The acquisition of smaller players and product innovations by major players are driving the AI in Cell and Gene Therapy Market. The AI in cell and gene therapy market is a competitive market, the prominent players in the global market include Dyno Therapeutics, Exelixis, Form Bio, Généthon, DeepMind (Google), IBM, Insilico, Microsoft, Nosis Bio, Oxford BioMedica, SK Pharmteco, Thales The acquisition of smaller players and product innovations by major players are driving the AI in cell and gene therapy market.

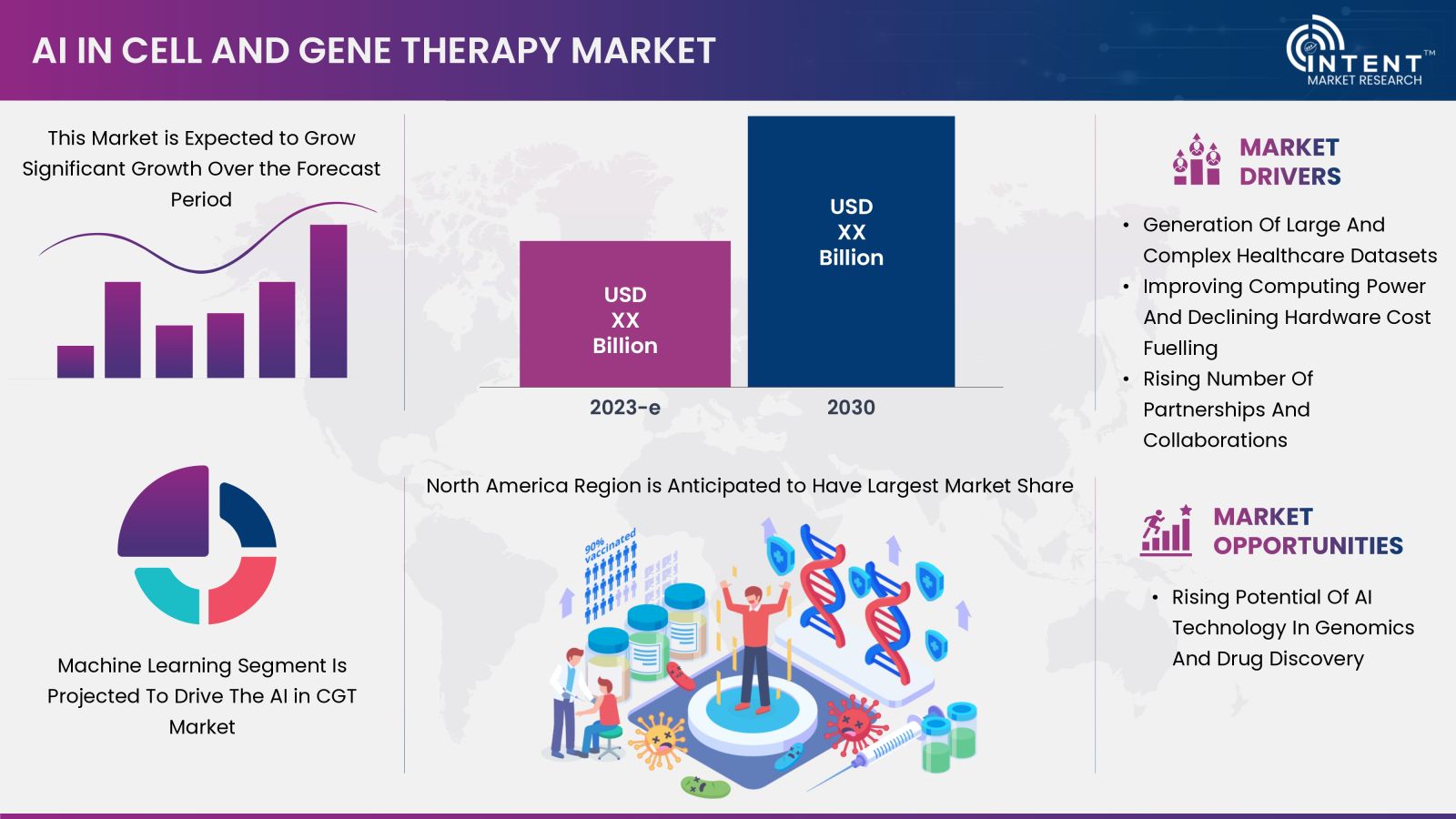

These methods have the potential to help address the root causes of both genetic and acquired diseases. In recent years, there have been several advances in AI technology have enabled the application of AI in complex operations including CGT. Research spanning from preclinical development to post-market surveillance underscores the growing significance of AI in this context. Its potential to improve and expedite various phases of therapy development and application has become increasingly apparent. The market is expected to grow due to the generation of large and complex healthcare datasets by AI.

Click here to: Get FREE Sample Pages of this Report

The integration of AI is becoming prevalent in the CGT sector, driven by advancements in digital technologies, computing power, and the influx of data. The transformative surge of AI is creating an incredible mark on every field including CGT and anticipated to transform both the ecosystem and value chain of CGT.

Major market players in CGT sector are adopting collaboration and partnerships strategies to gain market share

Technology and pharmaceutical players increasing their investments in AI to expand their businesses. Various companies such as Microsoft, Google, and Thales, amongst others, are investing with emerging players in biopharmaceutical companies to establish themselves in the field of AI in CGT market. For instance, in March 2023, researchers used the Goggles' DeepMind AI system "AlphaFold" to develop a tiny syringe that can inject proteins into the cells. Moreover, in June 2022, Microsoft collaborated with Oxfort BioMedica, UK headquartered company to use their AI technology to make CGT manufacturing easier and cheaper.

Increasing complexities, data breaches, and concerns about data privacy are hindering market growth

While AI has found multiple applications across various industries, its integration into the field of CGT remains somewhat constrained. This limitation primarily stems from the intricate challenges faced by healthcare providers. Similar to other health information technologies, AI raises concerns about data privacy and security. This is especially pertinent in today's landscape, marked by the prevalence of cyberattacks, where patients' protected health information has become a lucrative target for identity thieves and cybercriminals. This aids complexity in the rapid adoption of AI in CGT sector.

High potential of AI technology in genomics and drug discovery is projected to drive market growth opportunities

AI is accelerating R&D in the pharmaceutical industry by efficiently handling complex molecular data. In CGT, AI is optimizing delivery methods through deep learning, allowing for the design of immune-evasive viral vectors, and enhancing treatment effectiveness. For clinical trials, AI streamlines patient recruitment by analyzing medical records and offers a solution in the form of synthetic control arms, reducing costs and ethical concerns.

AI-driven digital twins transform manufacturing for consistent product quality, optimize supply chains, ensure regulatory compliance, streamline processes, and accelerate the development of advanced cell and gene therapies. The transformative potential of AI in the CGT sector is substantial, offering benefits in R&D, manufacturing, and beyond.

Accelerating research, optimizing patient matching, and enhancing treatment outcomes in healthcare with machine learning technology

Machine learning (ML) technology has witnessed remarkable growth in recent years, it is mainly driven by the increasing adoption of AI and data-driven solutions across various industries. ML, a subset of AI, empowers computers to learn and make predictions or decisions without being programmed, making it an invaluable tool for businesses. Natural language processing (NLP) and predictive analytics are also employed in the CGT segment. NLP has the capability to examine unstructured data sourced from medical records, enabling the identification of individuals exhibiting particular symptoms, biomarkers, and/or diagnoses aligning with the inclusion criteria for clinical trials. It is revolutionizing the cell and gene therapy market by accelerating research and development processes, optimizing patient matching, and improving treatment outcomes.

Dominance of clinical trials application fuels growth in AI for CGT market

Clinical trials application segment held the largest market share in the AI in CGT market. Increased revenue from this segment is attributed to substantial investments in research, drug discovery, drug development, and clinical trials for newly developed medications. Factors such as patent expirations, an increasing demand for accelerated clinical trial outcomes, and the need for innovative drug advancements is expected to drive segment growth. Moreover, AI's integration into patient recruitment processes is expected to reduce time and costs, further fueling the demand for AI in CGT market.

Biopharmaceutical companies accounted for highest market share in 2023

Biopharmaceutical companies accounted for highest market share in 2023 owing to widespread applications of AI in various technologies. This trend is attributed to the extensive research efforts and adoption of AI within various biopharmaceutical companies. The widespread applications of AI across diverse technologies have spurred its integration into the strategies and operations of these companies, solidifying their position in the AI in CGT market.

North America's market thrives, fuelled by the strong influence and prevalence of key industry players

North America accounted for the highest market share in 2023 as the region is characterized by an increased inclination towards the advanced and latest digital technologies. The strong and developed healthcare, IT, and telecommunications infrastructure in North America has supported the growth of AI in CGT market. Additionally, the North American market experiences growth fueled by the substantial presence of key industry players.

The acquisition of smaller players and product innovations by major players are driving the market growth

The AI in CGT market is characterized by intense competition due to the presence of numerous international and emerging players. These industry leaders are primarily focused on acquiring smaller players and innovating their product lines to cater to changing consumer preferences and needs.

- In July 2023, Généthon and Thales collaborated to develop digital models for improving gene therapy bio-production yields. The objective of this collaboration is to improve production yields, reducing the production costs of innovative therapy drugs

- In July 2023, CF Foundation funds Nosis Bio to design gene therapy using AI

- In September 2022, WhiteLab Genomics raises $10.0 million for AI-powered genomic therapies platform.

- In August 2022, IBM Research REPROCELL and STFC announced a new initiative using AI to advance the discovery of new drug cell and gene therapies and improve the design of clinical trials. This collaboration aims to build discovery-driven communities that make a lasting impact, including in the areas of drug discovery, CGT and clinical trial

- In July 2021, NJII partnered with McKinsey & Company to establish a new center aimed at advancing manufacturing excellence and operations in the field of CGT

Click here to: Get your custom research report today

AI in Cell and Gene Therapy Market Coverage

The report provides key insights into the AI in cell and gene therapy market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyses key players as well as the competitive landscape within the market

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD XX billion |

|

Forecast Revenue (2030) |

USD XX billion |

|

CAGR (2024-2030) |

XX% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

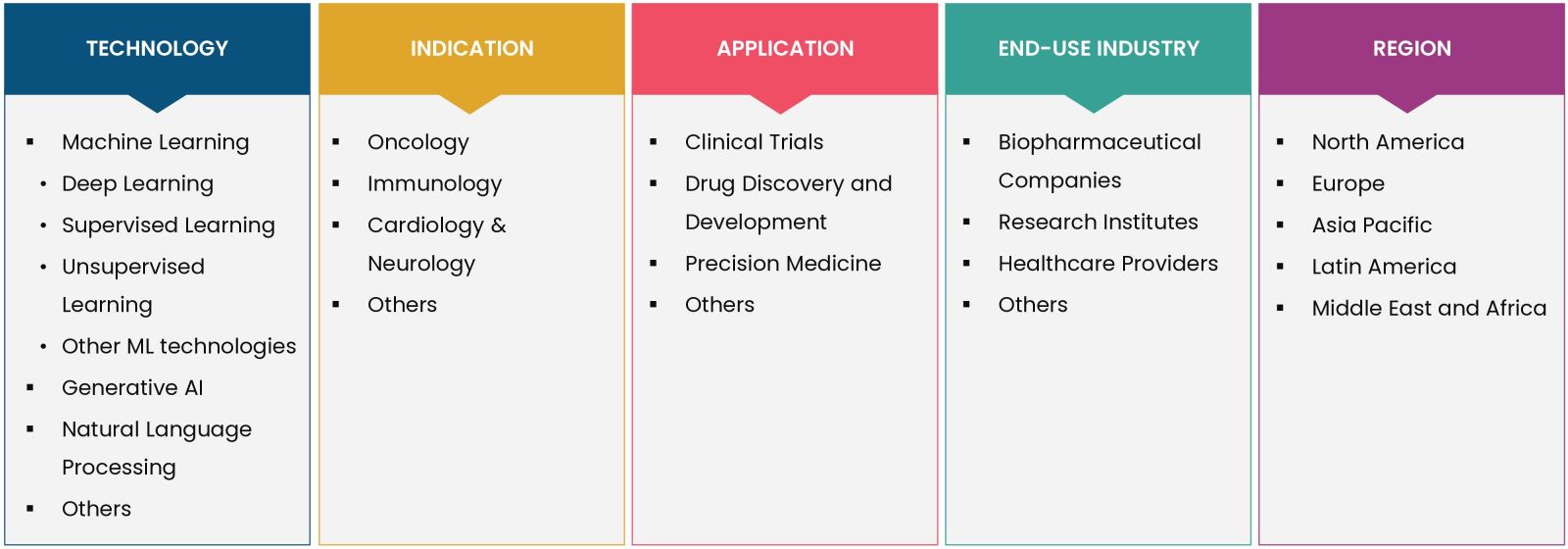

Segments Covered |

By Technology (Machine Learning (ML) {Deep Learning, Supervised Learning, Unsupervised Learning, Other ML technologies}, Generative AI, Natural Language Processing, Others), By Indication (Oncology, Immunology, Cardiology & Neurology, Infectious Disease, Others), By Application (Clinical Trials, Drug Discovery, Precision Medicine, Others), By End-User (Biopharmaceutical Companies, Research Institutes, Healthcare Providers, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India) Latin America (Brazil, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

Dyno Therapeutics, Exelixis, Form Bio, Généthon, DeepMind (Google), IBM, Insilico, Microsoft, Nosis Bio, Oxford BioMedica, SK Pharmteco, Thales |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.Generation of Large and Complex Healthcare Datasets |

|

4.1.2.Improving Computing Power and Declining Hardware Cost Fuelling |

|

4.1.3.Rising Number of Partnerships and Collaborations |

|

4.2.Market Growth Challenges |

|

4.2.1.Increasing Complexities, and Data Breaches Issues |

|

4.2.2.Data Privacy Concerns |

|

4.3.Market Growth Opportunities |

|

4.3.1.Rising Potential of AI Technology in Genomics and Drug Discovery |

|

5.Pestle Analysis |

|

6.Porter’s Five Forces Analysis |

|

7.Market Outlook |

|

7.1.Supply Chain Analysis |

|

7.2.Cell and Gene Industry Outlook |

|

7.3.Regulatory Analysis |

|

7.4.Technological Advancement |

|

7.5.Pipeline Analysis |

|

7.6.Investment Scenario |

|

7.7.Evolution of AI Technology |

|

7.8.Value Chain Analysis |

|

7.9.Pricing Model Analysis |

|

7.10. Business Model Analysis |

|

7.11. Key Conferences and Events |

|

7.12. Case Studies |

|

8.Market Segment Outlook |

|

8.1.Segment Synopsis |

|

8.2.By Technology (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.2.1.Machine Learning |

|

8.2.1.1.Deep Learning |

|

8.2.1.2.Supervised Learning |

|

8.2.1.3.Unsupervised Learning |

|

8.2.1.4.Other ML technologies |

|

8.2.2.Generative AI |

|

8.2.3.Natural Language Processing |

|

8.2.4.Others |

|

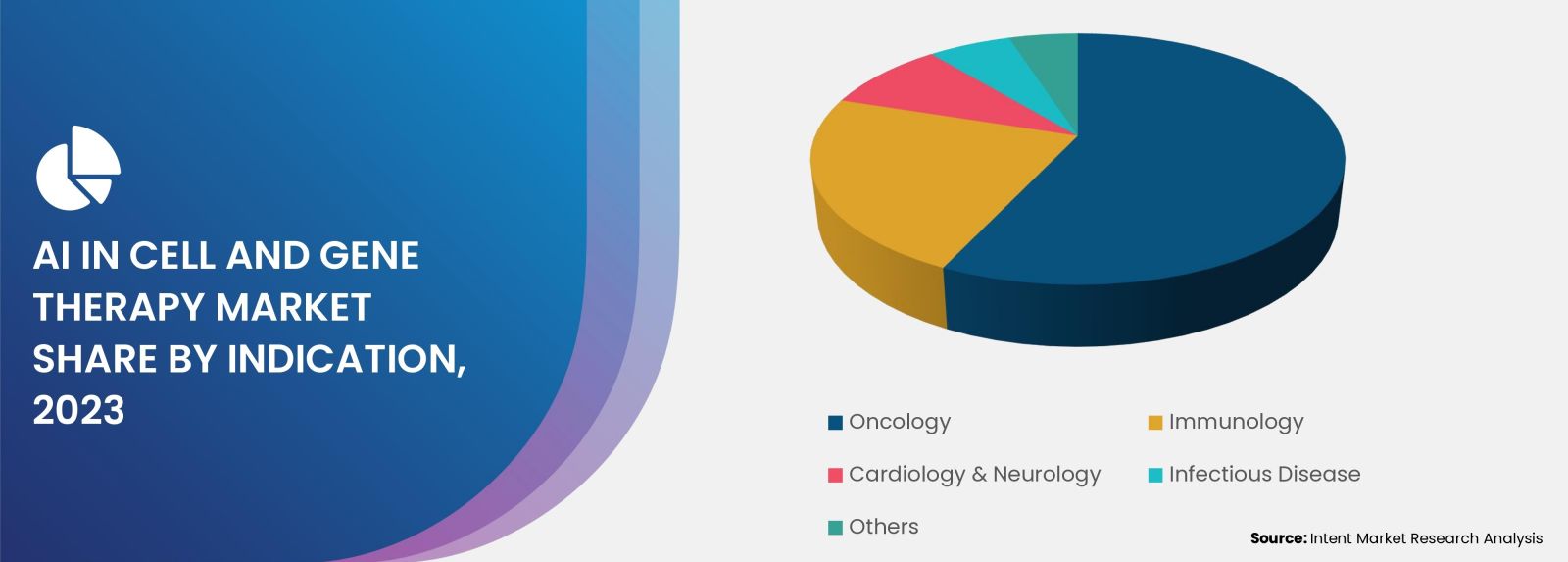

8.3.By Indication (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.3.1.Oncology |

|

8.3.2.Immunology |

|

8.3.3.Cardiology & Neurology |

|

8.3.4.Infectious Disease |

|

8.3.5.Others |

|

8.4.By Application (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.4.1.Clinical Trials |

|

8.4.2.Drug Discovery and Development |

|

8.4.3.Precision Medicine |

|

8.4.4.Others |

|

8.5.By End-User (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

8.5.1.Biopharmaceutical Companies |

|

8.5.2.Research Institutes |

|

8.5.3.Healthcare Providers |

|

8.5.4.Others |

|

9.Regional Outlook |

|

9.1.Global Market Synopsis |

|

9.2.North America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.2.1.North America AI in Cell and Gene Therapy Market Outlook |

|

9.2.2.US |

|

9.2.2.1.US AI in CGT Market, By Technology |

|

9.2.2.2.US AI in CGT Market, By Indication |

|

9.2.2.3.US AI in CGT Market, By Application |

|

9.2.2.4.US AI in CGT Market, By End-User |

|

9.2.3.Canada |

|

*Note: Cross-segmentation by segments for each region will be covered as shown above |

|

9.3.Europe (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.3.1.Europe AI in CGT Market Outlook |

|

9.3.2.Germany |

|

9.3.3.UK |

|

9.3.4.France |

|

9.3.5.Spain |

|

9.3.6.Italy |

|

9.4.Asia-Pacific (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.4.1.Asia-Pacific AI in CGT Market Outlook |

|

9.4.2.China |

|

9.4.3.India |

|

9.4.4.Japan |

|

9.5.Latin America (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.5.1.Latin America AI in CGT Market Outlook |

|

9.5.2.Brazil |

|

9.5.3.Argentina |

|

9.6.Middle East & Africa (Market Size and Forecast by Value - USD billion, 2024 - 2030) |

|

9.6.1.Middle East & Africa AI in CGT Market Outlook |

|

9.6.2.Saudi Arabia |

|

9.6.3.South Africa |

|

9.6.4.Turkey |

|

9.6.5.United Arab Emirates |

|

10. Competitive Landscape |

|

10.1. Market Share Analysis |

|

10.2. Product/Service Benchmarking |

|

10.3. Company Strategy Analysis |

|

10.4. Competitive Matrix |

|

11. Company Profiles |

|

11.1. AI in CGT Market (Supply-Side) |

|

11.1.1. Dyno Therapeutics |

|

11.1.1.1. Company Synopsis |

|

11.1.1.2. Company Financials |

|

11.1.1.3. Product/Service Portfolio |

|

11.1.1.4. Recent Developments |

|

*Note: All the companies in the section 11.1 will cover same sub-chapters as above |

|

11.1.2. Exelixis |

|

11.1.3. Form Bio |

|

11.1.4. Généthon |

|

11.1.5. DeepMind (Google) |

|

11.1.6. IBM |

|

11.1.7. Insilico |

|

11.1.8. Microsoft |

|

11.1.9. Nosis Bio |

|

11.1.10. Oxford BioMedica |

|

11.1.11. SK Pharmteco |

|

11.1.12. Thales |

|

11.2. AI in CGT Market (Demand-Side) |

|

11.2.1.AstraZeneca |

|

11.2.1.1.Company Synopsis |

|

11.2.1.2.Company Financials |

|

11.2.1.3.Recent Developments |

|

*Note: All the companies in the section 11.2 will cover same sub-chapters as above |

|

11.2.2.Bayer |

|

11.2.3.Bio-Techne |

|

11.2.4.bioMérieux |

|

11.2.5.Biogen |

|

11.2.6.Cytiva |

|

11.2.7.Dendreon Pharmaceuticals |

|

11.2.8.Helixmith |

|

11.2.9.JCR Pharmaceuticals |

|

11.2.10.Kolon TissueGene |

|

11.2.11.Merck |

|

11.2.12.Novartis |

|

11.2.13.Pfizer |

|

|

|

|

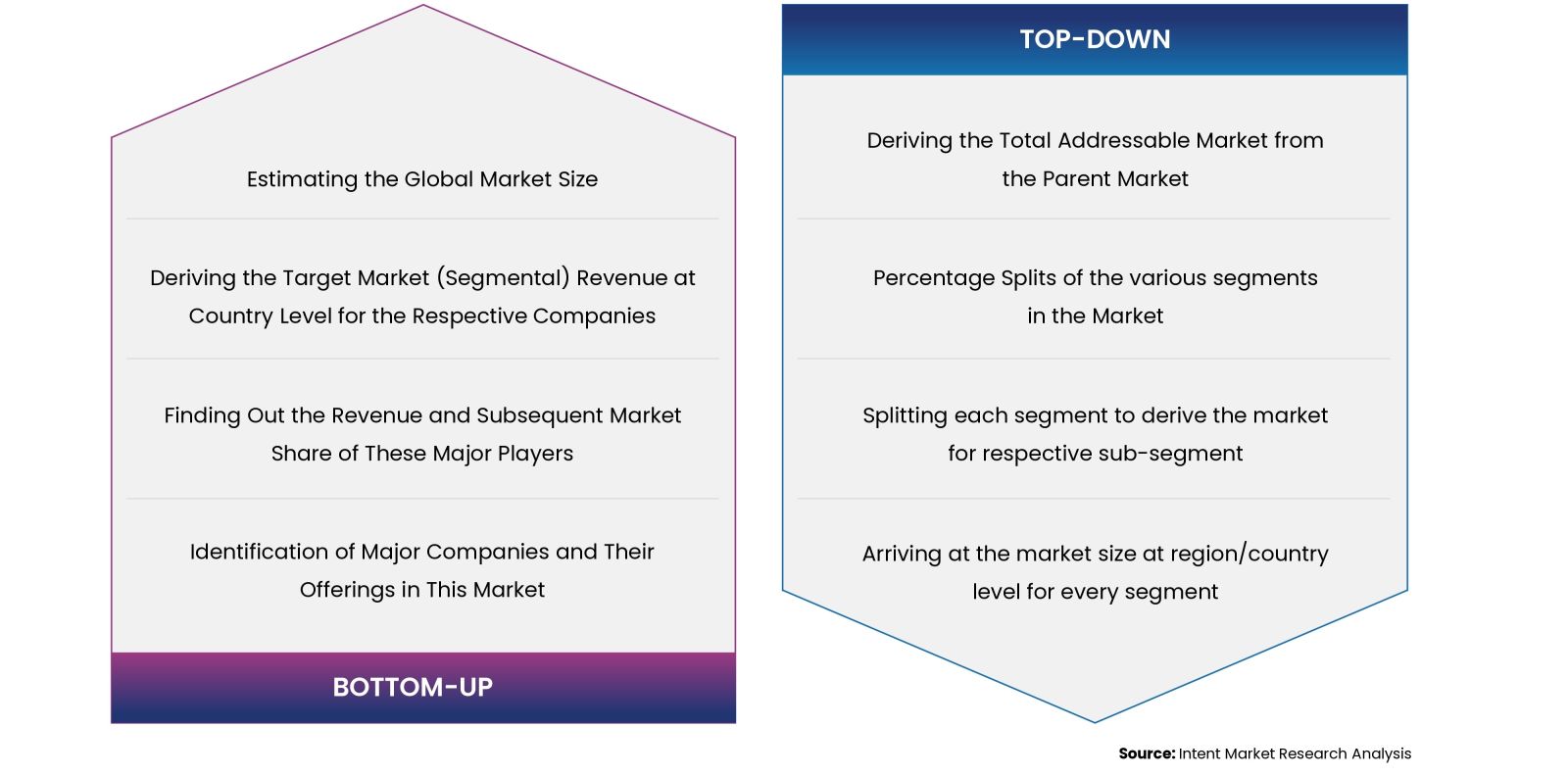

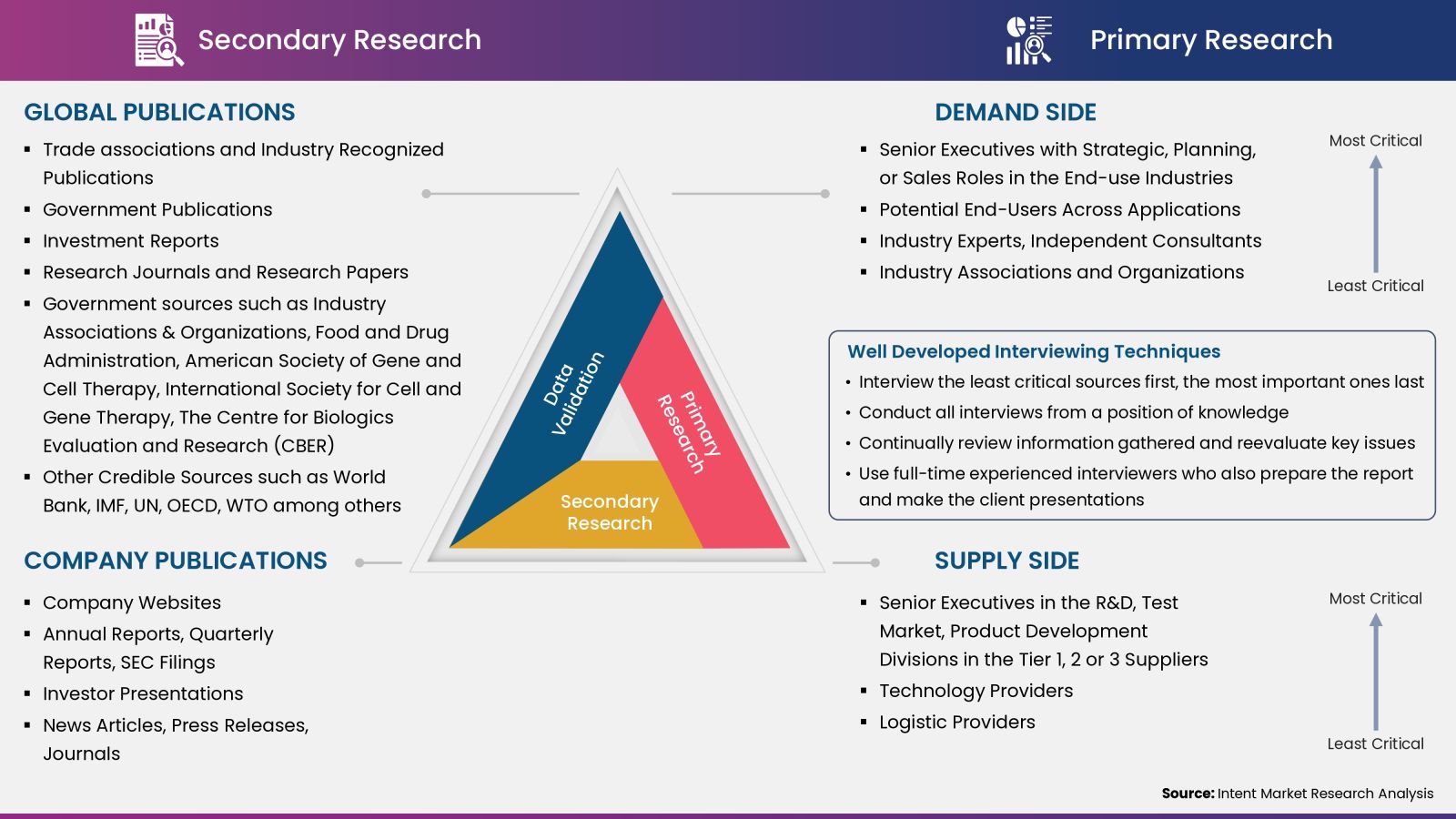

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.