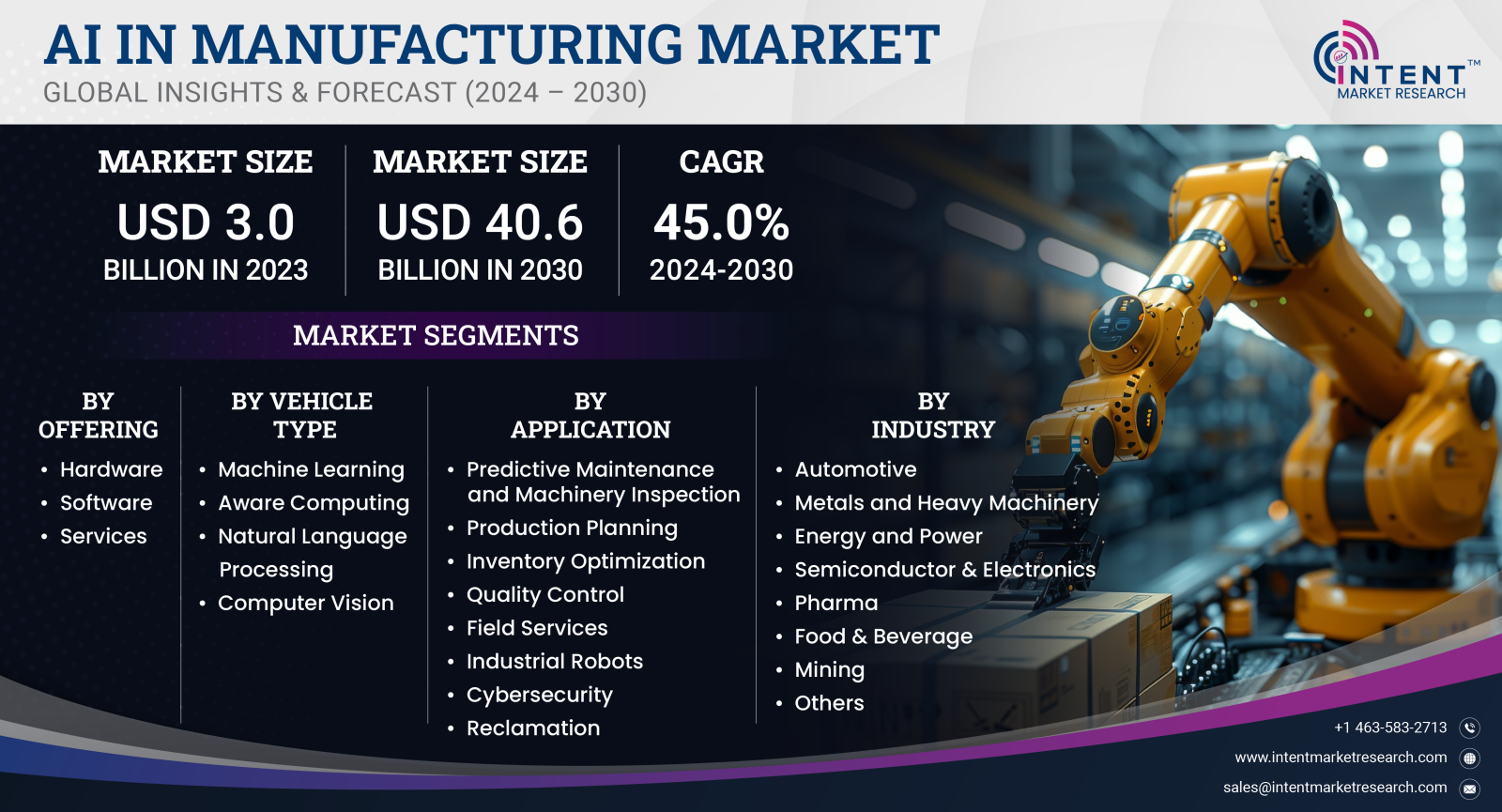

As per Intent Market Research, the AI in Manufacturing Market was valued at USD 3.0 billion in 2023-e and will surpass USD 40.6 billion by 2030; growing at a CAGR of 45.0% during 2024 - 2030.

The Artificial Intelligence (AI) in Manufacturing Market has witnessed significant advancements over the past decade, driven by rapid technological evolution and the increasing demand for automation and efficiency across the manufacturing sector. AI technologies, including machine learning, natural language processing, and robotics, are reshaping traditional manufacturing processes, leading to enhanced productivity, reduced operational costs, and improved quality control. As manufacturers strive to remain competitive in a rapidly changing landscape, the adoption of AI solutions has become a strategic imperative.

The expansion of the AI in manufacturing market is propelled by several factors, including the increasing need for predictive maintenance, quality assurance, supply chain optimization, and enhanced data analytics. As manufacturers continue to embrace Industry 4.0, AI-driven technologies are playing a pivotal role in streamlining operations and driving innovation. The market is characterized by diverse applications across various manufacturing sectors, including automotive, electronics, pharmaceuticals, and consumer goods, each leveraging AI to enhance their operational efficiency and decision-making processes.

Predictive Maintenance Segment is Fastest Growing Owing to Enhanced Operational Efficiency

The Predictive Maintenance segment is emerging as the fastest-growing segment within the AI in manufacturing market. Manufacturers are increasingly recognizing the value of predictive maintenance as a proactive approach to equipment management, reducing downtime and enhancing operational efficiency. By utilizing AI algorithms and machine learning models, companies can analyze real-time data from sensors embedded in machinery to predict failures before they occur. This shift from traditional maintenance practices to predictive maintenance not only minimizes unexpected breakdowns but also optimizes maintenance schedules, significantly reducing operational costs.

The growing demand for predictive maintenance is fueled by the increasing complexity of manufacturing equipment and the need for reliable and uninterrupted operations. As industries adopt advanced manufacturing technologies, the integration of AI into maintenance processes allows for continuous monitoring and data analysis, providing actionable insights that improve decision-making. The ability to foresee potential issues and address them proactively is crucial in maintaining production efficiency and ensuring customer satisfaction, making predictive maintenance a key driver of growth within the AI in manufacturing market.

Robotics and Automation Segment is Largest Owing to Increased Labor Efficiency

The Robotics and Automation segment is the largest within the AI in manufacturing market, primarily due to the increasing demand for labor efficiency and productivity. Robotics integrated with AI technologies enables manufacturers to automate repetitive tasks, streamline workflows, and enhance overall production capabilities. This integration allows for precision and speed, significantly reducing the likelihood of human error and improving product quality. Industries such as automotive, electronics, and consumer goods are leveraging AI-powered robotics to enhance their manufacturing processes, driving significant growth in this segment.

The demand for collaborative robots, or cobots, which work alongside human operators, has also contributed to the growth of the robotics segment. Cobots enhance workforce productivity by assisting with complex tasks while ensuring safety and ease of operation. As manufacturers seek to optimize their operations and respond to the demands of a dynamic market, the adoption of robotics and automation solutions will continue to expand, solidifying this segment's position as the largest in the AI in manufacturing market.

Computer Vision Segment is Fastest Growing Owing to Quality Control Enhancements

The Computer Vision segment is the fastest-growing within the AI in manufacturing market, driven by its applications in quality control and defect detection. As manufacturers strive to maintain high standards of product quality and reduce waste, AI-powered computer vision systems are becoming indispensable tools. These systems utilize advanced image recognition algorithms to inspect products at various stages of production, identifying defects and inconsistencies that might be overlooked by human inspectors. This capability not only enhances quality assurance processes but also accelerates production times, ultimately leading to increased customer satisfaction.

Moreover, the integration of computer vision in manufacturing is facilitating automation in various applications, from assembly line inspections to inventory management. By harnessing the power of AI and machine learning, manufacturers can analyze vast amounts of visual data to gain insights that improve operational efficiency. The demand for computer vision technology is expected to surge as manufacturers continue to prioritize quality and consistency in their products, making this segment a key driver of growth within the AI in manufacturing market.

Natural Language Processing Segment is Largest Owing to Enhanced Communication

The Natural Language Processing (NLP) segment holds a significant position in the AI in manufacturing market, driven by its ability to enhance communication and streamline processes. NLP technologies enable manufacturers to process and analyze vast amounts of unstructured data, such as customer feedback, operational reports, and maintenance logs. By extracting valuable insights from this data, manufacturers can make informed decisions that improve operational efficiency and customer satisfaction.

The application of NLP in manufacturing also extends to chatbots and virtual assistants that facilitate real-time communication between teams, customers, and suppliers. These AI-driven tools can handle routine inquiries, streamline information sharing, and provide instant access to critical data, freeing up human resources for more strategic tasks. As the demand for efficient communication solutions grows, the NLP segment is poised for continued expansion, solidifying its role as a major contributor to the overall AI in manufacturing market.

Supply Chain Management Segment is Fastest Growing Owing to Demand for Efficiency

The Supply Chain Management segment is experiencing rapid growth within the AI in manufacturing market, driven by the increasing need for efficiency and transparency in supply chain operations. As manufacturers navigate complex global supply chains, AI technologies are being utilized to optimize logistics, demand forecasting, inventory management, and supplier relationship management. By leveraging AI algorithms to analyze historical data and market trends, manufacturers can make data-driven decisions that enhance supply chain resilience and responsiveness.

The growing complexity of supply chains, exacerbated by recent global events, has underscored the need for advanced solutions that enable real-time visibility and proactive risk management. AI-powered tools can identify potential disruptions and recommend alternative strategies, ensuring continuity in operations. As manufacturers continue to prioritize supply chain optimization in their strategic initiatives, the demand for AI solutions in this segment is expected to accelerate, marking it as one of the fastest-growing areas within the AI in manufacturing market.

North America is the Largest Region Owing to Technological Advancements

North America stands as the largest region in the AI in manufacturing market, driven by its advanced technological infrastructure and robust manufacturing sector. The region is home to a significant number of leading technology companies and manufacturing giants that are actively investing in AI technologies to enhance productivity and operational efficiency. The United States, in particular, is witnessing a surge in AI adoption across various manufacturing sectors, including automotive, aerospace, and electronics. This trend is supported by favorable government policies, increased R&D activities, and a growing focus on Industry 4.0 initiatives.

The presence of key players in the North American market, coupled with the region's strong emphasis on innovation, has fostered an environment conducive to the rapid adoption of AI solutions. Manufacturers are increasingly leveraging AI technologies to optimize their operations, enhance supply chain management, and improve product quality. As a result, North America is expected to maintain its dominance in the AI in manufacturing market throughout the forecast period, with substantial investments in AI-driven technologies anticipated to drive further growth.

Competitive Landscape and Leading Companies

The AI in Manufacturing Market is characterized by intense competition, with several leading companies at the forefront of technological innovation. Key players such as Siemens AG, IBM Corporation, General Electric Company, Rockwell Automation, and Mitsubishi Electric Corporation are actively investing in R&D to develop advanced AI solutions tailored for the manufacturing sector. These companies are leveraging strategic partnerships, mergers, and acquisitions to enhance their product offerings and expand their market reach.

The competitive landscape is marked by the increasing integration of AI technologies with IoT, big data analytics, and cloud computing, creating opportunities for new entrants and established players alike. As manufacturers seek to harness the power of AI to drive efficiency and productivity, companies that can deliver innovative and scalable solutions are poised for success in this rapidly evolving market. The emphasis on sustainable manufacturing practices and the growing demand for smart factories further add to the competitive dynamics, compelling companies to adapt and innovate continuously to meet the evolving needs of the industry.

Report Objectives

The report will help you answer some of the most critical questions in the AI in Manufacturing market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the AI in Manufacturing market?

- What is the size of the AI in Manufacturing market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 3.0 billion |

|

Forecasted Value (2030) |

USD 40.6 billion |

|

CAGR (2024-2030) |

45.0% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

AI in Manufacturing Market By Offering (Hardware, Software, Services), Technology (Machine Learning, Natural Language Processing), By Application (Predictive Maintenance & Machinery Inspection, Cyber security), By End-use (Semiconductor & Electronics, Energy & Power, Pharmaceuticals, Medical Devices, Automotive, Machine Manufacturing, Consumer Goods, Aerospace & Defense) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Artificial Intelligence in Manufacturing Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Software |

|

4.2.Hardware |

|

4.3.Services |

|

5.Artificial Intelligence in Manufacturing Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Machine Learning |

|

5.2.Aware Computing |

|

5.3.Natural Language Processing |

|

5.4.Computer Vision |

|

6.Artificial Intelligence in Manufacturing Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Predictive Maintenance and Machinery Inspection |

|

6.2.Production Planning |

|

6.3.Inventory Optimization |

|

6.4.Quality Control |

|

6.5.Field Services |

|

6.6.Industrial Robots |

|

6.7.Cybersecurity |

|

6.8.Reclamation |

|

7.Artificial Intelligence in Manufacturing Market, by Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Automotive |

|

7.2.Metals and Heavy Machinery |

|

7.3.Energy and Power |

|

7.4.Semiconductor & Electronics |

|

7.5.Pharma |

|

7.6.Food & Beverage |

|

7.7.Mining |

|

7.8.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Artificial Intelligence in Manufacturing Market, by Offering |

|

8.2.7.North America Artificial Intelligence in Manufacturing Market, by Technology |

|

8.2.8.North America Artificial Intelligence in Manufacturing Market, by Application |

|

8.2.9.North America Artificial Intelligence in Manufacturing Market, by Industry |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Artificial Intelligence in Manufacturing Market, by Offering |

|

8.3.1.2.US Artificial Intelligence in Manufacturing Market, by Technology |

|

8.3.1.3.US Artificial Intelligence in Manufacturing Market, by Application |

|

8.3.1.4.US Artificial Intelligence in Manufacturing Market, by Industry |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.NVIDIA |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Siemens |

|

10.3.Microsoft |

|

10.4.General Electric |

|

10.5.Alphabet |

|

10.6.Intel |

|

10.7.IBM |

|

10.8.Amazon Web Services |

|

10.9.Micron Technology |

|

10.10.Sight Machine |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the AI in manufacturing market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the AI in manufacturing Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the AI in manufacturing ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the AI in manufacturing market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA