U.S., are further propelling market growth. This program aims to modernize the national airspace system by transitioning from ground-based radar to satellite-based technologies, significantly enhancing the precision of air traffic control. With the FAA at the forefront of adopting new technologies, North America is likely to maintain its leading position in the ATC equipment market throughout the forecast period.

Leading Companies and Competitive Landscape

The Air Traffic Control (ATC) Equipment Market is highly competitive, with several key players actively shaping the industry’s landscape. Prominent companies include Thales Group, Raytheon Technologies Corporation, Indra Sistemas, and L3Harris Technologies, among others. These firms are at the forefront of innovation, continually developing new technologies to enhance air traffic management and ensure safety.

The competitive landscape is characterized by both organic growth strategies, such as product innovations and R&D, and inorganic strategies like mergers and acquisitions. As air traffic continues to rise globally, companies are focusing on creating more efficient, automated, and scalable solutions. Furthermore, the growing collaboration between governments and private firms to develop national airspace systems presents lucrative opportunities for companies to secure contracts and establish long-term partnerships.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 9.8 billion |

|

Forecasted Value (2030) |

USD 16.6 billion |

|

CAGR (2024 – 2030) |

7.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

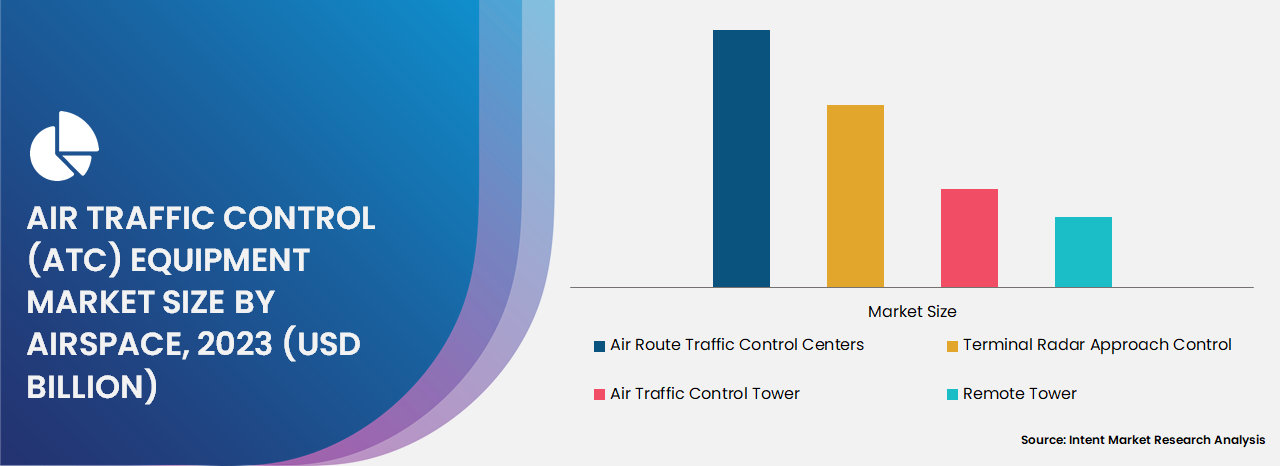

Air Traffic Control (ATC) Equipment Market By Offering (Hardware, Software, Services), By Airspace (Air Route Traffic Control Centers, Terminal Radar Approach Control, Air Traffic Control Tower, Remote Tower), By Airport Size (Large, Medium, Small), By Sector (Commercial, Military), By Application (Communication, Navigation, Surveillance, Automation) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Air Traffic Control (ATC) Equipment Market, by Offering (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Services |

|

5. Air Traffic Control (ATC) Equipment Market, by Airspace (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Air Route Traffic Control Centers (ARTCC) |

|

5.2. Terminal Radar Approach Control (TRACON) |

|

5.3. Air Traffic Control Tower (ATCT) |

|

5.4. Remote Tower |

|

6. Air Traffic Control (ATC) Equipment Market, by Airport Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Large |

|

6.2. Medium |

|

6.3. Small |

|

7. Air Traffic Control (ATC) Equipment Market, by Sector (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Commercial |

|

7.2. Military |

|

8. Air Traffic Control (ATC) Equipment Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Communication |

|

8.2. Navigation |

|

8.3. Surveillance |

|

8.4. Automation |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Air Traffic Control (ATC) Equipment Market, by Offering |

|

9.2.7. North America Air Traffic Control (ATC) Equipment Market, by Airspace |

|

9.2.8. North America Air Traffic Control (ATC) Equipment Market, by Airport Size |

|

9.2.9. North America Air Traffic Control (ATC) Equipment Market, by Sector |

|

9.2.10. North America Air Traffic Control (ATC) Equipment Market, by Application |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Air Traffic Control (ATC) Equipment Market, by Offering |

|

9.2.11.1.2. US Air Traffic Control (ATC) Equipment Market, by Airspace |

|

9.2.11.1.3. US Air Traffic Control (ATC) Equipment Market, by Airport Size |

|

9.2.11.1.4. US Air Traffic Control (ATC) Equipment Market, by Sector |

|

9.2.11.1.5. US Air Traffic Control (ATC) Equipment Market, by Application |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. BAE Systems |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Cyrrus Limited |

|

11.3. Honeywell International Inc. |

|

11.4. Indra Sistemas, S.A. |

|

11.5. L3Harris Technologies, Inc. |

|

11.6. Leonardo S.p.A |

|

11.7. Northrop Grumman |

|

11.8. Raytheon Systems Limited, |

|

11.9. Saab |

|

11.10. Thales |

|

11.11. Westminster Group Plc. |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Air Traffic Control (ATC) Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Air Traffic Control (ATC) Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Air Traffic Control (ATC) Equipment ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Air Traffic Control (ATC) Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA