Advanced Oxidation Technologies Market By Technology (Ozone-based AOTs, UV-based AOTs, Hydrogen Peroxide-based AOTs, Fenton-based AOTs, Electrochemical-based AOTs), By Application (Water Treatment, Air Treatment, Soil Remediation, Food Processing, Pharmaceuticals & Healthcare), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Advanced Oxidation Technologies Market was valued at USD 3.1 billion in 2023 and will surpass USD 5.2 billion by 2030; growing at a CAGR of 7.7% during 2024 - 2030.

The advanced oxidation technologies (AOTs) market is witnessing robust growth due to the increasing need for effective and sustainable solutions to treat pollutants in water, air, and soil. AOTs employ highly reactive species, such as hydroxyl radicals, to degrade organic contaminants, pathogens, and other harmful substances, making them a critical component in environmental protection and remediation efforts. With growing concerns over pollution, particularly in urban areas, AOTs are being recognized as a highly efficient and eco-friendly alternative to traditional treatment methods. These technologies are increasingly used across a variety of applications, including water treatment, air purification, soil remediation, and even in food processing and pharmaceuticals.

As environmental regulations become stricter and the demand for cleaner and safer ecosystems grows, the AOTs market is evolving to meet these challenges. Innovations in AOTs, such as the integration of ozone, UV, hydrogen peroxide, and electrochemical processes, are driving market expansion. The push for sustainable industrial practices, along with rising awareness of climate change and pollution, has resulted in greater investments in advanced oxidation technologies. The market is also benefiting from advancements in the efficiency of these technologies, making them more cost-effective and applicable across diverse industries.

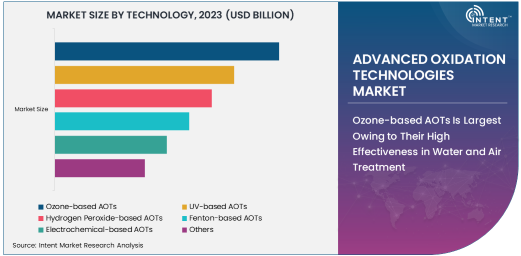

Ozone-based AOTs Is Largest Owing to Their High Effectiveness in Water and Air Treatment

The ozone-based AOTs segment is the largest in the market, owing to their high effectiveness in treating water and air contaminants. Ozone, a powerful oxidizing agent, is widely used for its ability to break down a broad spectrum of organic and inorganic pollutants. In water treatment, ozone-based systems are particularly effective at removing microorganisms, pesticides, and pharmaceuticals, as well as improving water clarity and taste. In air treatment, ozone is used to eliminate odors, volatile organic compounds (VOCs), and other harmful pollutants, making it ideal for both industrial and residential applications.

The advantages of ozone-based AOTs include their ability to degrade a wide variety of contaminants without leaving harmful by-products, which makes them an environmentally friendly choice. Ozone’s ability to treat large volumes of water and air efficiently has made it the preferred option in industries such as municipal water treatment, industrial effluent treatment, and air purification systems. Due to these benefits, the ozone-based segment remains the largest in the AOTs market, with increasing demand for high-quality water and cleaner air fueling its growth.

UV-based AOTs Is Fastest Growing Owing to Their Energy Efficiency and Precision

UV-based AOTs are the fastest growing segment in the market, driven by their energy efficiency and the precision with which they can target specific contaminants. Ultraviolet (UV) light is used in AOTs to generate hydroxyl radicals, which are highly reactive and capable of breaking down harmful organic compounds and pathogens. This technology is particularly effective in water and wastewater treatment, where UV radiation can be used for disinfection without the need for additional chemicals. UV-based AOTs are increasingly favored in applications where energy efficiency and chemical-free treatment are crucial, such as in drinking water purification, wastewater treatment, and food processing.

The demand for UV-based AOTs is rapidly expanding due to their minimal environmental impact, ease of integration into existing systems, and ability to provide highly targeted treatment. As environmental regulations tighten and the need for sustainable water treatment solutions grows, UV-based systems are becoming increasingly popular. The energy efficiency of UV AOTs, coupled with their ability to treat a wide range of pollutants effectively, positions them as the fastest growing technology in the AOTs market.

Water Treatment Application Is Largest Owing to Growing Demand for Clean Water

The water treatment application is the largest in the AOTs market, driven by the increasing global demand for clean and safe water. With rising concerns about water contamination from pollutants such as pesticides, pharmaceuticals, heavy metals, and bacteria, AOTs have emerged as a highly effective solution for ensuring water quality. Technologies like ozone-based AOTs, UV-based AOTs, and hydrogen peroxide-based AOTs are extensively used in municipal, industrial, and wastewater treatment plants to remove contaminants and disinfect water, making it safe for consumption and industrial use.

The growing global population, coupled with increasing industrialization and urbanization, has placed immense pressure on water resources, making effective water treatment solutions more critical than ever. Advanced oxidation technologies offer an efficient, chemical-free alternative to traditional methods such as chlorine disinfection, with the added benefit of improving water taste and odor. As a result, the water treatment segment remains the largest application for AOTs, with increasing investments in water purification systems driving the market forward.

Air Treatment Application Is Fastest Growing Owing to Rising Air Pollution

The air treatment application is the fastest growing segment in the AOTs market, fueled by the rising levels of air pollution in urban areas and industrial regions. Air pollution from vehicle emissions, industrial activities, and other sources has become a major health concern globally, driving the demand for air purification technologies. Ozone-based and UV-based AOTs are particularly effective at removing particulate matter, volatile organic compounds (VOCs), and other airborne pollutants. These technologies are being deployed in various air purification systems, including those used in industrial settings, residential buildings, and commercial spaces.

The rapid growth of the air treatment segment is driven by both regulatory pressures to meet air quality standards and growing awareness of the health risks associated with poor air quality. As governments around the world implement stricter environmental regulations and consumers demand cleaner air, the air treatment segment is expected to continue to grow at a rapid pace. The ability of AOTs to effectively target a wide range of air pollutants makes them a critical technology for improving air quality, further fueling their adoption in the market.

Asia-Pacific Is Fastest Growing Region Owing to Rapid Industrialization and Environmental Awareness

The Asia-Pacific region is the fastest growing in the AOTs market, driven by rapid industrialization, increasing urbanization, and rising environmental awareness. Countries such as China, India, and Japan are experiencing significant industrial growth, which has led to heightened concerns about pollution and the need for effective environmental management solutions. As industrialization accelerates, the demand for advanced technologies to treat water, air, and soil contaminants is growing. The adoption of AOTs in the region is also being driven by government initiatives and stricter environmental regulations aimed at improving air and water quality.

In addition to industrial applications, the Asia-Pacific region is also witnessing a growing focus on sustainable water and air treatment solutions in response to the region's water scarcity and air pollution challenges. The rise in public and private sector investments in environmental technologies is expected to continue driving the demand for advanced oxidation technologies in the region, making it the fastest growing market globally.

Leading Companies and Competitive Landscape

The advanced oxidation technologies market is highly competitive, with several key players leading the development of innovative solutions. Companies such as A2O Water Technologies, Trojan Technologies, and SUEZ are at the forefront of offering AOT-based solutions for water and air treatment. These companies focus on research and development to enhance the effectiveness and efficiency of AOTs, particularly in terms of energy consumption, pollutant removal efficiency, and integration with existing treatment systems.

In addition to large players, smaller companies and startups are also entering the market with novel solutions, particularly in the areas of electrochemical-based AOTs and the integration of multiple oxidation technologies for specific applications. As the demand for cleaner water, air, and soil grows, companies in the AOTs market are focusing on product diversification, technological advancements, and strategic partnerships to expand their market share. The competitive landscape is expected to remain dynamic, with continuous innovation and the development of more sustainable and cost-effective solutions driving the future of the AOTs market.

Recent Developments:

- In November 2024, Trojan Technologies unveiled a new ozone-based AOT system aimed at enhancing the efficiency of water treatment in municipal applications.

- In October 2024, Xylem Inc. introduced an advanced electrochemical oxidation system to improve the removal of contaminants from industrial wastewater.

- In September 2024, SUEZ Water Technologies & Solutions launched an upgraded UV-based AOT system for large-scale disinfection applications.

- In August 2024, Evoqua Water Technologies announced the acquisition of Advanced Oxidation Technologies, Inc. to expand its portfolio of environmental treatment solutions.

- In July 2024, Calgon Carbon Corporation (a subsidiary of Kuraray Co., Ltd.) introduced a new Fenton-based AOT system designed for chemical wastewater treatment in the pharmaceutical industry.

List of Leading Companies:

- Trojan Technologies

- SUEZ Water Technologies & Solutions

- Xylem Inc.

- A. O. Smith Corporation

- Calgon Carbon Corporation (a subsidiary of Kuraray Co., Ltd.)

- Advanced Oxidation Technologies, Inc.

- Lenntech

- Veolia North America

- KURITA WATER INDUSTRIES LTD.

- IDEXX Laboratories, Inc.

- Evoqua Water Technologies

- Pentair plc

- Danaher Corporation

- Siemens Water Technologies

- Honeywell International Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 3.1 billion |

|

Forecasted Value (2030) |

USD 5.2 billion |

|

CAGR (2024 – 2030) |

7.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Advanced Oxidation Technologies Market By Technology (Ozone-based AOTs, UV-based AOTs, Hydrogen Peroxide-based AOTs, Fenton-based AOTs, Electrochemical-based AOTs), By Application (Water Treatment, Air Treatment, Soil Remediation, Food Processing, Pharmaceuticals & Healthcare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Trojan Technologies, SUEZ Water Technologies & Solutions, Xylem Inc., A. O. Smith Corporation, Calgon Carbon Corporation (a subsidiary of Kuraray Co., Ltd.), Advanced Oxidation Technologies, Inc., Lenntech, Veolia North America, KURITA WATER INDUSTRIES LTD., IDEXX Laboratories, Inc., Evoqua Water Technologies, Pentair plc, Danaher Corporation, Siemens Water Technologies, Honeywell International Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Advanced Oxidation Technologies Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Ozone-based AOTs |

|

4.2. UV-based AOTs |

|

4.3. Hydrogen Peroxide-based AOTs |

|

4.4. Fenton-based AOTs |

|

4.5. Electrochemical-based AOTs |

|

4.6. Others |

|

5. Advanced Oxidation Technologies Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Water Treatment |

|

5.2. Air Treatment |

|

5.3. Soil Remediation |

|

5.4. Food Processing |

|

5.5. Pharmaceuticals & Healthcare |

|

5.6. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Advanced Oxidation Technologies Market, by Technology |

|

6.2.7. North America Advanced Oxidation Technologies Market, by Application |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Advanced Oxidation Technologies Market, by Technology |

|

6.2.8.1.2. US Advanced Oxidation Technologies Market, by Application |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Trojan Technologies |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. SUEZ Water Technologies & Solutions |

|

8.3. Xylem Inc. |

|

8.4. A. O. Smith Corporation |

|

8.5. Calgon Carbon Corporation (a subsidiary of Kuraray Co., Ltd.) |

|

8.6. Advanced Oxidation Technologies, Inc. |

|

8.7. Lenntech |

|

8.8. Veolia North America |

|

8.9. KURITA WATER INDUSTRIES LTD. |

|

8.10. IDEXX Laboratories, Inc. |

|

8.11. Evoqua Water Technologies |

|

8.12. Pentair plc |

|

8.13. Danaher Corporation |

|

8.14. Siemens Water Technologies |

|

8.15. Honeywell International Inc. |

|

9. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Advanced Oxidation Technologies Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Advanced Oxidation Technologies Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Advanced Oxidation Technologies Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats