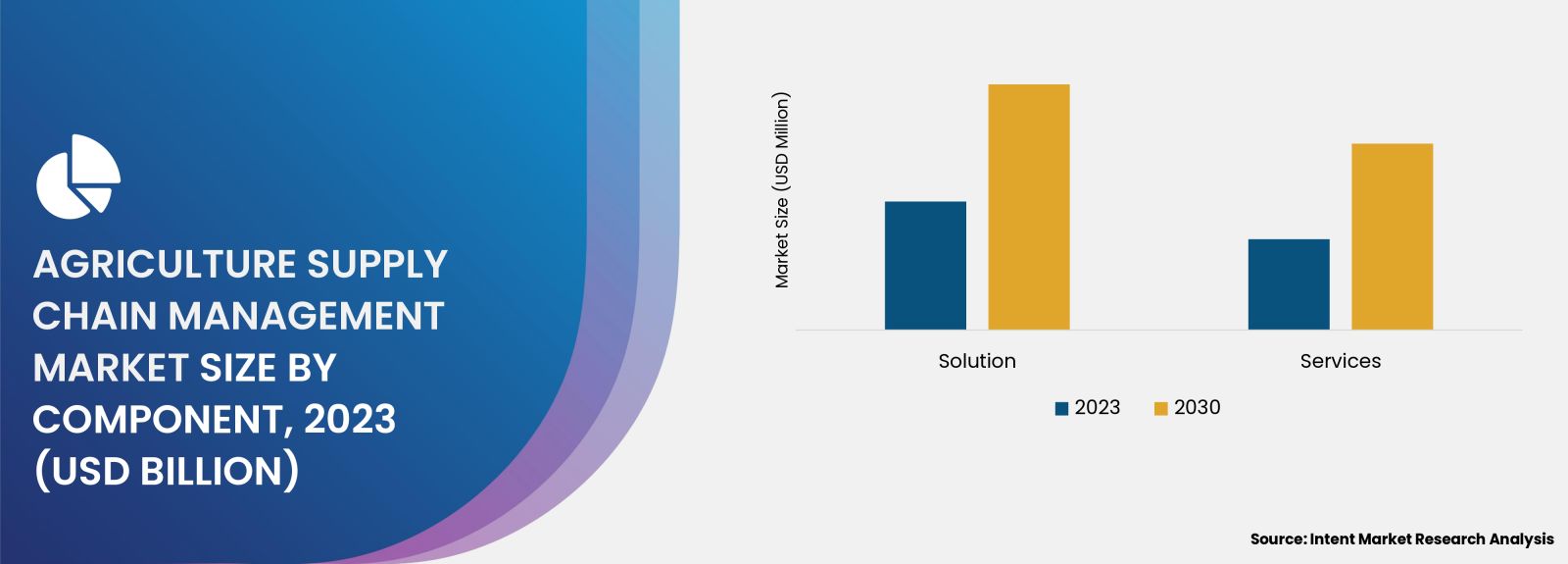

As per Intent Market Research, the Agriculture Supply Chain Management Market was valued at USD 361.2 million in 2023 and will surpass USD 715.6 million by 2030; growing at a CAGR of 10.3% during 2024 - 2030.

Increasing consumer demand for transparency and quality in food products is pushing agricultural businesses to adopt innovative SCM solutions. Moreover, the rise of e-commerce in agriculture is revolutionizing traditional supply chains, enabling farmers and suppliers to reach customers more effectively. As global food production faces pressure from climate change and a growing population, efficient supply chain management is becoming crucial to meet the demands of both producers and consumers.

Farm Management Software Segment is Largest Owing to Increased Adoption of Digital Solutions

The farm management software segment stands as the largest component of the Agriculture Supply Chain Management market, driven by the increasing adoption of digital solutions among farmers. These software applications provide comprehensive tools for planning, monitoring, and analyzing all activities on the farm, from planting to harvesting. With the integration of IoT and data analytics, farmers can optimize resource use, enhance crop yields, and make informed decisions based on real-time data.

The growing emphasis on precision agriculture has further propelled the demand for farm management software. By enabling farmers to monitor environmental conditions, soil health, and crop performance, these tools contribute to improved productivity and sustainability. As more agricultural stakeholders recognize the benefits of digital solutions, the farm management software segment is expected to maintain its leadership position, fostering continuous innovation and adoption across the sector.

Logistics Management Segment is Fastest Growing Owing to E-Commerce Trends

The logistics management segment is the fastest-growing area within the Agriculture Supply Chain Management market, largely driven by the increasing trends in e-commerce and online food delivery services. With consumers seeking fresh and locally sourced produce, efficient logistics management has become paramount to ensure timely delivery while maintaining product quality. Advanced logistics solutions leverage technology to optimize routing, reduce transportation costs, and enhance overall supply chain visibility.

The rise of consumer demand for convenience and quick access to fresh food has necessitated the implementation of efficient logistics management systems. This segment's growth is also attributed to innovations in last-mile delivery solutions, which are critical for meeting consumer expectations in the e-commerce landscape. As more agricultural businesses shift their focus towards direct-to-consumer sales models, the logistics management segment is poised for rapid expansion.

Traceability Solutions Segment is Largest Owing to Growing Consumer Demand for Transparency

The traceability solutions segment is the largest within the Agriculture Supply Chain Management market, driven by increasing consumer demand for transparency in food sourcing and safety. Traceability solutions enable stakeholders to track agricultural products throughout the supply chain, from farm origin to final consumption. This not only helps in ensuring food safety and quality but also addresses growing concerns regarding sustainability and ethical sourcing.

As foodborne illnesses and safety issues garner public attention, traceability has become essential for agricultural businesses to build consumer trust. Regulatory pressures and standards for food safety are also fueling the adoption of traceability solutions. The emphasis on sustainability in agriculture is further reinforcing the need for transparency, making this segment a critical area for investment and innovation.

Supply Chain Analytics Segment is Fastest Growing Owing to Big Data Insights

The supply chain analytics segment is the fastest-growing category in the Agriculture Supply Chain Management market, primarily due to the increasing use of big data analytics to drive operational efficiency. These analytics tools help agricultural businesses assess performance metrics, forecast demand, and identify inefficiencies within their supply chains. By leveraging data-driven insights, stakeholders can make informed decisions that enhance productivity and reduce costs.

The growing complexity of agricultural supply chains, exacerbated by factors such as climate change and market fluctuations, is driving the demand for robust analytics solutions. As agricultural stakeholders increasingly recognize the value of data in optimizing their operations, the supply chain analytics segment is expected to experience rapid growth, positioning itself as a vital component of modern agricultural practices.

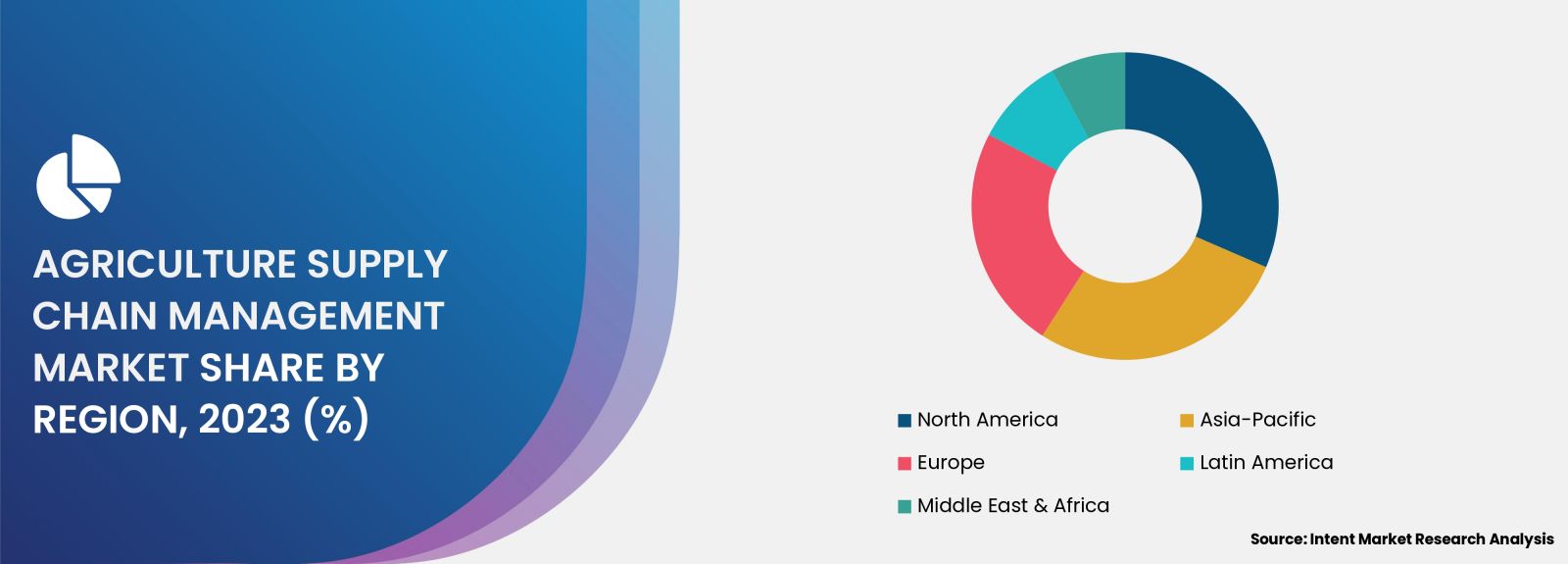

North America Region is Largest Owing to Advanced Infrastructure and Technology Adoption

North America is the largest region in the Agriculture Supply Chain Management market, largely owing to its advanced infrastructure and high levels of technology adoption in agriculture. The United States and Canada lead the way in implementing innovative solutions that enhance supply chain efficiency. With a well-established agricultural sector, significant investments in research and development, and a strong emphasis on sustainability, North America has become a hub for agricultural innovations.

The region's regulatory environment also supports the growth of agriculture SCM technologies, facilitating the integration of digital solutions across the supply chain. As farmers and agricultural businesses in North America continue to adopt advanced supply chain management practices, the region is expected to maintain its dominance in the market, setting the pace for innovations that can be replicated globally.

Competitive Landscape of Leading Companies

The Agriculture Supply Chain Management market is characterized by a dynamic competitive landscape, with several key players leading the industry. Prominent companies in this sector include:

- SAP SE: A global leader in enterprise software, SAP offers comprehensive supply chain management solutions tailored for the agriculture sector.

- Oracle Corporation: Oracle provides cloud-based SCM solutions that enable agricultural businesses to optimize their supply chain processes.

- IBM Corporation: IBM offers advanced analytics and blockchain solutions for traceability and transparency in agricultural supply chains.

- AG Leader Technology: Specializing in precision farming, AG Leader develops software solutions for farm management and supply chain optimization.

- Trimble Inc.: Trimble provides integrated software and hardware solutions for agricultural logistics and supply chain management.

- Corteva Agriscience: As a major agricultural company, Corteva focuses on sustainable supply chain practices and digital solutions for farmers.

- Bayer Crop Science: Bayer is actively investing in digital agriculture solutions to enhance supply chain management across its product offerings.

- Monsanto Company: Now part of Bayer, Monsanto emphasizes traceability and sustainable practices in agricultural supply chains.

- Trellis: Trellis provides AI-driven supply chain management solutions specifically designed for the agriculture industry.

- Farmlogs: Farmlogs offers farm management software that aids farmers in optimizing their operations and improving supply chain efficiency.

These companies are continuously innovating and expanding their product offerings to meet the evolving needs of the agriculture supply chain. Collaborations, partnerships, and strategic acquisitions are common as firms aim to leverage complementary technologies and enhance their market presence. The competition in the Agriculture Supply Chain Management market is expected to intensify as businesses strive to provide comprehensive and effective solutions that address the challenges facing modern agriculture.

Report Objectives:

The report will help you answer some of the most critical questions in the Agriculture Supply Chain Management Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Agriculture Supply Chain Management Market?

- What is the size of the Agriculture Supply Chain Management Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 361.2 million |

|

Forecasted Value (2030) |

USD 715.6 million |

|

CAGR (2024 – 2030) |

10.3% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Agriculture Supply Chain Management Market By Component (Solution, Services), By Solution Type (Market Intelligence, Food Safety & Compliance, Inventory Management Solution, Fleet Management Solutions, Supplier Management), By Deployment Model (On-Premise, On-Demand / Cloud-Based) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Agriculture Supply Chain Management Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Solution |

|

4.2. Services |

|

5. Agriculture Supply Chain Management Market, by Solution Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Market Intelligence |

|

5.2. Food Safety & Compliance |

|

5.3. Inventory Management Solutions |

|

5.4. Fleet Management Solutions |

|

5.5. Supplier Management |

|

5.6. Others |

|

6. Agriculture Supply Chain Management Market, by Deployment Model (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. On-Premise |

|

6.2. On-Demand / Cloud-Based |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Agriculture Supply Chain Management Market, by Component |

|

7.2.7. North America Agriculture Supply Chain Management Market, by Solution Type |

|

7.2.8. North America Agriculture Supply Chain Management Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Agriculture Supply Chain Management Market, by Component |

|

7.2.9.1.2. US Agriculture Supply Chain Management Market, by Solution Type |

|

7.2.9.1.3. US Agriculture Supply Chain Management Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. AirDAO |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. BEXT360 |

|

9.3. Eka |

|

9.4. GrainChain |

|

9.5. IBM |

|

9.6. Intellync |

|

9.7. KPMG |

|

9.8. LexisNexis Risk Solutions |

|

9.9. SAP |

|

9.10. Sustainable Agriculture Initiative Platform |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Agriculture Supply Chain Management Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Agriculture Supply Chain Management Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Agriculture Supply Chain Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Agriculture Supply Chain Management Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA