sales@intentmarketresearch.com

+1 463-583-2713

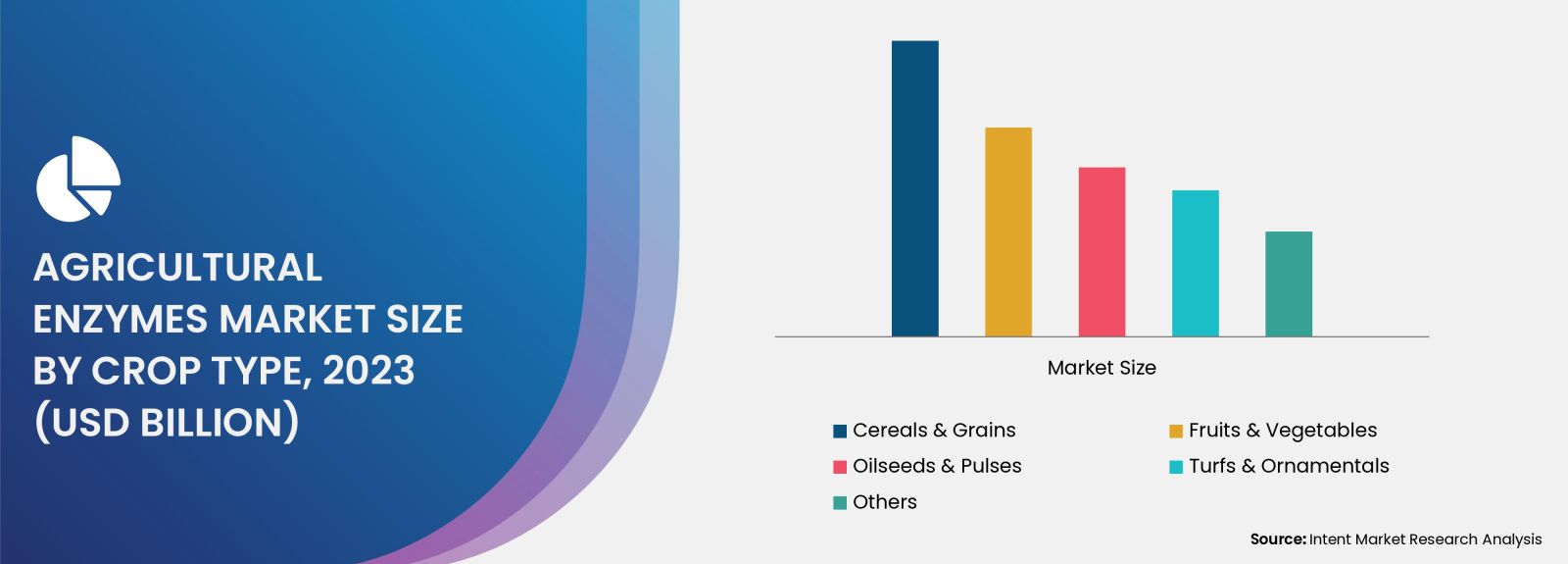

Agricultural Enzymes Market By Product Type (Soil Fertility Products, Growth Enhancing Products), By Type (Phosphatases, Dehydrogenases, Proteases, Sulfatases, Urease), By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turfs & Ornamentals) and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Agricultural Enzymes Market was valued at USD 277.2 million in 2023 and will surpass USD 523.2 million by 2030; growing at a CAGR of 9.5% during 2024 - 2030.

The agricultural enzymes market can be segmented into various categories, including soil enzymes, plant enzymes, and fertilizer enzymes. Each segment contributes significantly to improving agricultural efficiency and sustainability. The rising focus on precision agriculture, coupled with the need to address soil health issues and enhance crop resilience, is expected to drive the growth of the agricultural enzymes market. As farmers increasingly turn to innovative biological solutions, the market for agricultural enzymes is set to expand rapidly.

Soil Enzymes Segment is Largest Owing to Enhancing Soil Health and Fertility

The soil enzymes segment holds the largest share in the agricultural enzymes market, primarily due to their essential role in improving soil health and fertility. Soil enzymes are naturally occurring proteins that catalyze biochemical reactions in the soil, breaking down organic matter and releasing essential nutrients for plant uptake. By enhancing soil microbial activity and nutrient cycling, soil enzymes significantly contribute to sustainable farming practices.

The growing awareness of the importance of soil health in agricultural productivity is driving the demand for soil enzymes. Farmers are increasingly adopting enzyme-based solutions to combat soil degradation and improve crop yields. Additionally, the trend toward organic farming and sustainable agriculture is fueling interest in soil enzymes, as they align with environmentally friendly practices. As a result, the soil enzymes segment is expected to continue its dominance in the agricultural enzymes market over the forecast period.

Plant Enzymes Segment is Fastest Growing Owing to Improving Plant Health and Yield

The plant enzymes segment is the fastest-growing category within the agricultural enzymes market, driven by the increasing focus on enhancing plant health and yield. Plant enzymes play a vital role in various physiological processes, including photosynthesis, respiration, and nutrient assimilation. By supplementing crops with specific enzymes, farmers can improve growth rates, increase resistance to stress factors, and enhance overall plant vigor.

The rising adoption of biostimulants in agriculture is a key factor propelling the growth of the plant enzymes segment. As farmers seek natural solutions to enhance crop performance, the demand for enzyme-based products is expected to surge. Furthermore, the increasing prevalence of abiotic stresses, such as drought and salinity, is prompting farmers to explore enzyme formulations that can mitigate these challenges. The plant enzymes segment is poised for substantial growth as the agricultural sector continues to embrace innovative solutions for sustainable farming.

Fertilizer Enzymes Segment is Largest Owing to Enhancing Nutrient Efficiency

The fertilizer enzymes segment is significant within the agricultural enzymes market, driven by the growing need to enhance nutrient efficiency in fertilizers. Fertilizer enzymes are added to fertilizers to improve nutrient availability and uptake by plants, ensuring that crops receive the necessary nutrients for optimal growth. These enzymes aid in breaking down complex nutrients into forms that are more accessible to plants, thereby enhancing the effectiveness of fertilizers.

As the global agricultural industry faces increasing pressure to optimize input costs and minimize environmental impact, the adoption of enzyme-enhanced fertilizers is gaining traction. Farmers are recognizing the value of incorporating enzymes into their fertilization practices to achieve better nutrient utilization and improve crop yields. The fertilizer enzymes segment is expected to witness steady growth as the demand for efficient fertilization solutions continues to rise.

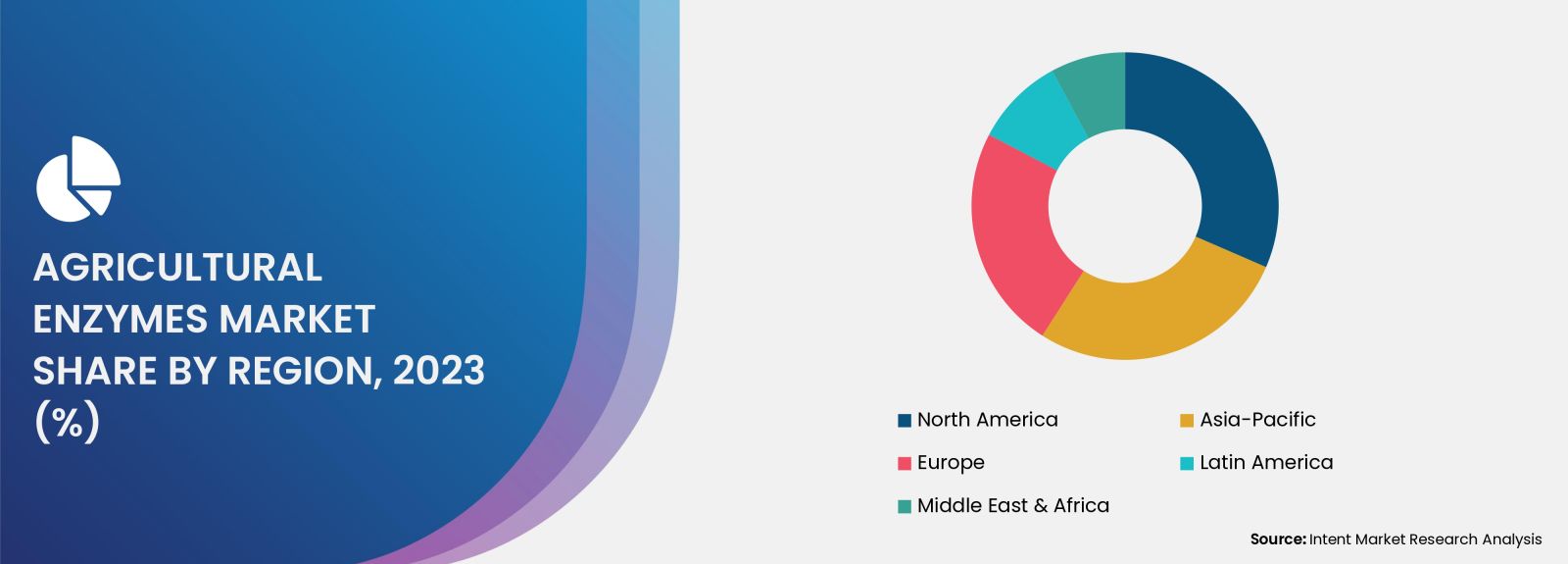

North America Region is Largest Owing to Advancements in Agricultural Practices

The North America region holds the largest share of the agricultural enzymes market, attributed to the region's advanced agricultural practices and significant investments in research and development. The United States and Canada are at the forefront of adopting innovative agricultural technologies, including enzymatic solutions, to enhance crop productivity and sustainability. The strong emphasis on precision agriculture and sustainable farming methods in North America aligns with the increasing adoption of agricultural enzymes.

Furthermore, the presence of key players in the region's agricultural enzymes market fosters innovation and product development. Farmers in North America are increasingly seeking effective biological solutions to improve soil health, enhance nutrient efficiency, and boost crop yields. As the agricultural sector continues to evolve, the North America region is expected to maintain its dominance in the agricultural enzymes market.

Competitive Landscape of Leading Companies

The competitive landscape of the agricultural enzymes market is characterized by a diverse range of players involved in the development and manufacturing of innovative enzymatic solutions. The top companies in this sector include:

- BASF SE: A global leader in chemical solutions, BASF offers a wide range of agricultural enzymes designed to enhance crop productivity and soil health.

- Novozymes A/S: Novozymes specializes in enzyme production and offers innovative solutions for agriculture, focusing on sustainability and efficiency.

- Syngenta AG: Syngenta is known for its comprehensive portfolio of crop protection products and has developed enzyme formulations to improve agricultural performance.

- FMC Corporation: FMC provides a range of agricultural solutions, including enzyme-based products that enhance nutrient availability and crop health.

- Yara International ASA: Yara focuses on fertilizer solutions and offers enzyme-enhanced fertilizers to promote sustainable agricultural practices.

- Corteva Agriscience: Corteva is dedicated to sustainable agriculture and provides innovative enzymatic solutions for improving crop performance.

- Bayer AG: Bayer offers a diverse range of agricultural products, including enzymes that support soil health and enhance nutrient efficiency.

- American Vanguard Corporation: American Vanguard specializes in agricultural products and offers enzyme formulations to improve soil and plant health.

- Kemin Industries, Inc.: Kemin focuses on providing nutritional solutions, including enzymes for enhancing crop productivity and sustainability.

- Green Plains Inc.: Green Plains is involved in agricultural technology and offers enzyme-based solutions to optimize agricultural processes.

The competitive landscape in the agricultural enzymes market is marked by continuous innovation and a strong emphasis on research and development. Companies are increasingly focusing on sustainable practices and eco-friendly formulations to meet the evolving needs of farmers. Strategic collaborations, mergers, and acquisitions are common as firms seek to expand their product portfolios and enhance market presence. As the agricultural enzymes market continues to grow, competition is expected to intensify, with a focus on delivering high-quality, innovative solutions to address the challenges of modern agriculture.

The report will help you answer some of the most critical questions in the Agricultural Enzymes Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Agricultural Enzymes Market?

- What is the size of the Agricultural Enzymes Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 277.2 million |

|

Forecasted Value (2030) |

USD 523.2 million |

|

CAGR (2024 – 2030) |

9.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Agricultural Enzymes Market By Product Type (Soil Fertility Products, Growth Enhancing Products), By Type (Phosphatases, Dehydrogenases, Proteases, Sulfatases, Urease), By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Turfs & Ornamentals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Agricultural Enzymes Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Soil Fertility Products |

|

4.2. Growth Enhancing Products |

|

4.3. Others |

|

5. Agricultural Enzymes Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Phosphatases |

|

5.2. Dehydrogenases |

|

5.3. Proteases |

|

5.4. Sulfatases |

|

5.5. Urease |

|

5.6. Others |

|

6. Agricultural Enzymes Market, by Crop Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Cereals & Grains |

|

6.2. Fruits & Vegetables |

|

6.3. Oilseeds & Pulses |

|

6.4. Turfs & Ornamentals |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Agricultural Enzymes Market, by Product Type |

|

7.2.7. North America Agricultural Enzymes Market, by Type |

|

7.2.8. North America Agricultural Enzymes Market, by Crop Type |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Agricultural Enzymes Market, by Product Type |

|

7.2.9.1.2. US Agricultural Enzymes Market, by Type |

|

7.2.9.1.3. US Agricultural Enzymes Market, by Crop Type |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. American Biosystems Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Aries Agro Limited |

|

9.3. BASF |

|

9.4. Bayer AG |

|

9.5. DFPCL |

|

9.6. DSM |

|

9.7. DuPont |

|

9.8. Monsanto |

|

9.9. Novozymes A/S |

|

9.10. Syngenta AG |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Agricultural Enzymes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Agricultural Enzymes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Agricultural Enzymes ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Agricultural Enzymes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats