As per Intent Market Research, the Air Separation Unit Market was valued at USD 5.0 billion in 2023 and will surpass USD 6.8 billion by 2030; growing at a CAGR of 4.5% during 2024 - 2030.

The global air separation unit (ASU) market plays a critical role in the separation of gases from atmospheric air, primarily oxygen, nitrogen, and argon, using cryogenic or non-cryogenic technologies. These units are essential for multiple industries, including healthcare, chemicals, oil and gas, and food and beverages. The increasing demand for high-purity gases, coupled with advancements in technology to improve energy efficiency, is propelling the growth of the ASU market. As industries evolve to meet stricter environmental standards and pursue more sustainable operations, air separation technologies are becoming more critical in driving industrial growth globally.

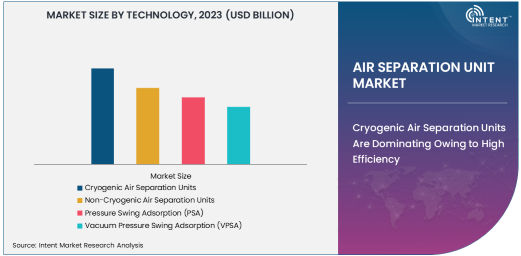

Cryogenic Air Separation Units Are Dominating Owing to High Efficiency

Among the various technologies in the ASU market, Cryogenic Air Separation Units (ASUs) dominate due to their high efficiency and ability to produce gases at large scales. These units use extremely low temperatures to liquefy air and separate its components. Cryogenic ASUs are widely used across industries that require large volumes of industrial gases, such as oxygen and nitrogen, with high purity. The ability to generate high-purity gases at large production capacities makes cryogenic ASUs the go-to technology for industries like oil and gas, chemicals, and healthcare, where gas purity and volume are critical.

The demand for cryogenic ASUs is increasing due to the growing need for bulk industrial gases in the global market. For instance, the increasing number of oil extraction operations, large-scale chemical processes, and the rising number of hospitals requiring medical-grade oxygen are all contributing to the demand for cryogenic air separation. Moreover, advancements in cryogenic technology are leading to more energy-efficient units that help reduce operational costs, further driving their dominance in the market.

Oxygen Segment is Largest Due to Extensive Applications in Various Industries

In the ASU market, oxygen is the largest product segment due to its widespread use across multiple industries. Oxygen is a vital component in various industrial processes, including steel production, chemical manufacturing, oil refining, and healthcare. It is also increasingly used in the food and beverage industry for packaging and preservation. The demand for oxygen is expected to continue growing as industries seek to increase production efficiency, and healthcare systems expand their capabilities, especially with the increasing requirement for medical oxygen in hospitals.

The largest share of oxygen demand comes from the industrial and healthcare sectors. In the industrial sector, oxygen is used extensively in combustion processes, while in healthcare, the demand is driven by the increasing prevalence of respiratory diseases, especially in the wake of the COVID-19 pandemic. This broad usage across critical sectors ensures that oxygen remains the largest product in the ASU market.

Oil and Gas Industry is a Key Driver for the ASU Market

The oil and gas industry is one of the largest end-user industries for air separation units, owing to its significant demand for high-purity gases like nitrogen and oxygen. In oil and gas production, air separation units are used for inerting, gas lifting, and enhanced oil recovery processes, where nitrogen plays a vital role. Nitrogen is often used to displace flammable gases, ensuring the safety of operations. Additionally, oxygen is used in combustion and refining processes.

The expanding exploration activities in offshore and onshore oil fields, coupled with the increasing demand for more efficient and environmentally sustainable operations, drive the need for ASUs. As the oil and gas industry continues to grow, particularly in emerging markets, the demand for air separation units tailored to the industry’s needs will remain strong, positioning oil and gas as a dominant end-user.

Industrial Gases Production is the Fastest-Growing Application

Among the various applications of ASUs, industrial gases production is the fastest-growing segment. This includes the production of gases such as oxygen, nitrogen, and argon for use in a wide range of industries. The growth of industrial gases production is driven by the increasing demand for these gases in sectors like chemicals, metals, and food processing, where they are used in everything from chemical reactions to packaging.

The rise in industrialization and the shift toward more energy-efficient and cleaner production processes are key factors contributing to the growth of this segment. Additionally, industrial gas production is expanding rapidly in emerging markets, where industrial activities are booming, further driving the growth of air separation units for industrial gas production.

Asia Pacific is the Fastest Growing Region

Asia Pacific is the fastest-growing region in the air separation unit market due to the rapid industrialization and expansion of key industries such as chemicals, oil and gas, and healthcare. Countries like China, India, and Japan are investing heavily in industrial infrastructure, driving the demand for industrial gases and, consequently, air separation units. The region's increasing focus on energy-efficient technologies and the need for cleaner production methods are also contributing to this growth.

China, in particular, is a major contributor to the growth of the ASU market in the region, given its vast industrial base and heavy reliance on industrial gases for manufacturing processes. The rise of healthcare systems and the increasing demand for medical oxygen have further bolstered the demand for air separation units in Asia Pacific.

Leading Companies and Competitive Landscape

The air separation unit market is highly competitive, with several global players dominating the industry. Companies like Linde Group, Air Liquide, Air Products and Chemicals, and Messer Group are leading the market, offering a wide range of ASU technologies and products. These companies are continuously innovating to improve efficiency, reduce energy consumption, and meet the growing demand for high-purity gases. Strategic mergers and acquisitions, technological partnerships, and expanding service portfolios are key strategies employed by these companies to maintain a competitive edge.

The competitive landscape is also witnessing the entry of regional players, especially in Asia Pacific, who are catering to the growing demand in the region. As the market becomes more focused on environmental sustainability and energy efficiency, companies are investing heavily in R&D to develop advanced air separation technologies that are both cost-effective and eco-friendly. This has led to increased collaboration between industry giants and smaller technology firms to push the boundaries of air separation technology.

Recent Developments:

- \Air Products and Chemicals announced the acquisition of a stake in a new green hydrogen project in the Netherlands, enhancing its position in the clean energy sector.

- Linde Group completed the merger with Praxair, creating a global leader in industrial gases. This merger is expected to improve operational efficiencies and expand product offerings.

- Air Liquide launched a new range of air separation systems designed for high-purity oxygen production in the medical sector, supporting hospitals and healthcare facilities.

- Taiyo Nippon Sanso Corporation launched an advanced PSA air separation unit for small-scale gas production facilities, expanding its presence in the medical and industrial sectors.

- Chart Industries unveiled a new cryogenic air separation unit, designed to offer greater energy efficiency and reduced operational costs for industrial gas production.

List of Leading Companies:

- Air Products and Chemicals Inc.

- Linde Group

- Air Liquide S.A.

- Praxair Technology, Inc. (Now part of Linde)

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- The BOC Group Ltd.

- Honeywell UOP

- Airgas, Inc. (A subsidiary of Air Liquide)

- Chart Industries, Inc.

- Inox Air Products Ltd.

- Parker Hannifin Corporation

- Oxair Gas Systems Pty Ltd

- The Linde Group

- Guangzhou Yicheng Air Separation Equipment Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.0 billion |

|

Forecasted Value (2030) |

USD 6.8 billion |

|

CAGR (2024 – 2030) |

4.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Air Separation Unit Market by Technology (Cryogenic Air Separation Units, Non-Cryogenic Air Separation Units, Pressure Swing Adsorption, Vacuum Pressure Swing Adsorption), by Product (Oxygen, Nitrogen, Argon, Helium, Hydrogen), by End-User Industry (Oil & Gas, Chemicals, Metals, Healthcare, Electronics, Food & Beverages), by Application (Industrial Gases Production, Medical Gases Production, Oil & Gas Production, Electronics Manufacturing, Food & Beverage Processing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Air Products and Chemicals Inc., Linde Group, Air Liquide S.A., Praxair Technology, Inc. (Now part of Linde), Messer Group GmbH, Taiyo Nippon Sanso Corporation, The BOC Group Ltd., Honeywell UOP, Airgas, Inc. (A subsidiary of Air Liquide), Chart Industries, Inc., Inox Air Products Ltd., Parker Hannifin Corporation, Oxair Gas Systems Pty Ltd, The Linde Group, Guangzhou Yicheng Air Separation Equipment Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Air Separation Unit Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Cryogenic Air Separation Units |

|

4.2. Non-Cryogenic Air Separation Units |

|

4.3. Pressure Swing Adsorption (PSA) |

|

4.4. Vacuum Pressure Swing Adsorption (VPSA) |

|

5. Air Separation Unit Market, by Product (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Oxygen |

|

5.2. Nitrogen |

|

5.3. Argon |

|

5.4. Others |

|

6. Air Separation Unit Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Oil and Gas |

|

6.2. Chemicals |

|

6.3. Metals |

|

6.4. Healthcare |

|

6.5. Electronics |

|

6.6. Food and Beverages |

|

6.7. Other Industries |

|

7. Air Separation Unit Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Industrial Gases Production |

|

7.2. Medical Gases Production |

|

7.3. Oil and Gas Production |

|

7.4. Electronics Manufacturing |

|

7.5. Food & Beverage Processing |

|

7.6. Other Applications |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Air Separation Unit Market, by Technology |

|

8.2.7. North America Air Separation Unit Market, by Product |

|

8.2.8. North America Air Separation Unit Market, by End-User Industry |

|

8.2.9. North America Air Separation Unit Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Air Separation Unit Market, by Technology |

|

8.2.10.1.2. US Air Separation Unit Market, by Product |

|

8.2.10.1.3. US Air Separation Unit Market, by End-User Industry |

|

8.2.10.1.4. US Air Separation Unit Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Air Products and Chemicals Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Linde Group |

|

10.3. Air Liquide S.A. |

|

10.4. Praxair Technology, Inc. (Now part of Linde) |

|

10.5. Messer Group GmbH |

|

10.6. Taiyo Nippon Sanso Corporation |

|

10.7. The BOC Group Ltd. |

|

10.8. Honeywell UOP |

|

10.9. Airgas, Inc. (A subsidiary of Air Liquide) |

|

10.10. Chart Industries, Inc. |

|

10.11. Inox Air Products Ltd. |

|

10.12. Parker Hannifin Corporation |

|

10.13. Oxair Gas Systems Pty Ltd |

|

10.14. The Linde Group |

|

10.15. Guangzhou Yicheng Air Separation Equipment Co., Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Air Separation Unit Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Air Separation Unit Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Air Separation Unit ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Air Separation Unit Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA