As per Intent Market Research, the Aerospace Accumulator Market was valued at USD 9.0 billion in 2023 and will surpass USD 11.6 billion by 2030; growing at a CAGR of 3.7% during 2024 - 2030.

The aerospace accumulator market is a dynamic and integral part of the aerospace industry, playing a crucial role in fluid power systems, particularly in hydraulic applications. These accumulators store and release energy to maintain pressure, absorb shocks, and compensate for fluid leaks in various aerospace systems, including landing gear, braking systems, and flight control systems. With the increasing demand for advanced aerospace technologies, this market is poised for significant growth, driven by advancements in aircraft manufacturing, rising air traffic, and the surge in defense spending globally

Hydraulic Accumulator Segment is the Largest Owing to Extensive Usage in Critical Aircraft Systems

The hydraulic accumulator segment holds the largest share in the aerospace accumulator market, accounting for its widespread application in crucial aircraft systems like landing gears, brakes, and flight controls. Hydraulic accumulators are preferred for their ability to absorb shock, maintain pressure, and compensate for fluid leaks, ensuring the smooth operation of hydraulic systems in both commercial and military aircraft. This segment is experiencing robust demand as modern aircraft become more reliant on hydraulic power systems, where accumulators play a vital role in enhancing operational safety and efficiency.

Within this segment, piston accumulators represent the largest subsegment due to their durability, ability to withstand high-pressure conditions, and superior performance in harsh environments. Piston accumulators are favored in high-performance aircraft, particularly military jets, which require precise control and high-pressure hydraulic systems. Their ability to handle large fluid volumes and offer consistent performance makes them indispensable in high-pressure applications, driving the growth of this subsegment over the forecast period.

Pneumatic Accumulator Segment is the Fastest Growing Owing to Rising Demand for Lightweight Components

The pneumatic accumulator segment is projected to witness the fastest growth during the forecast period. The demand for pneumatic accumulators is on the rise due to their lightweight construction and ability to operate without hydraulic fluids, reducing overall aircraft weight and improving fuel efficiency. These accumulators are commonly used in aircraft systems where reducing weight is a critical factor, such as in smaller aircraft and unmanned aerial vehicles (UAVs).

Bladder accumulators are the fastest-growing subsegment within this category, driven by their compact size, ease of maintenance, and ability to perform in low-temperature environments. Bladder accumulators are particularly suitable for aerospace applications that demand quick response times and minimal weight, such as emergency landing gear systems. Their growing adoption in both commercial and military applications is expected to propel this subsegment's growth over the next few years.

Metal Accumulator Segment is Largest Owing to High Durability and Resistance

Metal accumulators dominate this segment due to their robustness and ability to withstand extreme environmental conditions, including temperature fluctuations and high-pressure environments. These accumulators are predominantly used in aerospace applications where durability and longevity are paramount, such as in military aircraft that operate under extreme conditions. The demand for metal accumulators is growing as aerospace manufacturers seek components that can enhance operational efficiency while minimizing maintenance costs.

Among the metal accumulators, stainless steel accumulators are the largest subsegment, owing to their corrosion resistance, high durability, and ability to operate in demanding environments. Stainless steel accumulators are widely used in aerospace hydraulic systems, particularly in military and defense aircraft, where reliability and performance are non-negotiable. Their ability to handle high-pressure applications with minimal wear makes them a preferred choice, ensuring their dominance in the market.

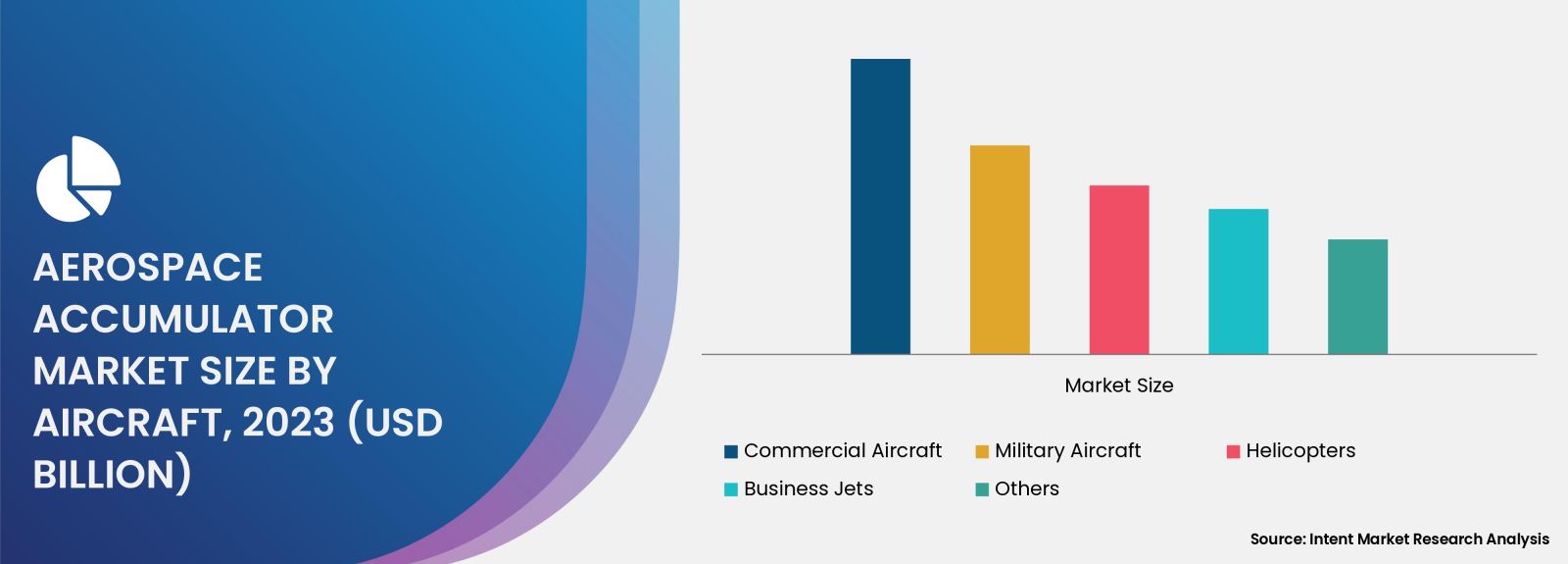

Commercial Aviation Segment is Fastest Growing Owing to Surge in Air Traffic and Fleet Expansion

The commercial aviation segment is expected to be the fastest-growing segment of the aerospace accumulator market during the forecast period, driven by the rapid increase in global air traffic and the subsequent expansion of commercial aircraft fleets. Airlines worldwide are investing heavily in upgrading their fleets to improve fuel efficiency, enhance passenger safety, and meet stringent regulatory standards, all of which contribute to the rising demand for advanced hydraulic and pneumatic systems in commercial aircraft.

Within this segment, the narrow-body aircraft subsegment is the fastest-growing due to the rising demand for short-haul flights and regional air travel. Narrow-body aircraft, such as the Boeing 737 and Airbus A320, are widely used for domestic and regional routes and are being increasingly equipped with advanced accumulator systems to optimize hydraulic performance, reduce maintenance costs, and improve overall operational efficiency. The surge in new aircraft orders, particularly from emerging markets, is expected to drive the growth of this subsegment.

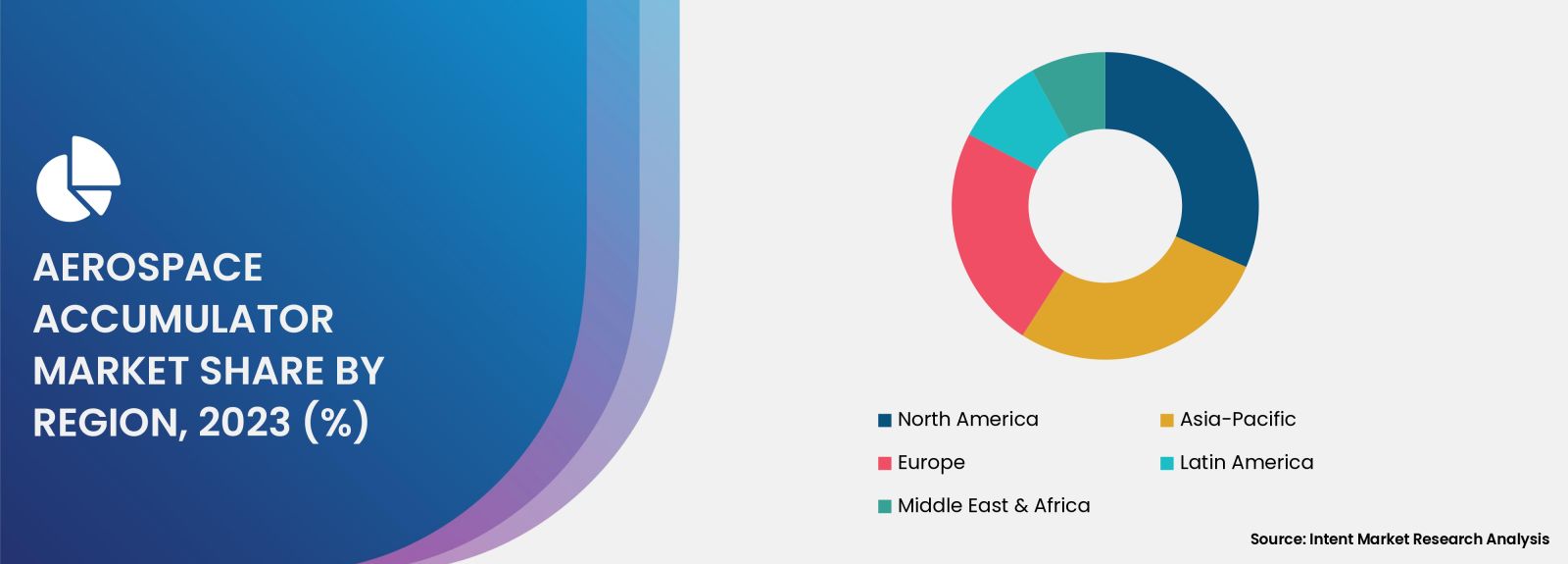

North America is the Largest Region Owing to Established Aerospace Industry and High Defense Spending

North America holds the largest share in the aerospace accumulator market, driven by the presence of major aircraft manufacturers, a robust defense sector, and significant investments in aerospace technology. The region is home to industry giants such as Boeing and Lockheed Martin, which are continually investing in advanced hydraulic and pneumatic systems for both commercial and military applications. Additionally, the U.S. government’s focus on strengthening its defense capabilities has led to increased demand for military aircraft, further boosting the market for aerospace accumulators.

The United States is the largest market within North America, benefiting from high defense spending, a strong commercial aviation sector, and the presence of a well-established aerospace supply chain. The U.S. military's focus on modernizing its fleet, combined with the increasing adoption of advanced technologies in the commercial aviation sector, is expected to keep North America at the forefront of the global aerospace accumulator market over the forecast period.

Competitive Landscape: Leading Companies and Market Positioning

The aerospace accumulator market is highly competitive, with several leading players vying for market share. Key companies in this space include Eaton Corporation, Parker Hannifin, HYDAC, and Bosch Rexroth, all of which are recognized for their technological innovations and wide product portfolios. These companies are focused on developing advanced accumulator systems that cater to the evolving needs of the aerospace industry, particularly in terms of weight reduction, performance optimization, and cost efficiency.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 9.0 billion |

|

Forecasted Value (2030) |

USD 11.6 billion |

|

CAGR (2024 – 2030) |

3.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Aerospace Accumulator Market By Product Type (Hydraulic Accumulators, Pneumatic Accumulators, Electric Accumulators), By Material (Metallic Accumulators, Composite Accumulators), By Aircraft (Commercial Aircraft, Military Aircraft, Helicopters, Business Jets) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Aerospace Accumulator Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hydraulic Accumulators |

|

4.2. Pneumatic Accumulators |

|

4.3. Electric Accumulators |

|

5. Aerospace Accumulator Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Metallic Accumulators |

|

5.2. Composite Accumulators |

|

6. Aerospace Accumulator Market, by Aircraft (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Commercial Aircraft |

|

6.2. Military Aircraft |

|

6.3. Helicopters |

|

6.4. Business Jets |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Aerospace Accumulator Market, by Product Type |

|

7.2.7. North America Aerospace Accumulator Market, by Material |

|

7.2.8. North America Aerospace Accumulator Market, by Aircraft |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Aerospace Accumulator Market, by Product Type |

|

7.2.9.1.2. US Aerospace Accumulator Market, by Material |

|

7.2.9.1.3. US Aerospace Accumulator Market, by Aircraft |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. AMETEK.Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Arkwin Industries, Inc. |

|

9.3. Bosch Rexroth Corporation |

|

9.4. Eaton |

|

9.5. Flexial Corporation |

|

9.6. HYDAC International GmbH |

|

9.7. Parker Hannifin Corp |

|

9.8. Technetics Group |

|

9.9. Triumph Group |

|

9.10. Valcor Engineering Corporation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Aerospace Accumulator Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Aerospace Accumulator Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Aerospace Accumulator ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Aerospace Accumulator Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA