As per Intent Market Research, the Agricultural Variable Rate Technology Market was valued at USD 7.4 billion in 2023 and will surpass USD 17.6 billion by 2030; growing at a CAGR of 13.1% during 2024 - 2030.

The adoption of VRT is driven by several factors, including the increasing global population, which necessitates higher food production, and the rising awareness of sustainable agricultural practices. As farmers seek ways to optimize resource use while maximizing output, VRT technologies offer innovative solutions that align with both economic and environmental goals. The integration of advanced data analytics, GPS technology, and remote sensing in VRT systems is revolutionizing traditional farming methods, leading to more informed decision-making and ultimately contributing to the growth of the agricultural sector.

Precision Agriculture Segment is Largest Owing to Enhanced Crop Management

The precision agriculture segment is the largest within the Agricultural Variable Rate Technology market, driven by the growing need for efficient crop management solutions. Precision agriculture involves the use of technology to monitor and manage field variability in crops, soil, and weather conditions. By leveraging VRT systems, farmers can apply fertilizers, pesticides, and other inputs more accurately, thereby optimizing resource use and improving overall productivity.

The importance of precision agriculture lies in its ability to provide real-time data, allowing farmers to make informed decisions that enhance crop yields and reduce costs. With increasing pressure to produce more food sustainably, farmers are turning to precision agriculture as a solution to meet these challenges. As this segment continues to evolve with advancements in technology, the precision agriculture segment is expected to maintain its dominance in the VRT market throughout the forecast period.

Data Management and Analysis Segment is Fastest Growing Owing to Rising Demand for Insights

The data management and analysis segment is the fastest-growing category within the Agricultural Variable Rate Technology market, fueled by the rising demand for actionable insights derived from agricultural data. As farmers increasingly adopt precision agriculture practices, the need for robust data management systems becomes crucial to effectively analyze and interpret vast amounts of data collected from various sources, including soil sensors, weather stations, and satellite imagery.

This segment's growth is largely attributed to advancements in big data analytics and machine learning technologies, which enable farmers to gain deeper insights into field conditions and crop performance. By leveraging these technologies, farmers can make data-driven decisions that optimize input application, enhance crop health, and ultimately increase yields. The increasing availability of affordable and user-friendly data management solutions is further propelling the adoption of this segment, positioning it as a key driver of the overall VRT market.

Fertilizer Application Segment is Largest Owing to Cost-Effectiveness

The fertilizer application segment is the largest within the agricultural variable rate technology market, driven by the need for cost-effective nutrient management solutions. Fertilizers play a critical role in enhancing crop growth and yield; however, their overuse can lead to soil degradation and environmental pollution. VRT enables farmers to apply fertilizers at variable rates based on soil nutrient levels and crop needs, ensuring optimal application and minimizing waste.

This segment's significance lies in its ability to enhance fertilizer efficiency and reduce costs for farmers. By utilizing VRT for fertilizer application, farmers can achieve higher yields while simultaneously decreasing input costs and mitigating negative environmental impacts. As sustainability becomes a central focus in agriculture, the fertilizer application segment is expected to continue its growth trajectory, underscoring its importance in the broader VRT market.

North America Region is Largest Owing to Technological Adoption

North America represents the largest region in the Agricultural Variable Rate Technology market, primarily due to the widespread adoption of advanced agricultural technologies and precision farming practices. The United States and Canada have well-established agricultural sectors that leverage cutting-edge technologies to enhance productivity and sustainability. The increasing availability of VRT solutions and favorable government policies promoting precision agriculture further contribute to the growth of this region.

The North American market is characterized by a high level of awareness and investment in VRT technologies among farmers. This trend is driven by the need to optimize resource use, reduce production costs, and improve crop yields amid growing environmental concerns. As North America continues to lead the way in agricultural innovation, its dominance in the VRT market is expected to persist throughout the forecast period.

Competitive Landscape of Leading Companies

The Agricultural Variable Rate Technology market is characterized by a competitive landscape with several key players shaping the industry. Prominent companies in this market include:

- Trimble Inc.: Trimble is a global leader in precision agriculture solutions, providing advanced VRT technologies that enhance agricultural productivity and efficiency.

- AG Leader Technology: AG Leader specializes in precision farming technologies, offering a range of VRT solutions designed to optimize input application and improve farm management.

- John Deere: John Deere is a well-known name in agricultural machinery, providing integrated VRT systems that enhance precision farming practices.

- Monsanto (Bayer AG): Bayer's agricultural division focuses on developing innovative VRT solutions that improve crop yield and sustainability.

- CNH Industrial: CNH Industrial offers advanced precision farming technologies, including VRT solutions, to help farmers enhance productivity and reduce environmental impact.

- Raven Industries: Raven is a key player in precision agriculture, providing VRT technologies that support efficient input application and farm management.

- Yara International: Yara is a leading provider of crop nutrition solutions, leveraging VRT technologies to optimize fertilizer application and enhance sustainability.

- Syngenta: Syngenta focuses on developing advanced agricultural technologies, including VRT solutions that support precision farming practices.

- Valmont Industries: Valmont specializes in agricultural irrigation and technology solutions, offering VRT systems that enhance water and nutrient management.

- Topcon Positioning Systems: Topcon provides precision agriculture solutions, including VRT technologies that improve field management and productivity.

The competitive landscape in the Agricultural Variable Rate Technology market is characterized by continuous innovation and collaboration among key players. Companies are increasingly investing in research and development to enhance their product offerings and expand their market presence. Strategic partnerships and acquisitions are also common as companies seek to leverage complementary technologies and expertise. As the demand for sustainable agricultural practices grows, competition in the VRT market is expected to intensify, driving further advancements and market growth.

Report Objectives:

The report will help you answer some of the most critical questions in the Agricultural Variable Rate Technology Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Agricultural Variable Rate Technology Market?

- What is the size of the Agricultural Variable Rate Technology Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 7.4 billion |

|

Forecasted Value (2030) |

USD 17.6 billion |

|

CAGR (2024 – 2030) |

13.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Agricultural Variable Rate Technology Market By Offering (Hardware, Software, Services), By Type (Fertilizer VRT, Crop Protection Chemical VRT, Soil Sensing, Seeding VRT, Yield Monitoring, Irrigation VRT), By Application Method (Map-Based VRT, Sensor-Based VRT), By Application Fit (Fertilizers, Crop Protection Chemicals), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Agricultural Variable Rate Technology Market, by Offering (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hardware |

|

4.1.1. Guidance and Steering systems |

|

4.1.2. Flow and Application Control Devices |

|

4.1.3. GPS / DGPS Receivers |

|

4.1.4. Handheld Mobile Devices/Computers |

|

4.1.5. Yield Monitors |

|

4.1.6. Sensors |

|

4.1.7. Displays |

|

4.2. Software |

|

4.3. Services |

|

4.3.1. Farm Operation Services |

|

4.3.2. Integration & Consultation Services |

|

5. Agricultural Variable Rate Technology Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Fertilizer VRT |

|

5.2. Crop Protection Chemical VRT |

|

5.3. Soil Sensing |

|

5.4. Seeding VRT |

|

5.5. Yield Monitoring |

|

5.6. Irrigation VRT |

|

6. Agricultural Variable Rate Technology Market, by Application Method (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Map-Based VRT |

|

6.2. Sensor-Based VRT |

|

6.2.1. Active Optical Sensor VRT |

|

6.2.2. Drone-Based VRT |

|

6.2.3. Satellite-Based VRT |

|

7. Agricultural Variable Rate Technology Market, by Application Fit (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Fertilizers |

|

7.2. Crop Protection Chemicals |

|

7.3. Others |

|

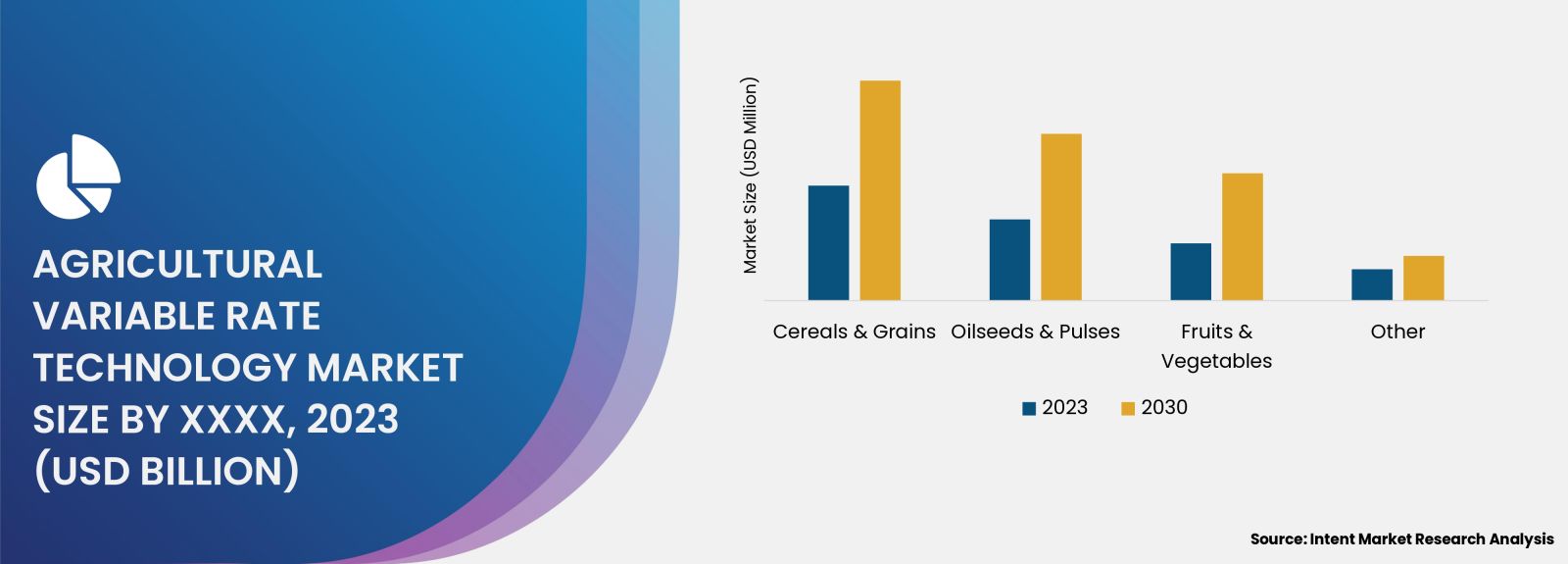

8. Agricultural Variable Rate Technology Market, by Crop Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Cereals & Grains |

|

8.2. Oilseeds & Pulses |

|

8.3. Fruits & Vegetables |

|

8.4. Other |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Agricultural Variable Rate Technology Market, by Offering |

|

9.2.7. North America Agricultural Variable Rate Technology Market, by Type |

|

9.2.8. North America Agricultural Variable Rate Technology Market, by Application Method |

|

9.2.9. North America Agricultural Variable Rate Technology Market, by Application Fit |

|

9.2.10. North America Agricultural Variable Rate Technology Market, by Crop Type |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Agricultural Variable Rate Technology Market, by Offering |

|

9.2.11.1.2. US Agricultural Variable Rate Technology Market, by Type |

|

9.2.11.1.3. US Agricultural Variable Rate Technology Market, by Application Method |

|

9.2.11.1.4. US Agricultural Variable Rate Technology Market, by Application Fit |

|

9.2.11.1.5. US Agricultural Variable Rate Technology Market, by Crop Type |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Deere & Company |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Trimble Inc. |

|

11.3. AGCO |

|

11.4. CNH Industrial |

|

11.5. Topcon |

|

11.6. Kubota |

|

11.7. Yara International |

|

11.8. Valmont Industries |

|

11.9. Lindsay Corporation |

|

11.10. AgJunction |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Agricultural Variable Rate Technology Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Agricultural Variable Rate Technology Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Agricultural Variable Rate Technology ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Agricultural Variable Rate Technology Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

.jpg)