As per Intent Market Research, the Agricultural Packaging Market was valued at USD 6.9 billion in 2023 and will surpass USD 10.2 billion by 2030; growing at a CAGR of 5.8% during 2024 - 2030.

The agricultural packaging market is witnessing significant growth, driven by the increasing need for sustainable and efficient packaging solutions in the agricultural sector. With the rising global population and the demand for food products, the need for effective packaging to protect and preserve agricultural goods is paramount. The agricultural packaging market encompasses a wide range of materials, including flexible plastic, rigid plastic, paper and paperboard, and metal, catering to diverse agricultural products such as fruits, vegetables, grains, and livestock feed.

In recent years, there has been a marked shift towards eco-friendly packaging solutions, as consumers and businesses alike are becoming more conscious of environmental sustainability. Innovations in biodegradable and recyclable materials are reshaping the agricultural packaging landscape, making it more appealing to environmentally responsible consumers. Additionally, advancements in packaging technology, such as modified atmosphere packaging (MAP) and intelligent packaging, are enhancing the shelf life of agricultural products, thereby contributing to market growth. The increasing trend of online grocery shopping is also propelling demand for effective agricultural packaging solutions that ensure product safety and quality during transit.

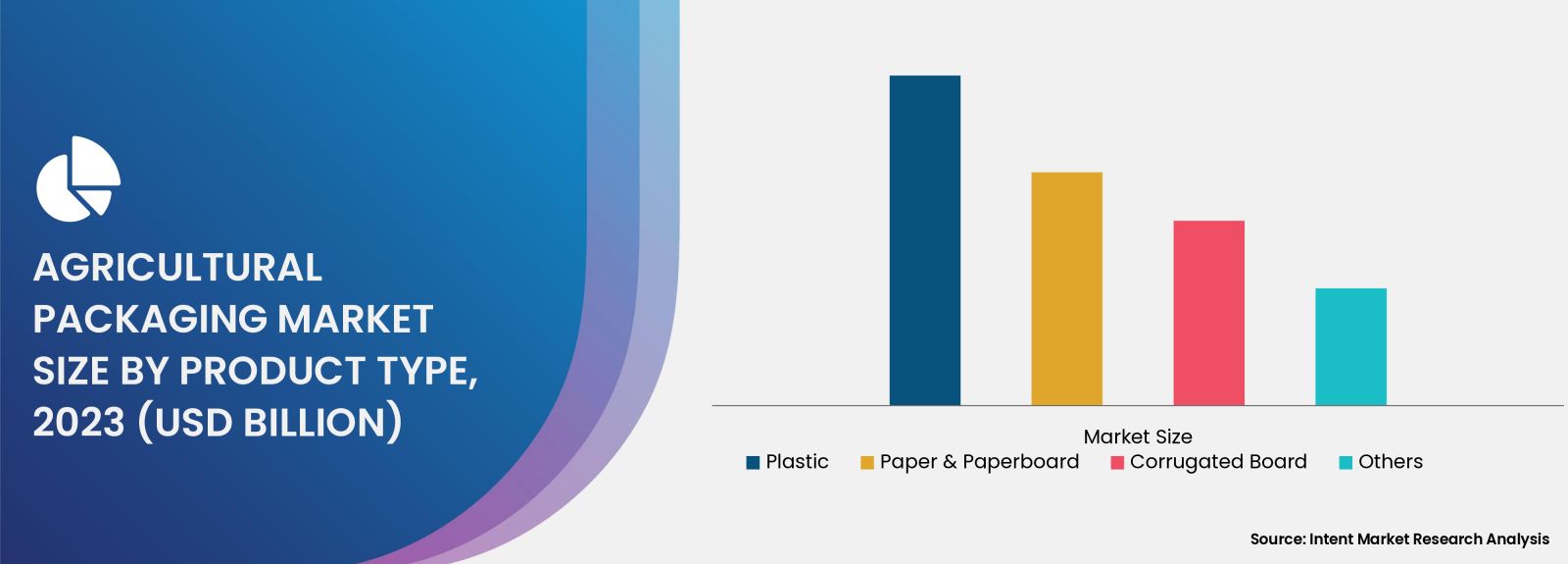

Flexible Plastic Packaging Segment is Largest Owing to Versatility and Cost-Effectiveness

The flexible plastic packaging segment is the largest in the agricultural packaging market, attributed to its versatility and cost-effectiveness. Flexible plastic materials are widely used for packaging fruits, vegetables, grains, and other agricultural products due to their lightweight nature and ability to conform to the shape of the product. This flexibility not only optimizes storage space but also reduces transportation costs, making it an attractive option for farmers and distributors alike.

Moreover, flexible plastic packaging offers excellent barrier properties, protecting products from moisture, oxygen, and contaminants, thereby extending shelf life. The growing preference for convenience foods and ready-to-eat meals is further driving the demand for flexible plastic packaging in the agricultural sector. As the agricultural industry continues to evolve, the flexible plastic packaging segment is expected to maintain its leading position, supported by ongoing innovations in material science and packaging technology.

Rigid Plastic Packaging Segment is Fastest Growing Owing to Enhanced Protection

The rigid plastic packaging segment is emerging as the fastest-growing subsegment in the agricultural packaging market, driven by the increasing demand for enhanced protection of agricultural products. Rigid plastic containers, such as crates, tubs, and jars, are gaining popularity due to their ability to provide structural integrity and protection during transportation and storage. As the focus on food safety and quality intensifies, the demand for robust packaging solutions that minimize damage and spoilage is on the rise.

Furthermore, the rigid plastic packaging segment is benefiting from advancements in design and manufacturing techniques, allowing for the creation of reusable and recyclable containers that align with sustainability goals. As more agricultural producers and suppliers prioritize eco-friendly practices, the rigid plastic packaging segment is expected to experience significant growth. The increasing adoption of rigid plastic packaging solutions in fresh produce, dairy products, and processed foods further supports this trend, making it a key area for investment and development.

Paper and Paperboard Packaging Segment is Largest Owing to Sustainability Trends

The paper and paperboard packaging segment is the largest within the agricultural packaging market, primarily due to the growing emphasis on sustainability and eco-friendly practices. Paper and paperboard materials are biodegradable, recyclable, and compostable, making them an attractive option for consumers and businesses seeking to reduce their environmental footprint. This shift towards sustainable packaging solutions is particularly relevant in the agricultural sector, where the focus on reducing plastic waste is becoming increasingly critical.

Additionally, paper and paperboard packaging offer excellent printability, allowing for attractive branding and labeling that can enhance product appeal. This segment is widely used for packaging grains, cereals, and other dry agricultural products, as well as for secondary packaging solutions. As environmental regulations become stricter and consumer preferences shift towards sustainable options, the paper and paperboard packaging segment is poised for continued growth, capitalizing on the demand for responsible packaging solutions.

Metal Packaging Segment is Fastest Growing Owing to Product Preservation

The metal packaging segment is the fastest-growing subsegment in the agricultural packaging market, driven by its exceptional ability to preserve product quality and extend shelf life. Metal containers, such as cans and tins, are widely used for packaging perishable agricultural products, including fruits, vegetables, and dairy items. The superior barrier properties of metal packaging protect against light, oxygen, and moisture, making it an ideal choice for ensuring product integrity during storage and transportation.

Moreover, the growing trend of convenience foods and ready-to-eat meals is fueling the demand for metal packaging solutions, as consumers seek easy-to-use options that maintain freshness. The metal packaging segment is also benefiting from advancements in technology, such as easy-open lids and enhanced recycling processes, which align with sustainability goals. As the agricultural sector continues to adapt to changing consumer preferences, the metal packaging segment is expected to experience robust growth, driven by its durability and effectiveness in preserving product quality.

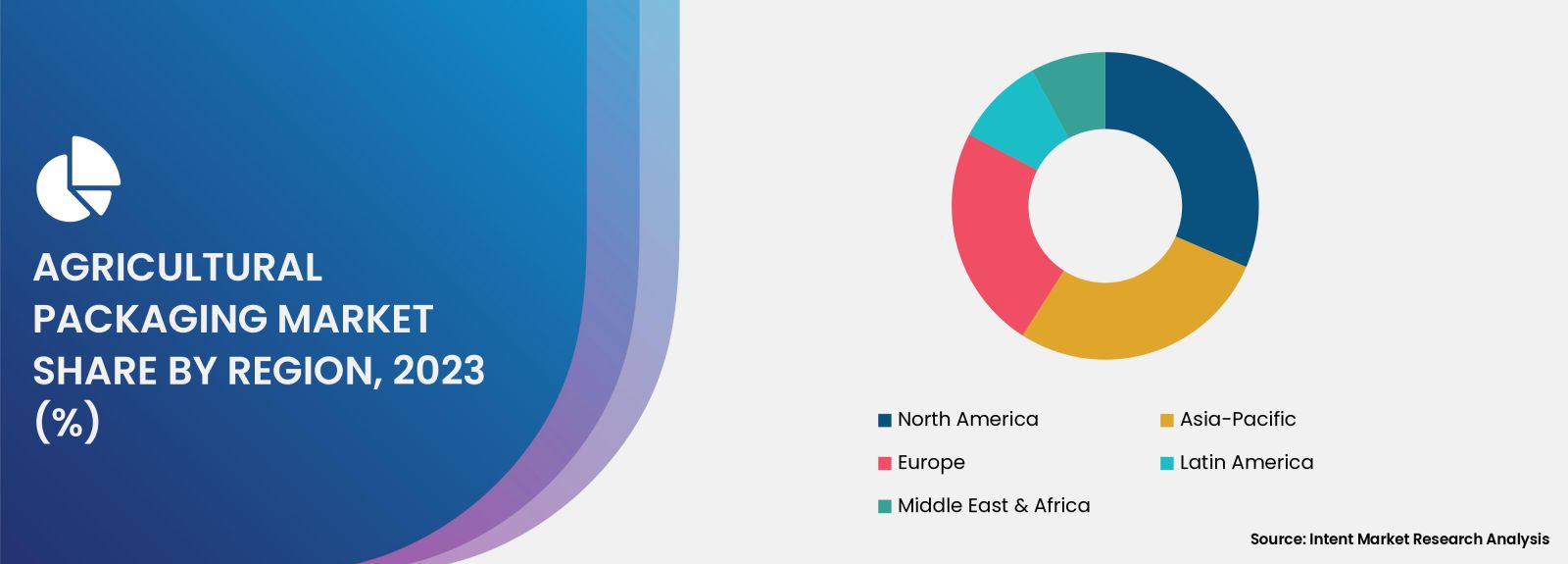

Region Analysis: Asia-Pacific is Fastest Growing Owing to Increasing Agricultural Activities

The Asia-Pacific region is the fastest-growing market for agricultural packaging, fueled by increasing agricultural activities and a rising population. Countries such as India and China are significant contributors to the agricultural sector, with a focus on enhancing productivity and reducing post-harvest losses. The demand for effective packaging solutions that can preserve product quality and extend shelf life is paramount in these countries, driving the growth of the agricultural packaging market.

Furthermore, the rising disposable incomes and changing consumer preferences in the Asia-Pacific region are leading to increased demand for packaged agricultural products. As urbanization accelerates and modern retail channels expand, there is a growing need for innovative packaging solutions that cater to the evolving needs of consumers. The Asia-Pacific region's focus on sustainable practices and eco-friendly packaging further supports its position as a key growth area in the agricultural packaging market.

Competitive Landscape of Leading Companies

The competitive landscape of the agricultural packaging market is characterized by the presence of several leading companies that are actively innovating and expanding their product offerings. Some of the top players in this market include:

- Amcor plc: A global leader in packaging solutions, Amcor specializes in sustainable packaging for a wide range of agricultural products, focusing on innovation and eco-friendliness.

- Berry Global, Inc.: Berry Global provides a diverse portfolio of packaging solutions, including flexible and rigid plastic packaging, catering to the agricultural sector's needs for safety and efficiency.

- Sealed Air Corporation: Known for its innovative packaging solutions, Sealed Air offers products that enhance the shelf life of agricultural goods while minimizing environmental impact.

- Smurfit Kappa Group: A major player in the paper and paperboard packaging segment, Smurfit Kappa focuses on sustainable practices and offers customized packaging solutions for agricultural products.

- International Paper Company: This company is a leader in the production of paper and paperboard packaging, providing eco-friendly solutions for the agricultural sector.

- WestRock Company: WestRock specializes in paper and packaging solutions, offering a range of products tailored to the agricultural market, emphasizing sustainability and efficiency.

- Davis-Standard, LLC: Known for its advanced packaging machinery, Davis-Standard provides solutions that enhance the efficiency and effectiveness of agricultural packaging processes.

- Novolex Holdings, Inc.: A leader in flexible packaging solutions, Novolex focuses on sustainable practices and innovative packaging technologies for the agricultural sector.

- Sonoco Products Company: Sonoco is involved in providing various packaging solutions, including metal and paper packaging, for agricultural products, emphasizing product safety and preservation.

- Mondi Group: Mondi offers a wide range of sustainable packaging solutions, focusing on innovative materials and designs that cater to the agricultural industry.

The competitive landscape in the agricultural packaging market is dynamic, with companies continually investing in research and development to enhance their offerings. Strategic partnerships, mergers, and acquisitions are common as firms aim to strengthen their market positions and expand their product portfolios. The focus on sustainability, coupled with the integration of advanced packaging technologies, positions these companies well to capitalize on the growing demand for agricultural packaging solutions in the coming years.

Report Objectives:

The report will help you answer some of the most critical questions in the Agricultural Packaging Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Agricultural Packaging Market?

- What is the size of the Agricultural Packaging Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.9 billion |

|

Forecasted Value (2030) |

USD 10.2 billion |

|

CAGR (2024 – 2030) |

5.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Agricultural Packaging Market By Product Type (Pouches & Bags, Drums, Bottles & Cans), By Material Type (Plastic (Rigid, Flexible), Paper & Paperboard, Corrugated Board), By Barrier Type (Low, Medium, High), By Application (Chemical Pesticides, Chemical Fertilizers, Biologicals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Agricultural Packaging Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Pouches & Bags |

|

4.2. Drums |

|

4.3. Bottles & Cans |

|

4.4. Others |

|

5. Agricultural Packaging Market, by Material Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Plastic |

|

5.1.1. Rigid |

|

5.1.2. Flexible |

|

5.2. Paper & Paperboard |

|

5.3. Corrugated Board |

|

5.4. Others |

|

6. Agricultural Packaging Market, by Barrier Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Low |

|

6.2. Medium |

|

6.3. High |

|

7. Agricultural Packaging Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Chemical Pesticides |

|

7.2. Chemical Fertilizers |

|

7.3. Biologicals |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Agricultural Packaging Market, by Product Type |

|

8.2.7. North America Agricultural Packaging Market, by Material Type |

|

8.2.8. North America Agricultural Packaging Market, by Barrier Type |

|

8.2.9. North America Agricultural Packaging Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Agricultural Packaging Market, by Product Type |

|

8.2.10.1.2. US Agricultural Packaging Market, by Material Type |

|

8.2.10.1.3. US Agricultural Packaging Market, by Barrier Type |

|

8.2.10.1.4. US Agricultural Packaging Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Amcor plc |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Berry Global, Inc. |

|

10.3. International Paper |

|

10.4. Mondi |

|

10.5. Novolex |

|

10.6. Pactiv Evergreen Inc. |

|

10.7. Sealed Air |

|

10.8. Smurfit Westrock |

|

10.9. Sonoco Products Company |

|

10.10. UFP Industries, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Agricultural Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Agricultural Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Agricultural Packaging ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Agricultural Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA