sales@intentmarketresearch.com

+1 463-583-2713

Aerospace Insulation Market By Type (Thermal Insulation, Acoustic Insulation, Vibration Insulation, Electric Insulation), By Material (Foamed Plastics, Fiberglass, Mineral Wool, Ceramic-Based Materials), By Application, (Airframe, Engine, Avionics, Cabin Interiors), By End User (Commercial Aircraft, Military Aircraft, Helicopters) and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Aerospace Insulation Market was valued at USD 11.0 billion in 2023 and will surpass USD 15.2 billion by 2030; growing at a CAGR of 4.7 % during 2024 - 2030.

The aerospace insulation market is set to experience robust growth between 2024 and 2030, driven by the increasing demand for lightweight, durable, and high-performance materials for aircraft construction and maintenance. Insulation materials are crucial in aerospace applications to ensure temperature regulation, fire safety, noise reduction, and vibration damping. With the growing focus on enhancing passenger comfort, improving fuel efficiency, and meeting stringent safety standards, the need for advanced insulation solutions is becoming more pronounced. The aerospace insulation market, therefore, is witnessing innovation in materials such as thermal, acoustic, and fire-resistant insulation, particularly in commercial and military aircraft. The market is projected to expand at a significant compound annual growth rate (CAGR) during the forecast period, propelled by trends in aircraft design, advancements in insulation technology, and the growing number of air passengers globally.

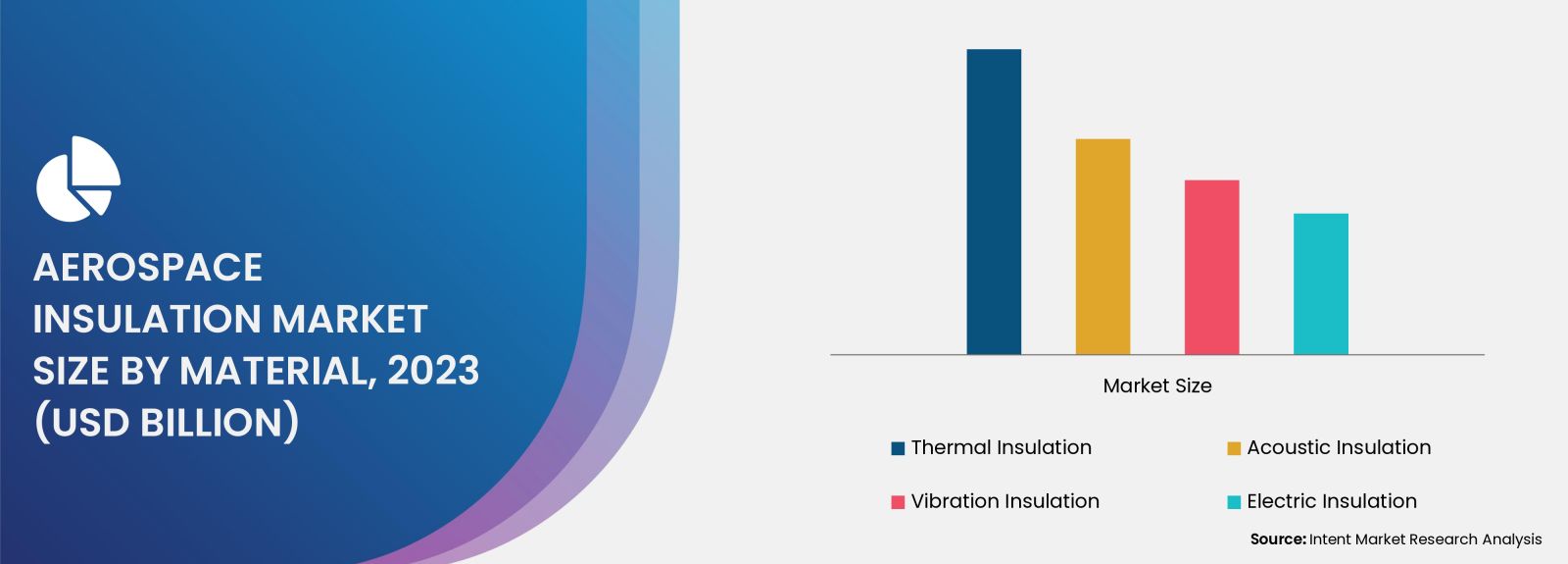

Thermal Insulation Segment is Largest Owing to Demand for Temperature Control and Fuel Efficiency

The thermal insulation segment is the largest within the aerospace insulation market, driven by its critical role in temperature control and fuel efficiency in aircraft. Thermal insulation is essential for regulating the temperatures in various parts of an aircraft, from the engine and exhaust systems to cabin areas. With the increasing demand for more energy-efficient aircraft, manufacturers are prioritizing thermal insulation to reduce heat transfer, ensuring both fuel efficiency and passenger comfort. Efficient thermal management is particularly important in commercial aviation, where insulating materials help optimize energy consumption and minimize cooling and heating requirements.

In addition to energy savings, thermal insulation also plays a significant role in preventing heat-related damage to sensitive components, such as avionics and electronic systems. As aircraft technology evolves and the focus on reducing carbon footprints intensifies, the need for lightweight, high-performance thermal insulation materials is expected to grow. Innovations in materials such as aerogels, fiberglass, and polymer-based insulations are driving the growth of the thermal insulation segment, ensuring its dominance in the aerospace insulation market through 2030.

Acoustic Insulation Segment is Fastest Growing Owing to Increasing Focus on Passenger Comfort

The acoustic insulation segment is the fastest-growing subsegment within the aerospace insulation market, primarily driven by the increasing demand for enhanced passenger comfort. Aircraft noise reduction has become a key focus for both manufacturers and airlines, as passengers demand a quieter and more comfortable flight experience. Acoustic insulation materials are used to reduce noise from the engines, airframe, and vibrations during flight, making them essential in ensuring a pleasant cabin environment. As the commercial aviation industry expands, both in terms of air traffic and fleet modernization, the demand for effective acoustic insulation continues to rise.

Newer aircraft designs, such as the Boeing 787 Dreamliner and Airbus A350, feature advanced acoustic insulation systems that contribute to noise reduction and improve overall cabin comfort. Additionally, the increasing focus on creating environmentally friendly, quieter aircraft to meet noise regulation standards in urban airports has led to innovations in acoustic insulation materials. With airlines investing in passenger experience, the acoustic insulation market is expected to continue its rapid growth, driven by advancements in material science and increasing consumer expectations for noise-free travel.

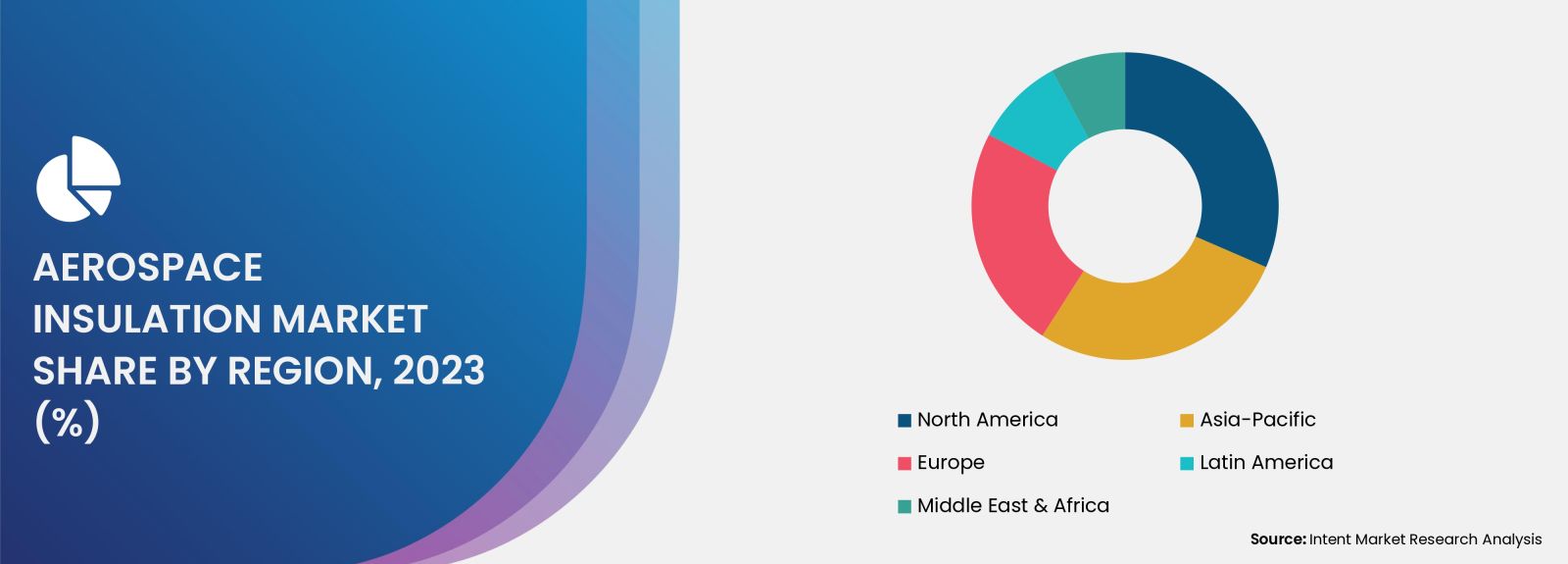

North America Leads Market Share Owing to Strong Aviation Industry and Technological Advancements

North America is the largest region in the aerospace insulation market, accounting for a significant share of global demand. The region's dominance is attributed to its robust aviation industry, home to major aircraft manufacturers such as Boeing, Lockheed Martin, and Northrop Grumman, as well as a strong presence of key suppliers of insulation materials. The U.S. aerospace sector is also a major contributor to military and commercial aviation, with a steady demand for high-quality, durable insulation materials that meet strict regulatory standards for safety, performance, and fuel efficiency.

Furthermore, the region's focus on research and development has led to continuous innovations in aerospace insulation technologies. This includes the development of lightweight and high-performance thermal and acoustic insulation solutions aimed at reducing operational costs and environmental impact. As the aviation industry in North America continues to grow and evolve with new aircraft designs and an increasing number of air passengers, the region is expected to maintain its leadership position in the aerospace insulation market, with steady demand for advanced insulation materials through the forecast period.

Competitive Landscape and Key Players

The aerospace insulation market is highly competitive, with several key players dominating the industry. Leading companies in this market include 3M Company, BASF SE, Johns Manville (a Berkshire Hathaway Company), Owens Corning, and Armacell International S.A. These players are known for their comprehensive product portfolios, which include a wide range of insulation materials designed to meet the diverse needs of the aerospace industry. They offer thermal, acoustic, and fire-resistant insulation products that are crucial for both commercial and military aircraft.

These companies are continuously focusing on product innovation to meet the evolving demands for higher performance, lightweight materials, and sustainable solutions in aerospace insulation. They are investing heavily in R&D to develop advanced materials such as aerogels, high-performance foams, and composite insulation systems. Additionally, strategic partnerships and collaborations with aircraft manufacturers and airlines are key strategies employed by these companies to expand their market share and strengthen their position in the aerospace insulation sector.

As competition intensifies, companies are also placing a strong emphasis on meeting environmental standards, such as those for reducing carbon emissions, which is driving the demand for eco-friendly insulation materials. The competitive landscape in the aerospace insulation market is expected to remain dynamic, with leading companies focusing on expanding their technological capabilities, optimizing supply chains, and exploring new markets to stay ahead in the growing global aerospace industry.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Report Objectives:

The report will help you answer some of the most critical questions in the Aerospace Insulation Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Aerospace Insulation Market?

- What is the size of the Aerospace Insulation Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.0 billion |

|

Forecasted Value (2030) |

USD 15.2 billion |

|

CAGR (2024 – 2030) |

4.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aerospace Insulation Market By Type (Thermal Insulation, Acoustic Insulation, Vibration Insulation, Electric Insulation), By Material (Foamed Plastics, Fiberglass, Mineral Wool, Ceramic-Based Materials), By Application, (Airframe, Engine, Avionics, Cabin Interiors), By End User (Commercial Aircraft, Military Aircraft, Helicopters) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aerospace Insulation Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Thermal Insulation |

|

4.2. Acoustic Insulation |

|

4.3. Vibration Insulation |

|

4.4. Electric Insulation |

|

5. Aerospace Insulation Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Foamed Plastics |

|

5.2. Fiberglass |

|

5.3. Mineral Wool |

|

5.4. Ceramic-Based Materials |

|

5.5. Others |

|

6. Aerospace Insulation Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Airframe |

|

6.2. Engine |

|

6.3. Avionics |

|

6.4. Cabin Interiors |

|

6.5. Others |

|

7. Aerospace Insulation Market, by End User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Commercial Aircraft |

|

7.2. Military Aircraft |

|

7.3. Helicopters |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Aerospace Insulation Market, by Type |

|

8.2.7. North America Aerospace Insulation Market, by Material |

|

8.2.8. North America Aerospace Insulation Market, by Application |

|

8.2.9. North America Aerospace Insulation Market, by End User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Aerospace Insulation Market, by Type |

|

8.2.10.1.2. US Aerospace Insulation Market, by Material |

|

8.2.10.1.3. US Aerospace Insulation Market, by Application |

|

8.2.10.1.4. US Aerospace Insulation Market, by End User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BASF Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Boyd |

|

10.3. DuPont |

|

10.4. Duracote Corporation |

|

10.5. Evonik Industries |

|

10.6. HUTCHINSON SA |

|

10.7. Rogers Corporation |

|

10.8. Safran |

|

10.9. TA Aerospace |

|

10.10. Triumph |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Aerospace Insulation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aerospace Insulation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg) Secondary Research

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aerospace Insulation ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aerospace Insulation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg) Data Triangulation

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats